Trader Chen Shu: 11.1 Afternoon Bitcoin and Ethereum Market Strategy *No. 1, with non-farm data coming in, how to judge operations today, an article tells you!

When most people in the market start to collectively bullish on Bitcoin, risks will quietly arrive. Yesterday, the bears fought back and wiped out all the longs! Bitcoin plummeted nearly 2500 points in a single day.

What caused Bitcoin's drop yesterday? Was it the negative impact of the September PCE price index? Or was it the negative impact of the initial jobless claims for the week? What triggered this plunge in U.S. stocks, gold, and Bitcoin?

This time's Bitcoin crash is just a prelude; the monthly closing is merely the bulls taking profits. This month, it rose from 5.9 to 7.3, and although there were countless washouts in between, too many long positions accumulated profits that needed to exit during this process.

Next, the October non-farm employment data will be released tonight, and next week will see the U.S. presidential election and the Federal Reserve meeting, a pile of uncertainties stacking up. A bird in hand is worth two in the bush; exiting may be the optimal solution.

Today, my views and logic on the non-farm data market:

1: A sharp drop is hard to sustain; the bull market's rise is the main trend, and the drop is just an interlude. A quick drop means a quick end; this drop itself does not indicate Bitcoin has peaked, so there’s no rush to short!

2: The U.S. October non-farm employment data will be released tonight at 20:30, with a previous value of 254,000 and an expectation of only 113,000. The pessimistic employment forecast is less than half of last month, which is bullish for Bitcoin, at least in terms of sentiment!

3: Weakness often does not provide opportunities. Did yesterday's drop give any opportunities? It fell steadily with almost no rebound. Those who wanted to short or were bearish lacked the courage to enter because there was no rebound, fearing they would buy at the bottom, ultimately leading to Bitcoin accelerating its drop below the $70,000 mark!

4: Today's Bitcoin remains relatively weak during the Asian and European sessions, with very little rebound strength and continuing to test downward. For the current downtrend, it seems that it hasn't reached a bottom yet; before the data arrives, we should first pay attention to whether the support zone around 6.95-6.9 is effective.

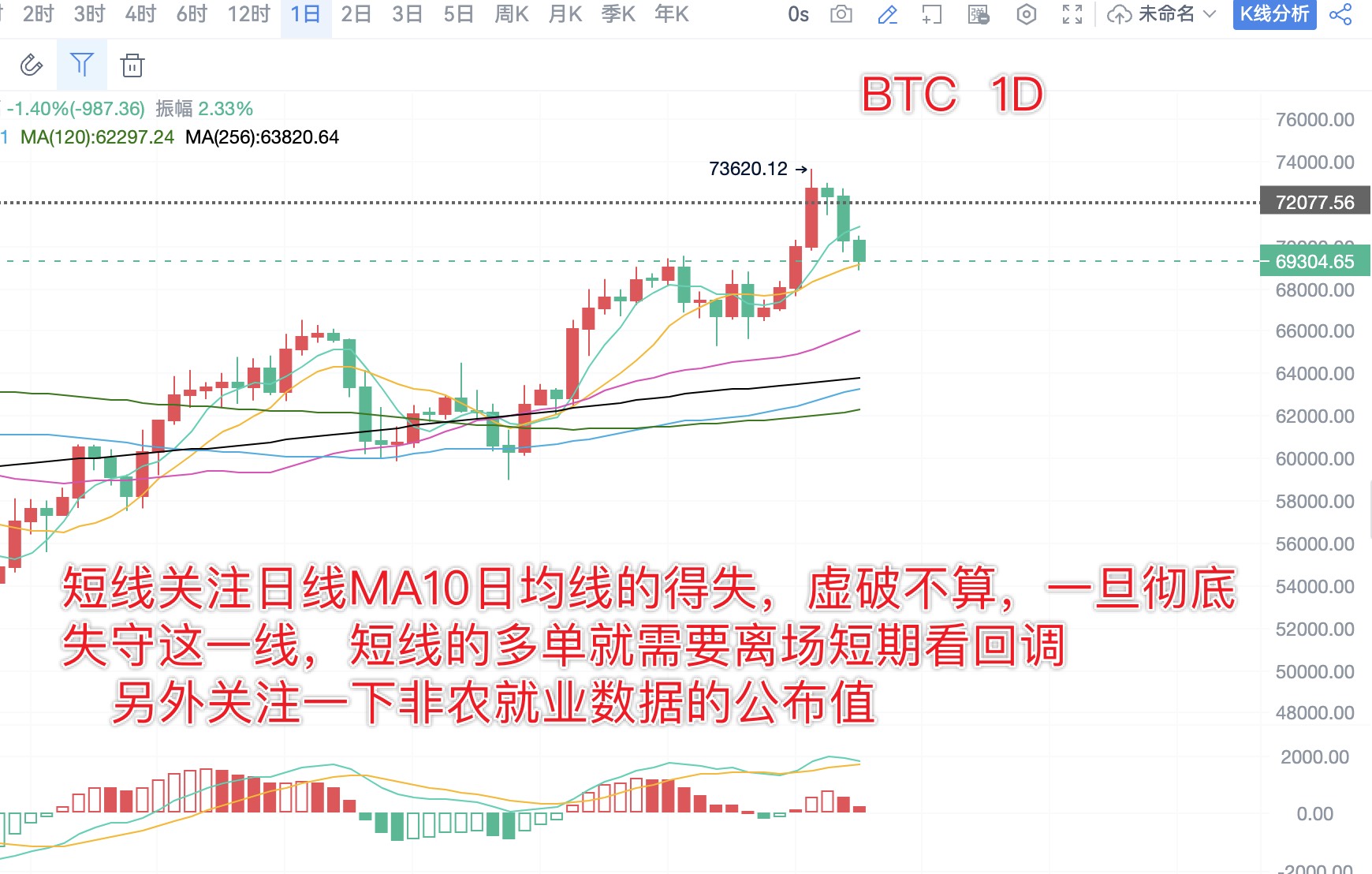

In summary: Today, I believe we should not chase shorts on Bitcoin. Although the Asian and European sessions remain weak, the cost-effectiveness of chasing shorts is not high. At least until the daily line has not lost the MA10 (6.92), we should not chase shorts.

Afternoon operation thoughts (writing time: 15:00):

BTC: Short lightly near the rebound around 7.05, targeting around 6.92; for the lower range of 6.91-6.88, take a small long with a light stop loss, targeting around 1500 points.

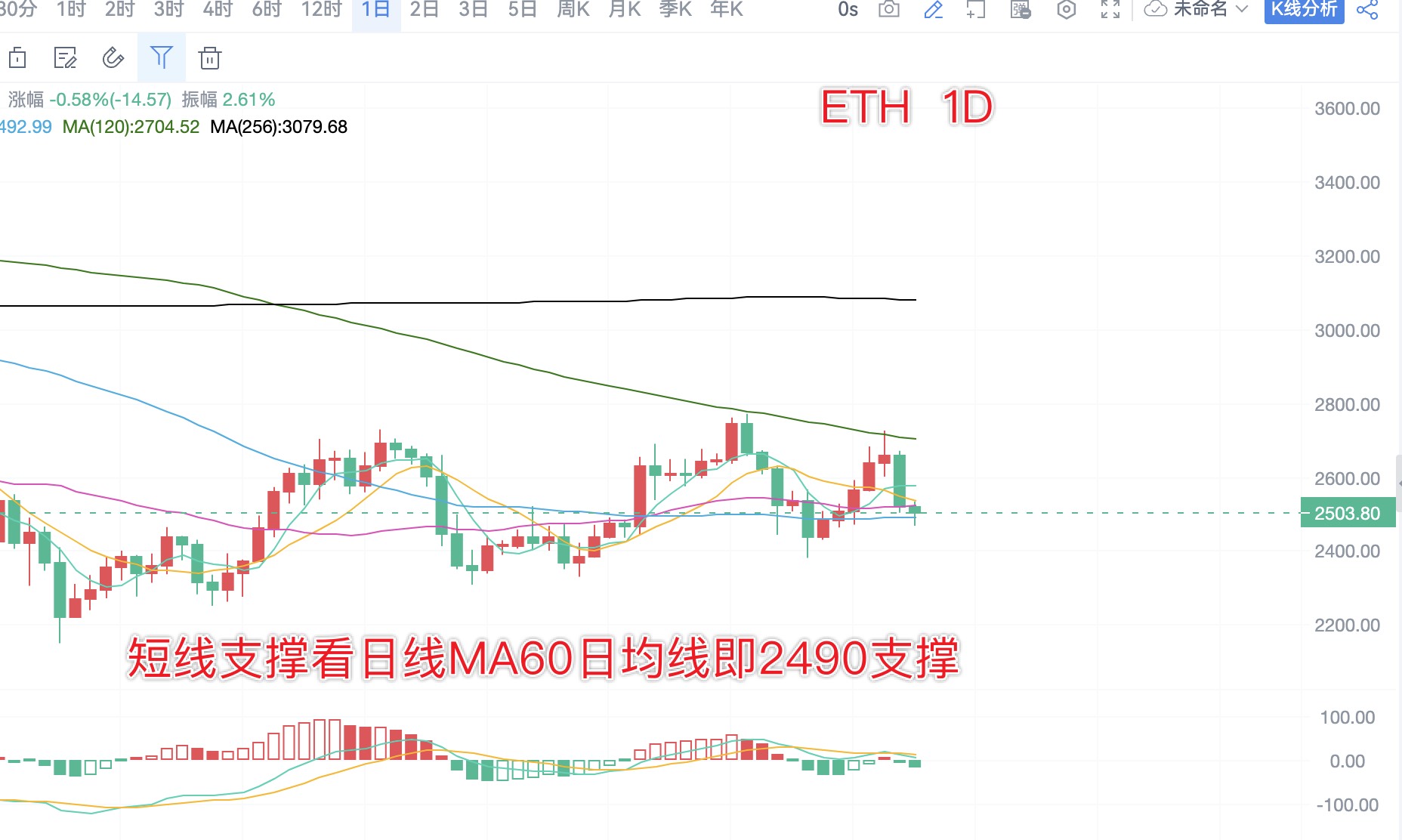

ETH: Short lightly in the rebound range of 2540-70, targeting 2480;

Note: For short-term support, pay attention to the support area around 6.92-6.88. If it completely loses the daily MA10 (6.91), it indicates that the downtrend has become a certainty, and we cannot go long anymore. Additionally, pay attention to tonight's non-farm data; the market expectation is only 114,000. If the number exceeds expectations, it may be bearish for Bitcoin!

Daily analysis strategy has a high win rate! Analysis is not easy; I hope everyone can give a free follow, save, like, and comment. Thank you all, and feel free to leave comments below; I will reply one by one!

For real-time market strategy exchanges and inquiries about market issues, you can follow me. I am the top personal KOL in the original (Coin World) ranking, providing free guidance and answering trading questions. Everyone is welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。