Bitcoin Rapidly Drops Below $70,000

The market confirms my idea from the 30th; this wave of decline has scared off the bulls, with Ethereum leading the altcoins to a collective pause. Undoubtedly, the recent sharp drop is the time to buy the dip and increase positions.

Having risen so much, a slight pullback is normal, completing a large-scale 1:1 extension target.

What’s next?

I rarely trade the few hundred points of intraday fluctuations. Now that the coin price is so high, making 300 points is less than 0.5%. If you need someone to help you make 1%, you might as well flip a coin.

Let’s focus on the structure; the most worthwhile position to gamble on is, of course, near the structural breakdown point. If you can wait, then wait; if you can’t, continue with short-term trading. Of course, you can also look at the intraday structure.

From this market movement, how many people feel that trend gains are greater than intraday gains? You can raise your hand. If you claim to be a friend of time, doing trends and structures, yet still need to monitor the market daily, then how can you manage trends and structures?

Today, the non-farm payroll and unemployment rate are both set to be released, with the UK expected to cut interest rates next week, and the U.S. elections finalized.

Non-farm Payroll and Unemployment Rate Release

The non-farm expectations are too far off from last week’s figures; the Federal Reserve is playing tricks.

If positive, BTC will likely surge to around $72,000.

If negative, BTC may experience a spike down to around $67-68.

U.S. Elections Finalized on the 5th

If Harris is elected, BTC will pull back.

If Trump is elected, BTC will surge and then deeply correct.

UK Interest Rate Announcement on the 7th

Expected to cut rates by 25 basis points.

Federal Reserve Rate Announcement at 3 AM on the 8th

The most impactful data for BTC post-election,

If rates are cut by 50 basis points, cryptocurrencies will generally see a rally.

Focus on ETH; if there’s no rate cut, it will likely pull back.

A 25 basis point cut would be seen as already priced in, followed by a retracement.

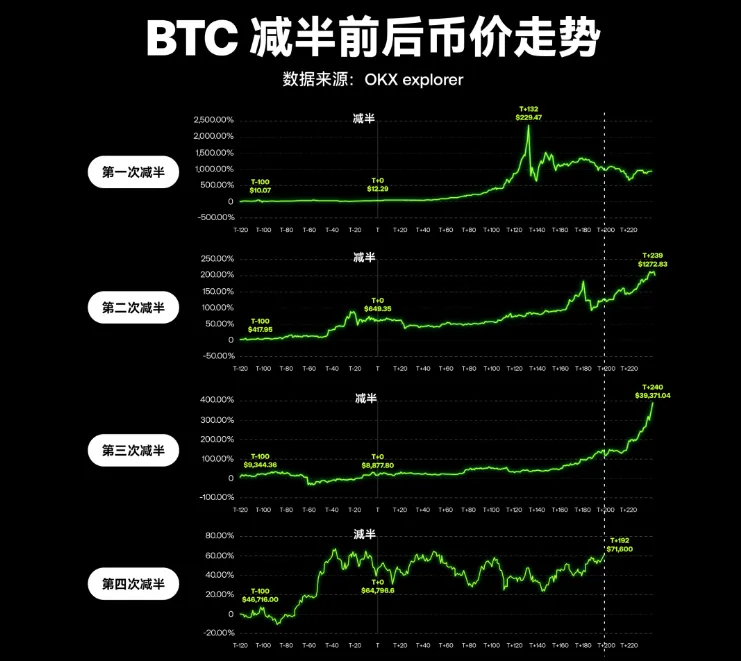

Unknowingly, it has been half a year since Bitcoin's fourth halving; how many opportunities do we still have!

For many newcomers, the feeling isn’t very strong, but looking at the chart above, one can clearly sense that Bitcoin's volatility is gradually diminishing.

For us ordinary people, the more stable it is, the safer it is, and correspondingly, the opportunities become fewer.

Moreover, Bitcoin's opportunities no longer belong to ordinary people; first, the price is too high, and second, the space is small.

This may also explain why everyone is so eager to chase altcoins.

However, altcoins come with many uncertainties, and with the current speed of new coin launches in the crypto space, once a hot trend emerges, thousands of imitation coins will quickly appear, which not only increases difficulty but also dilutes market share.

This leads to coins that could have risen 30 or even 50 times significantly shrinking, as their lifecycle is prematurely consumed by imitators.

The rise of each coin relies on the support of a consensus group; only when everyone works together to form an absolute force can the price rise significantly.

Currently, the market's rhythm is stuck in the mindset of speculating on new coins rather than old ones. Those who can get rich quickly will definitely not choose to wait long-term.

This is a personal choice, with no right or wrong; many people have also achieved results through wave trading this year.

My personal view is: to stick to long-term investment, choosing the major bull market in the crypto space that occurs every four years, rather than buying continuously regardless of bull or bear cycles like El Salvador.

By using my own experience and technical analysis, I identify when the bear market is about to end and the bull market is about to begin, decisively buying in. As long as there are no signals indicating the bull market has peaked, I will continue to hold.

This article is time-sensitive and for reference only; it is updated in real-time.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Crypto悟饭

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。