Recently, MSTR's premium has skyrocketed, mainly due to MicroStrategy's "new weapon," which has not only impacted MSTR's fundamentals but also made MSTR "more valuable as it sells more."

Written by: CMed

In the past few days, both the US stock market and the crypto market have been dazzled by MSTR. In the latest wave of Bitcoin's market, MSTR not only led the rally but also maintained a continuous premium growth against Bitcoin for a period afterward, with its price soaring from around $120 one or two weeks ago to the current $247.

Most interpretations of MSTR's surge in the market still revolve around "leveraged Bitcoin." However, this does not seem to explain why MSTR's premium suddenly skyrocketed despite the fundamentals of "issuing bonds to buy Bitcoin" remaining unchanged. After all, MicroStrategy has been buying Bitcoin for many years, and such a rise in premium has never been seen before.

In fact, the recent surge in MSTR's premium, in addition to "issuing bonds to buy Bitcoin," is also attributed to another secret weapon of MicroStrategy, which has had a significant impact on MSTR's fundamentals and has even been referred to by many analysts as MicroStrategy's "infinite money printer," making MSTR "more valuable as it sells more."

Leveraged Bitcoin? A Common Topic

MicroStrategy, as a company focused on business intelligence software, adopted an aggressive strategy starting in 2020: raising funds through bond issuance to purchase Bitcoin. This strategy began in August 2020 when the company announced the conversion of $250 million in treasury reserve assets into Bitcoin. The main motivation behind this strategy was to address challenges posed by declining cash returns and the depreciation of the dollar due to global macroeconomic factors.

To further expand its Bitcoin holdings, MicroStrategy financed through long-term bonds in the capital markets in earlier years. These bonds typically have long maturities, most maturing in 2027-2028, with some even being zero-coupon bonds. This allowed the company to maintain low financing costs over the next few years and quickly use the bond financing obtained to purchase Bitcoin, directly adding it to the company's balance sheet.

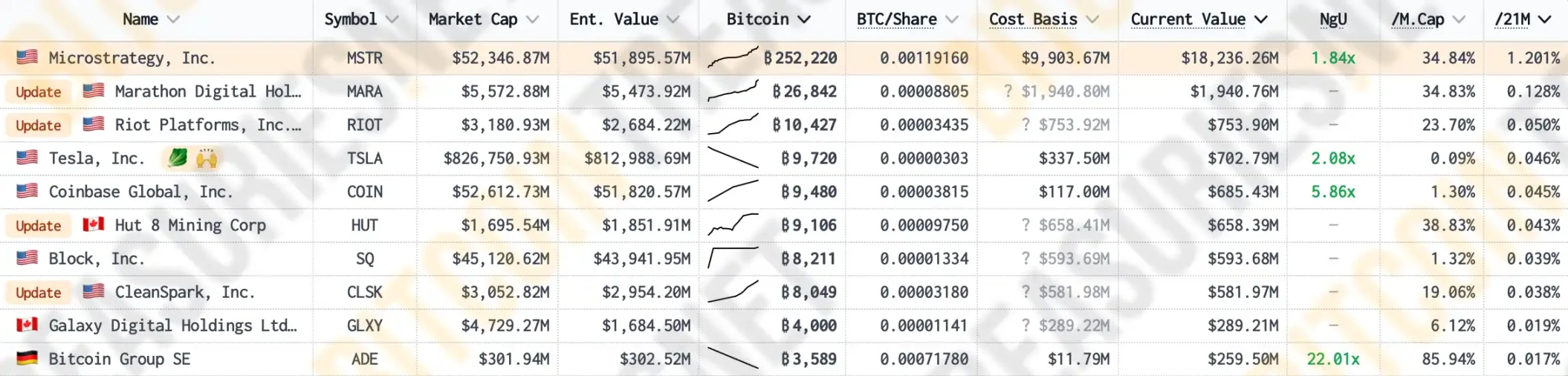

According to data from Bitcoin Treasuries, as of now, MicroStrategy holds Bitcoin that accounts for 1.2% of the total circulating supply, making it the publicly listed company with the most Bitcoin globally, far surpassing Bitcoin mining companies like Marathon, Riot, and leading crypto trading platform Coinbase, which are more "crypto-native" in their business operations.

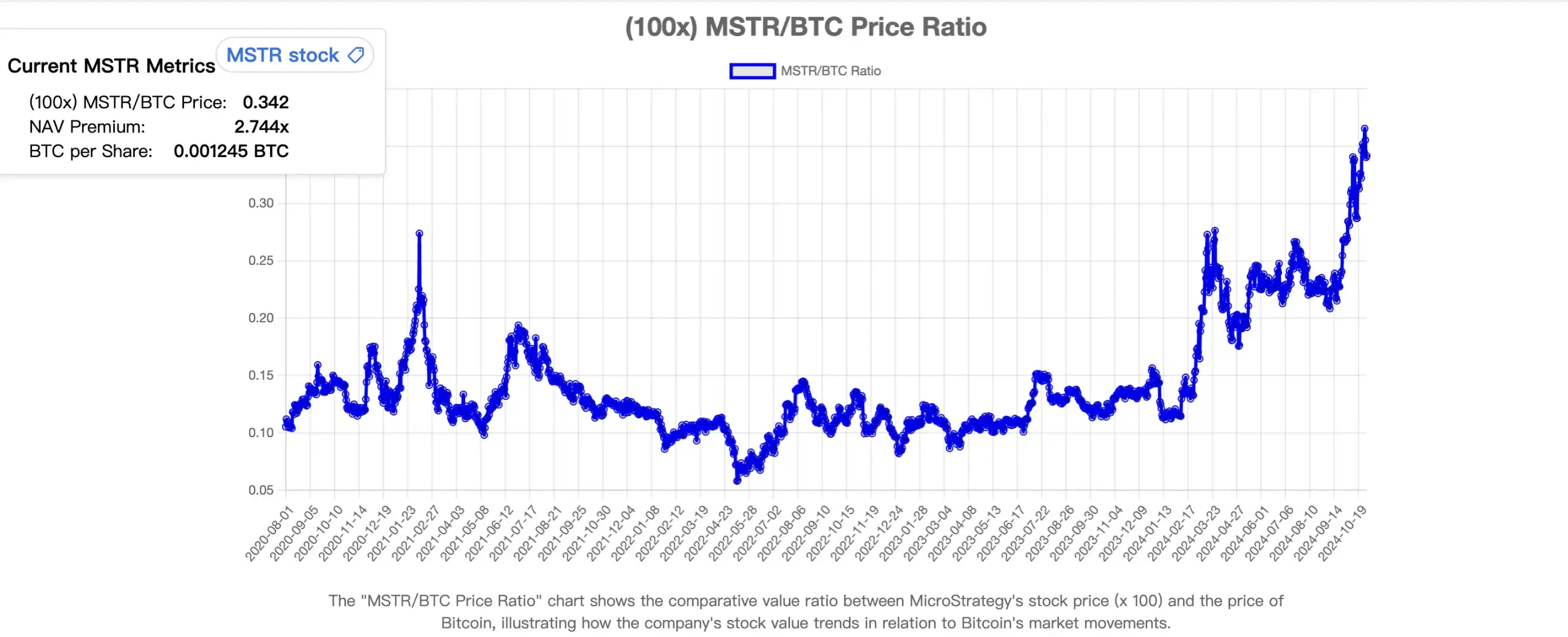

By financing through bond issuance, MSTR has continuously increased its Bitcoin holdings, which not only increases the number of Bitcoins on its balance sheet but also creates a significant upward pressure on Bitcoin's market price. As the proportion of Bitcoin in MSTR's asset portfolio continues to rise, the positive correlation between the company's stock market value and Bitcoin's price has further strengthened. According to MSTR Tracker, the correlation coefficient between MSTR's stock price and Bitcoin's price has recently surged to 0.365, setting a historical high.

This correlation makes investors willing to buy MSTR's stock while being optimistic about Bitcoin, further driving up the company's market value. Of course, after four years of market and time testing, MSTR's "leveraged Bitcoin effect" has long been a common topic; whenever MSTR's price rises, people always use the logic of "issuing bonds to buy Bitcoin" to explain it.

However, in the recent Bitcoin market, MSTR's market price not only rose ahead of Bitcoin but also maintained an increasingly high premium against Bitcoin for a period afterward. This has left many investors puzzled: why did the premium suddenly rise when the fundamentals remained unchanged?

Premium Increase: "More Valuable as it Sells More," MSTR's Cheat Code

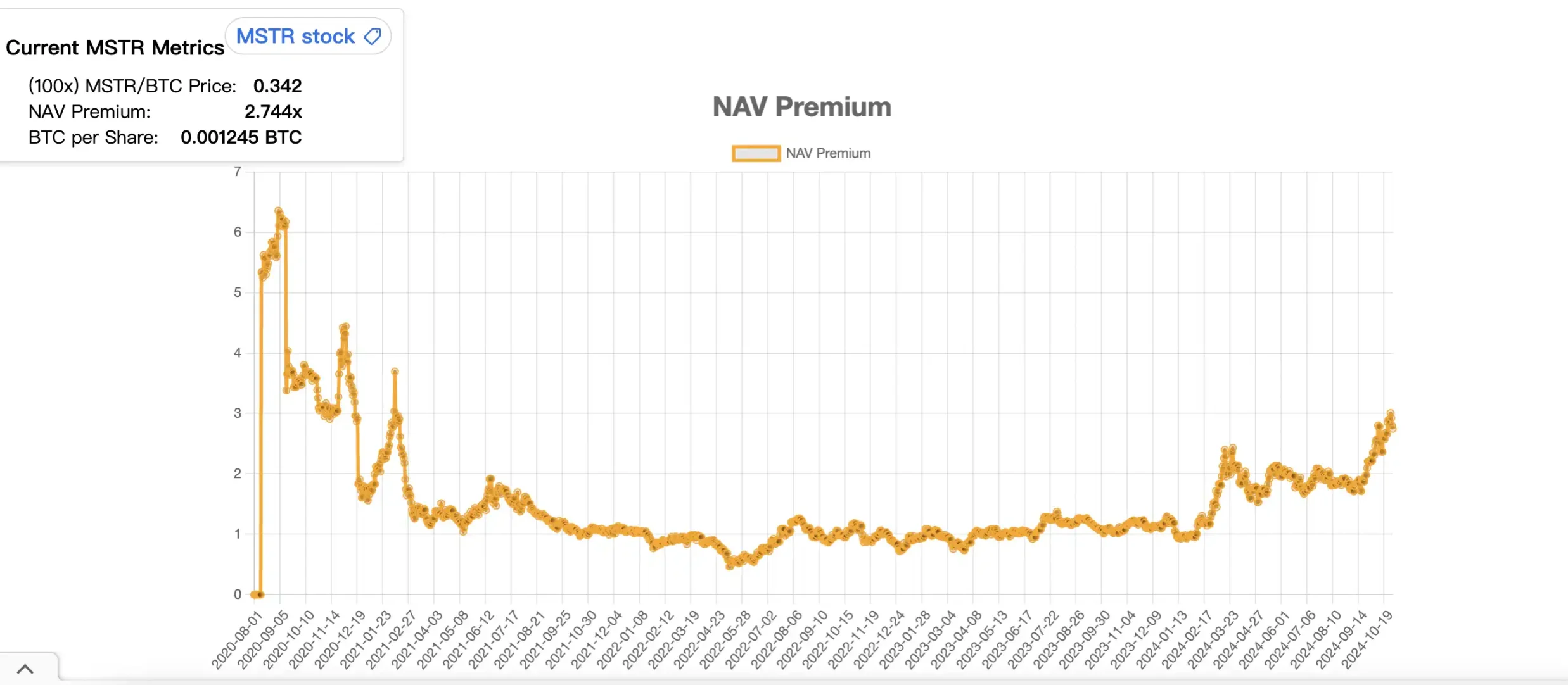

First, let's take a look at how exaggerated MSTR's recent premium has been. According to MSTR Tracker, MSTR's premium over Bitcoin experienced a surge from early February to March this year, rising from about 0.95 to 2.43 before falling back to around 1.65. The second rapid increase began just before the recent rise in Bitcoin prices, growing from 1.84 to a peak of 3.04, currently maintaining around 2.8.

It can be seen that although MicroStrategy has been accumulating Bitcoin over the past four years, its NAV (Net Asset Value) premium has not shown significant growth, remaining at a 1:1 state for a long time.

So what exactly caused MSTR's premium to skyrocket? Did the fundamentals of MicroStrategy's "issuing bonds to buy Bitcoin" change?

The answer is: yes. This change in fundamentals is called "premium increase." Since the latter half of last year, MicroStrategy has adopted a new method of buying Bitcoin, namely by issuing and selling its own MSTR stock to purchase more Bitcoin. This "selling stock to buy Bitcoin" strategy may sound foolish at first, as it could hurt the stock price and even threaten MSTR's market positioning as "leveraged Bitcoin."

However, when you analyze the logic chain carefully, you will find that this new "selling stock to buy Bitcoin" model is simply MSTR's super flywheel and MicroStrategy's infinite money printer.

First, it is necessary to explain the concept of "Net Asset Value premium" (NAV). Since MSTR holds a large amount of Bitcoin through bond issuance, and the market has strong expectations for Bitcoin's future price increase, the value of MSTR's stock often exceeds the value of the Bitcoin it holds. This premium is referred to as "Net Asset Value premium," reflecting the market's expectations for the company's future expansion of Bitcoin holdings and becoming the support point for MSTR's continuous stock issuance to purchase Bitcoin.

On the other hand, when Bitcoin's price rises, MicroStrategy's market value will also increase accordingly, which forces various index funds to increase their purchases of MSTR based on weight considerations, further driving up its price and market value.

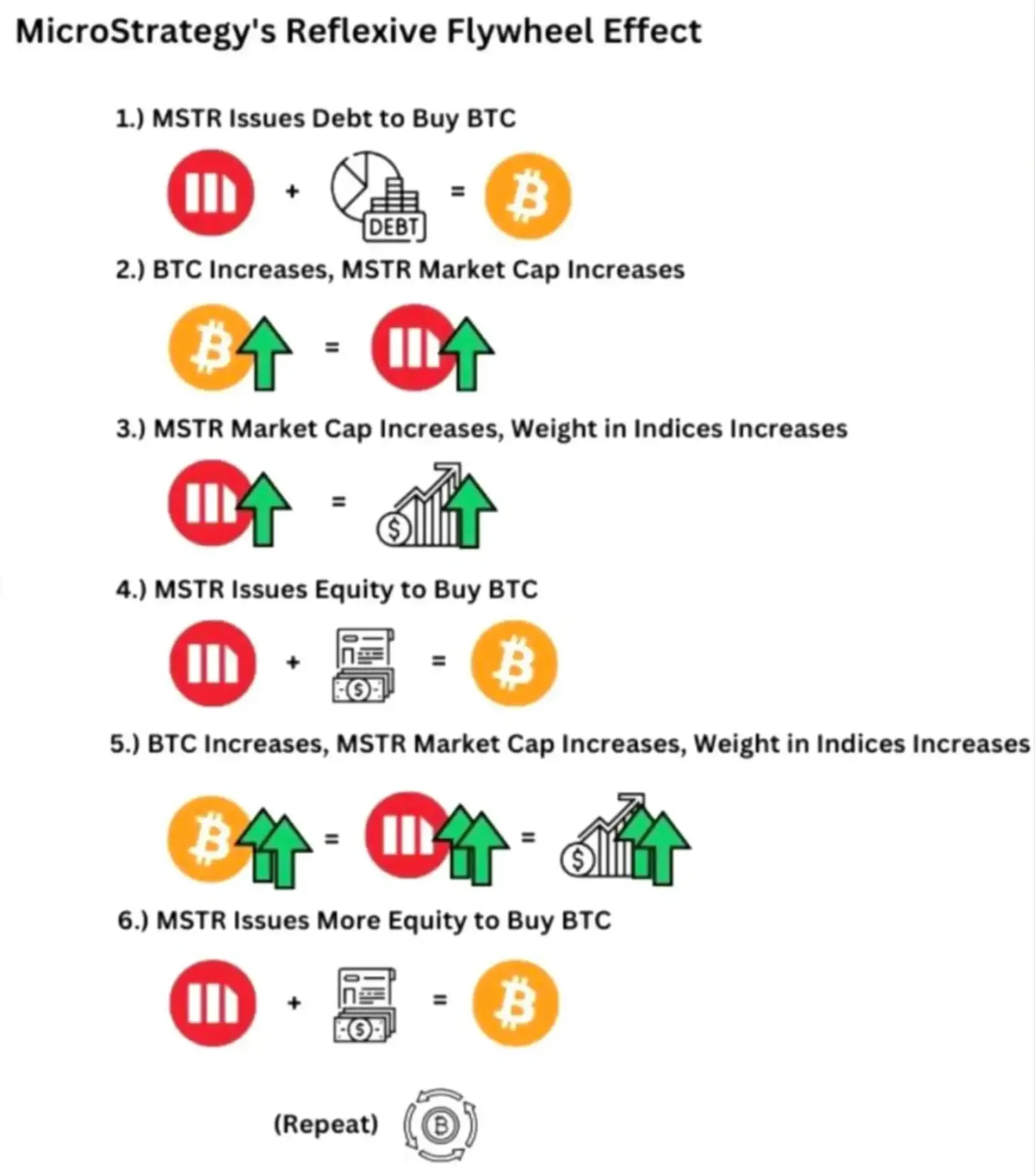

At this point, due to the existence of the "Net Asset Value premium," MSTR can begin its "premium increase" operation. By continuously issuing new shares, it can obtain more funds to purchase Bitcoin, driving up Bitcoin's price, and the rise in Bitcoin further enhances the company's market value and financing ability, allowing this cycle to continue. This strategy creates a "Reflexive Flywheel Effect."

In MicroStrategy's "Reflexive Flywheel Effect," the most ingenious point is that the issuance of new shares does not negatively impact MSTR's price; instead, it makes MSTR more valuable.

When MicroStrategy issues new shares to purchase Bitcoin, the newly issued shares are usually traded at a price higher than their Net Asset Value. With this premium, MicroStrategy can buy more Bitcoin than what each share of MSTR truly represents when selling each share.

For example, calculating based on the correlation coefficient between MSTR and Bitcoin, 36% of the value of each MSTR share represents the Bitcoin backed by the company. Without any premium, when MicroStrategy sells MSTR, it can only exchange for 36% of Bitcoin from the market. However, currently, MSTR's premium over Bitcoin is around 2.74, meaning that every time MicroStrategy sells one share of MSTR, it can exchange for about 98% of Bitcoin.

This means that the company can use funds higher than the net asset value of Bitcoin to increase its Bitcoin holdings, thereby expanding its Bitcoin position on the balance sheet. The core of this strategy is that MSTR enhances the speed and scale of its Bitcoin holdings through high premium financing, and this speed far exceeds the previous "issuing bonds to buy Bitcoin" speed.

Once the flywheel is in motion, MSTR's increasing market value is also included in the investment scope of US stock indices, attracting more incremental funds and generating more Net Asset Value premium. One reason for MSTR's decoupling from BTC in the third quarter is also due to the market pricing in advance that MSTR would be included in the Nasdaq 100 index, bringing in a large amount of passive fund inflow.

US stock index investors will be "forced" to invest in MSTR, returning to the reflexive flywheel, resulting in a larger Net Asset Value premium, enabling MSTR to raise more funds to increase Bitcoin holdings, driving up Bitcoin's price, enhancing market optimism towards MSTR, and potentially increasing the company's weight in the index, which will trigger further buying demand from index funds, forming a self-reinforcing positive feedback loop, overall creating a pressure flywheel for index buying.

From a larger time dimension, the amount of BTC equivalent held by each MSTR shareholder is continuously increasing, which not only enhances the market's recognition of MSTR as a "Bitcoin alternative investment tool" but also raises pricing expectations for MSTR.

"There Will Be More MSTR in the US Stock Market"

In recent weeks, MicroStrategy CEO Michael Saylor has become increasingly high-profile, proclaiming on various podcasts and news programs that "there will be more MSTR in the US stock market" and that "MSTR's mechanism is simply an 'infinite financial silver printing malfunction.'"

Saylor believes that MSTR's "Reflexive Flywheel" model has strong capital operation potential, as this model can not only continuously accumulate Bitcoin but also maintain its growth through financing and rising stock prices, demonstrating how a publicly listed company can leverage asset premiums and capital market financing capabilities for long-term expansion. This model is not just a traditional "buy and hold" strategy but a proactive way to utilize capital market advantages to expand the balance sheet. This mechanism could become a model for other companies to emulate, especially in resource-intensive or capital-intensive industries. In fact, many companies have emerged that mimic MSTR to conduct partial asset operations.

Currently, it seems that this "left foot stepping on the right foot" model has a decent feasibility. According to the current data statistics, for every $2.713 of stock issued by MSTR, only $1 is used for Bitcoin purchases. Many believe that it is through high leverage that MSTR can significantly "outperform" Bitcoin, but in fact, MSTR's health is quite high. It is estimated that MSTR only faces liquidation risk if Bitcoin's price falls below $700.

At present, this mechanism seems to be operating smoothly, with MSTR continuously increasing its BTC holdings. However, as this mechanism becomes more widely used, it will undoubtedly cause US stock indices to be influenced more by crypto assets and their related derivatives. This mechanism acts like a rope, binding the cryptocurrency market and the US stock market together, leading to profound changes in the market. For the cryptocurrency market, it undoubtedly introduces a large amount of liquidity from US stock funds (mainly absorbed by BTC), while for the US stock market, it seems to exacerbate volatility risks.

According to Saylor (the founder of MSTR), in the future by 2050, the price of Bitcoin is expected to reach $500,000 per coin. He hopes that by then, MSTR will become a trillion-dollar company, better applying itself in promoting the deeper integration of cryptocurrency into people's lives. Whether this model, which sounds very much like a "refined version of a Ponzi scheme," can operate until that time may need subsequent market validation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。