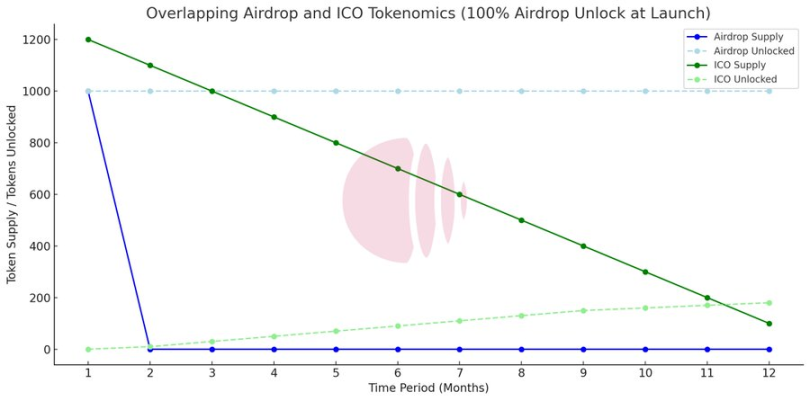

ICOs usually set lock-up periods to reduce the pressure of early sell-offs, while airdrops rarely impose such restrictions.

Written by: Tokenomist

Translated by: Deep Tide TechFlow

1. Overview of Airdrops and ICOs

- Airdrop: Free distribution of tokens, usually used to enhance brand awareness, reward early users, or connect with the community.

- ICO (Initial Coin Offering): A fundraising activity in which the project team sells tokens in advance to raise funds, helping them achieve their project vision.

2. Impact of Airdrops on Token Supply

- Increased circulating supply: Airdrops quickly introduce tokens into the market, often leading to inflationary pressure and market volatility.

- Market sentiment: While airdrops can create excitement, a large influx of tokens into recipients' hands may lead to sudden sell-offs, affecting token prices.

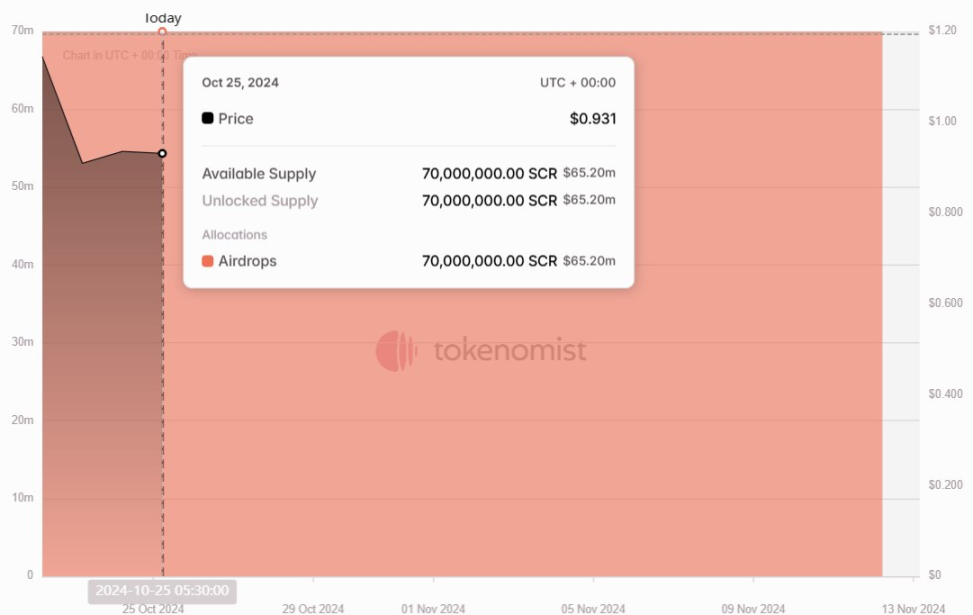

Example: The recent airdrop of Scroll initially traded at $1.40, but after recipients claimed and sold the tokens, the price dropped to $0.77, reflecting the common price volatility after an airdrop.

Through the above analysis, we can see the different roles of airdrops and ICOs in the token market, as well as how they affect token supply and market sentiment.

3. Impact of ICOs on Token Supply

- Controlled release mechanism: ICO tokens are usually distributed gradually, using monthly or quarterly unlocks. While this method can stabilize supply in the early stages, it may lead to market volatility as early investors sell off.

- Demand-driven valuation: Although ICOs generate initial market demand, regular token unlocks may affect prices, sometimes causing downward pressure, thus impacting market sentiment.

4. Key Differences in Token Economics

Lock-up and unlock: ICOs typically set lock-up periods to reduce the pressure of early sell-offs, while airdrops rarely impose such restrictions.

Through the above analysis, we can see the unique role of ICOs in token supply and market dynamics, as well as the key differences in token economics compared to airdrops.

Governance risk: Airdrops distribute tokens to a wide user base, which introduces uncertainty in governance decisions, as voting outcomes become more unpredictable.

Inflation management strategies: Some projects address the inflation risk brought by airdrops through burn mechanisms or staking incentives, aiming to maintain the value of the tokens and encourage users to hold them long-term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。