Tonight at 20:30 (UTC+8), the U.S. Labor Department will release the non-farm payroll data for October. The market expects that the hurricane and Boeing strike events will lead to a significant reduction in the number of new non-farm jobs, with estimates dropping from 254,000 to 113,000. However, the impact on the unemployment rate is expected to be limited, with the unemployment rate projected to remain unchanged at 4.1%.

Non-farm data tracking: https://www.aicoin.com/en/data

Political and Economic Game, Non-farm Data May Become a Key Variable

Currently, the market has very high expectations for the Federal Reserve to cut interest rates by 25 basis points in November. However, if this non-farm data comes in weaker than expected and cannot be explained by the impact of the hurricane, the pressure for the Federal Reserve to cut rates by 50 basis points will increase.

In addition, with the U.S. elections approaching, the non-farm data may become politicized before the election. If the employment data is extremely weak, it could affect the election results.

It is reported that during the 1970 British election, Labour Prime Minister Harold Wilson had a strong chance of winning, but the trade data released on the eve of the election was extremely unfavorable, particularly regarding the trade deficit, signaling weakness in the British economy and raising market concerns, leading to a decline in Wilson's government support among voters. Ultimately, Edward Heath of the Conservative Party made a stunning comeback and became the 46th Prime Minister of the United Kingdom.

Main Players' Layout Direction Changes Abruptly, BTC May Face Trend Reversal Risk

At this moment, the cryptocurrency market is in a state of high tension, with overall sentiment being extremely greedy and a strong FOMO atmosphere. Traders are wavering between whether BTC is about to break new highs or correct.

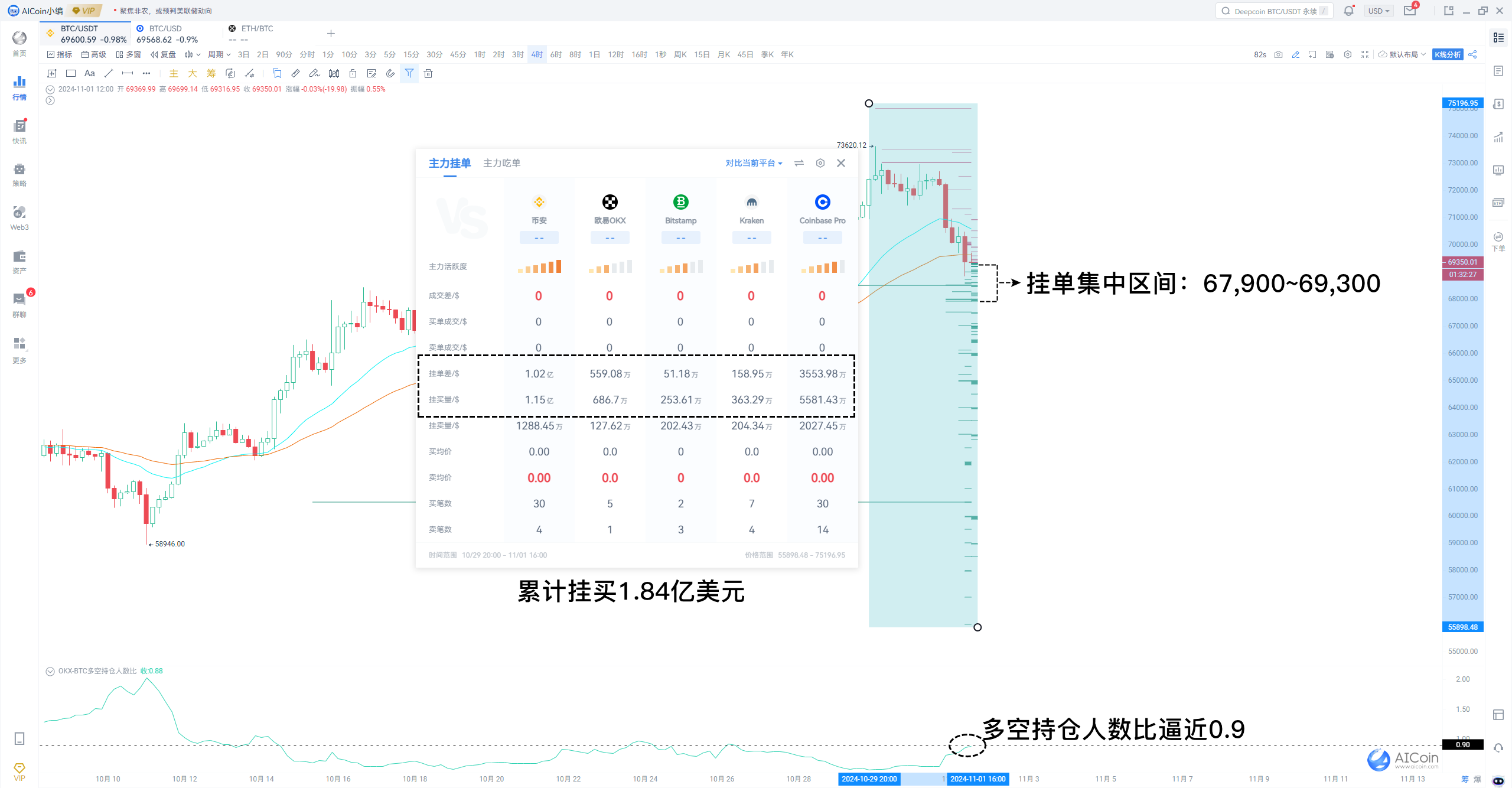

According to AICoin (aicoin.com) main order data, large spot holders have turned bearish. Previously placed large sell orders in the $73,000 to $75,000 range have been withdrawn, and they have shifted to placing buy orders of $184 million below the current price, focusing on the $67,900 to $69,300 range, with the lowest outrageous order at $56,000, commissioned by large holders from Coinbase and Binance.

Main orders can track large holders' order situations in real-time, providing clear insights into the main players' betting directions and points, which is a feature of AICoin PRO: https://www.aicoin.com/vip

At the same time, in custom periods such as 45 minutes and 90 minutes, BTC has fallen below the EMA24 and EMA52 moving averages, with potential divergence risks at the 12-hour and daily levels, requiring close attention to the 6-hour cycle signals. As of the time of writing, BTC is testing the EMA52 moving average support (point: $68,860) in this cycle. If it closes above the moving average, BTC is expected to return above $70,000.

Additionally, according to the chip peak and Fibonacci retracement tools, there is support in the $68,000 to $67,570 range, with resistance above at $70,000 to $70,140.

Chip peak function: Located above the price, it is considered resistance; located below the price, it is considered support. Experience it now: https://www.aicoin.com/vip

Economic Terminology Revealed: A Simple Understanding of Non-farm Data

Non-farm employment data reflects the health of the labor market and is an important basis for the Federal Reserve's economic decisions. Generally, when we say the "labor market is strong," it mainly refers to a significant increase in new non-farm jobs, while the unemployment rate remains stable or decreases; "labor market weakness" is reflected in a decrease or sluggish growth in new non-farm jobs, while the unemployment rate increases. The former will prompt the Federal Reserve to raise interest rates, while the latter will lead to a rate cut for the following reasons:

• Strong non-farm data and low unemployment rate: This means an increase in employment, and employment is related to wages. With jobs come wages, and with wages comes purchasing power. An increase in consumer demand can lead to rising inflationary pressures, prompting the Federal Reserve to raise interest rates to prevent the economy from overheating and control inflation.

• Weak non-farm data and rising unemployment rate: This means a decrease in disposable consumer spending, which can lead to slower economic growth (consumption is the main driver of economic growth). This will prompt the Federal Reserve to cut rates to put money back in consumers' pockets to stimulate economic activity.

For more details, please read: “Decoding the Economic Trio: Interest Rates, CPI, and Non-farm!”

Conclusion

In summary, the current macro environment in the U.S. is in a dual game of politics and economics, with economic data becoming the battleground for various forces. If this non-farm data comes in weaker than expected, it will cool the market, and BTC may face further downside risks, requiring close attention to the $68,860 support.

Please recognize the official website of AICoin: https://www.aicoin.com/

Note: The above content is for sharing purposes only and does not constitute any investment advice!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。