Author: FC, Linda Zheng

Last month, we organized a Trader Day event in Singapore, where we invited the heads of three funds and exchanges to share how they made 100 times their investment in the 1.5-level market, revealing the entire process from buying to selling.

At the end of this article, I will explain what the 1.5-level trading is.

They are:

@BastionTrading Founder Ning Zhang @TheSkyBomber

@MetricsVentures Partner Mark @CryptoMark0727

@MEXCOfficial Head of Strategic Investment Leo @zhaoeth

Question 1: Why do you choose the 1.5-level market for investment?

Ning: On one hand, the 2-level market is very competitive now, with a lot of funds and less liquidity, so we started exploring the 1.5-level; on the other hand, the 1.5-level market is now more mature. Although it is not much different from the secondary market, the risks are lower and the uncertainties are smaller compared to the primary market.

Mark: The 1.5-level is more mature than the primary level projects that have not issued tokens yet, because they have already issued tokens and have data running in the market;

1.5-level investments are more mid-term compared to 2-level investments (buying tokens directly on exchanges) because buying tokens at the 1.5-level has a lock-up period, requiring expectations and judgments about future market conditions, liquidity, and project development.

Additionally, OTC trading mostly occurs at the end of bear markets and the beginning of bull markets. If you buy directly in the secondary market, you might face poor market liquidity, causing a $1 million investment to push the price up by 30%.

At the bottom of the bear market, we proposed the concept of a "zero fund," buying an investment portfolio and selling it at the beginning of the bull market to profit from the transition between bull and bear markets.

Investment Representative Works

Leo: We started discussions with the TON Foundation in March 2023. "Once the other party confirmed the connection with Telegram, we invested tens of millions of dollars," at that time $TON had not yet launched.

Mark: Based on the "zero fund" concept, we selected a token last year, $BEAM, for two reasons: it was a Binance Launchpool project but had a low valuation, and we previously worked with a gaming guild and later realized there were plans for a gaming public chain, collaborating with ImmutableX to issue games.

"What does this indicate? 1. This project is cheap enough, 2. The team is very eager to increase its market value. We immediately decided to buy it at that time!"

Ning: "We bought a lot of $SOL," now publicly disclosed for the first time.

Question 2: OTC Merchants: "I can sell you tokens at a discount, what can you empower me with?"

When we, as a primary fund, want to invest, projects may ask, "Why should I sell to you? Why you and not someone else?" However, in 1.5-level investments, this question usually does not exist; it is simply a matter of buying and selling.

However, different buyers may have different perspectives. Leo believes that if a project or foundation sells 10% to 30% at a discount to everyone equally, it indicates that they have not thought through what kind of investors they need, which is not meaningful.

So when they select 1.5-level projects, an important indicator is whether the sector can become a mainstream trend in this cycle and whether it can help improve the project. For example, with the previous TON, when it announced OTC, its ecosystem was weak. As an exchange, we invested in it and assisted with token listings to increase overall ecosystem liquidity and activate users, which allows us to have good control over the results and confidence in making such 1.5-level investments.

Question 3: The 1.5-level market has a 1+3 unlocking cycle. Do you have any advice for investors?

Leo: This rule mainly emerged in this round. Previously, after a token was launched, 20% would be unlocked, and investors would sell everything in the following months, leading to significant selling pressure, which the market could not absorb, resulting in a double loss.

Ning: The 1+3 lock-up period is, on one hand, a form of self-regulation in the industry, and on the other hand, it will affect the token's performance in the first year and the following three years because liquidity changes. Therefore, funds need to manage expectations and risk control for LPs financially.

Background Knowledge

What is the 1.5-level market?

The 1.5-level market, also known as OTC (Over-the-Counter Market), refers to a market where buyers and sellers negotiate directly rather than trading on public exchanges. It focuses on assets that have already generated tokens but are still in a lock-up period.

Buyers and Sellers in the 1.5-level Market

The main sellers in the 1.5-level market are VC investment firms, crypto project teams, and foundations, aiming to ensure early profits or manage selling pressure.

Buyers are divided into two categories: "long-term holders" (hodlers) who believe in the long-term development of the project rather than short-term fluctuations;

and hedgers, who seek arbitrage through strategies like perpetual swaps.

Why is the 1.5-level becoming an active market?

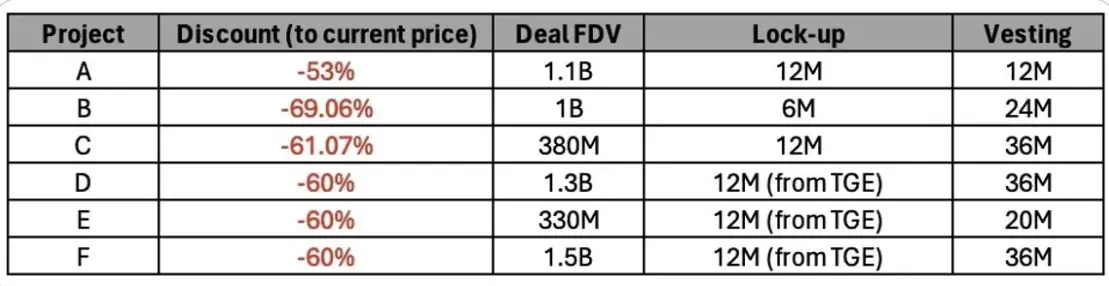

The activity in the 1.5-level market is primarily driven by stakeholders having a strong motivation to sell. For example, a token priced at $1 on exchanges like Binance may only sell for $0.30 on OTC platforms, with a one-year lock-up period and an additional two years of monthly unlocks.

Source: Presto Research

This trend is related to the current market environment, with many projects having high FDV (Fully Diluted Valuation) and low liquidity, along with negative sentiment towards VC tokens. The 1.5-level market helps reduce immediate selling pressure when tokens are unlocked, creating a more balanced market environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。