Compiled by: Scof, ChainCatcher

Edited by: flowie, ChainCatcher

Editor's Note: Cryptocurrency payments are one of the hottest sectors recently. In addition to Stripe's acquisition of the stablecoin payment startup Bridge for $1.1 billion, creating the largest acquisition in crypto history, many mainstream financial institutions have begun to accelerate their layout in cryptocurrency payments:

- BlackRock partnered with Ethena to issue the US dollar stablecoin USDb.

- PayPal collaborated with Ernst & Young to complete its first stablecoin commercial remittance using its self-issued PYUSD.

- VISA announced the VTAP platform to help institutions issue and operate stablecoins independently.

- Coinbase and A16Z jointly invested in the AI cryptocurrency payment company Skyfire.

- ……

Cryptocurrency payments are also experiencing a financing boom. As seen in the cryptocurrency payment financing statistics article published by ChainCatcher in September, recent financing in cryptocurrency payments has gathered giants from various fields such as payments, stablecoins, and traditional finance.

Visa, Tether, Circle, JPMorgan Chase, and Standard Chartered Bank are all vying to enter the market, while top-tier capital such as Sequoia Capital, Temasek, and A16Z are also placing their bets.

Recently, Larry Liu, an investor at the well-known investment fund Qiming Venture Partners, published a lengthy series of articles titled “The Last Big Thing – Cryptocurrency Payments”, systematically exploring the future of cryptocurrency payments from the perspectives of payment history transformation, the current state of cryptocurrency payments, and trends. ChainCatcher has compiled this.

This article is the first part of the series, discussing the origins of credit card payments to modern digital transformation, exploring the panorama of traditional payment systems.

The second part discusses the unique advantages of blockchain technology in payments and assesses the current state of cryptocurrency payments. The final part will analyze emerging trends and revolutionary possibilities.

1. Introduction

Over time, I have gradually come to believe that value transfer remains the most important and attractive application scenario of blockchain technology in the foreseeable future, consistent with its original vision.

As the entire industry collectively yearns for practical applications rather than further infrastructure development, I have focused on an in-depth exploration of this specific field over the past few months. I hope to share these learning notes with everyone, hoping they can be helpful.

2. Evolution of Payments

2.1 Card Payments

2.1.1 Origins of Credit Cards and Their Drivers

One night in 1949, New York City businessman Frank X. McNamara was dining at a restaurant called Major’s Cabin Grill when he suddenly realized he had forgotten his wallet. Therefore, he had to call his wife to bring cash to pay the bill. This embarrassing experience inspired him to create a single card that could be used at multiple merchants.

In 1950, McNamara founded Diners Club and issued the first credit card to 200 wealthy merchants. Cardholders could use the Diners Club card to pay for meals at participating restaurants, and merchants would then receive reimbursement from Diners Club, minus service fees.

Early Diners Club Credit Card

The card immediately achieved success, and the idea quickly spread to other companies and industries:

- In 1958, American Express launched its own credit card product to compete with Diners Club in the travel and entertainment market.

- In 1966, the Interbank Card Association (later renamed Master Charge, now Mastercard) was established by a group of banks, allowing consumers to use a universal credit card at numerous merchants.

- Also in 1966, Bank of America launched the BankAmericard, which later became Visa, authorized for issuance by multiple banks.

- In 1969, the Regional Bank Card Project Association established the International Bank Card Association, which was renamed Mastercard International in 1979.

These full-featured credit cards issued by banks rapidly expanded the credit card market in the 1960s and 1970s. As these companies and banks engaged in fierce marketing competition for signed merchants and consumers, reward programs, annual fees, interest rates, and other features gradually developed. The use of credit cards evolved from initially being limited to travel and entertainment products to a wide range of payment methods for various consumer purchases, gradually becoming an important component of the financial system.

However, it is worth noting that the widespread adoption of credit cards is closely linked to technological advancements. The development of computer systems and telecommunications networks in the 1960s and 1970s made it possible to process and authorize card transactions efficiently on a large scale.

Before the advent of computer systems and telecommunications networks, processing card transactions was a manual and cumbersome process. When customers used cards for purchases, merchants had to call the issuing bank to verify the customer's credit limit and obtain transaction authorization. This process was both time-consuming and inefficient, limiting the scalability of card payments.

The computerization of the financial system and the development of telecommunications networks made the automation of card payment processing possible, including:

- Electronic data capture at the point of sale (POS), eliminating manual input and errors.

- Efficient transmission of transaction data between merchants, banks, and card issuers via dedicated lines and the internet.

- Quick access to customer data and credit limits through computer systems, enabling near real-time transaction authorization.

- Batch processing and settlement of large volumes of transactions between financial institutions.

- Scalability, speed, and accuracy required to handle the growing base of merchants and consumers.

These technological advancements laid the foundation for modern electronic payment infrastructure, fundamentally changing the nature of card payments from a manual, localized process to an efficient, automated, globally interconnected system, paving the way for its widespread use in retail, online, and various other business sectors.

2.1.2 How It Works Today

Today, the operation of card payments involves a series of steps between the customer, the merchant, the merchant's bank (acquiring bank), the card network, and the customer's issuing bank.

- Authorization:

- The customer presents their credit or debit card to the merchant for payment.

- The merchant sends a request to their payment processor or gateway, including card information and transaction amount.

- The payment processor forwards the request to the card network (e.g., Visa, Mastercard).

- The card network routes the request to the issuing bank (the customer's bank).

- The issuing bank verifies the card information, checks for sufficient funds or credit, and approves or declines the transaction.

- The response is returned to the merchant through the card network and payment processor.

- Capture:

- If the transaction is approved, the merchant receives an authorization code.

- The merchant completes the sale and captures the transaction, usually at the end of the day or in batches.

- The merchant sends the captured transaction to their payment processor.

- Clearing and Settlement:

- The payment processor sends the captured transaction to the card network for clearing.

- The card network facilitates the exchange of funds and transaction information between the issuing bank and the acquiring bank (the merchant's bank).

- The issuing bank deducts the transaction amount from the customer's account.

- The acquiring bank receives the funds and credits the merchant's account after deducting any applicable fees.

- Funds Availability:

- The merchant typically receives the funds in their account within 1-3 business days after settlement.

Throughout this process, multiple security measures are implemented to protect sensitive card information and prevent unauthorized or fraudulent transactions. These measures include encryption, compliance checks, and fraud detection.

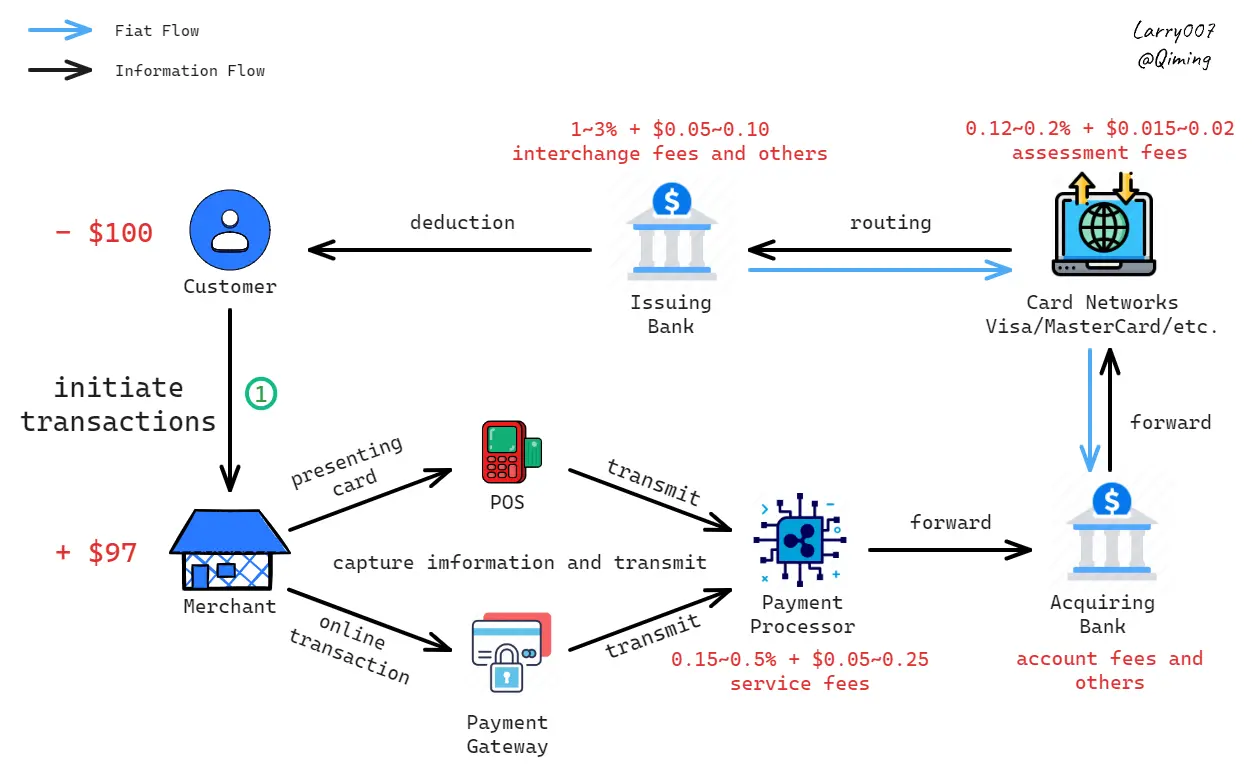

Undoubtedly, each step in this process extracts a small fee from the transaction. These fees can vary significantly based on factors such as card type, merchant industry, transaction volume, and whether the transaction is online or face-to-face. However, overall, these fees can be quite high. A typical process and fee breakdown is illustrated in the chart below.

Typical Workflow of Card Payments

As a consumer, you may have never noticed the numerous fees involved, as payment service providers charge merchants rather than directly charging customers. Over time, these service providers have established strong network effects, leading most customers (especially in the U.S. and Europe) to use credit or debit cards as their primary payment method. Despite the high costs, merchants have no choice but to participate in these networks to provide customers with a seamless and convenient payment experience.

2.2 From Card Payments to Open Banking

2.2.1 The Rise of Digital Payments

Since the late 1990s, with the proliferation of the internet and the development of e-commerce, online payment platforms began to emerge, changing the way payments are made. These platforms allow users to make payments quickly and easily from anywhere with an internet connection, eliminating the need for cash or checks. The rise of smartphones in the 2000s further accelerated the adoption of these platforms, with more and more customers becoming accustomed to seamless digital payment experiences.

In 1998, PayPal launched and quickly became the dominant player in the early 2000s; in 2004, Alipay was launched in China, later becoming the world's largest mobile and online payment platform. In 2010, the emergence of Stripe simplified payment processing for global businesses. The mobile era brought new participants, with Apple Pay in 2014 and Google Pay in 2015 transforming smartphones into digital wallets, changing the way millions pay online and in physical stores.

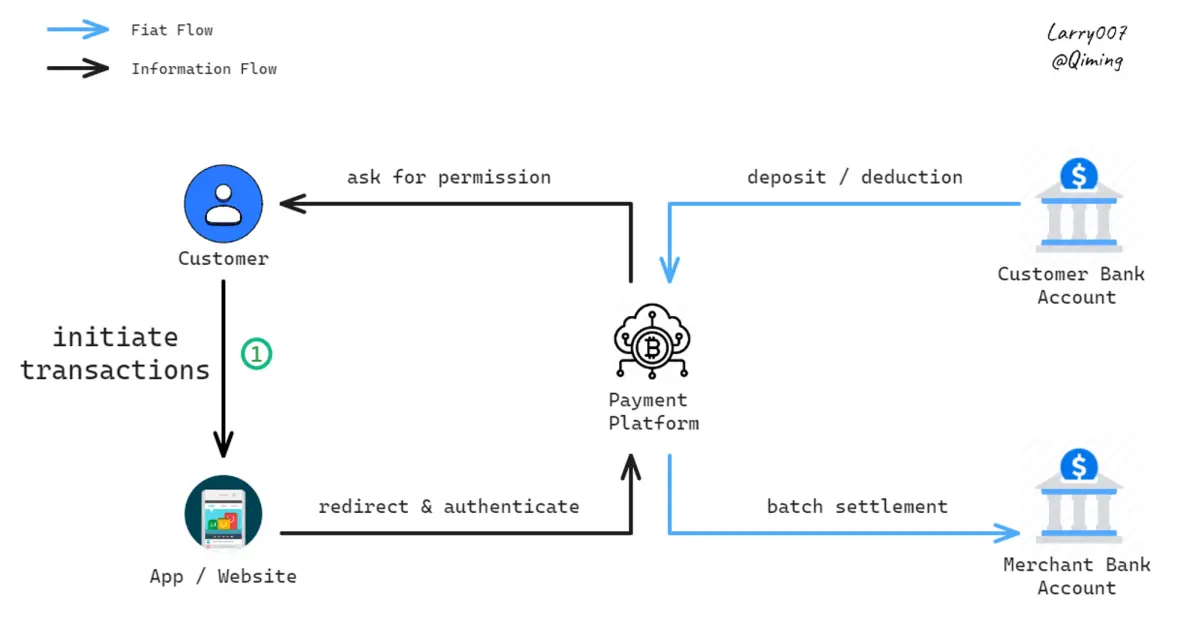

Digital payments, compared to traditional card payments, can be seen as a form of disintermediation. Funds from users and merchants gradually accumulate in electronic wallets, forming a pool of funds. They rarely interact directly with traditional payment systems anymore, viewing transactions as simple transfers of internal accounting entries, moving amounts from one balance to another. This method bypasses some previous intermediaries, and transactions are now effectively processed in "batches." Additionally, these platforms offer customers financial products and earning opportunities while charging commissions for utilizing these funds.

Typical Workflow of Digital Payments

More importantly, the trend of digital payments, as the name suggests, is a process of digitization. Once again, its many benefits stem from emerging technologies:

- Proliferation of mobile devices and the internet -> Convenience and Accessibility

The widespread use of smartphones, user-friendly applications, and extensive internet and mobile networks have made digital payments more convenient and accessible, promoting financial inclusion.

- Adoption of tokenization and biometric authentication -> Enhanced Security

The implementation of tokenization and biometric authentication has significantly improved the security of digital payments compared to traditional card payments.

- Utilization of cloud computing and digital infrastructure -> Cost Reduction

Leveraging cloud computing and digital infrastructure has streamlined transaction processing, reducing the need for physical infrastructure and thereby lowering costs associated with fraud.

- Advances in interoperability and integration -> Seamless User Experience

APIs, SDKs, and web services allow digital payment platforms to integrate seamlessly with various digital services, enhancing user experience and encouraging widespread adoption.

- Utilization of big data analytics and artificial intelligence -> Expanded Business Opportunities

Payment companies leverage big data analytics and artificial intelligence to gain valuable customer insights, develop targeted strategies, and expand market share.

2.2.2 Rapid Spread of Cutting-Edge Technologies in Underdeveloped Regions

Interestingly, most advanced payment technologies tend to spread rapidly in relatively underdeveloped countries.

POS payment methods by transaction volume. Data Source: 2024 Global Payments Report, Worldpay.

Worldpay's report highlights two key trends:

- Developed regions typically have a higher proportion of cashless transactions due to better technology access and stronger economic foundations, making the rapid adoption of new paradigms enhance convenience and efficiency.

- Underdeveloped regions are increasingly adopting digital payments. This contrasts with North America and Europe, where the payment markets are mature, and customers are accustomed to card payments. In these mature markets, the convenience of digital payments is often outweighed by the costs of switching. Additionally, established companies employ various strategies to maintain market share, indicating a strong resistance to change in large payment systems.

This raises an interesting question: Where is the adoption of cryptocurrency payments most effective? In developed countries, as well as places like China and India, widespread internet access and advanced financial systems are already in place. Here, cryptocurrencies offer benefits related to financial independence and privacy, as well as investment opportunities, but these are often seen as additional features rather than necessities. In contrast, in many other regions, such as Asia, Latin America, and Africa, where inflation is high or a large portion of the population lacks banking and payment platforms, cryptocurrencies can significantly enhance the convenience and efficiency of financial transactions.

Daily purchases of cryptocurrency with Argentine pesos (ARS) versus the value of the Argentine peso. Source: 2023 Global Cryptocurrency Adoption Index, Chainalysis.

Surprisingly, cryptocurrencies, especially stablecoins, have gained attention in several regions. In Argentina and Turkey, people use cryptocurrencies as a hedge against inflation, with about half of young people in Turkey owning some form of cryptocurrency. In the Philippines and Vietnam, cryptocurrencies facilitate remittances, helping overseas workers efficiently send money home. The Central Bank of the Philippines even launched a stablecoin pegged to the peso to promote financial inclusion. In urban areas of Africa, such as Lagos and Nairobi, small and medium-sized enterprises are increasingly accepting cryptocurrencies, reducing cross-border transaction fees from as high as 15% to between 1% and 3%.

Of the top ten countries, eight leading countries in cryptocurrency adoption come from developing countries. Source: 2023 Global Cryptocurrency Adoption Index, Chainalysis.

The next article in this series will explore the unique advantages of blockchain in payments: how it opens financial services to a broader audience and creates a transparent environment for efficient collaboration among different parties. We will also analyze the current state of cryptocurrency payments, discussing the challenges and opportunities in this emerging field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。