The monthly line for BTC in October officially closed at 8:00 AM this morning. October has lived up to its reputation as "uptober," continuing to rise after breaking below 60,000 at the beginning of the month. This time, we have witnessed a sustained upward trend.

On October 30, BTC surged during the night. As the market hoped to break through previous highs, BTC ended its rally just 130 dollars below the previous high. After two days of narrow fluctuations at high levels, with the release of PCE data, the market's expectations for Trump's successful presidential campaign declined, leading to a synchronized drop in BTC, U.S. stocks, and gold. Trump's media company even hit a circuit breaker limit down.

Many investment bank analysts pointed out that BTC's effective breakthrough and stabilization above 69,000 is proof of breaking free from an 8-month consolidation period and marks the beginning of a new trend. Can this viewpoint still apply now? Let's see how traders make their decisions.

Technical Analysis Group

As I mentioned, Bitcoin could test 60-70k (retest) before another bullish rebound. A successful retest can lead to another wave of bullish momentum towards 80k.

The reference period is 4H. Currently, it has temporarily stopped falling in the 68950 area, but there has not yet been a confirmation of a green K closing in the 68950 support area for the next K bar. If this support level breaks, we will look directly down to the 66150 and 65170 areas.

@laban_li believes this is a resonance after the deep-sea super crab completion. This drop has been quite sharp, and the downward trend has not yet stopped. Entering on the left side is relatively dangerous; it can be tried with a loss, but it is still recommended to enter on the right side for more stability.

The previously predicted 75k was a forecast from two months ago, and the recent top of 73500 is actually not far off, with a high probability of being a small top in the near term.

Data Analysis Group

All exchanges are selling, and the supply in the spot market is relatively firm and obvious. However, in the futures market, CME has been selling throughout, while Binance and OKX have seen a significant reduction in supply after the U.S. stock market closed, and a small amount of buying power has begun to appear.

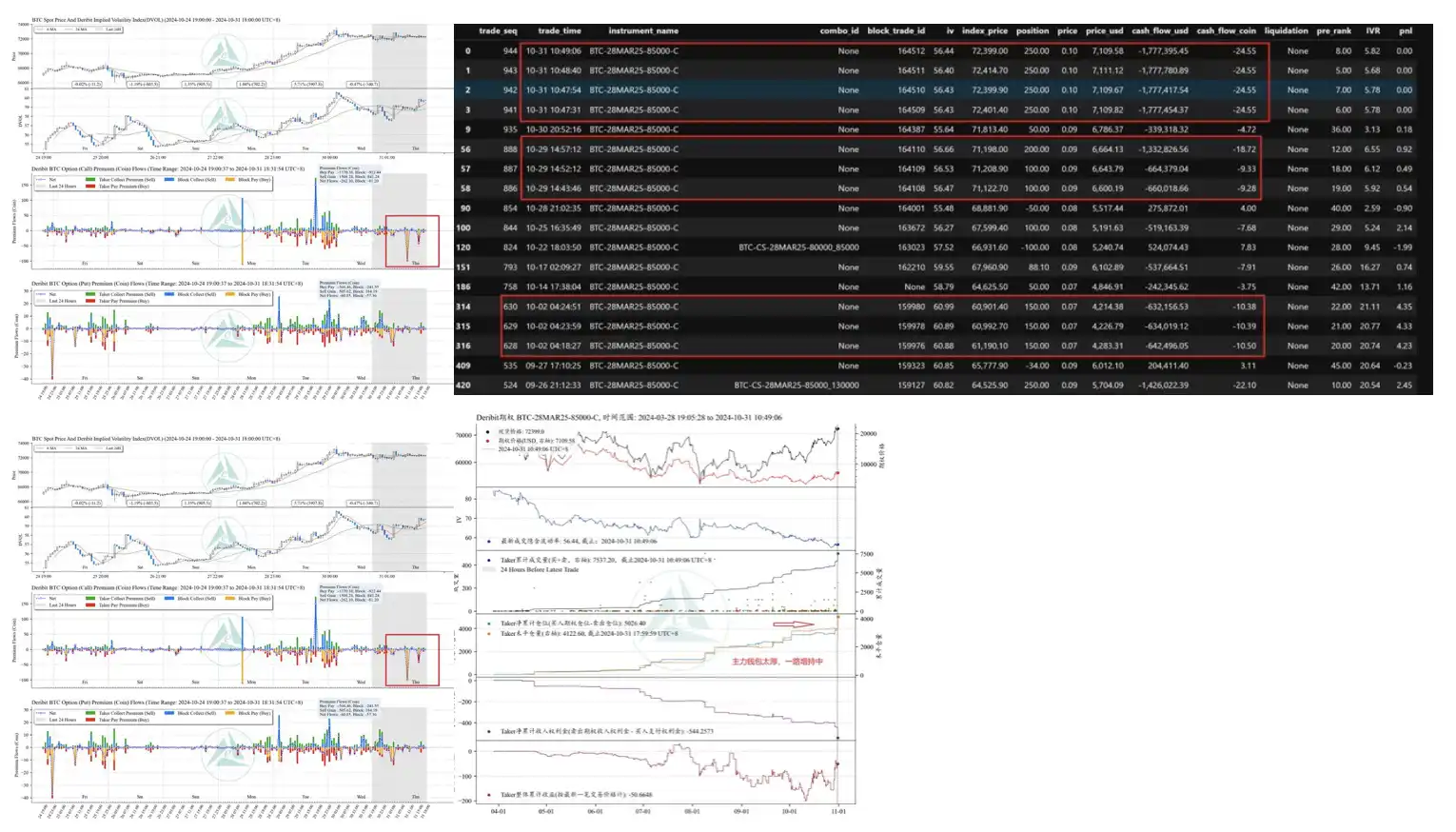

Major options players have entered the market again, continuing to be bullish. At 10 AM, 1000 contracts for the 85000 strike expiring in March next year were bought, costing approximately 98 BTC, or 7.1 million dollars.

The 85000 price level has seen three large bullish buys since the beginning of October from a price of 61000, accumulating nearly 15 million dollars in premiums for 2000 contracts.

From the perspective of the order book, it is believed that buying pressure has emerged, and the pullback is basically over.

From on-chain data analysis:

STH, short-term holder BTC

LTH, long-term holder BTC

On October 29, STH sold 232,000 BTC, and LTH sold 15,000 BTC;

On October 30, STH sold 251,000 BTC, and LTH sold 18,000 BTC;

On October 31, STH sold 207,000 BTC, and LTH sold 11,000 BTC;

It can be seen that:

From October 28 to October 30, the main selling pressure came from "short-term profit" holders, while on the 31st, the main selling pressure came from short-term "stuck holders";

The 29th and 30th were an accelerated distribution process, including both LTH and STH. By the 31st, selling pressure began to weaken.

In the coming days, continue to observe whether the data shows a sustained slowdown or accelerated distribution, which can serve as one of the short-term judgment criteria.

Currently, the average cost for STH is around 64000. As long as this level is not broken, we believe the trend remains unchanged.

Macro Analysis Group

In terms of geopolitical issues:

The main international geopolitical focus remains on Israel and Iran. Currently, Netanyahu has modified his son's wedding event, and Iranian leader Khamenei is inspecting the border, with both sides preparing for opportunities. This is a point to note; of course, personally, I expect that there should be no possibility of an attack before the U.S. election day.

Regarding Russia and Ukraine, the U.S. has publicly stated that due to North Korea sending troops to the battlefield, there is a high possibility that soldiers from a third country will support Ukraine in the Russia-Ukraine war, which is a manifestation of U.S. pressure on Russia.

In the case of North and South Korea, North Korea test-fired an intercontinental missile into the East Sea, raising regional tensions. The U.S. publicly condemned this and stated that it was not notified before the test.

The Russia-Ukraine situation is a normalized issue, while North and South Korea are considered provocative events. The Israel and Iran situation is currently the most concerning "unexpected" risk in the market. Although many people are optimistic that Trump can resolve these issues, the election has not yet concluded, and even after it does, the transfer of power to Trump will still need to wait until January next year.

Regarding stablecoins:

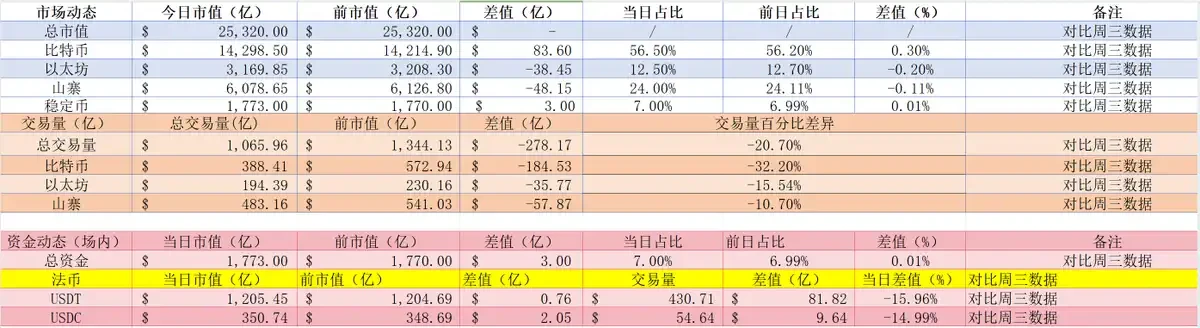

The market value of stablecoins has increased by 300 million, reaching 177.3 billion. This includes some inflow of funds and some retention of funds after outflows.

USDT: Official data shows 120.573 billion, an increase of 6.9 million compared to yesterday, indicating a slight inflow of funds;

USDC: Data shows a market value increase of 2.05, accompanied by a decrease in trading volume, indicating a possibility of fund inflow.

BTC has currently experienced a decrease in volume after the previous two days of rising, with reduced selling pressure and stabilized prices, which may lead to further price breakthroughs, a positive sign.

Although many people are calling for the arrival of altcoin season, looking at the trading volume activity, both buyers and sellers remain active, with relatively small volume reductions, indicating that sentiment is still not optimistic enough.

The optimistic launch of altcoins still requires BTC to stabilize after refreshing historical highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。