From a technical perspective: Non-farm data is a major negative for the U.S. economy, leading to a sharp decline in the dollar index, while Bitcoin's price rises to 71,600, which is logically reasonable.

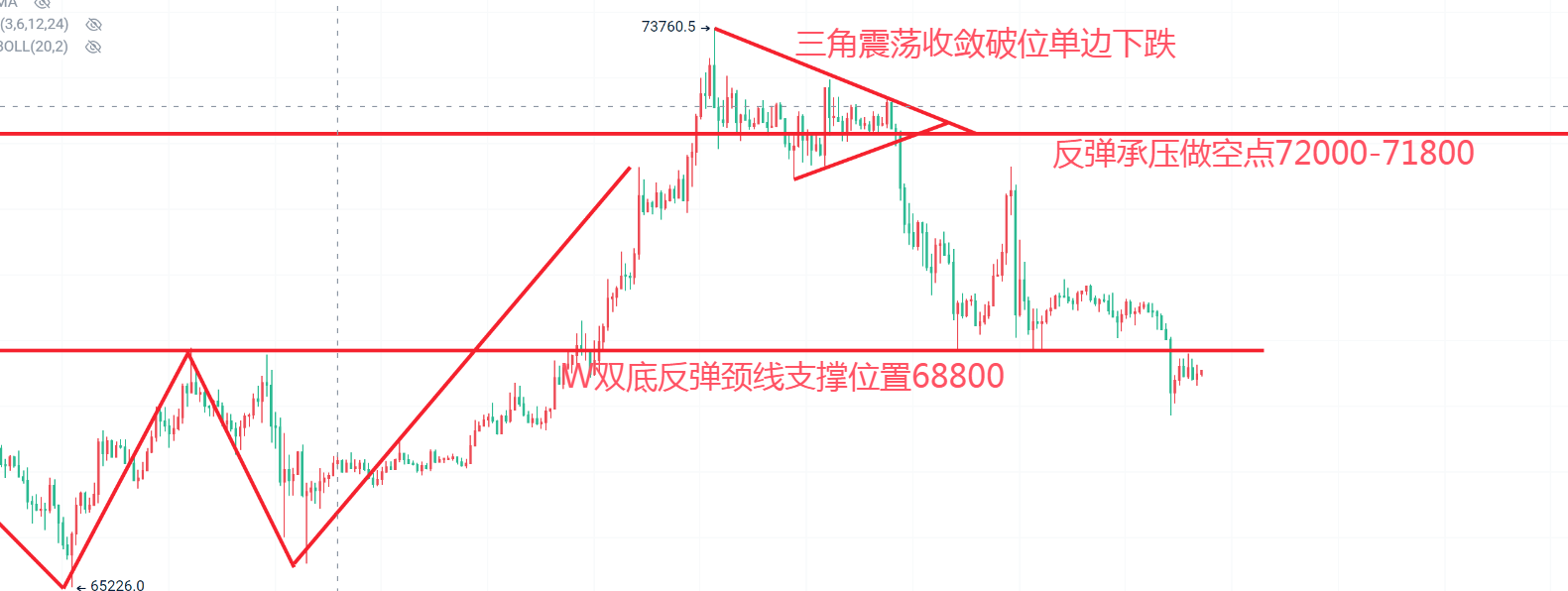

Issue: The concentrated short positions across the network on Friday were around 70,500. The rise to 71,600 could trigger stop-losses for all short-term short positions, but it did not reach the second short position above 71,800. The market quickly reversed and fell after reaching 71,600. Over the weekend, after experiencing three rebounds from the support at 68,800, it broke below the previous daily level W double bottom rebound's key support position, accelerating the decline.

Hunter's thoughts: This point is very confusing. I have repeatedly mentioned that the market would make moves around the 68,800 position. Simply put, it creates endless speculation about this position. Considering the major negative impact of non-farm data on the dollar and the positive impact on the crypto market, this wave of decline should be a real drop. From the actual fluctuations from Friday night to the weekend, the market did rise under favorable conditions, clearing out short positions, but did not provide a second opportunity to short (71,800-72,000). The continuous retest of 68,800 over the weekend and subsequent break below accelerated the decline. If the market were to rise afterward, there would be no need to retest 68,800; it could rise directly in line with the favorable non-farm data.

From a news perspective: The decline in U.S. stocks began on Wednesday when Harris's probability of winning surpassed Trump's. The non-farm data deviated from its usual falsification style, lowering expectations for the first time, with an actual reported employment figure of 12,000, which is unprecedented compared to the past.

Issue: Both the U.S. stock market and non-farm data reveal something strange. The election results are not yet announced, but the U.S. stock market has started to fall. The non-farm data is a statistic from the U.S. Department of Labor, part of the government system, which has now changed its previous style of falsification and started to appear normal.

Hunter's thoughts: The U.S. stock market began to decline when Harris's probability of winning surpassed Trump's. Does this mean the Democratic Party feels confident about their victory? After all, maintaining the prosperity of the U.S. stock market was previously for votes. Now, only if they are certain of winning, do they not need to maintain the stock market's prosperity (regardless of who comes to power, the issues of the dollar and U.S. debt need to be addressed; if the stock market remains bullish, this bubble could become the third crisis, so whoever comes to power needs to actively burst it). From another perspective, the capital behind both parties is facing liquidation this round. Has Trump's faction sensed the possibility of defeat and started to flee early?

Furthermore, the change in the falsification style of the non-farm data suggests that the U.S. bureaucratic system seems to be completely obedient to the Democratic Party. Previously, falsification was necessary to maintain a decent prosperity and prevent the stock market from crashing. Now that real data has emerged, does it indicate that the government system has also recognized that the Democratic Party will continue to hold power and can start to correct the previously outrageous data? After all, the lies we previously considered very magical were essentially for votes. From a human perspective, before the dust settles on the election, I can use any means necessary; if I lose, the mess is left for Trump to clean up. But if I win? The mess I created is also mine to clean up.

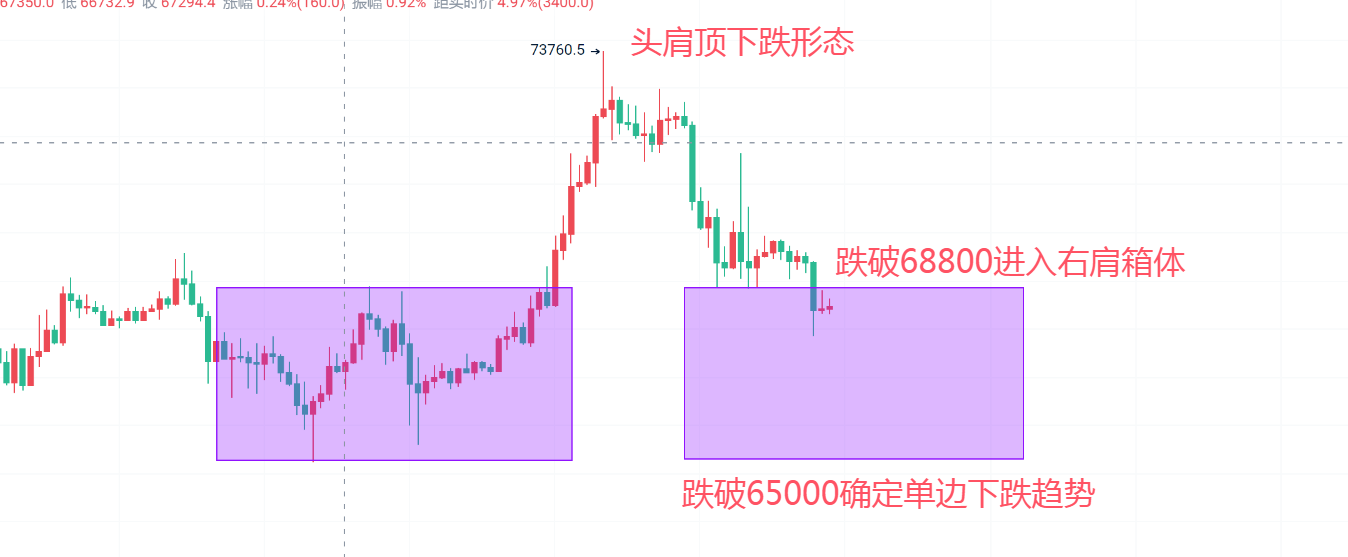

Having discussed these two points, let's talk about the current market situation. After the daily head and shoulders top broke below 68,800, it officially entered the process of forming a right shoulder box consolidation, with a top at 68,800 and a bottom at 65,000. This aligns with what the hunter previously mentioned about needing to create a range of about 3,000 points before the election announcement to facilitate control and stir emotions.

The break below 68,800 was chosen during the weekend when market trading was light. Who is in a hurry? What are they in a hurry about? If it were to rise, it could have fully utilized the favorable non-farm data to directly push to 61,800-62,000 for resistance, enticing short positions to enter, and then accelerate upward to initiate a bull market.

The only reasonable explanation is that the subsequent market trend is downward. Only in this way can the logic of this weekend's decline make sense. Breaking below 68,800 can initiate the right shoulder box consolidation of the head and shoulders top, providing a 3,000-point fluctuation range for the main force to control. Meanwhile, the fundamental reason for the market's bullish sentiment is betting on Trump's return to power. The election results will be announced on November 5. Even if Trump comes to power, the rise can still be controlled within this range. If Harris comes to power, there will be a direct waterfall decline, or a slow drop, which can technically justify this wave of market movement.

Over the weekend, everyone does not need to pay attention to the pressure situation at 68,800. Whether it breaks or not is not important. If it is a decline, even if there is a spike, it is not a big deal; at most, it counts as forcing a technical short position stop-loss. If the hunter's judgment is wrong and the market is not declining but rising, then a one-sided upward movement will not provide any pullback.

Therefore, the current position you can choose is to short near 68,800, with a stop-loss above 69,300. If the subsequent market moves upward in a one-sided manner, then the hunter's judgment is wrong. However, if the spike triggers the stop-loss and the market falls back into the range of 68,800-69,200, continuing to short again indicates that the market is a false break spike, and the subsequent movement is still a one-sided decline, which will likely drop to the area of 66,000-65,000 before the election announcement. This position can be chosen to reduce positions and withstand the volatility of the election.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。