The weekend homework can be complained about less. Recently, I've discussed many trend-related topics, even including references to Berkshire Hathaway's financial reports. The intention is to express that, as an investment, most people cannot predict short-term price fluctuations. Even someone as strong as Buffett can only judge the track through trends and will experience significant drawdowns. No one can accurately tell you the changes in the risk market the next day.

Therefore, trends and cycles should be the weapons that the vast majority of mediocre investors need to master. For example, I am a mediocre investor; during this cycle, I have basically been in a laid-back state, neither buying at the bottom nor exiting at the current peak. However, my paper profits are still acceptable because I recognize my mediocrity, and corresponding to mediocrity is how to improve the win rate and reduce the failure rate of PVP.

Thus, my focus has always been on the changes in the big cycle and the changes in trends, adapting to trends rather than going against them. Although this path may not lead to wealth, it can make life simpler and ensure I live longer. Of course, this may not be suitable for everyone; it can only be said to be for those who are mediocre and seek stability. I also want hundreds or thousands of times the return, but I will absolutely not blame myself for not earning that part of the money.

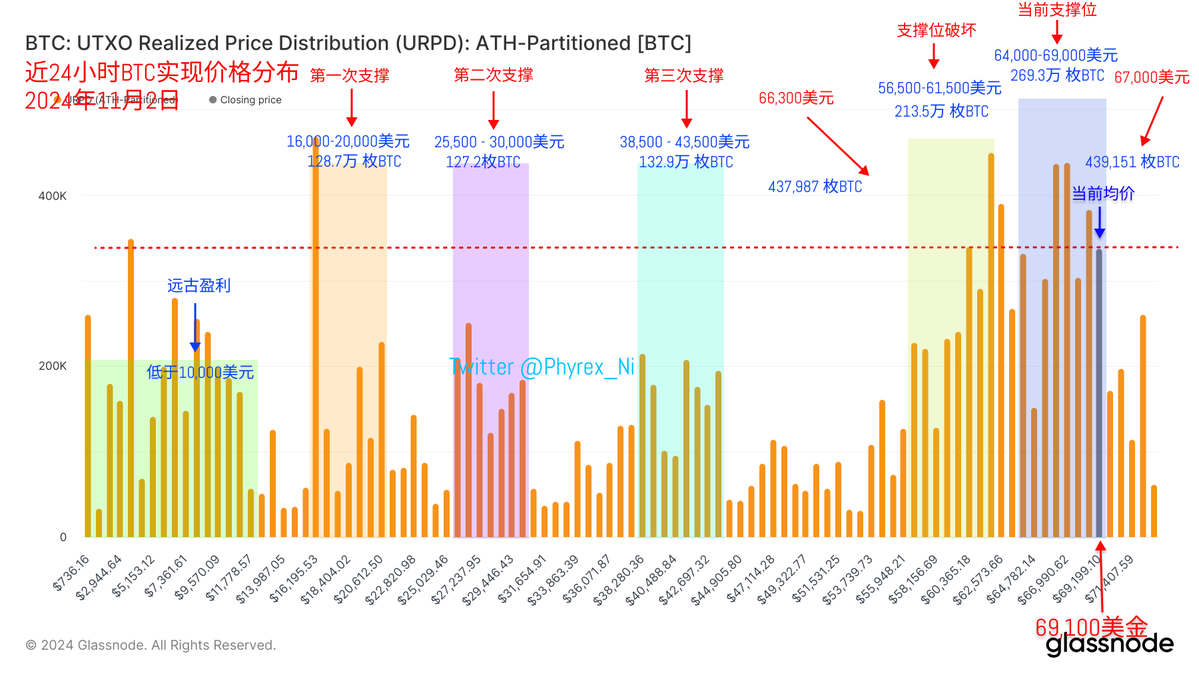

Looking back at the #BTC data, although the price has seen a slight pullback, that is not the main point. The focus is on the upcoming election in less than two days. Yesterday, I posted a specific tweet about what would happen if Trump is not elected, and I still hold that view. Although Trump's non-election may lower the short-term upper limit of BTC prices and could indeed lead to a significant pullback, the election is just one aspect of BTC, not the whole picture. The current trend is still moving towards monetary easing, and more investors will still increase their risk appetite. There will still be the implementation of FASB, and it can still be expected that even if Harris is elected, SAB121 is likely to be passed.

All of this is positive for BTC, so even if Trump is not elected, I still have expectations for Q4 and Q1 of next year.

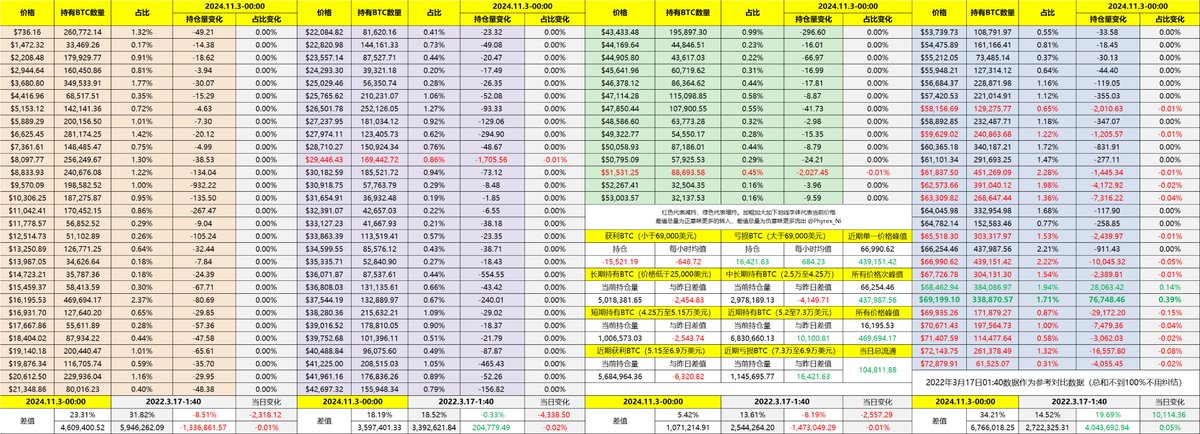

Currently, the support between $64,000 and $69,000 is very robust. The exit of short-term loss investors continues to increase, while short-term profit investors have been mostly cleaned out. Next, let's look forward to the election.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。