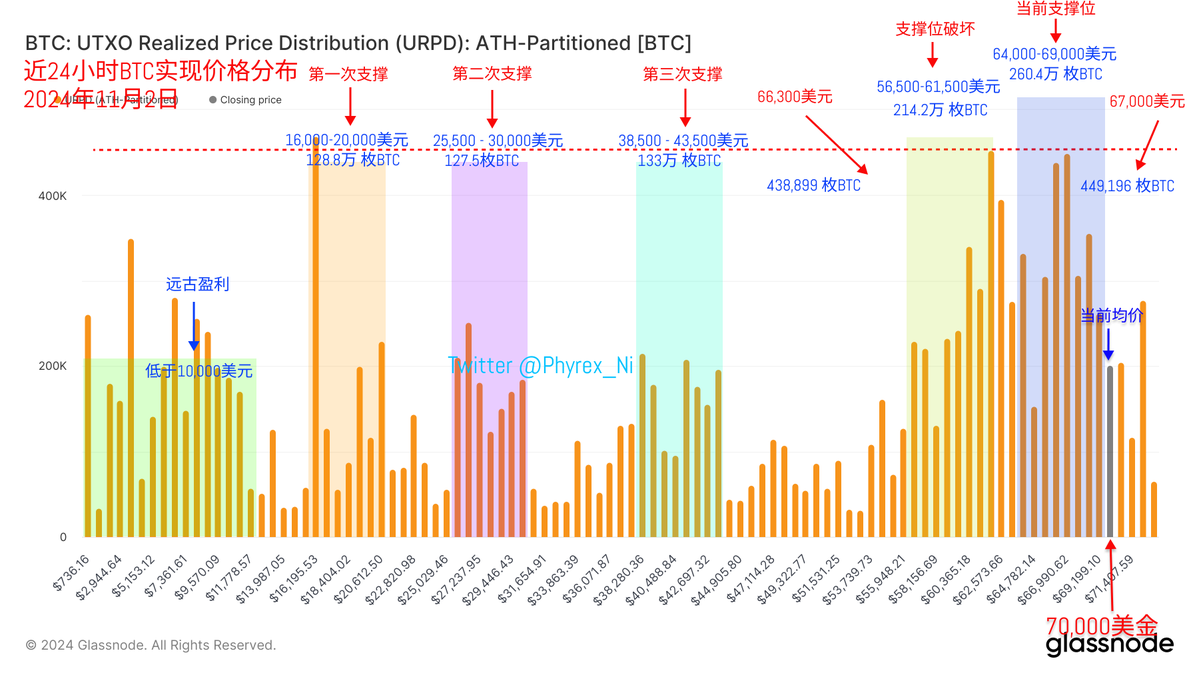

Yesterday's homework was a decline, and today's homework is still a decline. Today, a tweet was specifically sent out about trends, focusing on the importance of paying attention to the position of trends and cycles during price fluctuations. Therefore, even though #BTC's price has temporarily broken below $69,000, I am not too worried. On one hand, I have previously mentioned that the washout below $70,000 is not enough; it needs more time to settle for it to be safer.

Additionally, some friends asked whether the overall decline in the crypto market was due to the elections or non-farm payroll data. In fact, we can look at the U.S. stock market and see that it is still doing quite well, without any significant declines. Therefore, the issues with BTC may not be closely related to macroeconomic factors or the elections. It cannot be ruled out that it is guided by sentiment, especially since the ETF data clearly shows that BlackRock's investors are buying a lot of BTC and #ETH. Of course, this does not mean that if BlackRock buys, the price will definitely rise; it represents the sentiment of U.S. investors.

Earlier, I also retweeted a CBNC news flash stating that a large number of U.S. investors are buying BTC before the elections. See, this is not different from the ETF situation; it is driven by the election cycle and the trend of monetary easing. As for today's non-farm payroll data, regardless of whether there are any discrepancies, at least the Bureau of Labor Statistics provided a theoretically reasonable explanation, and that is sufficient.

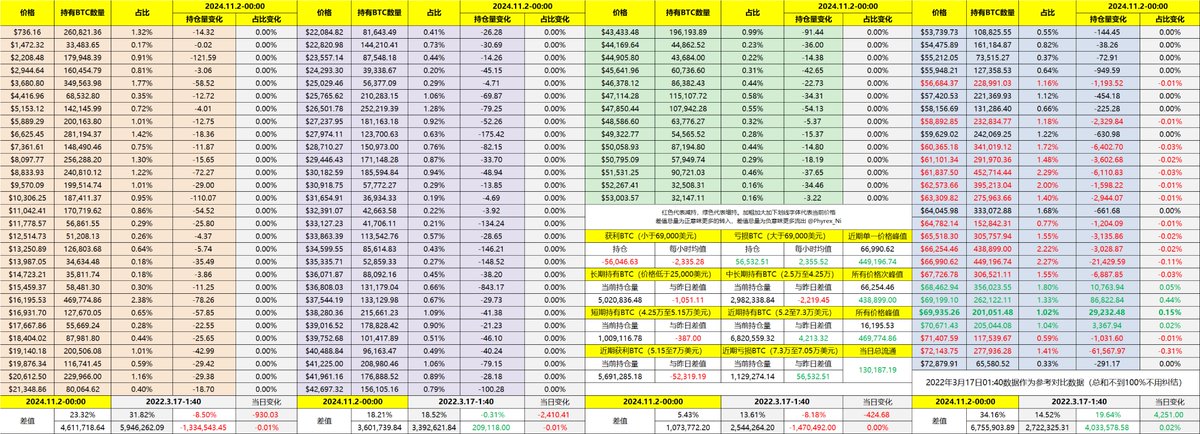

Looking back at BTC's own data, the price decline has led many short-term investors to frequently trade, but the turnover rate has significantly decreased compared to the previous two days. The proportion of loss-making investors exiting the market is increasing, while the exit of short-term profit-takers is gradually decreasing. With less than three days until the election, the current changes are just the prelude; the climax has yet to come, and it is still worth anticipating.

Many friends are worried about the Democrats' chances of winning and whether a Trump defeat would lead to a significant drop. However, from a long-term perspective, whether it is Harris or the Republicans, their attitudes towards BTC or cryptocurrencies are gradually changing. We can still anticipate the passage of SAB121. Of course, it is certain that the crypto market is now more closely tied to Trump. If Trump does not get elected, a short-term price correction may be unavoidable.

Currently, the support between $64,000 and $69,000 is still very healthy. The main trading activity is from short-term investors, while earlier investors remain indifferent to the current situation. It seems that even with the price nearly touching the previous high, early investors have not developed a fear of heights. This is a good sign, indicating that most investors have new expectations for BTC's price rather than competing over the current highs.

Tomorrow is the weekend, and liquidity will be worse. It is hard to say what will happen; we still need to watch the sentiment, with the focus being on next week.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。