Article Authors: Dessislava Aubert, Anastasia Melachrinos

Article Compilation: Block unicorn

On October 9, 2024, three market makers—ZM Quant, CLS Global, and MyTrade—and their employees were accused of engaging in wash trading and collusion on behalf of the cryptocurrency company and its token NexFundAI. According to evidence collected by the FBI, a total of 18 individuals and entities are facing charges.

In this in-depth analysis, we will examine the on-chain data of the NexFundAI cryptocurrency to identify wash trading patterns that may extend to other cryptocurrencies and question the liquidity of certain tokens. Additionally, we will explore other wash trading strategies in DeFi and how to identify illegal activities on centralized platforms.

Finally, we will also investigate price manipulation behaviors in the South Korean market, which blur the lines between market efficiency and manipulation.

FBI Identifies Wash Trading in Token Data

NexFundAI is a token issued by a company created by the FBI in May 2024, aimed at exposing market manipulation in the cryptocurrency market. The accused companies engaged in algorithmic wash trading and other manipulative tactics on behalf of clients, typically on DeFi exchanges like Uniswap. These actions targeted newly issued or low market cap tokens, creating a false impression of an active market to attract real investors, ultimately driving up token prices and increasing their visibility.

The FBI's investigation yielded clear confessions, with involved parties detailing their operational steps and intentions. Some even explicitly stated, "This is how we market make on Uniswap." However, this case not only provides verbal evidence but also showcases the true nature of wash trading in DeFi through data, which we will analyze in depth.

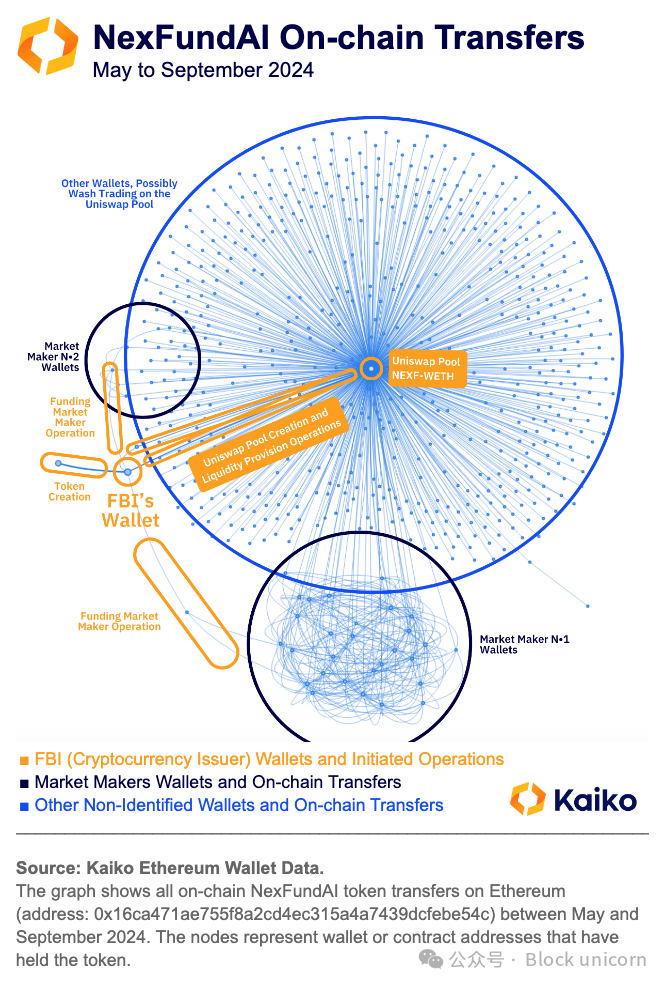

To begin our exploration of the FBI's fraudulent token NexFundAI (Kaiko code: NEXF), we will first examine the token's on-chain transfer data. This data provides a complete path from the token's issuance, including all wallet and smart contract addresses holding these tokens.

The data shows that the token issuer transferred the token funds into a market maker wallet, which then distributed the funds to dozens of other wallets, identified in the chart by deep blue clusters.

Subsequently, these funds were used for wash trading on the only secondary market created by the issuer—Uniswap—located at the center of the chart, which is the intersection point for almost all wallets receiving and/or transferring the token (from May to September 2024).

These findings further corroborate the information revealed by the FBI through undercover "sting" operations. The accused companies used multiple bots and hundreds of wallets for wash trading, without raising suspicion from investors looking to seize early opportunities.

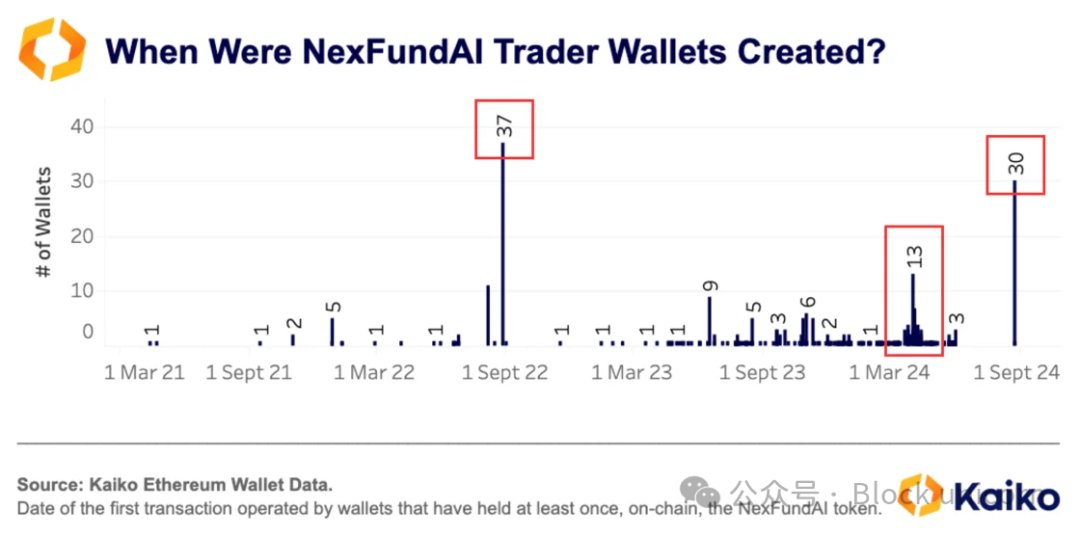

To refine our analysis and confirm that certain wallet transfers were fraudulent, particularly those within the clusters, we recorded the date of the first transfer received by each wallet, observing the entire on-chain data and not just limited to NexFundAI token transfers. The data shows that among the 485 wallets in the sample, 148 wallets (or 28%) received their initial funding in the same block as at least five other wallets.

For a token with such low visibility, the occurrence of this trading pattern is nearly impossible. Therefore, it is reasonable to speculate that at least these 138 addresses are related to trading algorithms, potentially used for wash trading.

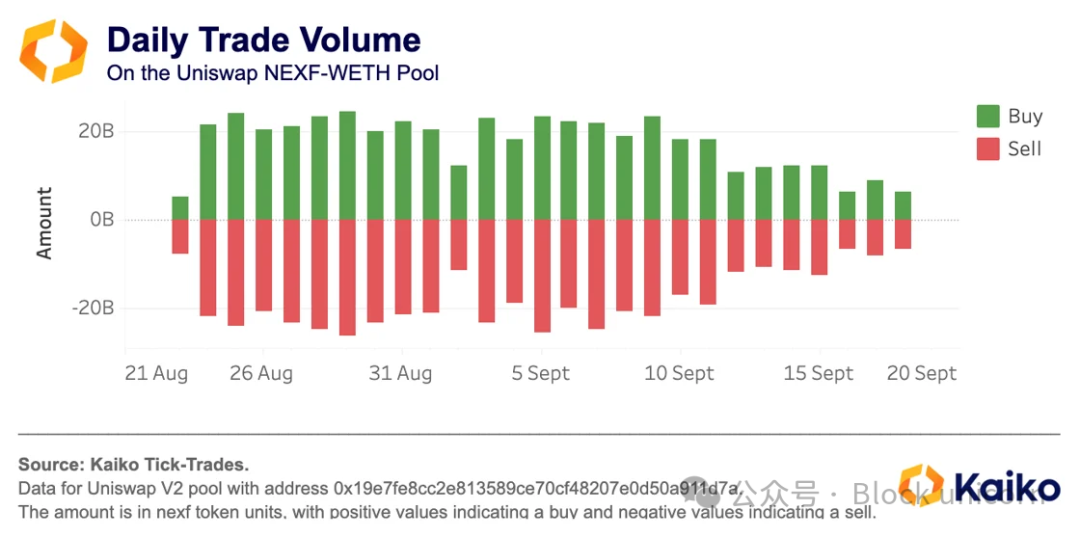

To further confirm the wash trading involving this token, we analyzed the market data from its only existing secondary market. By aggregating the daily trading volume on the Uniswap market and comparing buy and sell volumes, we found a surprising symmetry between the two. This symmetry indicates that the market maker company hedged the total amount across all wallets participating in wash trading daily.

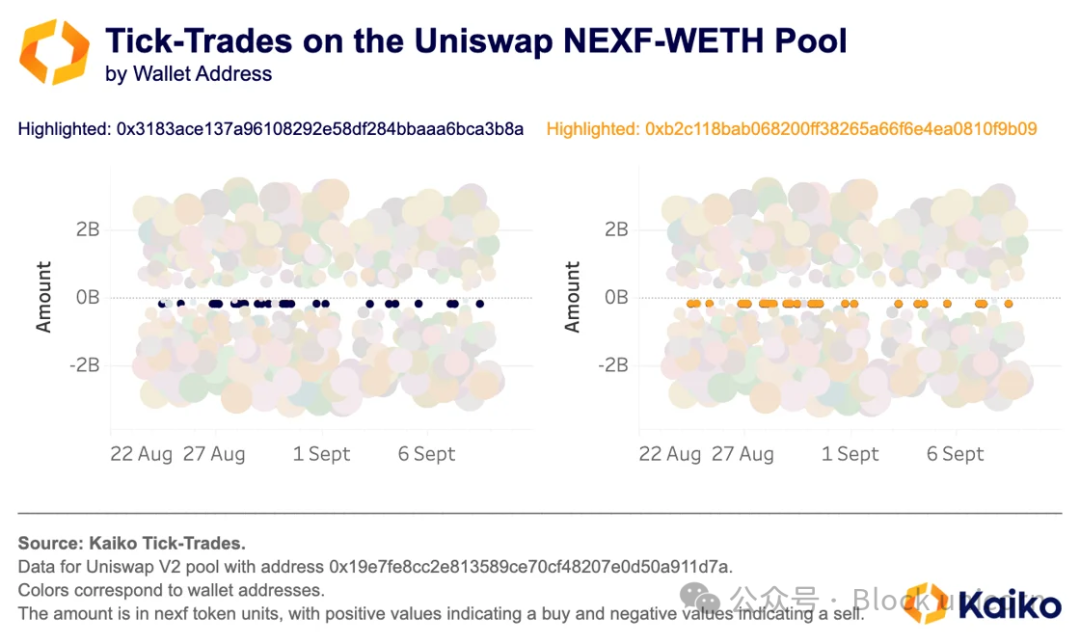

A deeper look at individual transaction levels, and coloring transactions by wallet address, revealed that certain addresses executed identical single transactions (same amount and timestamp) during a month of trading activity, indicating that these addresses employed wash trading strategies, suggesting that these addresses are interconnected.

Further investigation revealed that by using Kaiko's Wallet Data solution, we found that these two addresses, despite never interacting directly on-chain, were both funded by the same wallet address providing WETH: 0x4aa6a6231630ad13ef52c06de3d3d3850fafcd70. This wallet itself obtained funds through a smart contract from Railgun. According to information from Railgun's official website, "RAILGUN is a smart contract designed to provide privacy protection for crypto trading for professional traders and DeFi users." These findings suggest that these wallet addresses may be involved in activities that require concealment, such as market manipulation or even more serious situations.

DeFi Fraud Extends Beyond NexFundAI

Manipulative behaviors in DeFi are not limited to the FBI's investigation. Our data shows that among over 200,000 assets on Ethereum decentralized exchanges, many lack real utility and are controlled by a single individual.

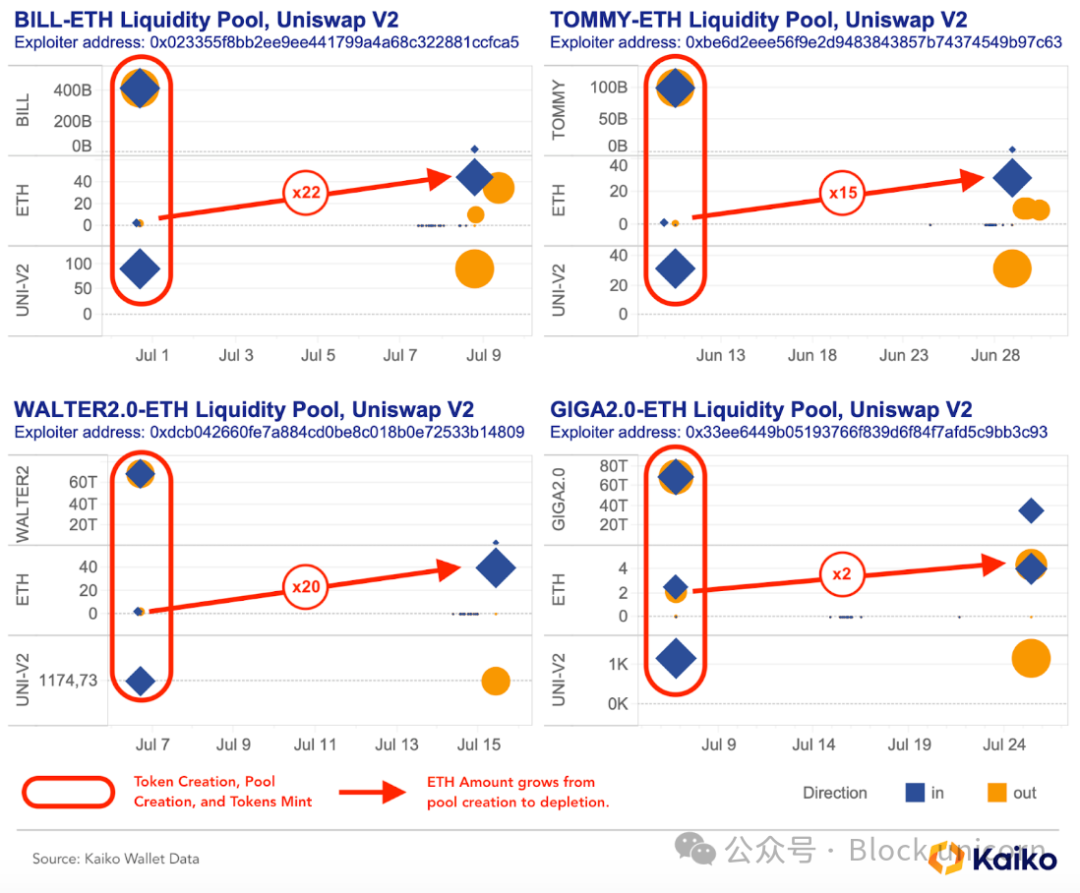

Some issuers of tokens on Ethereum establish short-term liquidity pools on Uniswap. By controlling the liquidity within the pool and using multiple wallets for wash trading, they enhance the pool's attractiveness, drawing in ordinary investors, accumulating ETH, and selling their tokens. According to Kaiko's Wallet Data, an analysis of four cryptocurrencies indicates that this operation can yield a 22-fold return on initial ETH investment within about 10 days. This analysis reveals widespread fraudulent behavior among token issuers, extending beyond the FBI's investigation of NexFundAI.

Data Pattern: Using GIGA2.0 Token as an Example

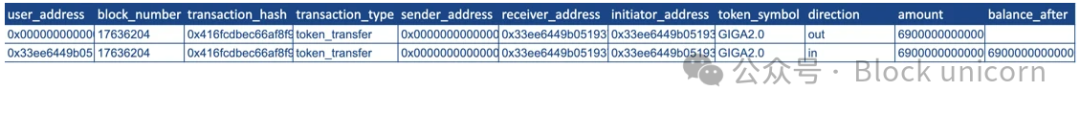

A user (e.g., 0x33ee6449b05193766f839d6f84f7afd5c9bb3c93) received (and initiated) the entire supply of a new token from a certain address (e.g., 0x000).

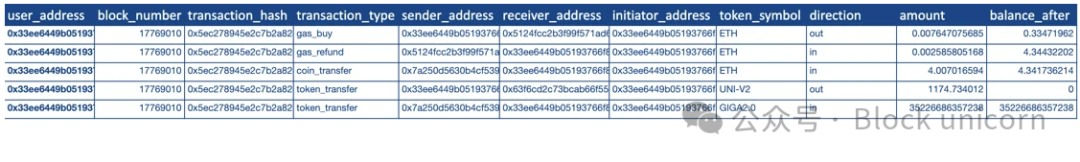

The user immediately (within the same day) transferred these tokens and some ETH to create a new Uniswap V2 liquidity pool. Since all liquidity was contributed by the user, they received UNI-V2 tokens representing their contribution.

On average, 10 days later, the user would withdraw all liquidity, burn the UNI-V2 tokens, and extract additional ETH earnings from transaction fees.

When analyzing the on-chain data of these four tokens, we found that the exact same pattern repeated, indicating manipulation conducted through automation and repetitive operations, with the sole purpose of profit.

Market Manipulation is Not Limited to DeFi

While the FBI's investigation effectively exposed these behaviors, market abuse is not unique to cryptocurrencies or DeFi. In 2019, the CEO of Gotbit publicly discussed his unethical business of helping crypto projects "fake success," leveraging the complicity of small exchanges in these practices. The CEO of Gotbit and two of its directors were also charged in this case for manipulating various cryptocurrencies using similar tactics.

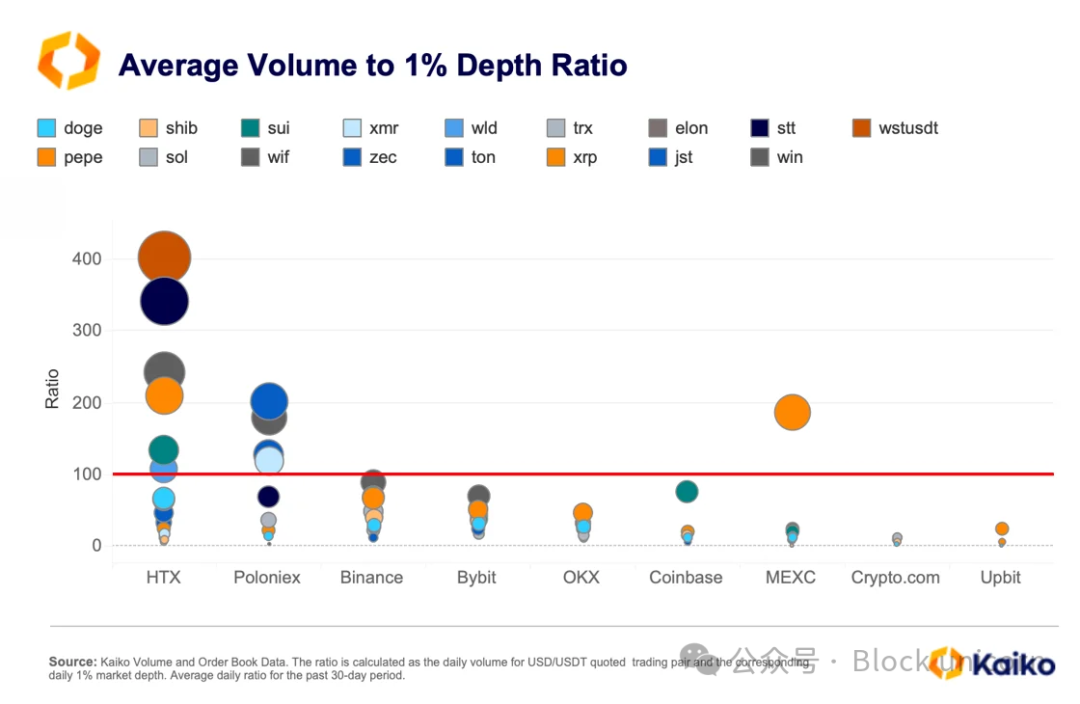

However, detecting such manipulation on centralized exchanges is more challenging. These exchanges only display market-level order books and trading data, making it difficult to accurately identify fake trades. Nevertheless, comparing trading patterns and market indicators across exchanges can still help uncover issues. For example, if trading volume significantly exceeds liquidity (1% market depth), it may be related to wash trading.

Data shows that assets on HTX and Poloniex with over 100 times the trading volume-to-liquidity ratio are the most prevalent. Typically, meme coins, privacy coins, and low market cap altcoins exhibit abnormally high trading volume-to-depth ratios.

It is important to note that the trading volume-to-liquidity ratio is not a perfect indicator, as trading volume may significantly increase due to promotional activities (such as zero-fee events) on certain exchanges. To more reliably assess fake trading volume, we can examine the correlation of trading volume across exchanges. Generally, the trading volume trends of a particular asset across different exchanges are correlated and show consistency over the long term. If trading volume is monotonous for an extended period, shows long periods of inactivity, or exhibits significant discrepancies between different exchanges, it may indicate abnormal trading activity.

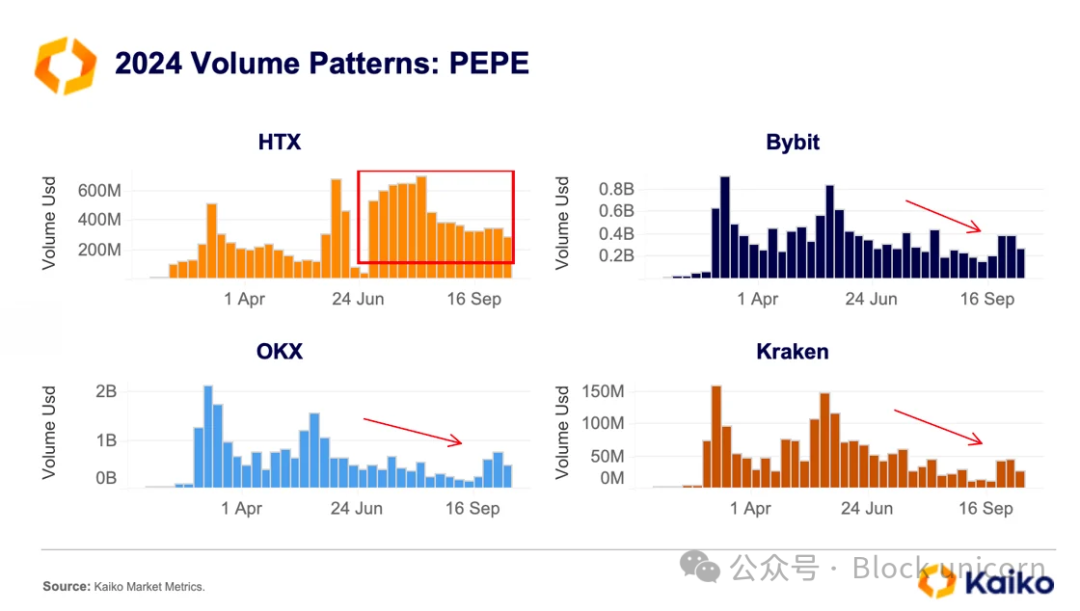

For example, when we look at the PEPE token on certain exchanges, we find significant differences in trading volume trends between HTX and other platforms in 2024. On HTX, the trading volume of PEPE remained high during July and even increased, while on most other exchanges, the trading volume declined.

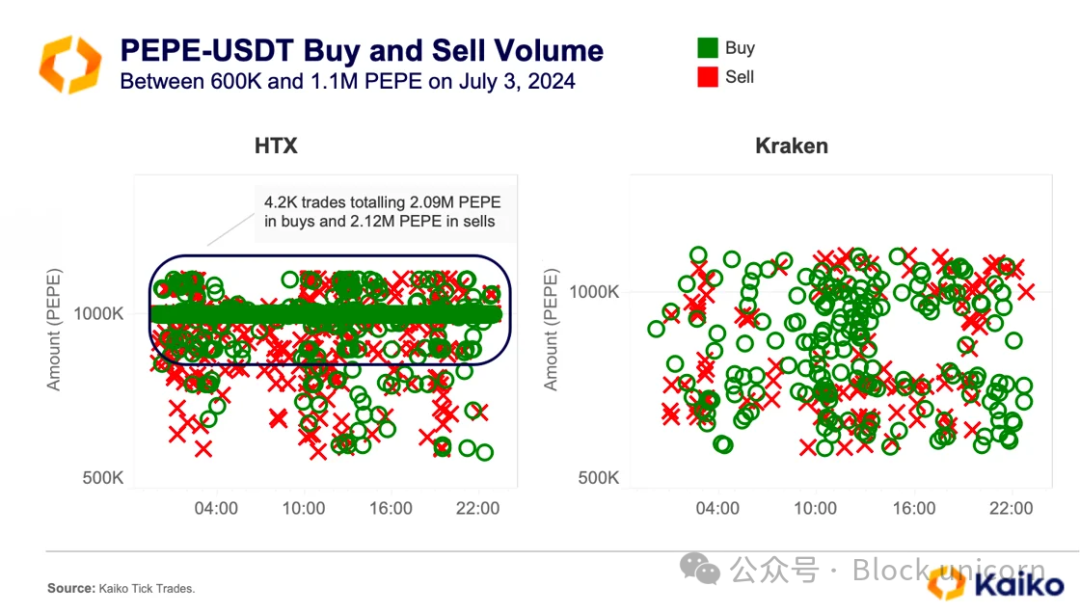

Further analysis of the trading data shows that there is active algorithmic trading in the PEPE-USDT market on HTX. Within a single day on July 3, there were 4,200 buy and sell orders of 1M PEPE, averaging about 180 orders per hour. This trading pattern sharply contrasts with the trading on Kraken during the same period, which appeared more natural and retail-driven, with irregular trade sizes and timings.

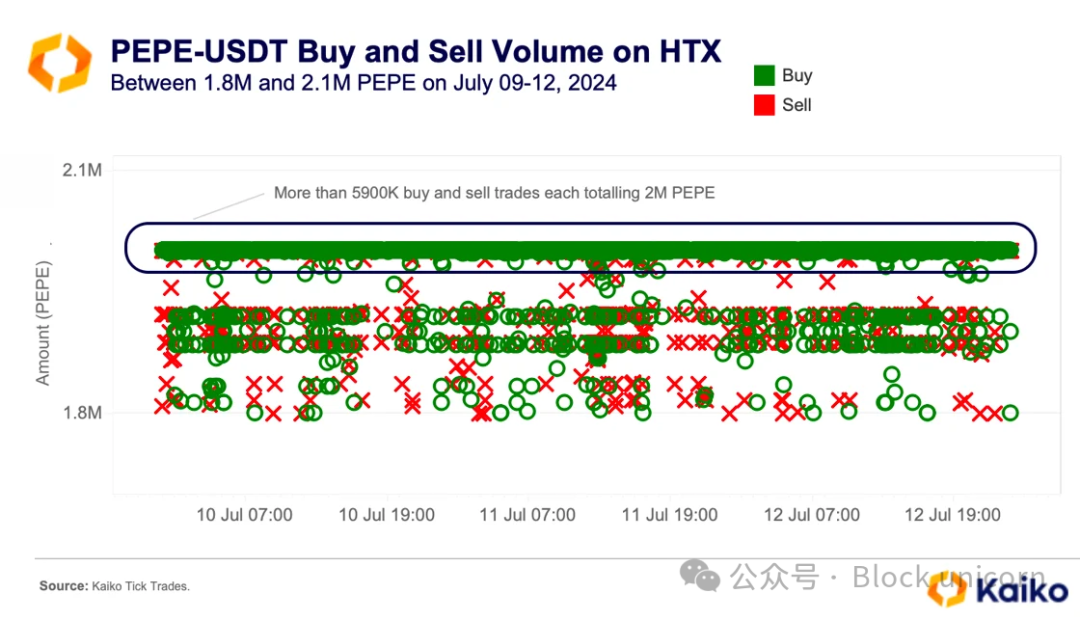

Similar patterns also appeared on other days in July. For instance, from July 9 to 12, over 5,900 buy and sell transactions of 2M PEPE were executed.

Various signs indicate the potential existence of automated wash trading behaviors, including high trading volume-to-depth ratios, unusual weekly trading patterns, fixed sizes of repeated orders, and rapid execution. In wash trading, the same entity simultaneously places buy and sell orders to artificially inflate trading volume, making the market appear more liquid.

The Subtle Line Between Market Manipulation and Efficiency Imbalance

Market manipulation in the cryptocurrency market is sometimes mistaken for arbitrage, which profits from market efficiency imbalances.

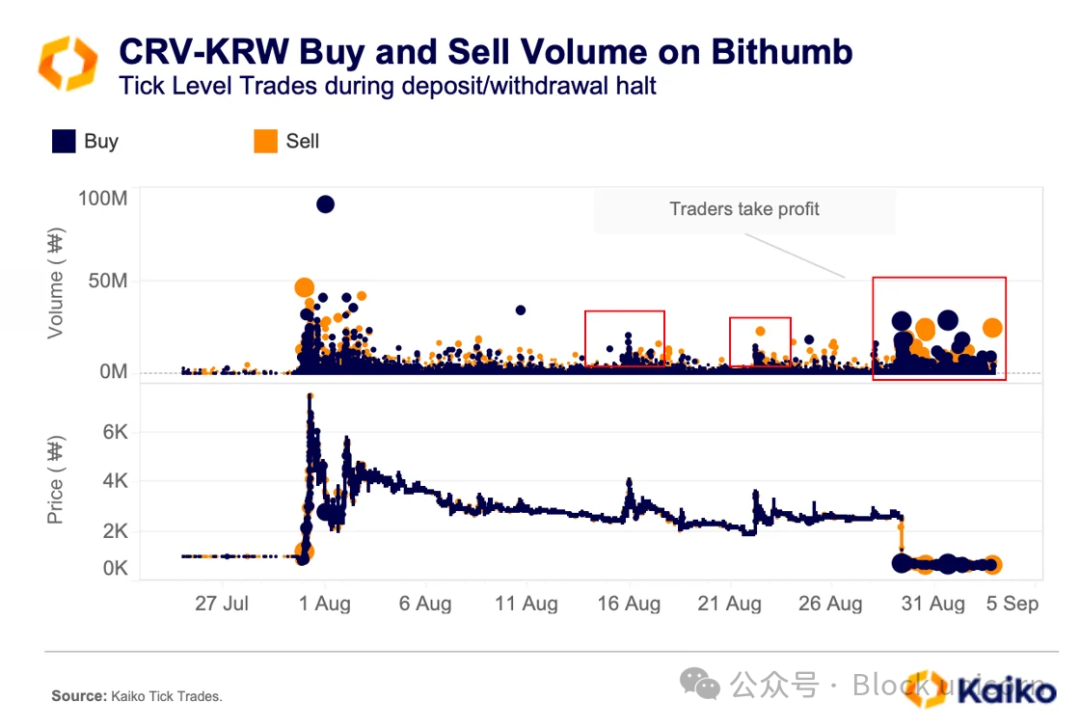

For example, the phenomenon of "net fishing-style price manipulation" is common in the South Korean market (where traders attract retail investors by driving up prices and then emptying the pool of funds). Traders take advantage of temporary pauses in deposits and withdrawals to artificially inflate asset prices for profit. A typical case occurred in 2023 when the native token of Curve (CRV) was suspended from trading on several South Korean exchanges due to a hacking incident.

The chart shows that when Bithumb suspended deposits and withdrawals for the CRV token, a large number of buy orders pushed the price up significantly, but it quickly fell back as selling began. During the suspension, multiple brief price increases due to buying were immediately followed by sell-offs. Overall, the sell-off volume was significantly higher than the buying volume.

Once the suspension ended, the price rapidly dropped as traders could easily buy and sell for arbitrage between exchanges. Such suspensions typically attract retail traders and speculators who expect prices to rise due to limited liquidity.

Conclusion

Identifying market manipulation in the cryptocurrency market is still in its early stages. However, combining past investigation data and evidence can help regulators, exchanges, and investors better address future market manipulation issues. In the DeFi space, the transparency of blockchain data provides a unique opportunity to detect wash trading across various tokens, gradually enhancing market integrity. In centralized exchanges, market data can reveal new market abuse issues and gradually align the interests of some exchanges with the public interest. As the cryptocurrency industry evolves, leveraging all available data helps reduce misconduct and create a fairer trading environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。