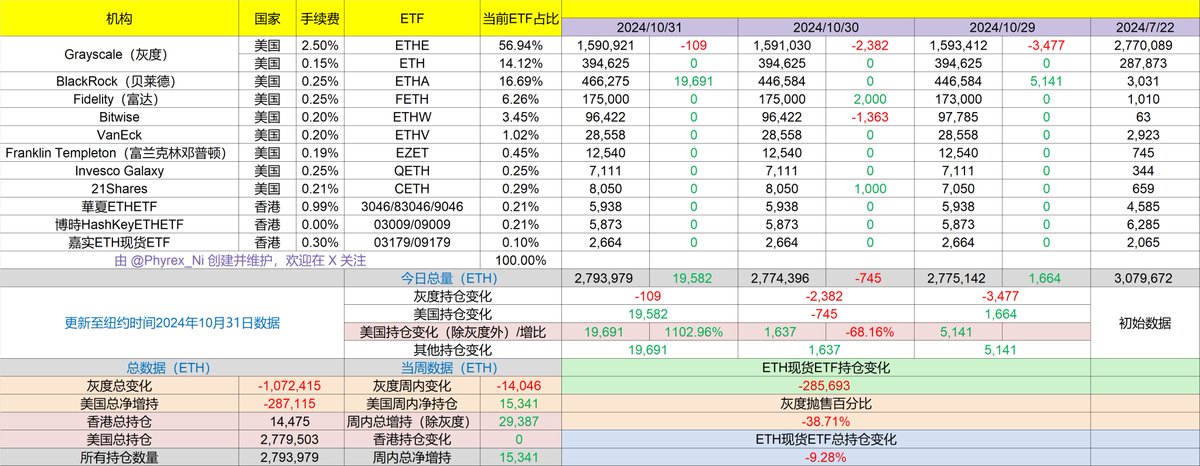

Just got home, and I'm sorry that the ETF data update was late today. In the previous trading days, we have been complaining about the low purchasing power of institutions for ETH. Apart from BlackRock, which has relatively high purchasing power, other institutions have very low buying volumes. This was still the case in the last trading day, but #ETH holders no longer need to envy BlackRock investors who have been buying #BTC at high prices, as BlackRock had a net inflow of 19,691 ETH yesterday.

This number is the purchasing power data that hasn't appeared since the third week after the spot ETF was approved. Just yesterday, we were complaining that BlackRock's financial managers only recommended BTC to users, but it seems they will also start recommending ETH.

However, apart from BlackRock, the purchasing power of other institutions is almost zero, and Grayscale's selling has not shown a significant downward trend. In the four days of this week, Grayscale's sell-off is similar to last week's five days, and relatively speaking, ETH's treatment is still much worse than BTC's.

On a slightly better note, today BTC's data shows that while BlackRock still has strong buying, there have been several larger sell-offs from other institutions, whereas ETH has not seen this.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。