After the dispute period, the market is expected to determine that "Trump lost."

Author: Zaddycoin

Translation: Deep Tide TechFlow

Please do your own research; this is just a personal opinion and does not constitute financial advice.

If, according to market rules, Trump is reported to have lost the election by @AP, @Foxnews, and @NBCNews, I predict that the U.S. presidential election market on @Polymarket will experience two "disputes," and retail investors may suffer losses due to chasing the possibility of a market reversal.

In other words, if the market determines that Trump lost, it may experience two disputes, and retail traders might go all in, hoping the market will overturn the disputed result. Please refer to here.

But remember, you are not Tom Brady… If Trump loses, I believe the holders of TRUMPYES will not give up easily, even more tenaciously than the supporters of HARRISYES. However, rules are rules, and @Polymarket reminds everyone of the consequences if this situation occurs.

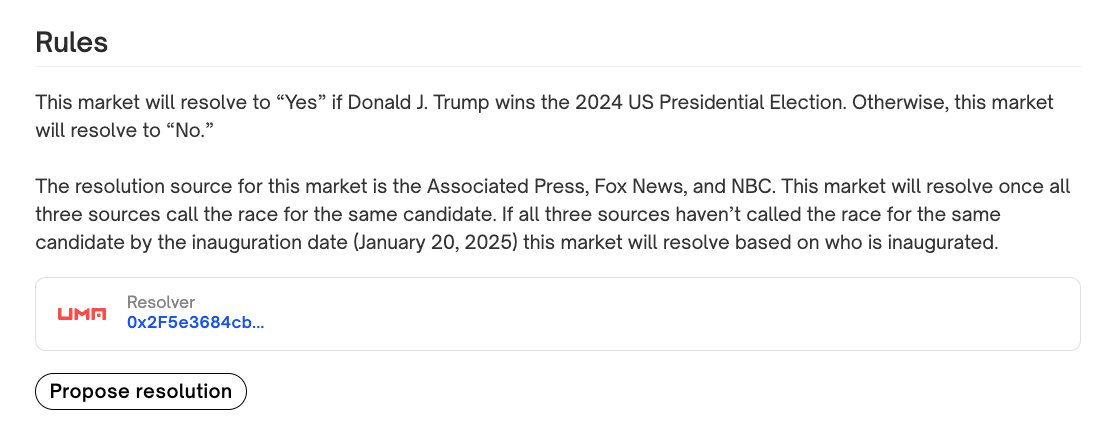

Market Rules

Polymarket 2024 Presidential Election Winner

Let me explain.

Dispute Mechanism

Anyone can dispute the market within about a day after it resolves by staking $750 on @UMAprotocol. This is just a small amount for the platform's liquidity. Traders can dispute twice before the market fully resolves.

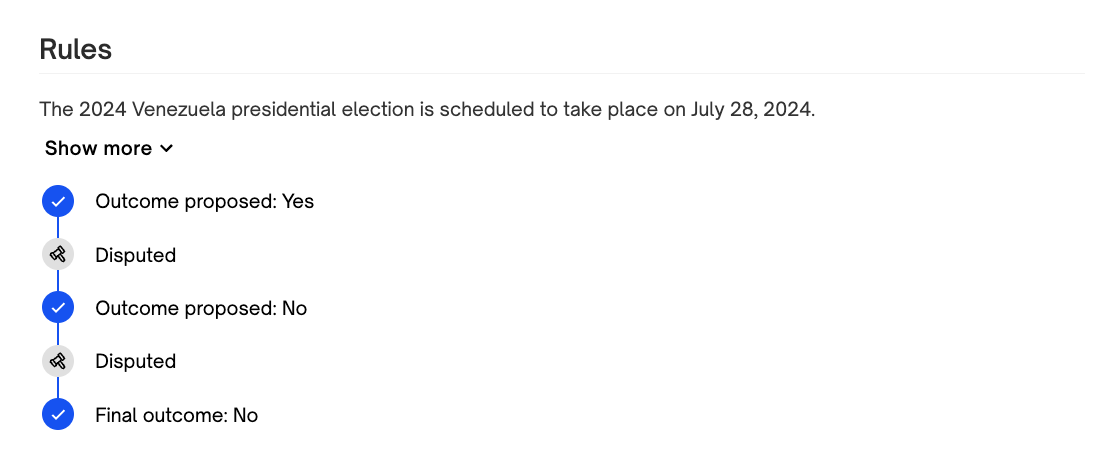

This is an example of a double dispute that was overturned. (These examples show what a dispute market looks like).

Since the rules require all these news organizations to confirm, and based on Polymarket's past precedent in dispute markets, I expect the market to enter a double dispute phase, and the holders of $UMA tokens (UMA voters) will ultimately determine the result as "Trump lost."

False Arbitrage Opportunities

During this period, I predict that some arbitrage opportunities will arise for those investors hoping to achieve 100 times returns through a market reversal (betting 1% on TRUMPYES, hoping to profit 100 times if the market reverses). During the dispute period, the market will initially price TRUMPYES at 1% and TRUMPNO at 99%, and as more people try to invest funds in hopes of achieving 100 times returns, market volatility may increase (creating arbitrage opportunities).

To be honest, these are like slot machines in the prediction market.

Some might say, "With a 100 times chance, I'll bet some," while others might invest large amounts more confidently. Sigh…

I won't bet on that 100 times chance; instead, I will invest in the 99% possibility because after the dispute period, the market is expected to determine that "Trump lost."

Note: The potential arbitrage opportunity may be small because "100 times bettors" cannot drive market changes alone.

In the RFK market, the market dropped to 96% YES after resolving on Friday. During the dispute period, seasoned investors (OGs) who understand Polymarket's stance on disputes can take advantage of market rules to gain a 6% free arbitrage profit.

How to Determine if the Timing is Right?

If @AP, @Foxnews, and @NBCNews announce that Trump lost the election, my prediction may come true.

Imagine if @FoxNews does not announce a winner out of support for Trump; that would be very interesting.

I'm not sure if there has been a precedent for this situation before, but if it really happens, it would be quite fascinating.

I sympathize with @Polymarket because if any of these hypothetical outcomes materialize, it could lead to a very complex situation involving a lot of money. Again, this is just some thought-provoking hypothetical ideas based on a combination of various variables; please consider this premise while thinking. At the same time, I would also like to hear the opinions of @Domahhhh, @hosseeb, and others.

Let the games begin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。