Content & Review | Ethereum Chinese Weekly

Organization & Editing | Connie

Image Source: Internet

"Ethereum Chinese Weekly"

——Building an Information Bridge for Chinese Ethereum

Introduction to "Ethereum Chinese Weekly"

Every Monday at 2 PM (UTC+8), the Ethereum Chinese Weekly invites renowned project engineers, KOLs, and others from the Web3 industry to share insights on Ethereum industry topics, interpretations of well-known institutional research reports, analyses of new projects, hot topic reviews, and more.

The "Ethereum Chinese Weekly" (hereinafter referred to as "Weekly") gathers the exciting content from the "Ethereum Chinese Weekly Meeting," capturing the latest news and in-depth analyses, continuously delivering the freshest and most substantial content to you.

The Ethereum Chinese Weekly Meeting and the "Weekly" are jointly initiated by Web3BuidlerTech and ETHPanda, with support from communities like LXDAO.

Together with you, we are building an information bridge for Chinese Ethereum.

Ethereum Chinese Weekly Video

The exciting content of this issue can be accessed via the following links, or click "Read the original text":

Bilibili:

https://www.bilibili.com/video/BV1tc1jYjE1b/?vd_source=86c94e1d4cf2cdadfe37833dcec7f09e

YouTube:

https://youtu.be/1tT7pnORbfk

Materials for this issue:

https://www.notion.so/Web3BuidlerTech-702bd1ab80a7422586f1edac1917fa9c?pvs=4

Table of Contents

This issue of the "Weekly" consists of 2 parts, taking approximately 10 minutes to read.

- Overview of Industry Information from Last Week

Blockchain News

Data Trends

- In-Depth Content Analysis

Vitalik's New Article: Possible Future of the Ethereum Protocol (Part 4) The Verge

Possible Future of the Ethereum Protocol (Part 5): The Purge

Arb Orbit Chain Configured to Support Fast Withdrawals

Last Week's Scroll Airdrop Caused Spike in Blob Gas Fees

Lily Liu's Response to a16z's 2024 Crypto Industry Report

Helios Releases New Version, Plans to Become a Multi-Chain Light Client

a16z: Estimating the Number of Real Crypto Users

Overview of Industry Information from Last Week

(October 21 to October 27)

Blockchain News

- Vitalik posted on X stating that his ETH holdings have increased, and Ethereum will not lose 5 million ETH annually due to proof of work, with low network fees and transactions completed within 30 seconds instead of 1-30 minutes (achieved through EIP-1550).

Since 2016, Ethereum has never gone down due to DoS attacks or consensus failures, and various security measures (internal development and grants) have prevented many fund losses. The relevant libraries also provide various codes for user applications, including wallets, DeFi applications, etc.

Learn more:

https://x.com/VitalikButerin/status/1849965496151789949

- Vitalik Buterin posted on X expressing that he believes the ideal solution is to make deep but selective cuts to gas fees.

Reduce the gas cost of all EVM opcodes currently in the range of 2-5 to 1, and those in the range of 6-10 to 2. Reduce the gas cost of log operations by 4 times.

Lower the gas cost of precompiled contracts (except for those we plan to deprecate). This way, it may increase TPS by 1.5 times without compromising any 'key worst-case' metrics (such as calldata size, IO).

Learn more:

https://x.com/VitalikButerin/status/1849338545498210652

- Vitalik responded to community questions on X, "I want to know why the Ethereum Foundation doesn't stake all its ETH like the Nobel Prize Foundation and only uses the income to cover costs? Why not consider market sentiment and everyone's voice, insisting on regularly selling ETH? You have always claimed that Ethereum's POS is very secure, why not stake ETH yourself? Do you lack confidence in POS?"

Vitalik replied: One internal reason is that we do not want to be forced to make an "official choice" when a controversial hard fork occurs. The idea being considered is to provide some grants in the form of "you can stake our ETH, you can choose how to stake it, as long as it is ethical and maintains an advantage."

Another way to address this issue is to distribute legitimacy and resources to more places, so that multiple organizations are seen as trustworthy representatives of Ethereum in people's eyes. In this regard, we are in a much better position than we were two years ago.

Learn more:

https://x.com/VitalikButerin/status/1850416571942068525

- According to The Block, Lido's community staking module (CSM) has been launched on the mainnet.

It breaks the high technical and financial barriers traditionally associated with individual staking. Once the mainnet is launched, anyone with 1.5 ETH can become a node operator by binding tokens to earn validator rewards.

Learn more:

https://x.com/LidoFinance/status/1849852480474993083

- Etherscan updated its documentation to release the Etherscan API V2 introduction, stating that the V2 update aims to unify EVM data across more than 50 chains and is currently in the testing phase.

Learn more:

https://x.com/etherscan/status/1849772046089322588

- According to Protos, Uniswap Labs recently announced the launch of its own blockchain, Unichain, raising concerns among large UNI token holders about its commitment to decentralization. Billy Gao, head of cryptocurrency governance at Stanford, posted 22 tweets on social media criticizing Uniswap for making significant decisions bypassing the decentralized autonomous organization (DAO).

Gao pointed out that the rushed release of Unichain "caught many by surprise" and left "representatives in the dark." He further questioned, "How much control do token holders really have?"

Gao also speculated about possible backdoor dealings between Uniswap and Optimism. As one of the many layer two networks in the Ethereum ecosystem, Optimism's market cap accounts for less than one-fifth of all Ethereum layer two solutions. Why did Uniswap Labs choose OP over other leading layer two solutions, such as Arbitrum, which has more than double the market cap of Optimism?

Learn more:

https://x.com/__billygao/status/1847776831782691226

- Arbitrum's original developer Offchain Labs announced the launch of a new "fast withdrawal" feature, allowing selected Orbit chains and RaaS providers to achieve withdrawal finality within 15 minutes, compared to the usual waiting time of up to 7 days.

The team stated: "After implementing fast withdrawals, the withdrawal time has been reduced by over 90%, and the withdrawal process is very similar to withdrawing from a bank account. While not exactly the same, it is a substantial improvement compared to traditional blockchain standards, bringing it closer to the traditional TradFi fund transfer experience."

Learn more:

https://x.com/arbitrum/status/1849471944480993647

According to Cyvers Alerts monitoring, Base has seen several suspicious transactions involving unverified lending contracts, with approximately $202,000 deposited into Tornado Cash, and attackers exploited the same vulnerability to gain an additional $455,000. The root cause seems to be the manipulation of WETH prices through excessive borrowing.

The Ethereum L2 network Starknet announced that the first phase of STRK staking will be completed. The completed work in the first phase includes: STRK staking contracts, community governance on STRK staking parameters, and the first phase testnet; ongoing work in the first phase includes the mainnet of the first phase, expected to be completed in Q4 2024. Starknet plans to transition to a fully decentralized PoS network through four phases.

Data Trends

- L2BEAT Data (as of October 28, 2024):

The total locked value (TVL) is $36.47 billion, with a decline of 6.54% over the past week.

First tier: Arbitrum One (TVL: $13.4 billion, decline of 5.64%), Base (TVL: $7.7 billion, decline of 3.29%), OP Mainnet (TVL: $5.89 billion, decline of 9.96%);

Second tier: Mantle (TVL: $1.35 billion, decline of 7.3%), Blast (TVL: $1.35 billion, decline of 7.3%), Scroll (TVL: $1.17 billion, decline of 15.1%);

Learn more:

https://l2beat.com/scaling/tvl

- Blockchain financing: As of October 27, there have been 24 transactions, with 2 exceeding $10 million, including Bluesky raising $15 million and Validation Cloud $10 million.

Data source:

https://www.rootdata.com/zh/Fundraising

According to CertiK monitoring, the largest hacker losses in October so far are due to private key leaks. In the third quarter, most losses were caused by PKC and phishing. Since the beginning of this month, CertiK has recorded 3 major PKC incidents, with total losses of approximately $60 million.

According to CoinDesk, Circle CEO Jeremy Allaire stated in an interview that the stablecoin market could grow to $5 trillion to $10 trillion in the next decade, accounting for 5% to 10% of the global money supply. Allaire expects 2025 to be a key year for stablecoin regulation, with relevant regulations expected to be introduced by G20 countries and many emerging markets by the end of 2025.

In-Depth Content Analysis

Vitalik's New Article: Possible Future of the Ethereum Protocol (Part 4) The Verge

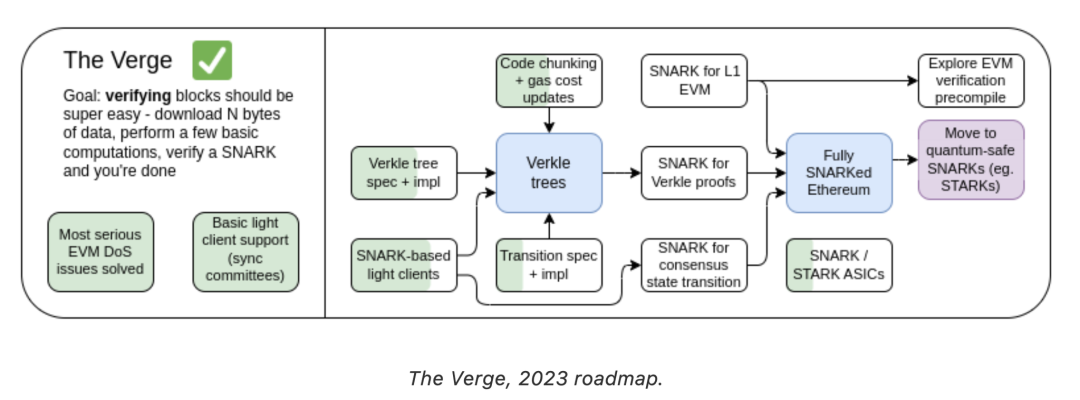

The fourth part of "Possible Future of the Ethereum Protocol": The Verge mainly discusses the optimization path for the future of the Ethereum protocol, proposing the core goal of the "Verge" phase: to reduce the storage and verification burden on nodes, allowing more users to easily run full nodes. The article is divided into three main parts: first, it discusses how to reduce the storage requirements of nodes through stateless verification technologies (such as Verkle trees and STARKs); second, it explores the validity verification of EVM execution through SNARKs; finally, it outlines the long-term planning for consensus verification (optimizing the PoS mechanism to enhance verification efficiency and reliability).

Read the original text:

https://vitalik.eth.limo/general/2024/10/23/futures4.html

Vitalik's New Article: Possible Future of the Ethereum Protocol (Part 5): The Purge

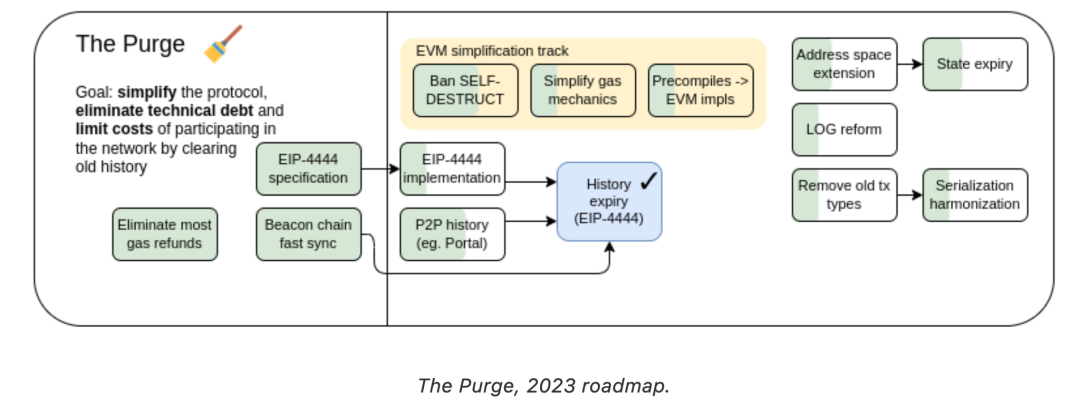

In "Possible Future of the Ethereum Protocol: The Purge," Vitalik proposes strategies to reduce Ethereum's storage and complexity. The key goal is to lower the storage burden on clients by reducing or eliminating the permanent storage requirements for all historical data and states; and to reduce complexity by streamlining protocol functions. He emphasizes that Ethereum is moving towards "time-limited storage" of historical data, such as consensus blocks being retained for about 6 months, and Blobs for 18 days, with plans to introduce distributed network storage in the future to alleviate the burden of old data. Vitalik also suggests transferring some protocol logic to contract code or introducing new virtual machines, such as RISC-V or Cairo, to achieve a balance between simplification and decentralization.

Read the original text:

https://vitalik.eth.limo/general/2024/10/26/futures5.html

Arb Orbit Chain Configured to Support Fast Withdrawals

Arbitrum's Orbit chain has now launched a fast withdrawal configuration, optimizing user cross-chain communication and withdrawal confirmation speed, especially suitable for low-trust AnyTrust chains, ensuring that DAC members also serve as validators to maintain the trust structure. By having a verification committee confirm transactions instantly, the withdrawal cycle is shortened, and it is recommended that at least 3 DAC members and validators participate together to handle high network loads. This mechanism also supports setting the shortest withdrawal confirmation time for L2 and L3 chains separately to further enhance user experience.

Learn more:

https://docs.arbitrum.io/launch-orbit-chain/how-tos/fast-withdrawals

Last Week's Scroll Airdrop Caused Spike in Blob Gas Fees

During last week's Scroll airdrop event, the surge in transaction volume caused the usage of Blob space in L2 to reach 50% of its capacity threshold, driving up Blob gas prices. @0xBreadguy created a dashboard to track L2's response after reaching the 50% threshold and found that there was about a 3-hour "price discovery lag time" in gas cost increases. This delay issue is expected to be resolved in the next Pectra update.

Learn more:

https://x.com/0xBreadguy/status/1848932981454606418

Lily Liu's Response to a16z's 2024 Crypto Industry Report

After reading a16z's "Crypto Industry Report," Lily Liu shared her views on the EVM bias in the report, pointing out that the report divides the ecosystem into EVM and non-EVM, neglecting the innovations in the non-EVM ecosystem. At the same time, she believes the report relies too heavily on metrics like active addresses and TVL (total locked value) without focusing on transaction fees and other indicators that better reflect actual economic activity. Ethereum's EIP-4844 is emphasized as a milestone for fee reduction, but she noted that Solana has had low transaction fees since 2020. This provides an alternative perspective on the report for reference.

Read the original text:

https://x.com/calilyliu/status/1848099896676462972

Helios Releases New Version, Plans to Become Multi-Chain Light Client

Helios announced a new version of its multi-chain light client, aimed at promoting Ethereum's scalability and supporting interoperability between different chains. This version provides light client support for OP Stack, allowing Rollup operators to efficiently verify cross-chain information between networks like Optimism and Base without needing a full node. Vitalik retweeted the announcement and pointed out that key future developments include: integration of clients like Helios into mobile and desktop wallets; gradual on-chain configuration of L2 (the first step is EIP-669); L2 configurations including state proof verification rules (starting from EIP-3668). Once these are completed, universal light client verification for L1 and L2 will be achieved, laying the foundation for multi-chain and Rollup scalability. In the future, Helios will also build more powerful tools for devices like browsers and mobile phones to help every user achieve trustless cross-chain interactions.

Learn more:

https://a16zcrypto.com/posts/article/scaling-ethereum-rollups-with-helios/

a16z: Estimating the Number of Real Crypto Users

In its "2024 Crypto Report," a16z explores the estimation of active crypto users, pointing out that relying solely on active addresses is not accurate, as many addresses may be created as fake identities under mechanisms like airdrop rewards. By analyzing wallet data and filtering out suspected machine addresses, they estimate that the real monthly active users may be between 30 million and 60 million, indicating significant growth potential compared to the approximately 600 million crypto holders worldwide.

Learn more:

https://a16zcrypto.com/posts/article/estimating-crypto-users/

This concludes the content of this issue of the Ethereum Chinese Weekly. Thank you for reading!

Next Monday at 2 PM (UTC +8), we look forward to sharing the new issue with you! (Joining method at the end)

Image source: Internet, please delete if infringing.

Co-initiating Communities

Supporting Communities

LXDAO is a research and development DAO focused on sustainably supporting valuable Web3 public goods and open-source projects.

Join Us

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。