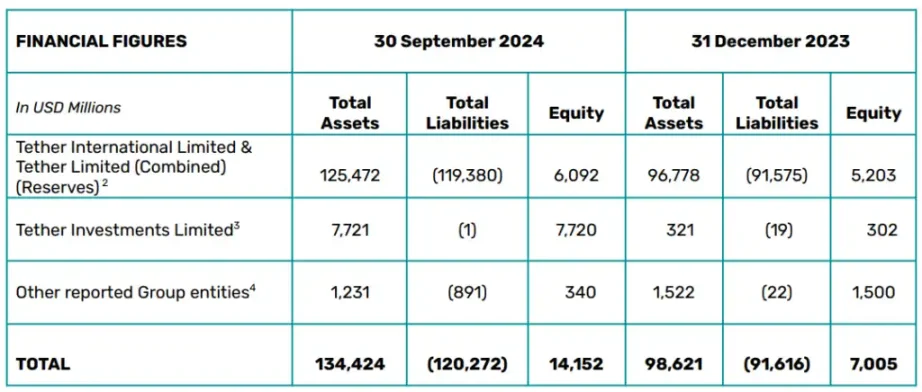

In the first nine months of this year, the cumulative profit reached 7.7 billion USD, and the group's equity reached 14.2 billion USD.

Written by: James, BlockTempo

The issuer of the US dollar stablecoin USDT, Tether, today announced its Q3 2024 reserve report audited by BDO, one of the top five independent public accounting firms globally, showing a net profit of 2.5 billion USD for the quarter. The cumulative profit for the first nine months of this year reached 7.7 billion USD, with the group's equity at 14.2 billion USD and total assets at 134.4 billion USD, all hitting historical highs.

Tether pointed out that its Q3 net profit of 2.5 billion USD was primarily driven by the strong performance of its gold holdings, which generated approximately 1.1 billion USD in unrealized profits for the quarter, while the remaining 1.3 billion USD in profits came from U.S. Treasury yields.

One of the highlights for Tether this quarter was the increase in USDT circulation, which grew by 27.8 billion USD to nearly 120 billion USD year-to-date, marking a growth rate of 30%. This growth scale is almost equivalent to the total market capitalization of its competitor USDC.

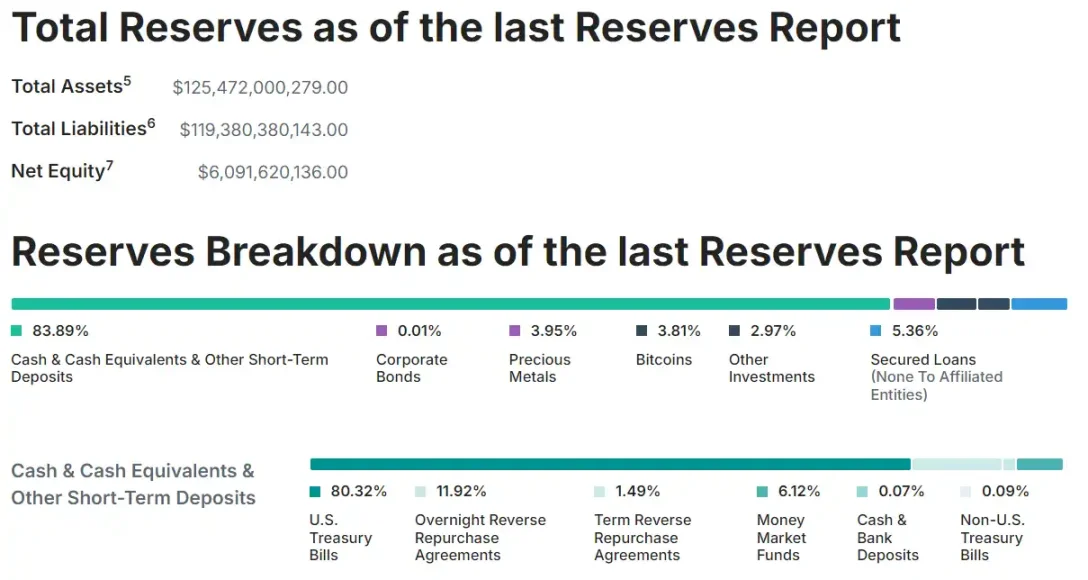

Tether Reserve Situation

In terms of reserves, as of Q3, Tether's asset reserves amounted to 125.5 billion USD, with liabilities at 119.4 billion USD, resulting in excess reserves increasing to over 6 billion USD, with a non-annualized growth rate of 15% over nine months.

Tether currently holds over 105 billion USD in cash and cash equivalents, with direct and indirect holdings of U.S. Treasuries amounting to 102.5 billion USD, making Tether one of the top 18 holders of U.S. Treasuries globally, ranking higher than Germany, Australia, and the United Arab Emirates.

In Q3, Tether also increased its holdings of Bitcoin and gold, with values reaching 4.8 billion USD and 5 billion USD, respectively.

Self-Managed Investment Scale Reaches 7.7 Billion USD

Additionally, according to Tether's long-term vision, its proprietary investment division, Tether Investments, has achieved a net asset value of 7.7 billion USD, up from 6.2 billion USD in the previous quarter. This division's strategic investments span key industries such as renewable energy, Bitcoin mining, AI, telecommunications, and education, and it holds 7,100 Bitcoins.

Tether CEO Paolo Ardoino stated that Tether's performance in Q3 reflects its unwavering commitment to transparency, liquidity, and responsible risk management, with the stablecoin's market capitalization reaching the milestone of 120 billion USD and holding 102.5 billion USD in U.S. Treasuries, highlighting the company's unparalleled financial strength:

"By increasing our reserve buffer to over 6 billion USD and maintaining a focus on strategic investments, Tether once again sets the standard for stability in the financial sector."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。