November 2024 is destined to be extraordinary. This month features a week with multiple significant factors, including the election, interest rate cuts, and tech sector earnings reports, all of which will greatly influence the financial market trends. Therefore, everyone must remain highly vigilant this week.

First half of 2024: BTC ETF approval; BTC reaches an all-time high; BTC halving;

Second half of 2024: The Federal Reserve begins the interest rate cut cycle, U.S. elections.

Two major events that will influence the market this week:

Tuesday — U.S. elections, will it be Republican Trump re-elected, or the Democratic Party's first female president taking office? The answer will soon be revealed.

Friday — Federal Reserve interest rate decision, expected to cut rates by 25 basis points.

These two events will cause significant fluctuations in the crypto market, affecting our wallet balances… will it be left or right… stay tuned.

In the coming week, tech sector earnings reports will be released. The rise of U.S. stocks has mainly been supported by the tech sector; if the tech sector underperforms expectations, it will also impact market trends.

The battle for the BTC support level at $68,000 is on. Tomorrow is the 5th for the election, and the results will be out on the 6th. It's time to buy big or small; the levels remain the same, and the trend is still unclear.

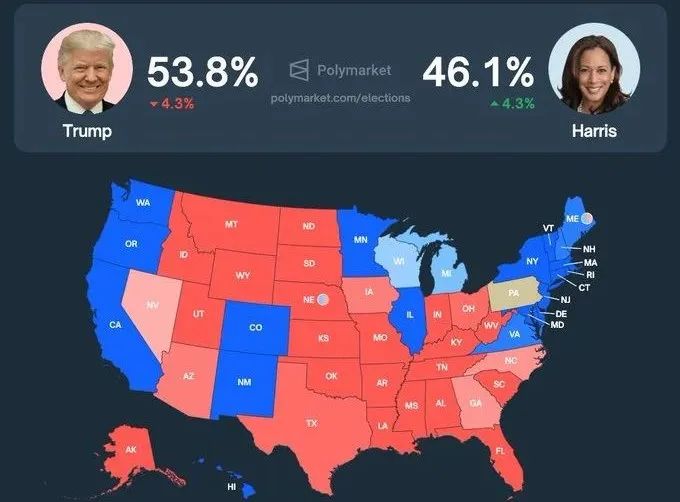

First, let's talk about the election betting data:

I've seen many people using betting data from Polymarket to analyze the U.S. elections. Personally, I think this data is not very objective, as it mainly reflects bets from non-U.S. users.

If you must look at data, it's better to check betting data from U.S.-based gambling sites regarding the election, such as Kalshi and BetOnline. I just saw that Kalshi's latest data shows over $100 million in bets, with Trump's winning probability rising by 6% to 53% this morning.

Of course, I believe that data is actually at the very bottom of the chain when observing changes in the election situation. Like the market, it sways with changes in media coverage, polls, and early voting information, making it an emotional market data rather than objective data.

Another historical data point to consider is that in the past seven elections, as the election approaches, expectations change rapidly, and market volatility increases. The period one to two weeks after the election is also a time of high volatility. Once two weeks have passed after the election, market volatility tends to decrease quickly, marking a transition from uncertainty to certainty.

Now, let's discuss the impact of the election on crypto:

Regardless of who is elected, it will not affect the long-term narrative. So let's discuss the short term:

If Trump loses, there will be a short-term decline, but it won't be significant; the outlook remains positive.

Over the weekend, the market has already experienced a pullback due to Trump's declining approval ratings. This trend can be seen as the market somewhat preemptively digesting the negative news of a potential Trump loss.

If Trump wins: Since there has already been a pullback last weekend, there won't be a large-scale pullback after the election, and it is likely to break new highs.

If Harris wins: The market will decline in the short term, but the drop won't be significant; there is no possibility of falling below $50,000 or $40,000. So, everyone should not panic blindly. The Bitcoin behind the election hype has substantial support, and we remain optimistic about next year's market trends.

As participants in the financial market, remember not to make expectation judgments based on news:

Whether you are defensive or trading based on market reactions, do not rely on news to make predictions. The market will react; emotional factors can lead to risk avoidance or unexpected reversals.

So how to proceed now? The market is simply about going down first and then up, or going up first and then down:

Going up first: Then combine with target levels. These are the several levels given since March: 7.4, 8.1, 8.6. When reaching these levels, it's time to reduce positions.

Going down first: That will be more painful; clear leverage and wash out positions. We just need to continue adding at the right levels.

That's all for this article. If you liked it, please give a follow and a thumbs up!

In the crypto industry, if you want to seize the next bull market opportunity, you need to have a quality circle. Everyone can band together for support and maintain insight. If you are alone, looking around and finding no one, it is actually very difficult to persist in this industry.

If you want to band together for support or have questions, feel free to join us — WeChat Official Account: You Bi Zhi Qing Nian.

Thank you for reading! If you liked it, please give a thumbs up and follow us. See you next time!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。