Original Title: "‘Not Producing, Just Holding Coins’: MSTR's Latest Financial Report Released, Revealing MicroStrategy's Capital Accumulation and High Premium Valuation Model"

Original Author: Alvis, MarsBit

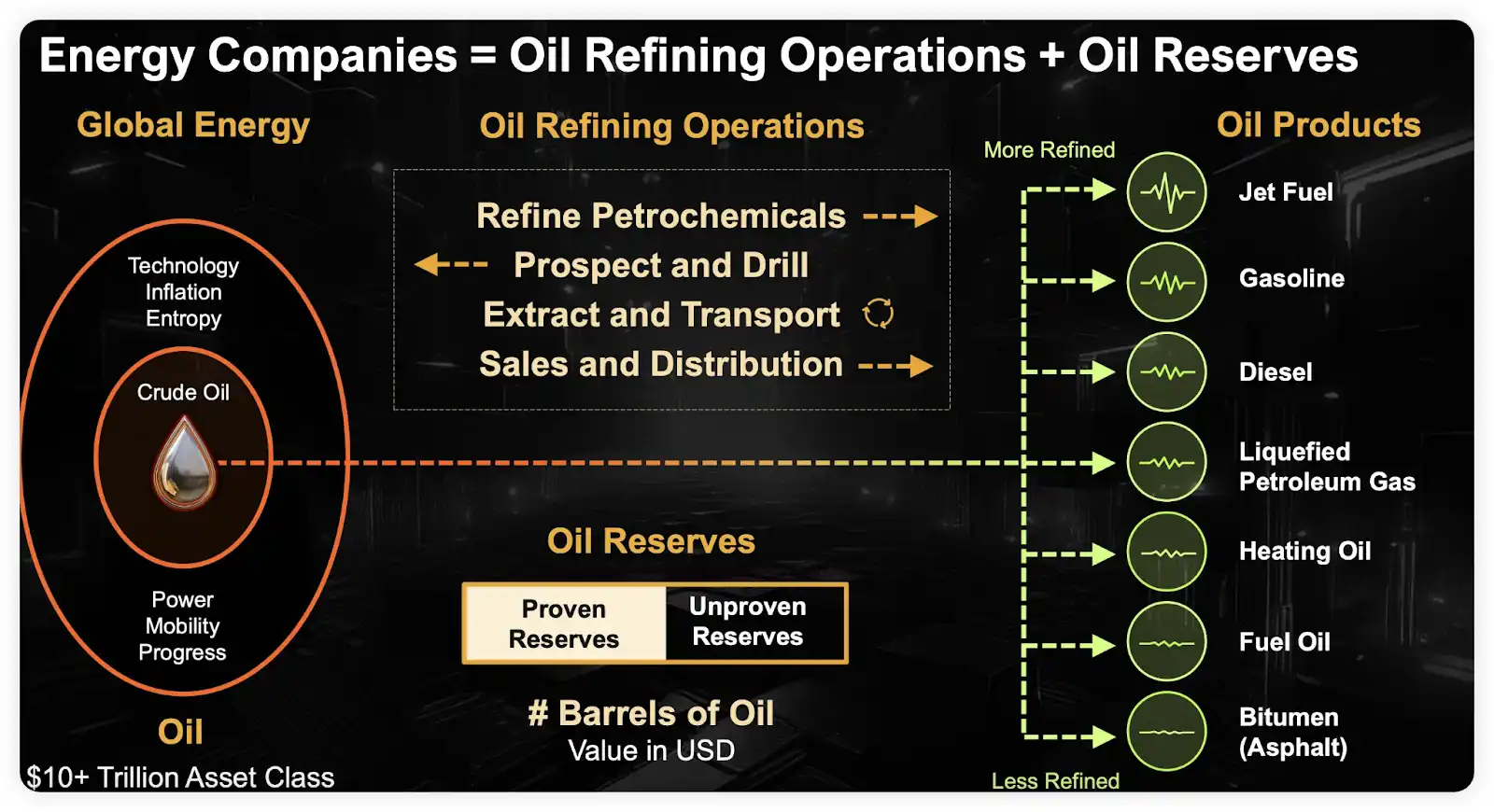

Historically, whenever a traditional industry reaches its peak, some groundbreaking companies often emerge, finding unique "production methods" in the market's crevices and attracting capital through distinctive strategies. These companies rarely "produce" actual goods but concentrate resources on a core asset—like Shell Oil Company in the past maintaining its valuation through oil reserves, or gold mining companies dominating prices through gold extraction and reserves. This morning, MicroStrategy's financial report was released, showcasing such a company again: it is not known for "production," but has broken traditional valuation rules with its massive investment in Bitcoin, becoming one of the largest and most unique Bitcoin holders in the world.

From Software Company to Bitcoin Whale: MicroStrategy's Transformation Journey

MicroStrategy (MSTR), originally built on commercial intelligence software, saw its founder Michael Saylor hit the gas in 2020, directly entering the "fast lane" of Bitcoin. From that year on, Saylor no longer allowed the company to remain in traditional "production," but instead recognized the potential of Bitcoin as a core asset, gradually converting the company's reserves into Bitcoin, even betting his own fortune, step by step transforming MicroStrategy into a "coin-holding bank" for Bitcoin. In Saylor's eyes, Bitcoin is the gold of the digital world, the anchor point for the future of global finance. Some think he is crazy, while others call him a "zealous evangelist" for Bitcoin, but he firmly believes he is securing a "new gold standard" for the company.

Saylor does not intend to follow the old path; he positions MicroStrategy more like an "air freight courier": compared to the "ground logistics" of traditional ETFs, MicroStrategy finances directly to purchase Bitcoin through bond issuance, loans, and equity offerings, which is flexible, efficient, and allows chasing the upward trend of the Bitcoin market. This makes MicroStrategy not just a stock code but a "fast target" in the Bitcoin market, with the company's market value directly linked to the rise and fall of Bitcoin. Saylor's operations have sparked considerable controversy, with well-known investor Peter Schiff even joking on social media platform X, "The company produces no products, yet achieves a high market value by hoarding Bitcoin." He pointed out that MicroStrategy's market value has surpassed most gold mining companies, second only to Newmont Corporation.

In response, Saylor's answer is very simple: "Bitcoin is our future reserve asset." Driven by this firm belief, MicroStrategy has accumulated over 250,000 Bitcoins and plans to raise $42 billion over the next three years to continue increasing its holdings. MicroStrategy's "production" method is not traditional material manufacturing but rather building a new financial system around Bitcoin's "infrastructure."

Some say Saylor is gambling, but perhaps this is not just a gamble but a kind of faith. He has carved out an alternative path through a risk, making MicroStrategy an alternative target in the financial market. As he said, "We do not produce; we just 'hold coins.'"

MSTR Latest Financial Report Interpretation: Capital Accumulation and Increased Bitcoin Reserves

1. Overview of Financial Report and Financing Plans

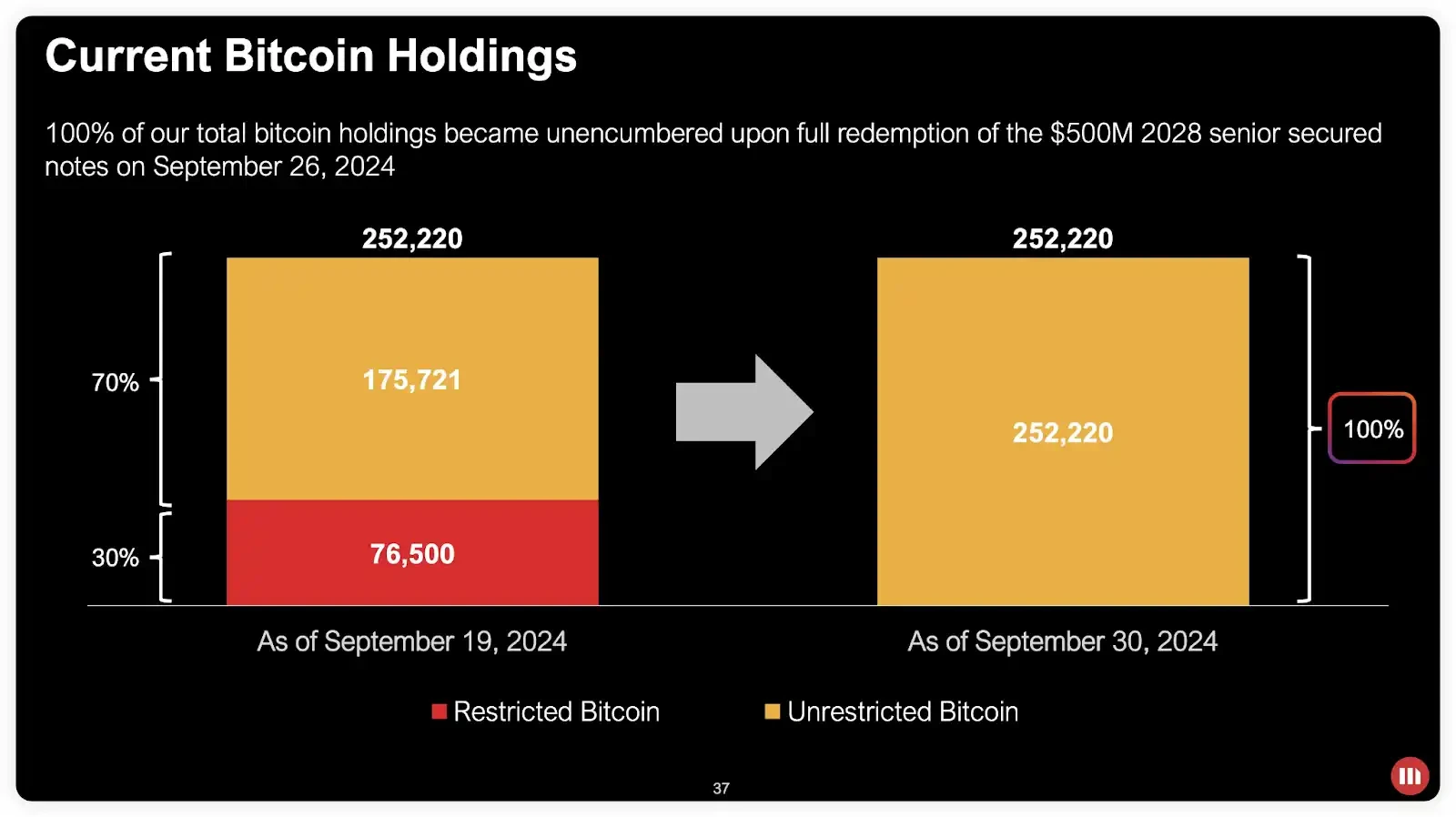

MicroStrategy's latest financial report presents a positive outlook. The company plans to raise $42 billion over the next three years to continue increasing its Bitcoin holdings and has completed the repurchase of previously pledged Bitcoins. As of the report date, MicroStrategy holds a total of 252,220 Bitcoins.

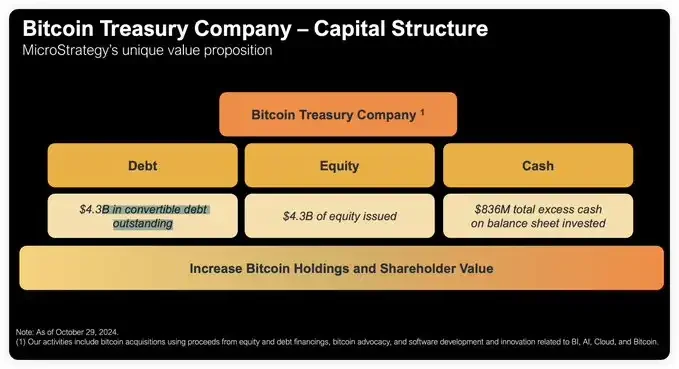

Since the end of the second quarter of 2024, the company has purchased an additional 25,889 Bitcoins at a total cost of approximately $1.6 billion, with an average price of $60,839 per Bitcoin. The company's total market value is approximately $18 billion, with a cumulative purchase cost of $9.9 billion for Bitcoin, averaging about $39,266 per Bitcoin. The company has also raised $1.1 billion through the sale of Class A common stock and an additional $1.01 billion through the issuance of convertible bonds maturing in 2028, while repaying $500 million of senior secured notes, releasing all Bitcoin assets from collateral. This release of collateral significantly enhances the company's financial flexibility and reduces its risk under extreme market conditions.

2. Cash Reserves and Future Financing Goals

MicroStrategy currently holds $836 million in cash, providing stable funding support for further Bitcoin purchases. The company has also announced phased financing goals: $10 billion in 2025, $14 billion in 2026, and $18 billion in 2027, totaling $42 billion. CEO Michael Saylor's plan aims to strengthen the company's core asset reserves through incremental Bitcoin acquisitions, which is undoubtedly viewed by the market as positive rather than negative news.

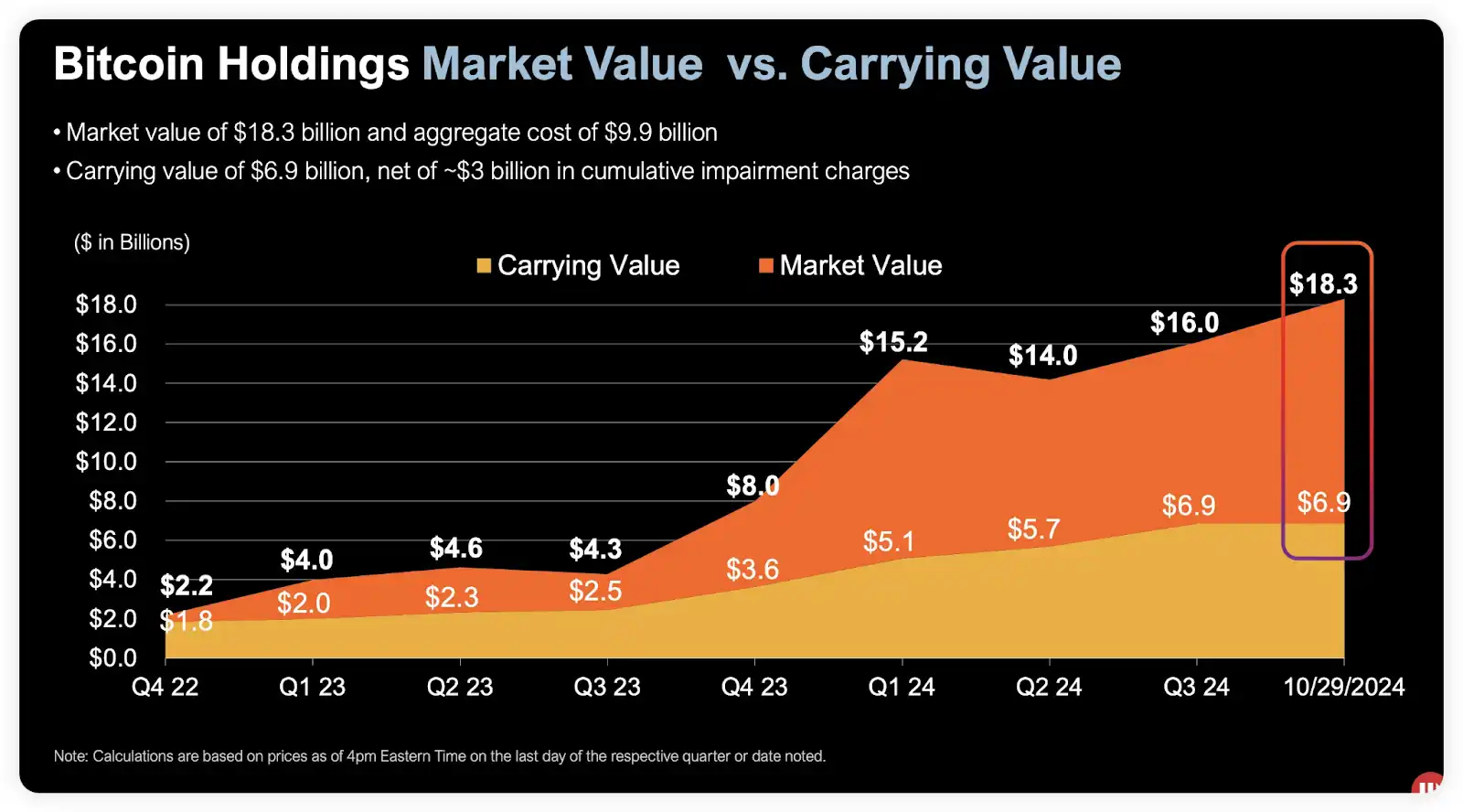

3. Market Value and Book Value

As of October 29, 2024, MicroStrategy's market value is approximately $18 billion, with a book value of $6.9 billion, which has deducted $3 billion in cumulative impairment losses. The reason for the impairment is not that MicroStrategy sold Bitcoin, but rather based on book adjustments under current accounting standards. According to accounting regulations, if Bitcoin's market price falls in a given quarter, the company must lower the book value of these assets and recognize an impairment loss. However, even if the price rebounds later, the book value does not automatically recover; it can only reflect appreciation upon sale. If future accounting standards are modified (such as the FASB's fair value measurement being implemented), this issue may improve.

4. Flexibility Advantages of Bitcoin as a Core Asset

As a core asset, Bitcoin provides MicroStrategy with greater capital operation flexibility compared to spot ETFs. The company operates its Bitcoin reserves similarly to how oil companies manage their oil reserves. Just as oil companies handle unrefined and refined products (such as gasoline, diesel, and jet fuel), MicroStrategy views its Bitcoin reserves as a capital preservation tool, allowing the company to enhance productivity and implement innovative financial strategies through this core asset.

5. MicroStrategy's Principles for Holding Bitcoin

MicroStrategy has established eight core principles for holding Bitcoin, reflecting its long-term investment strategy and market orientation:

- Continuously purchase and hold Bitcoin, focusing on long-term returns;

- Prioritize the long-term value of MicroStrategy common stock;

- Maintain transparency and consistency with investors;

- Utilize smart leverage to ensure the company's performance exceeds the Bitcoin market;

- Adapt quickly and responsibly to market dynamics, ensuring continuous growth;

- Issue innovative Bitcoin-backed fixed-income securities;

- Maintain a healthy and robust balance sheet;

- Promote Bitcoin as a global reserve asset.

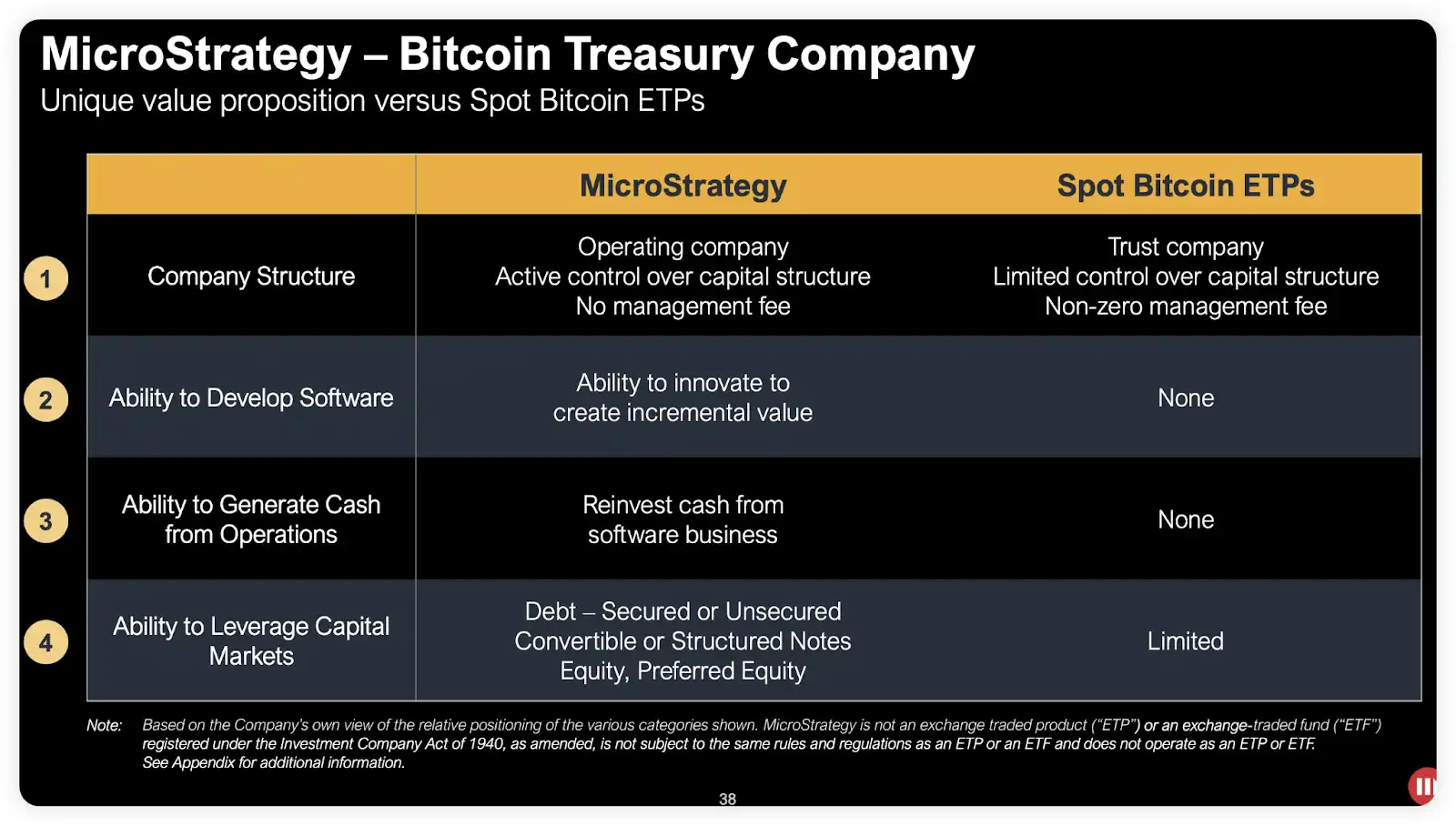

6. Differences Between MicroStrategy and Bitcoin Spot ETFs

Compared to Bitcoin spot ETFs, MicroStrategy's uniqueness lies in its financing methods. ETF investors must actively purchase ETF shares, while MicroStrategy raises funds through equity, unsecured or secured debt, convertible bonds, and structured notes to directly increase its Bitcoin holdings. This "selling stock for financing" model allows the company to actively raise funds to achieve its long-term strategic holding of Bitcoin.

The Cycle of Capital and High Premium Rates: MicroStrategy's Valuation Code

The Higher the Premium Rate, the More Suitable for Large-Scale Financing

MicroStrategy's valuation model relies on market value premium rates, using equity dilution financing to increase Bitcoin (BTC) holdings, enhancing the per-share BTC holding, thereby boosting the company's market value. Here is a detailed analysis of this model:

Simplified Analysis of Premium Rate and Accumulation Effect

Assuming the price of Bitcoin is $72,000, MicroStrategy holds 252,220 BTC, with a total holding value of approximately $18.16 billion. With the current company market value at $48 billion, MicroStrategy's market value is 2.64 times the total value of its Bitcoin holdings, resulting in a current premium rate of 164%.

Assuming the company's total share capital is currently 10,000 shares, each share corresponds to approximately 25.22 BTC holdings.

If MicroStrategy plans to raise $10 billion through a share issuance, the total share capital after the issuance will increase to 12,083 shares (calculation method: divide the financing amount of $10 billion by the current market value of $48 billion, resulting in 0.2083 times, meaning the share capital will increase by 20.83%, making the total share capital 10,000 shares multiplied by 1.2083, approximately equal to 12,083 shares). In this case, the company can use $10 billion to purchase approximately 138,889 Bitcoins at a price of $72,000, raising the total Bitcoin holdings to 391,109. Thus, the BTC holdings per share will also increase to 32.37 BTC (391,109 Bitcoins divided by 12,083 shares), an increase of about 28%.

Similarly, if the plan is to raise $42 billion

Further assuming MicroStrategy increases its share capital by 87.5%, that is, raising $42 billion by issuing 8,750 additional shares, the total share capital will increase to 18,750 shares (calculation method: multiply 10,000 shares by 1.875). If Bitcoin is purchased at $72,000, the company can acquire approximately 583,333 BTC, bringing the total holdings to 835,553 Bitcoins. At this point, the BTC holdings per share will increase to 44.23 BTC (835,553 Bitcoins divided by 18,750 shares), which is an increase of about 75% compared to the previous 25.22 BTC.

If this accumulation effect is realized within three years, the average annual increase would be 25%.

Of course, when reinvesting ultimately, the price of Bitcoin will fluctuate, potentially higher or lower, but this will not change the conclusion of the accumulation. Given MicroStrategy's extremely high premium rate (currently fluctuating around 180%-200%), the company should maximize financing by leveraging the premium rate. Therefore, CEO Michael Saylor's $42 billion financing plan, although initially causing market panic, quickly restored market sentiment, indicating the company's clear understanding of the current model, which is a rational decision that maximizes shareholder equity.

MicroStrategy's Advantages and the Logic Behind High Premium Rates

Many investors may wonder why the market is willing to purchase MicroStrategy's ATM or convertible bonds at a high premium rather than directly buying Bitcoin ETFs. This involves several unique advantages of MicroStrategy:

Continuous Accumulation of Returns

By continuously financing to increase BTC reserves, MicroStrategy has achieved an annualized return accumulation of 6%-10%, with a 17% annualized accumulation realized so far in 2024. Under the current high premium financing model, the annualized accumulation is expected to exceed 15%. Based on a valuation of 10 to 15 times, MicroStrategy's premium rate corresponds to a valuation of 150%-225%.

Volatility and Market Bridge

Michael Saylor believes that MicroStrategy acts as a bridge between traditional capital markets and the Bitcoin market. Currently, the market capitalization of Bitcoin is approximately $1.4 trillion, with a relatively low penetration rate. If the penetration rate increases, even if only 1% of the $300 trillion global bond market is allocated to Bitcoin, it would bring about $3 trillion in potential incremental funds to MicroStrategy. Additionally, the convertible bonds issued by the company not only provide some downside protection but also offer potential options for Bitcoin price appreciation.

Conclusion: The Self-Reinforcing Effect of High Premium Rates in a Bull Market

In a bull market environment, MicroStrategy's valuation model and high premium financing model create a self-reinforcing positive cycle. The higher the premium rate, the larger the amount of financing the company can secure, thereby increasing the BTC reserves per share and further boosting the company's market value. This market effect rolls forward like a snowball, especially with Bitcoin prices expected to rise to the $90,000-$100,000 range, MicroStrategy may continue to accelerate under the protection of high premium rates.

Michael Saylor's bets and the market's response seem to indicate a subtle game between traditional finance and digital assets. In this dual contest of capital and technology, will MicroStrategy achieve a financial revolution, or will it merely be a fleeting moment? What we are witnessing may be a harbinger of future financial transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。