According to Foresight News statistics, from October 26, 2024, to November 1, 2024, there were a total of 20 investment and financing events in the cryptocurrency market, including 9 in tools and infrastructure, 5 in the DeFi sector, 1 in asset management, 2 in blockchain games and NFTs, and 3 in the Web3 sector. The total disclosed investment amount is approximately $178 million.

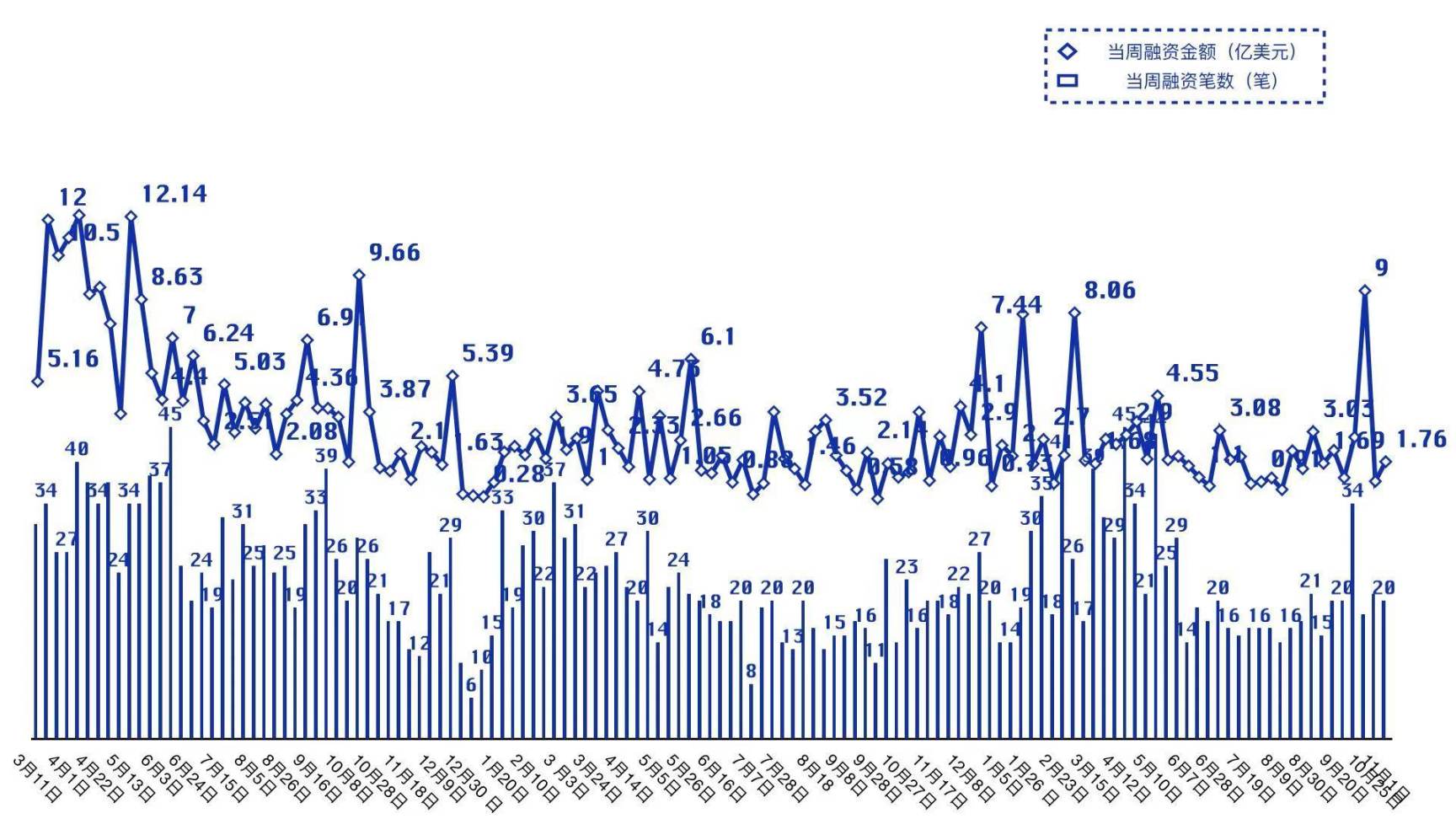

Weekly summary of disclosed financing amounts and number of financing events:

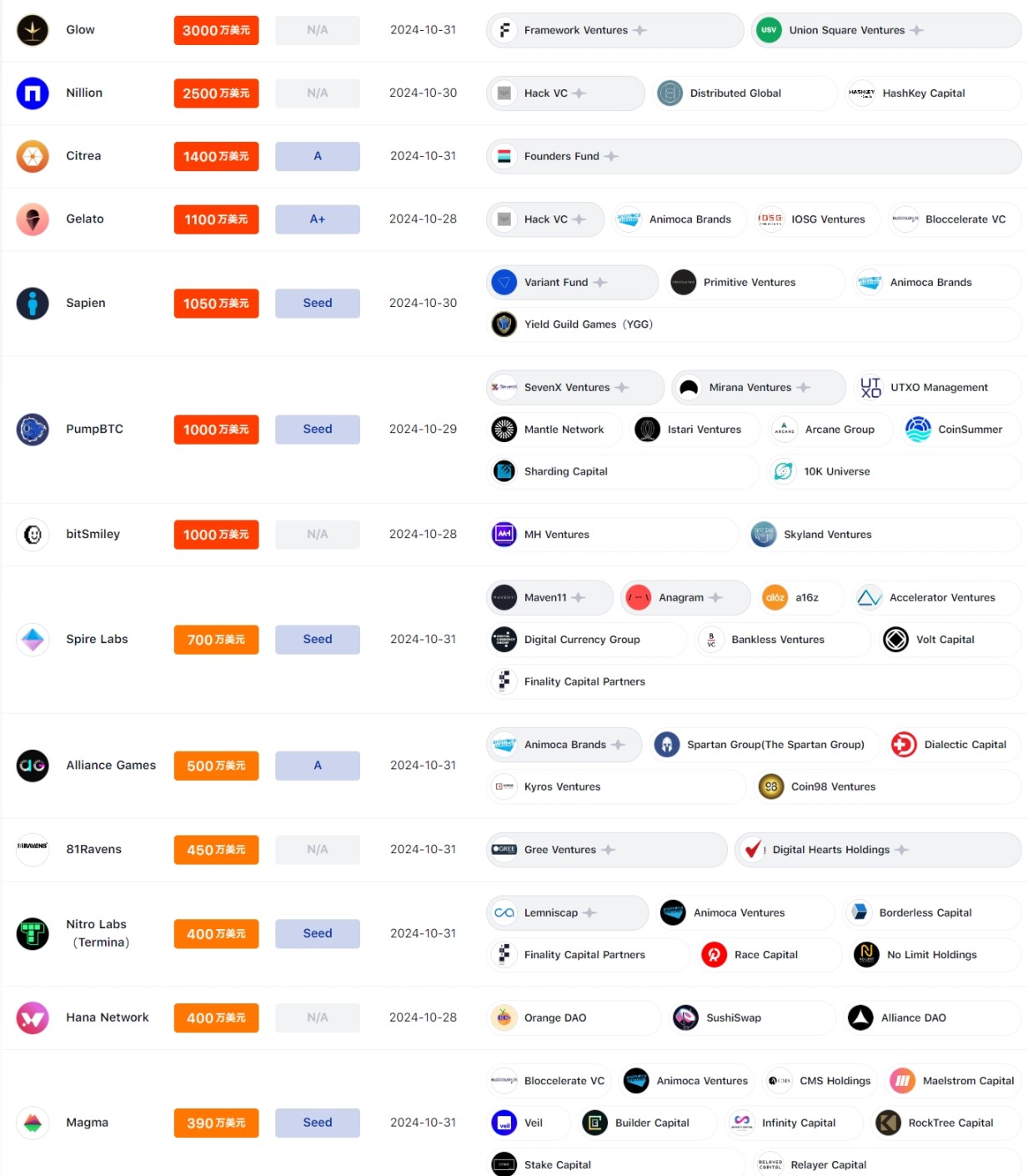

This week's investment and financing projects sorted by financing amount are shown in the following chart:

This week, there were a total of 8 financing events in the tens of millions of dollars, including Ellipsis Labs completing a $21 million financing to launch the L2 blockchain Atlas; the Bitcoin rollup project Citrea completing a $14 million Series A financing led by Founders Fund; blockchain solar company Glow completing a $30 million financing led by Framework and others; AI data collection company Sapien completing a $10.5 million seed round financing led by Variant; privacy security computing network Nillion completing a $25 million financing led by Hack VC; Bitcoin re-staking protocol PumpBTC completing a $10 million seed round financing led by SevenX Ventures and others; Rollup development platform Gelato completing a $11 million A+ round financing led by Hack VC; and bitSmiley completing a $10 million financing with participation from MH Ventures and others.

In the segmented investment and financing tracks, the tools and infrastructure sector was relatively hot this week, while the asset management sector was relatively sluggish.

On the institutional side, active institutions this week included Hack VC, Blockchain Capital, and Framework, mainly focusing on the tools and infrastructure sector.

Tools and Infrastructure

Citrea completes $14 million Series A financing

Citrea is a Bitcoin rollup project that adopts the BitVM computing paradigm, aiming to achieve Ethereum-style smart contracts on Bitcoin.

Axal completes $2.5 million Pre-Seed financing

Axal is a verifiable autonomous agent network.

Spire Labs completes $7 million seed round financing

Spire Labs is a startup focused on Ethereum scaling infrastructure.

Solana infrastructure developer Nitro Labs completes $4 million seed round financing

Termina is an open-source platform designed to enable developers to easily deploy custom Solana Rollup or SVM network extensions, supporting customized DApps in various use cases, including gaming, trading, and DePIN.

AI data collection company Sapien completes $10.5 million seed round financing

The Sapien team is led by Rowan Stone, a former co-founder of Coinbase Layer2 network Base, and Trevor Koverko, founder of Polymath and author of the RWA standard ERC1400. Sapien uses USDC stablecoins or a rewards points system to incentivize data providers.

Nillion completes $25 million financing

Nillion is a privacy security computing network.

Rollup development platform Gelato completes $11 million A+ round financing

Gelato aims to simplify the creation and management of Rollup integrations, streamlining the way web3 applications and ecosystems are built and scaled.

Blockchain content verification platform OpenOrigins completes $4.5 million seed round financing

OpenOrigins, founded in 2021, combats fake media by using blockchain technology to verify the authenticity of photos, videos, and other digital content, with relevant information recorded on the Hyperledger blockchain. It has partnered with UK media production company ITN.

Security protocol Phylax Systems completes $4.5 million seed round financing

Phylax Systems is a security protocol designed to address challenges in crypto security. Phylax Systems will build a proactive hacker prevention protocol called The Credible Layer, allowing dApps to define rules for preventing hacker attacks and communicate them to blockchain builders, specifying the states they want to prevent and taking action before an attack occurs.

DeFi

Monad ecosystem liquid staking protocol Magma completes $3.9 million seed round financing

Magma is building MEV-based liquid staking on Monad. Additionally, Magma will collaborate with Ether.fi to establish the first re-staking integration on Monad.

PumpBTC completes $10 million seed round financing

PumpBTC is a Bitcoin re-staking protocol.

bitSmiley completes $10 million financing

bitSmiley is a Bitcoin DeFi infrastructure.

Stablecoin project CAP Labs completes $1.9 million Pre-Seed financing

CAP Labs is one of the selected projects in the developer program Mega Mafia for the real-time blockchain MegaETH, with plans to launch the mainnet in the first quarter of 2025.

Ellipsis Labs completes $21 million financing

Ellipsis Labs is a developer of the DeFi protocol Phoenix on Solana.

Asset Management

Crypto insurance company Native completes $2.6 million seed round financing

Native will initially provide $20 million of on-chain insurance for each risk and will operate a fund pool on Nexus Mutual.

NFT and Blockchain Games

Web3 game studio 81Ravens completes $4.5 million financing

81Ravens, based in Singapore, is the developer of the 3v3 arena shooter game Paravox on the Solana chain, which is currently in global public Alpha testing.

Alliance Games completes $5 million Series A financing

Alliance Games is a game + depin project that combines centralized hosting, data storage, and AI-driven game creation associated with the chain.

Web3

Blockchain solar company Glow completes $30 million financing

Glow operates a decentralized physical infrastructure network (DePIN) consisting of solar power plants in the United States and India.

KRNL Labs completes $1.7 million Pre-Seed financing

KRNL Labs is an open software library for Web3.

Hana Network completes $4 million financing

Hana Network aims to become a gateway for newcomers to cryptocurrency by combining P2P transactions and communication on the blockchain with existing social network effects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。