Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: November 4, 14:54 Beijing time

Market Information

- Cathie Wood: Focus on Trump's stance on taxes, tariffs, and monetary policy;

- The Monetary Authority of Singapore announces the advancement of the financial services tokenization plan;

- Bitcoin volatility surges to a three-month high ahead of the U.S. elections;

- Musk: The Republican Party is expected to achieve a significant victory in Pennsylvania;

- JPMorgan: The results of the U.S. elections could reshape tax policy, government debt, and market stability, leading to significant economic changes;

Market Review

Tomorrow marks the start of the U.S. elections, with results expected to be announced on the afternoon of the 6th. The election process requires voting in each state, first by the public and then by the electors. Before the results are out, there is no need to make too many predictions. During the voting period, the market is likely to experience significant fluctuations. This kind of news impact cannot be discerned from a technical perspective. Before the results are announced, there is a possibility of small probability events occurring. As mentioned earlier, in the 2016 election between Trump and Hillary, due to high elector support, Trump was elected, while the market believed Hillary would win. Therefore, do not make too many predictions; the chances are slim, but there is still an opportunity. Control your positions and protect yourself to avoid unnecessary losses due to the election process.

Previously, when Bitcoin was around 69,300, I mentioned that there was still room for a decline, which occurred as expected, with a lowest drop at 67,446. The predicted range was 68,500-67,000, and those who positioned short made a small profit. After the decline, the market formed lower shadows on the 4-hour and daily charts. If you positioned long, you should currently have a small profit and can hold. The low for Ethereum was at 2,410. I advised waiting for Bitcoin to form a pin bar before opening long positions around 2,450. Currently, it is also showing a small profit. Although the election is approaching, there is no need to panic excessively. Manage your risk well in trading and set stop losses.

Market Analysis

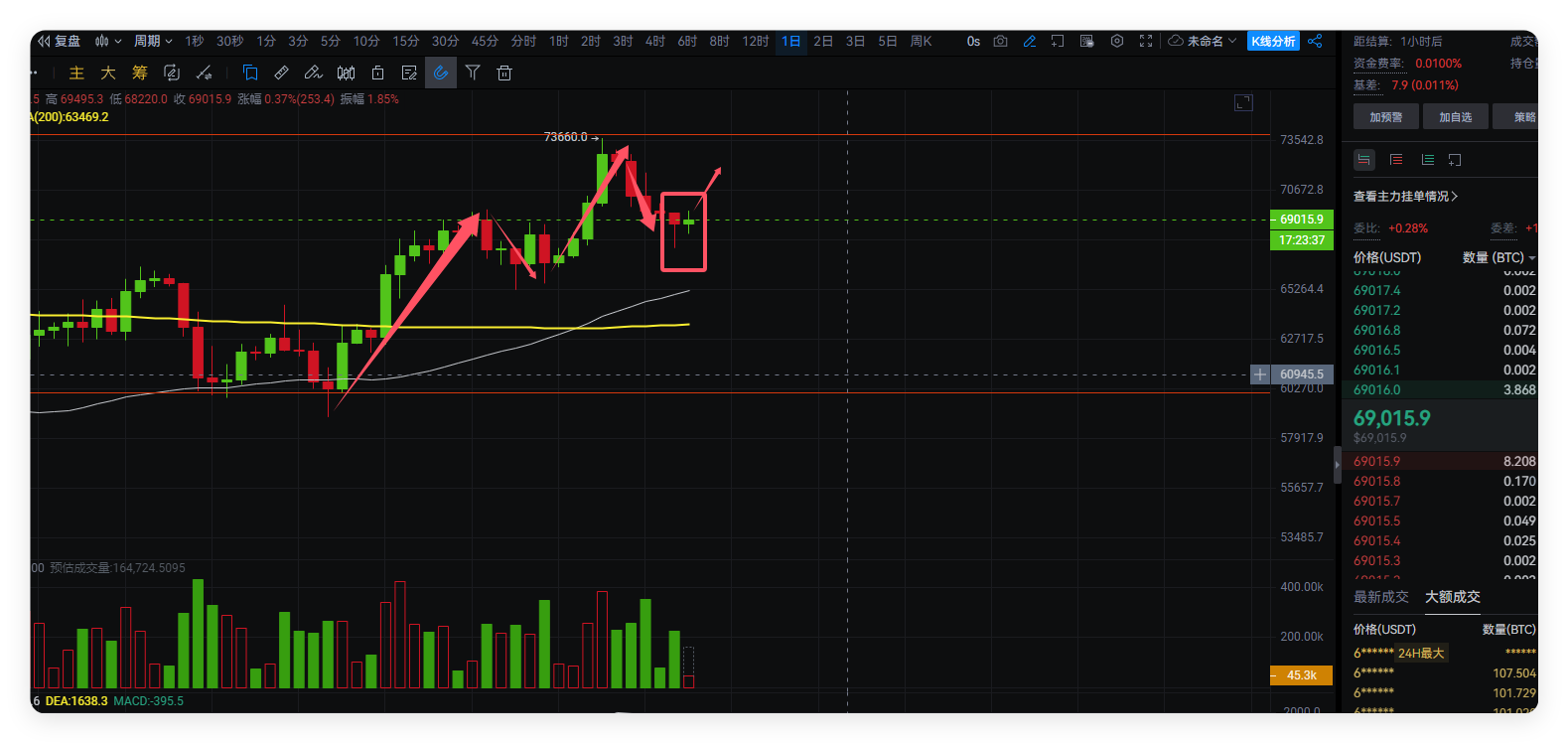

BTC:

From the daily chart, Bitcoin has retraced to the support range of 68,500-67,000 and formed a lower shadow, indicating that the support below is still effective. Currently, the price has not continued to decline, and a short-term rebound opportunity is approaching. We do not expect a breakout on this rebound; the upper range is 71,300-72,300. In the lead-up to the election, short-term trading can be handled with short positions. If the rebound does not reach the target, that’s fine; risk control is essential for steady profits. Those who have positioned long can continue to hold, and those who have not entered can consider light positions around 68,500. If the previous low is broken, do not continue to hold. The target is set at the 71,300-72,300 range; enter at your discretion. For short-term trading, control your risk and manage your own profits and losses.

ETH:

From the daily chart, Ethereum's decline is influenced by Bitcoin. After breaking the 2,450 support, it closed above, indicating that the 2,450 support is still effective in the short term. The lower lows are continuously rising, and the previous highs have also been refreshed. Ethereum has a relatively large rebound opportunity, with expected target points in the 2,600-2,650 range. Ethereum is currently experiencing low volatility, leaving only this profit space. Those who entered around 2,450 can continue to hold, and those who have not entered should still consider positioning around 2,450. If the previous low is broken, do not continue to hold. Manage your entry opportunities at your discretion. For short-term trading, control your risk and manage your own profits and losses.

In summary:

Both Bitcoin and Ethereum have support below in the short term, and long positions can be considered. With the election approaching, manage your risks well.

The article is time-sensitive; pay attention to risks. The above is only personal advice and for reference only!

Follow the WeChat public account Crypto Lao Zhao to discuss the market together;

All suffering stems from the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, not acting on a 50% certainty, not acting on a 70% certainty, must wait for a 100% certainty—where is there 100% certainty in the market? Trading is about trading risks, trying to make the odds stand on your side. Those who give love receive love in return; those who bring blessings receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit silly. For example, if the market is bullish, once this is confirmed, don’t get too stuck on the position, lower your position size a bit, and then get in first. If it reverses, so be it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。