Theoretically, this means that when the CPI report rises, the price of Bitcoin will increase, and when the CPI report falls, the price of Bitcoin will decrease.

Written by: Shane Neagle, Coingecko

Translated by: Bai Shui, Jinse Finance

Bitcoin was launched in 2009 after the financial crisis and has hardly undergone macroeconomic stress testing. This contrasts sharply with gold, which has a long history and has endured multiple centuries and different political systems.

However, the supply of gold is pseudo-limited, making its scarcity unstable. New gold mines are often discovered, while Bitcoin's scarcity is mathematically precise and predictable, capped at 21 million Bitcoins (BTC). But does this mean Bitcoin is a better hedge against inflation than gold?

How Does CPI Affect Bitcoin Prices?

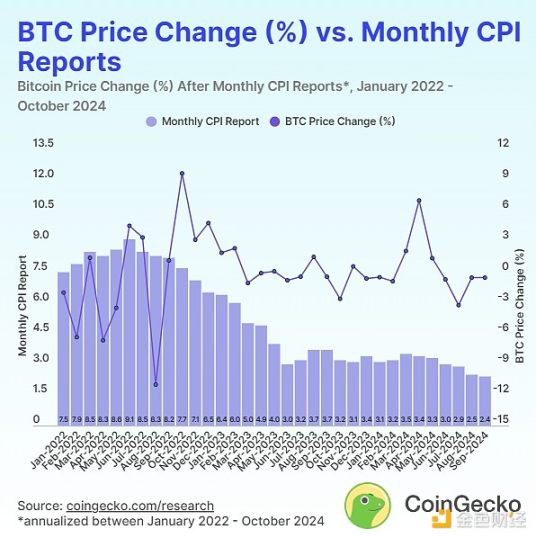

On a daily basis, from the opening price of Bitcoin (BTC) on the day of the CPI report to the opening price of BTC the next day, regardless of the direction of inflation rate changes, the price of Bitcoin tends to either fall or rise. For example, when the CPI report showed that the inflation rate dropped from 8.5% to 8.3% (annualized) between March and April 2022, the price of Bitcoin fell by -11%.

Conversely, after the CPI report indicated that the inflation rate dropped from 8.2% to 7.7% (annualized) between September and October 2022, the price of Bitcoin rose by 9.68%.

In May 2024, when the CPI was announced, the price of BTC rose by 7.02% the following day, showing a slight decrease from 3.5% to 3.4% (annualized). Notably, when the inflation rate surged from 7.5% to 7.9% in the March 2022 report, the price of Bitcoin actually fell by 6.37%.

In other words, the hypothetical logic regarding the relationship between Bitcoin prices and CPI announcements is not reflected in the data. It becomes meaningful once we look at monthly BTC price changes and broader driving factors with greater impact.

Will Bitcoin Rise or Fall with Inflation?

In March 2022, the Federal Reserve began a rate hike cycle to curb inflation. Given the lag in monthly CPI reports, January 2022 will serve as the starting point for comparing monthly Bitcoin prices for two reasons:

- Rate hikes have a suppressive effect on the economy as borrowing becomes more expensive.

- The legislation itself has placed inflation as a pressing issue in the public spotlight. This further drives the perception of Bitcoin as a hedge against inflation.

From this data, it is clear that the Federal Reserve's rate hike cycle, as a means of reducing the balance sheet, has a far greater (suppressive) impact on Bitcoin prices than CPI data. In fact, as CPI data declines, Bitcoin prices tend to rise. Considering these factors, this makes sense:

- Bitcoin is viewed as both a speculative asset and a hedge against currency devaluation. This perception stems from Bitcoin's limited use in the economy compared to the ubiquitous dollar (less than 2%).

- Conversely, before the Federal Reserve's rate hike cycle, when money was "cheap," Bitcoin was more likely to attract inflows as a higher-risk investment.

- However, as the Federal Reserve continues to raise rates to curb inflation, Bitcoin's increasingly limited supply offsets this effect. As of October 2024, after the fourth halving event in April 2024, 94.13% of Bitcoin's supply is provided at an inflation rate of 0.84%.

- It can be argued that Bitcoin is not just an inflation hedge but also a hedge against central banks. This was evident when Bitcoin rose by 9.5% during the recent regional banking crisis in the U.S.

In summary, compared to the underlying Bitcoin token economics, the impact of CPI announcements on Bitcoin prices is diluted. Most importantly, inflation rates above BTC's inflation are incorporated into the central bank's equation. This is why even as CPI data trends downward, it cannot obscure the fact that after the fifth halving in March 2028, the dollar will continue to devalue while Bitcoin's future inflation rate will be lower.

In contrast, it is highly unlikely that the federal government will control spending to the extent that it leads the Federal Reserve to stop monetizing the government's ever-increasing debt. Recently, a rate cut by the Federal Reserve is more likely to reopen capital inflows into Bitcoin, regardless of how CPI data declines.

Why Do Inflation Reports Affect Bitcoin Prices?

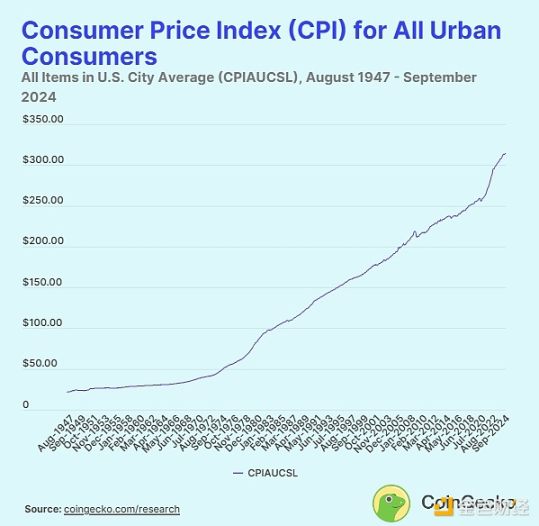

Inflation is elusive; it is understood as the rise in prices of goods and services, typically measured by government agencies. In the U.S., this is the responsibility of the Bureau of Labor Statistics (BLS) through the Consumer Price Index (CPI).

However, upon deeper examination, inflation is best understood as the impact of the central banking system. Specifically, when the Federal Reserve ("Fed") monetizes debt to pay for government spending, the central bank increases its securities portfolio. The result is an increase in the money supply, manifested as inflation.

After decades of increasing monetary plateau to monetize debt, the most extreme instance occurred in 2020. The Federal Reserve's balance sheet expanded from $4.2 trillion at the beginning of 2020 to $7.2 trillion by mid-year. Consequently, inflation (CPI) emerged as a lagging effect the following year, peaking at 9.1% (annualized) in June 2022, the highest level since 1981.

In other words, the Federal Reserve continuously devalues the dollar through ongoing monetary expansion. Even Federal Reserve Chairman Jerome Powell finds it difficult to explain why the benchmark inflation target (the rate of dollar value erosion) is set at 2% rather than another percentage.

Thus, this means the following:

- The dollar is a manipulated asset whose value has been inherently eroded.

- Bitcoin is an immutable asset whose value is secured through decentralization and inherent scarcity.

Theoretically, this means that when the CPI report rises, the price of Bitcoin will increase, and when the CPI report falls, the price of Bitcoin will decrease. However, as explored above, this is not the case.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。