The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and refuse any market smoke bombs.

Finally, we have welcomed a wave of correction. The pullback before the election has already given everyone the results, and once again, we have gained the support of many fans. Thank you all for trusting Lao Cui so much. As we step into November, we are greeted with a wave of pullback, which is indeed a bad sign. I originally thought of fully supporting users in the next couple of days, but the election data from yesterday reversed again, causing many users and coin friends to feel deep unease. Elections are like this; you never know the result until the last moment. Today, let's deeply analyze the impact of the election and the overall financial landscape on the crypto world. This article contains a lot of valuable information, so I hope everyone can watch it closely. First, everyone should be clear that behind this round of elections, the capital confrontation is very clear, almost a collision between traditional industries and traditional finance. New industrialists like Musk and the CEO of Oracle represent a stark contrast to traditional financial giants like Bill Gates and Soros. This time, the capital camp situation is clearer than in previous elections, so once you understand this aspect, it becomes easier to comprehend the trends in the crypto market.

Why do many people believe that if Trump comes to power, the crypto market will maintain a growth state? Because Trump represents industry; we need not belittle ourselves, nor do we need to discuss how the crypto market looks. We only need to view the crypto market from Trump's perspective. This is the only battlefield where Trump can positively defeat traditional finance on a financial level. In any other financial market, Trump cannot compete with traditional capital, except in the crypto market, this emerging market, supported by the new rich like Musk, where the odds of victory are far higher than in traditional finance. Everyone should understand that the previous round of 50 basis point interest rate cuts was ordered by Trump to Powell during the pandemic. This raises suspicions about his ulterior motives—was it really to save his own company? Trump has made promises in various public forums that as long as he is in power, he will definitely develop the crypto market, which is likely not just a slogan. In contrast, Harris's supporters are all traditional financial magnates, and they will never support the vigorous development of new financial markets. Isn't this a typical contradiction to their interests? It is very difficult for people to break out of their comfort zones, especially for those who have already established a monopoly in traditional finance. The principle that a gentleman does not stand under a dangerous wall is something almost everyone understands. Even if Harris comes to power, he will not target the crypto market, nor will he advocate for its development. Given the current size of the crypto market, it still cannot compete with other financial markets.

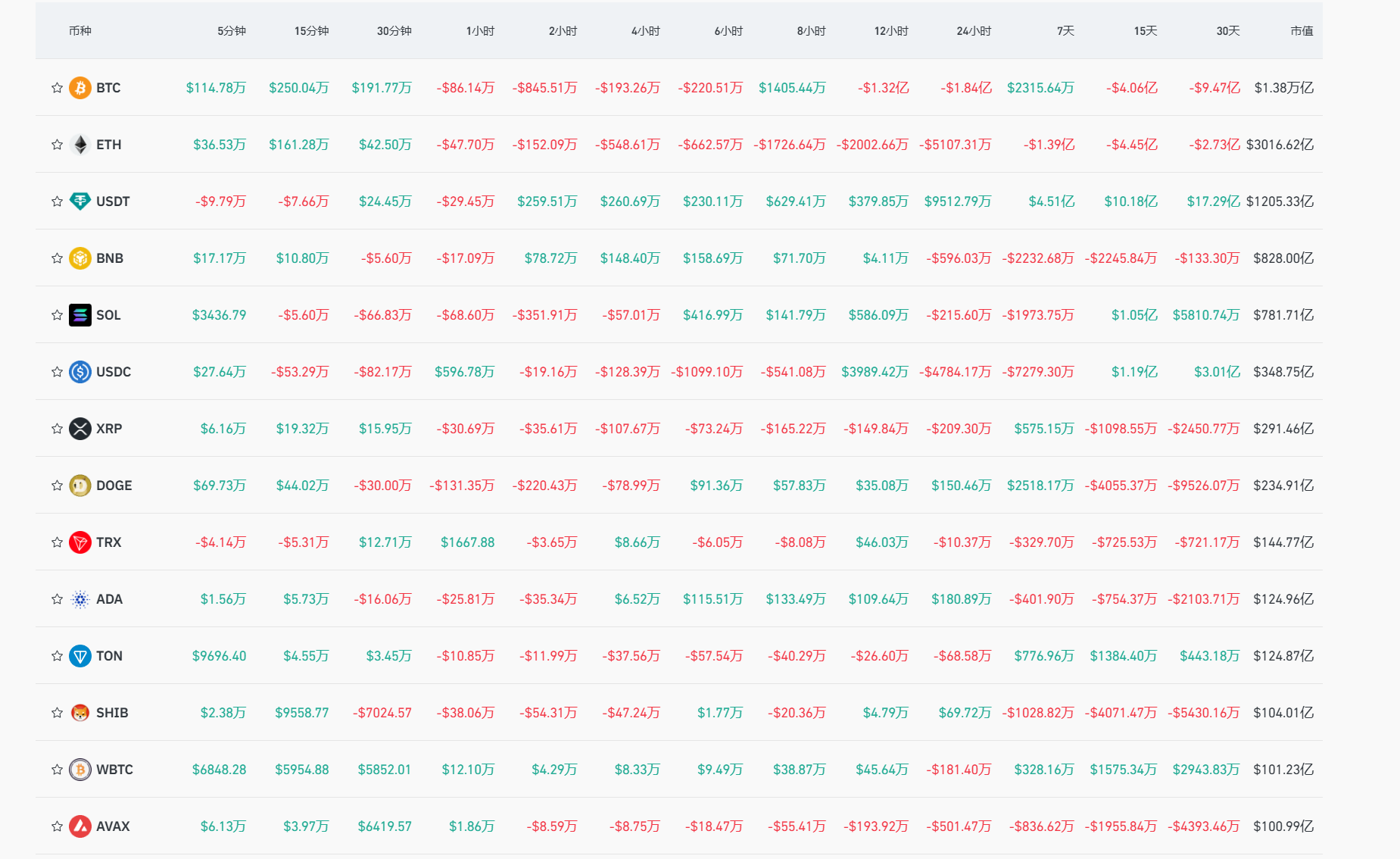

Combining the above, we can conclude that Trump's presidency is definitely better for the crypto market than Harris's. This favorable aspect is not short-term; at least for the next four years, the development of the crypto market will not be hindered. Therefore, after the latest data update yesterday, the crypto market welcomed a wave of pullback. This pullback has always been within Lao Cui's estimates; a pullback of 3000 points after a surge is considered normal market behavior, so there is no need to worry too much. However, the election results will definitely lead to short-term fluctuations in the crypto market, which is why Lao Cui reminds everyone that it is best not to enter contracts around the election; preemptively positioning in spot trading is the way to go. If anyone has been trapped in positions from yesterday, feel free to message Lao Cui, and I can help you look at it. With this round of pullback, the depth below is visibly clear; Bitcoin's downside space is less than a thousand points, while the upside space is at least over 5000 points. How to choose depends on your own understanding; definitely avoid small coins. Given the current market impact, Ethereum's performance can also be considered a small coin, and the choice between contracts and spot trading should ideally be focused on Bitcoin.

Today, there are many things to discuss. This article has taken nearly a week to revise, so please be a little patient. Many friends are dissatisfied with this round of growth, feeling that the crypto market should maintain strong growth and pullbacks like in the 2010s, and that historical-level interest rate cuts have surprisingly resulted in Bitcoin's growth of less than 10,000 points. Lao Cui can only say that the current Bitcoin is a representative of a healthy trading system. The probability of extreme fluctuations like before in the crypto market will decrease more and more. The ultimate direction of the crypto market can only be seen in the US stock market and A-shares. In the future, Bitcoin will no longer experience the previous halving or violent surges. A healthy trading market must first ensure that retail investors are not completely wiped out. It can be said that the previous fluctuations have almost eliminated most of the crypto market users. The users Lao Cui has worked with have changed thousands of times over the past decade, and very few have been able to walk together to the end. Currently, only five people have crossed the ten-year mark together, which is why Lao Cui has always emphasized risk and rarely talks about profits.

Returning to the crypto market, looking at the entire non-farm payroll data released by the US, it indirectly proves that the interest rate cuts in December may continue. Do not be misled by the gradually improving non-farm data, which seems to indicate an increase in employment. The key data Lao Cui is observing is the unemployment rate, which has risen by 0.1% compared to the previous period, and the number of permanently unemployed has increased by nearly 200,000. These two sets of data prove that the previous round of 50 basis point interest rate cuts did not achieve their intended purpose perfectly. It can be basically confirmed that the interest rate cuts in December will continue, so we must ignore the threats from the US. The US has now become accustomed to threatening everyone; the previous round of 50 basis point cuts was also like this. They are trying to fool everyone into thinking that there may not be a rate cut in November. We will wait for the meeting on the 6th, and the results will surely satisfy everyone. Based on these data comparisons, Lao Cui has made the following adjustments.

First, five days ago, Lao Cui was almost ready to close the long positions, just waiting to see if the depth of this round of pullback would be satisfactory. Spot users' entry points can almost be worry-free. The main focus is on the arrangements for contract users. Comparing the trend of the crypto market, Bitcoin is the dominant player. This is also because the current crypto market cannot attract a large amount of investment; capital has almost all chosen the stock market, whether it is US stocks, A-shares, or Indian stocks, the current return rates are all higher than those in the crypto market. Therefore, there will not be significant growth in the short term. The short-term goal is mainly to position for the future, as the old saying goes, to wait for the right timing. The result of positioning is the election results on the 5th and the interest rate cut results on the 6th, after which we can decide on the future trend. Undoubtedly, if the stock market remains strong, the investment in the crypto market may face another wave of pullback in mid-November and early December. The biggest problem in the current crypto market is that the funds cannot support this round of bull market growth. Therefore, everyone should try to focus on medium-term investments, which means choosing time nodes and buying on dips. As long as there are favorable news about interest rate cuts and the US meetings, non-farm payrolls, CPI, and other financial good news, everyone must preemptively position themselves to enter the market. Contracts can yield 1000-2000 points of profit, which can be withdrawn, allowing spot trading to continue generating returns.

Lao Cui's summary: There isn't much to say in the summary, just to talk about the mindset. Short-term growth will not be too strong, but declines will also not be too severe. Therefore, patience is very important at this stage. There are only three days left until the election results. Whoever can survive in this market will gain certain profits. Even if Harris wins on the 5th, the interest rate cut on the 6th will still occur, so entering short positions in the short term is not very wise. For those who want to short, it is best to wait until after the election and interest rate cut, and then choose to enter when the funds are insufficient in mid-month. The current crypto market is mainly driven by a large influx of capital, and all this capital is flowing into the stock market. In the short term, the crypto market will definitely not be the chosen track for capital. It is essential to have patience; enduring this round of bull market is still on the way. The capital aggregation in Bitcoin is greater than the total of all other coins, so investing primarily in Bitcoin is the way to go. Bitcoin below 70,000 can almost be bought without hesitation, and after a wave of profits, you can then choose to enter short positions. If you are unsure, feel free to ask Lao Cui. Of course, users who are trapped in long positions can also consult, and Lao Cui will answer one by one. Let us turn our attention back to the 5th and 6th of this month; whether we can profit this month depends on the performance of these two days. Today's trend will focus on recovery, with short-term profits around 1000 points, and you can enter long positions at the current price.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。