Today, Tether's third-quarter financial report was released, and it is still quite explosive. This is one of the reasons why many friends ask me if USDT will crash, and I firmly believe it will not.

In the third quarter, Tether's profit exceeded $2.5 billion. As of September 30, 2024, Tether's total assets were $134.424 billion, total liabilities were $120.272 billion, and net assets were $14.152 billion.

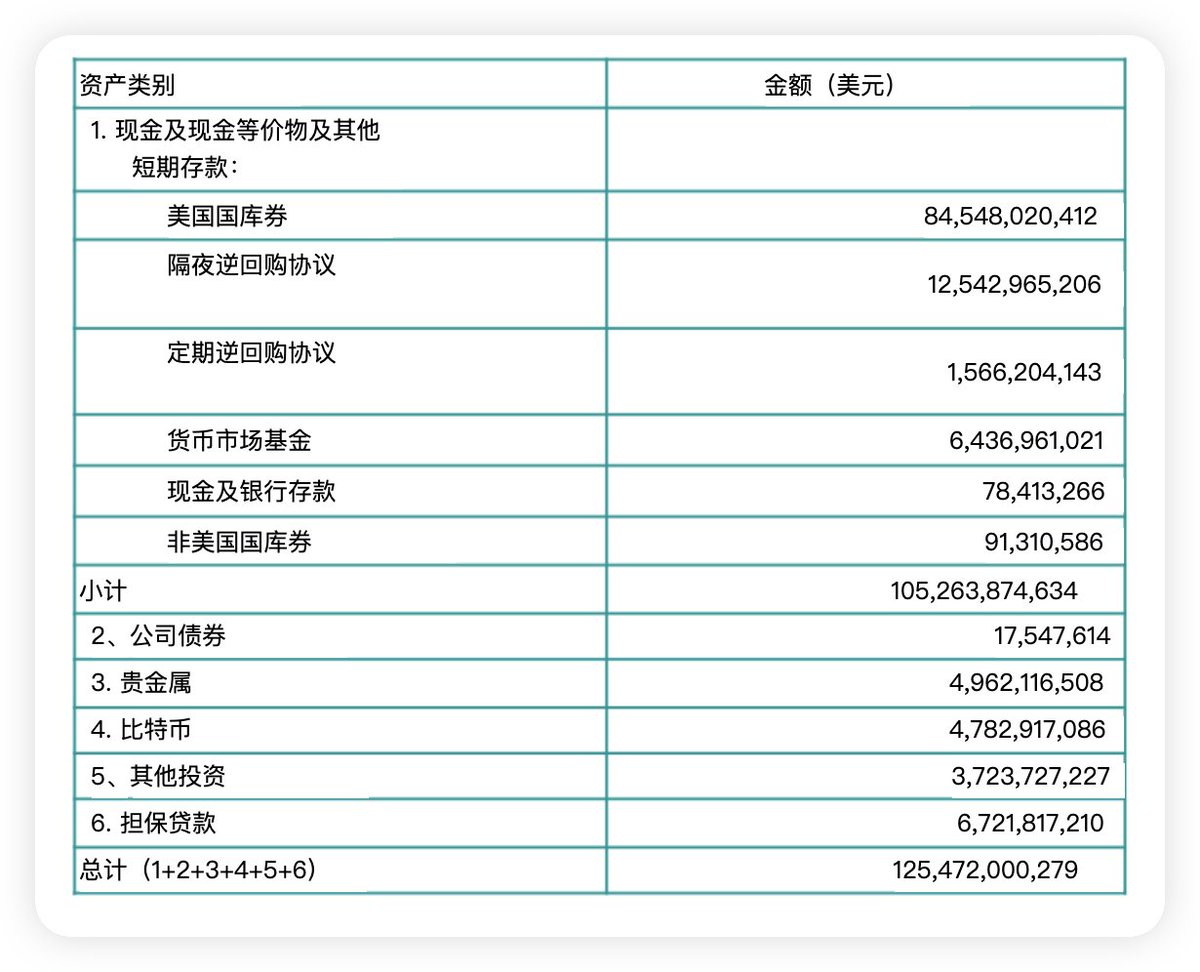

Among them, the total value of reserve assets was $125.472 billion, exceeding its corresponding total liabilities of $119.38 billion, with excess reserves of $6.092 billion. In the third quarter, the number of U.S. Treasury bonds held directly and indirectly by Tether increased, totaling over $102 billion.

In simple terms, a large portion of USDT's backing is in U.S. Treasury bonds, and Tether's main profit also comes from the yields of these bonds. To put it another way, as long as Tether doesn't act recklessly, it won't fail.

Additionally, as of the third quarter, Tether held a total of 75,353.56 BTC. This number not only did not increase compared to the second quarter but actually decreased by 187.71 BTC.

PS: I wonder how many friends remember that Tether mentioned in the first quarter of 2023 that it would use 15% of its quarterly profits to purchase Bitcoin. However, by the third quarter of 2024, not only was there no new increase in BTC, but it actually decreased, which is a breach of trust.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。