Don't turn your training business into a cryptocurrency coaching service.

Written by: Lawyer Liu Honglin, Mankun Law Firm

Traditional Financial Practitioners Transitioning to the Crypto Space

Recently, Lawyer Liu Honglin from Mankun Law Firm has noticed an increase in friends from the traditional private equity and public equity sectors who have started engaging in cryptocurrency education and paid community businesses. The reason is not hard to understand; for those who have been caught in the competition of traditional financial services, they find that providing investment advice and financial consulting for virtual currencies is essentially no different from investment training in traditional financial markets. After all, K-line charts, sentiment analysis, and information tracking in virtual currency investment are quite similar to those in the traditional stock market, making the transfer of investment skills seem natural.

However, these traditional financial practitioners have discovered that doing business with "old investors" in the crypto space is not easy—after all, the resources and information accumulated by veteran players in the crypto market are hard to surpass. Therefore, more people are starting to focus on the Web2 user base, leveraging their information and skill advantages in the Web3 industry to offer virtual currency financial training courses to these Web2 clients, with course fees starting from several thousand yuan. After completing the courses, clients can also choose higher-priced services, such as joining exclusive communities to receive investment advice on secondary market buying and selling points and potential projects in the primary market. Consultants often share their "successful achievements" in their social circles to attract more clients, but if investments fail, some may simply refund the fees. This business model is becoming increasingly common in the crypto space.

Behind this phenomenon, while it may seem like a service innovation, it also hides potential legal risks. Below, we will analyze the legal risks behind such services from a legal compliance perspective and how to prevent them.

Don't Turn Your Training Business into a Cryptocurrency Coaching Service

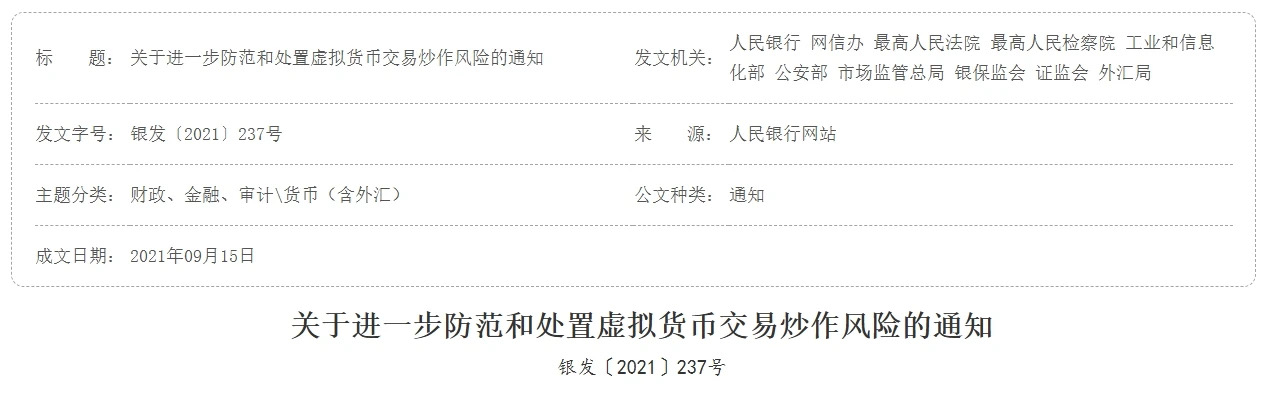

For well-known reasons, in mainland China, the legal challenges faced by virtual currency investment consulting far exceed those in the general financial industry. China has repeatedly clarified that virtual currencies do not possess legal compensation, and has gradually introduced strict regulations on virtual currency trading. The "Notice on Further Preventing and Dealing with Risks of Virtual Currency Trading Speculation" issued in 2021 comprehensively prohibits domestic financial institutions and payment institutions from providing services for virtual currency trading. This policy essentially limits the legality of engaging in virtual currency investment consulting and training in China.

For consultants providing virtual currency investment advice to clients, these policies mean they may always face compliance risks. If a consultant advises a client to "buy or sell" virtual currencies or even recommends speculative projects in the primary market without obtaining financial business licenses, they will cross the regulatory red line in China regarding financial activities. Such activities may be regarded as illegal investment or fraud, and if clients incur losses and file complaints, the consultant may face administrative penalties or even criminal liability.

Another situation is that many consultants in this field operate directly as individuals, without establishing a company. While operating and promoting under a personal name is convenient, it also lacks risk isolation. If a client has a dispute regarding investment services or results, the consultant must face claims and lawsuits directly as an individual, without even a company to act as a "shield." More importantly, operating as an individual may also involve issues of illegal business operations; once deemed illegal, the consequences can be more than just a hassle.

Additionally, many consultants, to reduce taxes or evade fund tracking, directly accept clients' virtual currencies, such as USDT. However, from a consumer perspective, using virtual currencies like USDT for payment also carries significant risks: once a dispute arises, legal support in China is relatively limited because, under existing regulatory policies, USDT is not considered "money." Therefore, virtual currency payments are subjective matters for both parties, and consumers should be particularly cautious about whether they can bear such risks.

Practical Legal Risk Control Suggestions

If you intend to provide virtual currency investment consulting, it is advisable to avoid using terms like "guaranteed profit" or "sure profit." Such public sharing of investment "achievements" should be as accurate as possible. When posting profit screenshots in social circles, do not be too "hard," and label them with "investment carries risks," which can clarify the situation and help avoid future disputes. If the training or coaching fees are relatively high, it is recommended that both parties sign a formal contract, especially including a key clause stating: investment advice is for reference only, and the corresponding profits and risks are borne by the client. Never fall into the "trap" of direct investment on behalf of clients.

If any friends genuinely plan to treat this as a long-term business, they might consider establishing a company. The most common option is to set up a company in Hong Kong, allowing them to conduct educational training business under a corporate identity, which offers better compliance assurance. However, while Hong Kong currently has a friendly policy towards virtual currency businesses, it is essential that friends ensure they are genuinely engaged in education and training, rather than disguising investment advice under the guise of training; otherwise, they may still violate Hong Kong's financial regulations, which are much stricter than those in mainland China.

As for regular private community interactions and course delivery, it is best to avoid direct "calls for orders." Let the community serve its purpose of sharing and exchanging information and market dynamics. The same goes for courses; try not to directly state "this coin can rise by how much" or "when to buy," but rather discuss tool usage and market analysis, ensuring you won't be caught on a "soft spot." Make it clear to clients that you are providing knowledge, not direct "financial advice," which will help everyone understand the situation better and significantly reduce compliance risks. By implementing these practical risk control strategies, you can not only protect yourself and avoid legal risks but also build greater trust and reassurance among clients regarding your services. While making money may feel good temporarily, ensuring consistent profitability is what truly matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。