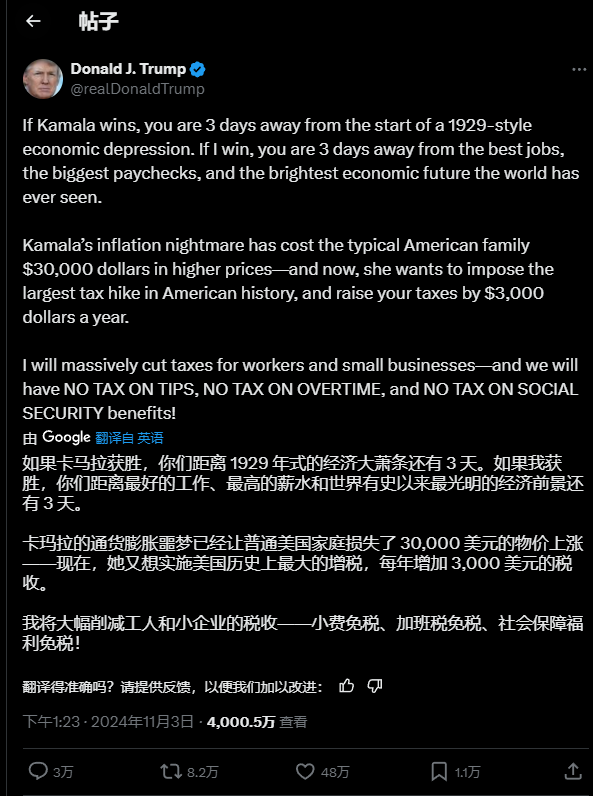

Intense and provocative remarks always spark discussions among the public. Former President Donald Trump's comments on November 3 have once again ignited public debate. He predicted that if Kamala Harris were elected president, the United States would face an economic depression.

Trump's prediction came during a public speech where he criticized the Democratic Party's policies, specifically targeting Vice President Kamala Harris. Trump claimed that Harris's economic policies would lead to the collapse of the U.S. economy, comparing it to the worst periods of economic depression in history.

Image Source: X

He also told female voters that he would protect them. "When you're home alone, if you don't want a monster who has killed six people and just got out of prison to break in, I think you'd better vote for Trump."

Differences in Economic Policies

Trump has always been known for his focus on economic issues. During his term, he repeatedly emphasized stimulating economic growth through tax cuts and deregulation. In his view, the current direction of economic policy has deviated from what he considers the right track, especially regarding the Democratic Party's stance on taxes and spending.

There are significant differences between Trump and Harris's economic policies. Trump tends to stimulate economic growth through tax cuts, tariff policies, and loose monetary policy. He has repeatedly pressured the Federal Reserve to lower interest rates to devalue the dollar and enhance the competitiveness of American manufacturing.

In contrast, Harris's policies focus more on "equitable outcomes," such as adjusting tax policies to raise rates for high-income individuals and large corporations, and expanding social welfare. This approach may reduce reliance on monetary policy but could also trigger inflationary pressures.

Voter concerns about economic policies often manifest in employment, taxation, and welfare policies. Trump's tax cuts were welcomed by the business community during his term but also sparked debates about increasing income inequality. Harris's policies attempt to achieve broader economic fairness by raising tax rates on high earners, which undoubtedly raises significant discussion among voters.

Trump's policies could likely lead to a new round of global "trade wars," which may temporarily increase inflation, subsequently affecting interest rates and the dollar's trajectory. Trump's tariff plans could result in job losses and rising unemployment rates.

Harris's policies may exacerbate inflation in the short term, as large-scale fiscal spending can easily trigger a long-term rise in inflationary pressures. The Congressional Budget Office predicts that we may see an increase in fiscal deficits in the future, which could adversely affect the long-term development of the economy.

Internationally, regardless of who is elected, the risks of expanding the U.S. fiscal deficit and economic recession may increase, having profound implications for the global economy.

Conclusion

Despite Trump's intense rhetoric, his economic warnings are worth pondering. Regardless of how policies are adjusted, the healthy development of the economy requires finding a balance between stimulating growth and maintaining stability. Voters should also rationally assess how various policies impact their own interests when casting their votes.

In this turbulent period, the direction of economic policy not only determines the future of the United States but will also influence the global economic landscape. Regardless of who ultimately prevails, policymakers need to find a sustainable path between stabilizing economic growth and achieving social equity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。