Original Author: BitMEX

Too Long; Didn't Read:

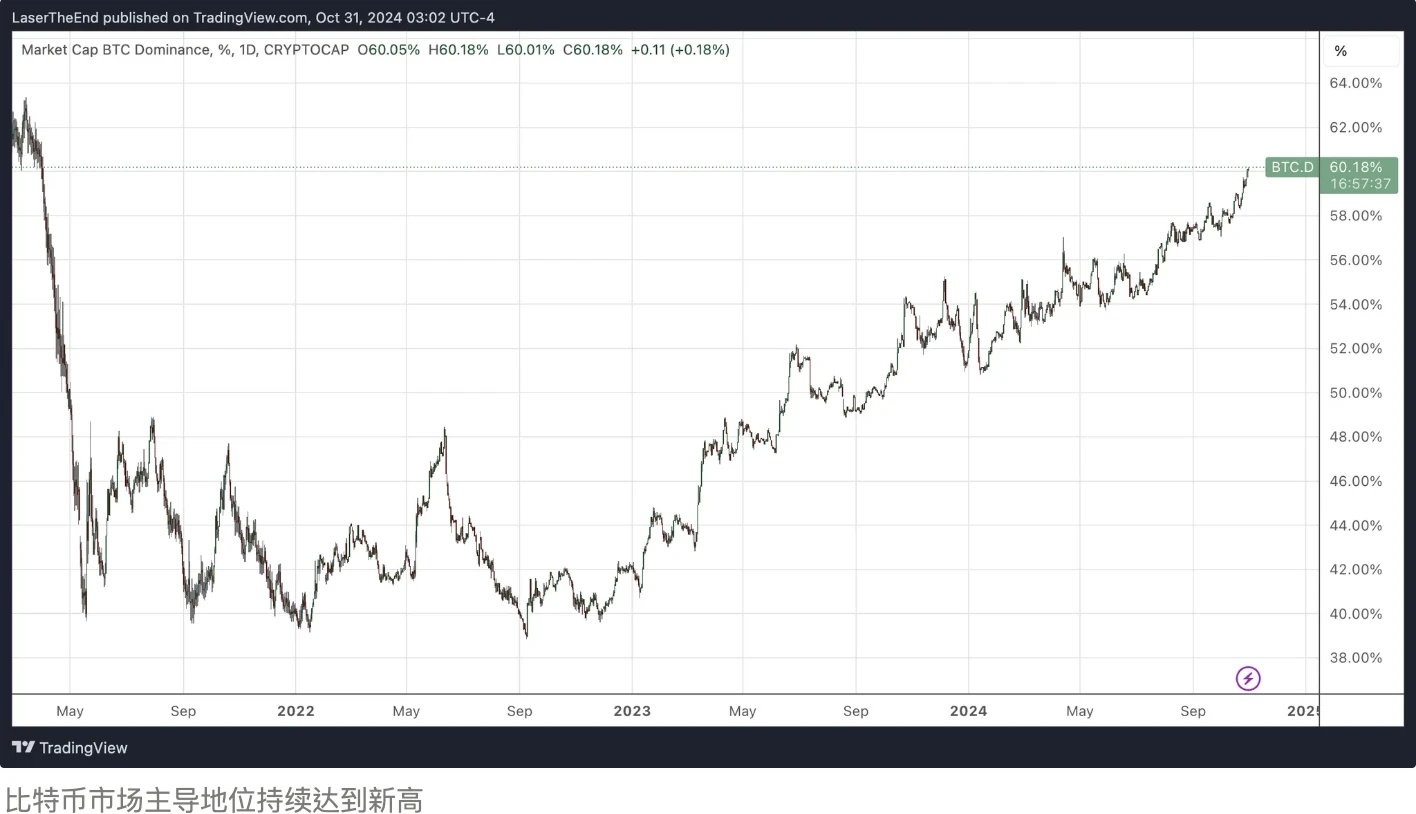

Bitcoin reached an all-time high but has pulled back to around $70,000, with its market dominance continuing to rise to 60%.

This week has been particularly exciting for Dogecoin, with its price soaring over 15%, mainly due to public support from high-profile figures like Elon Musk and Donald Trump for the "Government Efficiency Department." As Trump's probability of winning the upcoming election on Polymarket rises to 67%, just a week before election day, Dogecoin's price increase further expands.

We will explore the latest developments in Bitcoin as it continues to reach new peaks of market dominance in the cryptocurrency market.

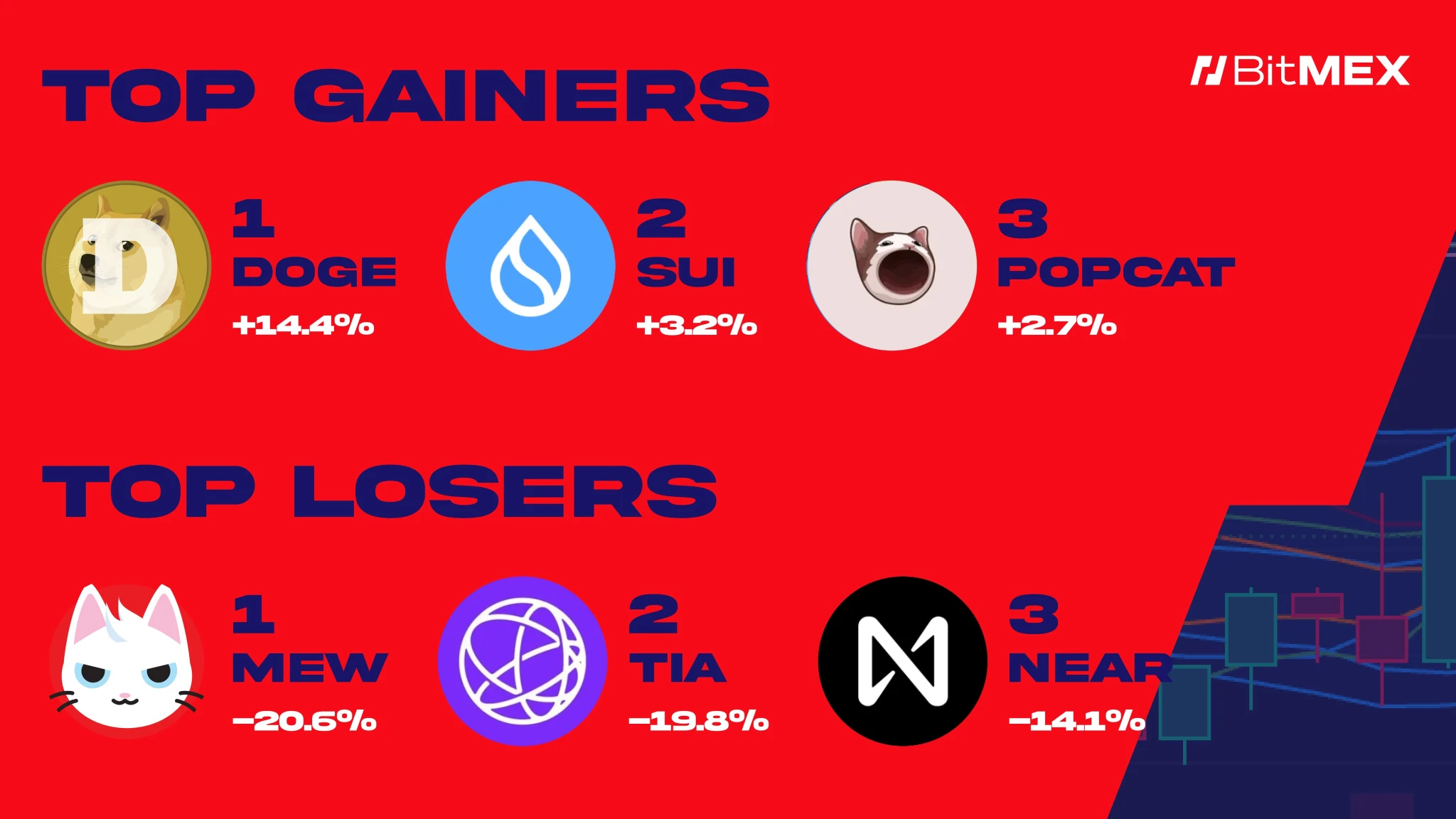

Data Overview

Good Coins

$DOGE (+14.4%): Dogecoin performed the best as it kept up with political trends, resonating with Musk's "Government Efficiency Department" plan.

$SUI (+3.2%): Sui continues to show strength, surprising many.

$POPCAT (+2.7%): Popcat continues to impress in this cycle, becoming a new top meme coin.

Bad Coins:

$MEW (-14%): Quick to rise, quick to fall, right? MEW was the best-performing coin last week.

$TIA (-19.8%): Tia faces a large-scale unlock, with its fundamentals questioned as the protocol fails to generate fees.

$NEAR (-14.1%): NEAR's decline may stem from pressure on AI stocks as well.

News Briefs

Macroeconomic:

ETH ETF weekly net outflow: +$23.9 million (Source)

BTC ETF weekly net outflow: +$2.27 billion (Source)

For the week ending October 26, the number of initial jobless claims in the U.S. was 216,000 (Source)

U.S. Poll: Harris leads Trump by a narrow 1% (Source)

Mt. Gox address transferred 500 BTC, worth about $35.04 million, after a two-month interval (Source)

MicroStrategy conjures stock market magic with a massive plan to buy more Bitcoin (Source)

Projects

VanEck invests in Web3 gaming startup Gunzilla Games (Source)

Canadian listed company Sol Strategies increases its holdings by 12,389 SOL (Source)

Vitalik praises the performance breakthrough of Polygon's ZK proof system Plonky3 (Source)

92.3 million TIA tokens enter circulation, with potential sell pressure of up to $460 million (Source)

Blockchain solar company Glow raises $30 million from Framework and Union Square Ventures (Source)

Trading Insights

Note: The following content should not be considered financial advice. This is a compilation of market news, and we always encourage you to do your own research (DYOR) before executing any trades. The following content does not guarantee any returns, and BitMEX is not responsible if your trades do not perform as expected.

Non-fungible: The Fundamental Advantage of Bitcoin

Bitcoin remains the best trading target in this cycle, especially for institutional-scale trading. In this article, we will analyze Bitcoin's current market position and explore the factors influencing whether to go long or short. We will examine fundamental demand drivers, current market dynamics, and potential risks to attempt a comprehensive overview of Bitcoin's appeal in the cryptocurrency market.

Traditional Financial Inflows Far Outpace ETH:

Bitcoin is gaining favor among institutional investors, a trend clearly reflected in recent ETF inflow data. The record inflows into BTC ETFs over the past two days coincided with Bitcoin's price attempting to break through its all-time high, indicating traditional financial investors' confidence in Bitcoin's potential to surpass historical price ceilings. Notably, the funding rate for BTC futures has not seen a significant increase, suggesting that hedge funds have not yet engaged in large-scale basis arbitrage. This indicates that it is primarily ordinary investors, rather than arbitrageurs, driving the inflows—this is a strong sign of market sentiment leaning towards Bitcoin's growth potential.

While there has been a significant inflow into Bitcoin ETFs, Ethereum (ETH) has seen inflows of only about 1% of Bitcoin's, despite ETH's market cap being approximately 21% of BTC's. This disparity highlights Bitcoin's unique appeal to traditional finance, which may drive its long-term dominance compared to other altcoins.

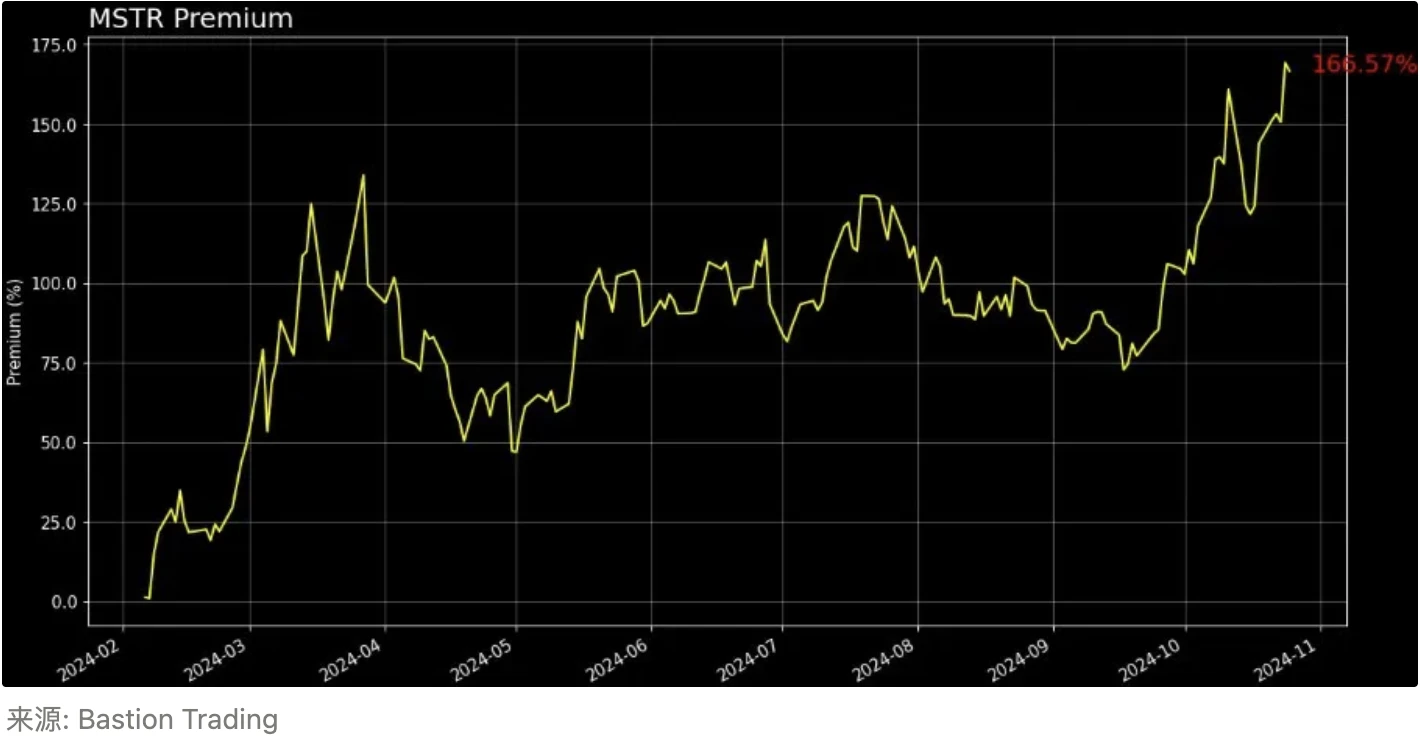

Holdings and Market Support from Public Companies

Public companies, led by MicroStrategy and its CEO Michael Saylor, continue to show strong support for Bitcoin. MicroStrategy's stock premium soared to a new high of 166% last Friday, reflecting strong investor confidence. The company's recent $42 billion Bitcoin purchase allocation plan underscores its long-term commitment. Their vision is clear: to evolve into a "Bitcoin bank" that offers Bitcoin-backed products to institutional investors. Meanwhile, Microsoft's upcoming shareholder meeting will consider investing in Bitcoin, which could mark another major player entering the market. This brings to mind Tesla's purchase of Bitcoin in early 2021, which triggered a 40% price surge within weeks. While Microsoft's participation is not yet confirmed, it is generating similar market excitement and anticipation.

Is Now the Time to Buy Bitcoin?

Historical Momentum of "Rising October"

October typically marks the beginning of significant upward trends in past Bitcoin bull market cycles. If historical trends continue, we may see further "explosive" price increases. Market momentum has already pushed Bitcoin higher, and entering November with this strength may further propel BTC upward.

Potential Impact of U.S. Election Volatility

The upcoming U.S. election adds another layer of complexity. While a crypto-friendly government may sound beneficial, significant policy shifts or economic restructuring plans under a new government could introduce higher volatility. Regardless of which candidate is seen as more crypto-friendly, the associated financial uncertainty could impact the cryptocurrency market, requiring investors to prepare for rapid fluctuations. The possibility of Elon Musk's involvement in the Government Efficiency Committee could trigger drastic economic policy changes. Investors should consider the risks these changes may pose to financial markets, potentially increasing Bitcoin's volatility.

Bitcoin from Bhutan

Bhutan's recent deposit of approximately 1,000 BTC ($65 million) into Binance has sparked speculation about a potential sale. While it is unclear whether the Bhutanese government intends to liquidate its Bitcoin holdings, a large-scale sale could exert downward pressure on prices. Investors should keep an eye on this as a potential risk factor for Bitcoin's price stability.

Conclusion

Despite Bitcoin's long-term outlook remaining positive, the upcoming elections and macroeconomic factors may require a cautious approach. For those inclined to maintain a bullish stance, swing trading may allow for profits while still capitalizing on Bitcoin's upward potential. As expected volatility increases, strategic positioning can enable investors to maximize returns while managing downside risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。