In recent months, an increasing number of crypto projects have entered the L2 track, with the technical solution OP Stack frequently appearing. The addition of several star projects has drawn significant market attention to OP Mainnet (Optimism).

Written by: Nancy, PANews

In recent months, an increasing number of crypto projects have entered the L2 track, with the technical solution OP Stack frequently appearing. The addition of several star projects has drawn significant market attention to OP Mainnet (Optimism). As the OP Stack ecosystem expands rapidly, the scale and activity of the Superchain ecosystem are also significantly increasing, largely due to the generous subsidy policies of OP Mainnet. However, most of the revenue contributed by Superchain remains relatively limited at this stage, primarily relying on the Base chain under Coinbase.

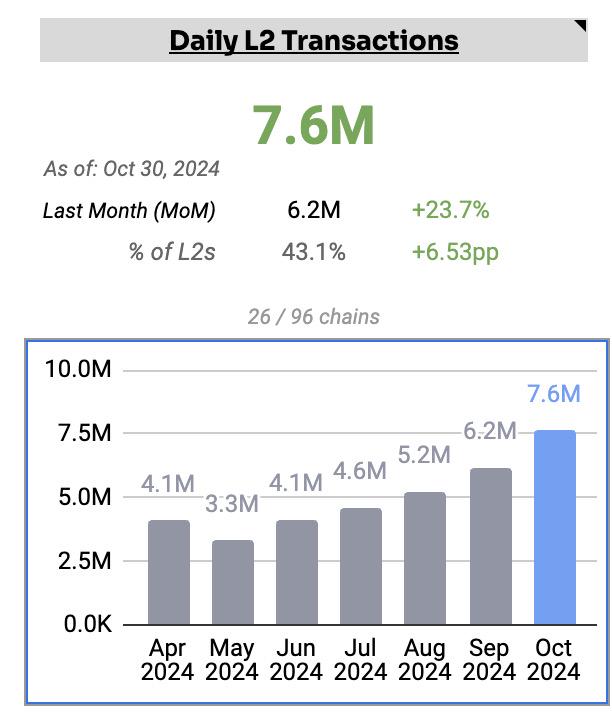

Nearly half of Ethereum L2s are based on OP Stack, with Superchain's daily transactions accounting for over 40% of the market

Coinbase launched the Ethereum L2 network Base based on OP Stack; Worldcoin announced the launch of the blockchain World Chain based on OP Stack and joined the Superchain; Uniswap launched its own Layer2 network Unichain built on OP Stack technology; Sony's Layer2 blockchain Soneium uses the OP Stack codebase… In recent months, OP Stack has welcomed an increasing number of star participants.

In fact, OP Stack is currently one of the more popular and attractive L2 Stacks in the Ethereum L2 market. According to L2BEAT data, as of October 31, the number of Ethereum Layer2s has reached 111. Superchain Eco statistics show that 59 of these L2s are built on OP Stack, far exceeding other competitors, such as 31 L2 projects using Arbitrum One and only 8 using Polygon.

Moreover, L2 projects running on OP Stack have significant influence. L2BEAT statistics indicate that among the top ten Ethereum L2s by TVL, six L2 projects use OP Stack as their technical solution, particularly Base, which ranks second with $8.17 billion.

As OP Stack continues to gain momentum, the Superchain ecosystem is also growing, which is an important tool for OP Mainnet to address the fragmentation of the L2 ecosystem. According to Superchain Eco statistics, as of October 31, there are 36 OP Chains that have joined the Superchain ecosystem, with these chains processing 7.6 million daily transactions (a 23.7% increase from last month), accounting for 43.1% of the L2 market.

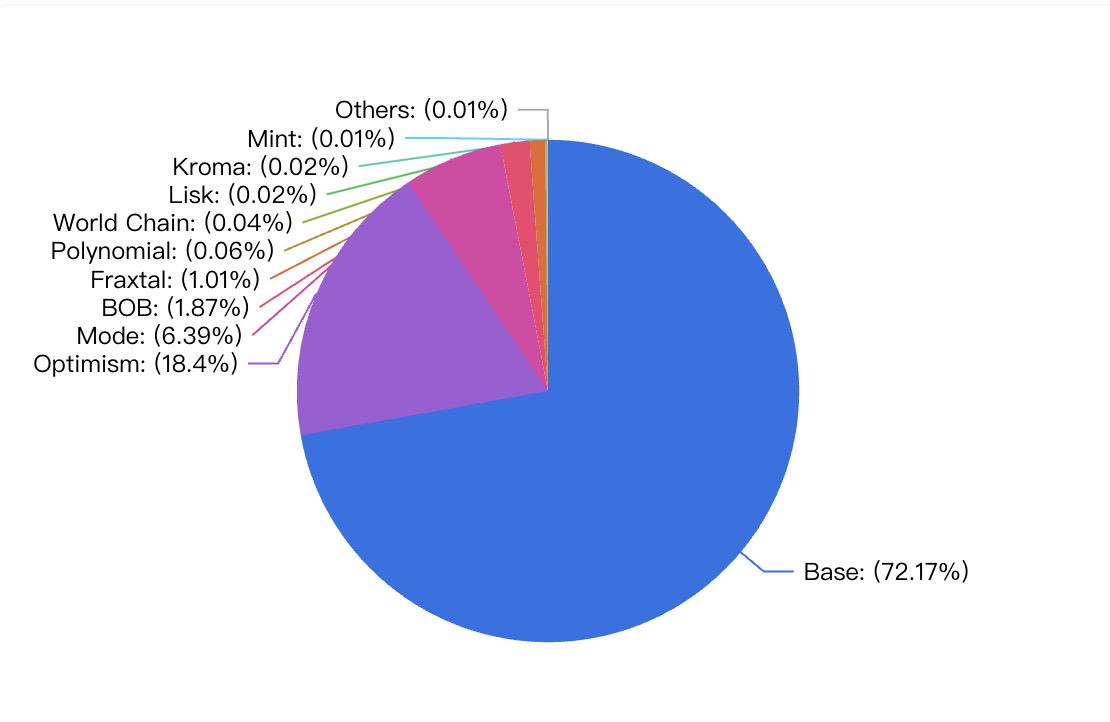

Additionally, DeFiLlama data shows that the TVL of OP Chains on Superchain has exceeded $3.67 billion. Among them, Base ranks first with a scale of $2.65 billion, accounting for 72.1% of the share; followed by OP Mainnet, with a TVL of $670 million, accounting for 18.4%; Mode follows closely with a TVL of over $230 million, accounting for nearly 6.4%. In contrast, most of the other projects have a TVL of less than $10 million, with some projects only having a few thousand dollars.

Generous subsidies for Superchain, with over $42 million in revenue primarily relying on Base contributions

The rapid development of the OP Mainnet ecosystem is largely attributed to its generous funding subsidy strategy. This "scatter money" subsidy has not only successfully attracted numerous developers and projects but has also effectively motivated market participants, laying a solid foundation for the rapid growth and prosperity of its ecosystem.

According to official documents, the Optimism Collective primarily supports builders through two types of funding: retroactive public goods funding and mission grants. Official data shows that since 2022, the Optimism Collective has distributed over 60.81 million OP tokens in several rounds of retroactive public goods funding, and has reserved 800 million OP tokens for future rounds of rewards. The funding scale for each project varies, ranging from a few thousand tokens to several hundred thousand tokens.

This strategy has also been applied to the construction of the Superchain ecosystem, making it more attractive among various L2 Stack solutions. For example, in the fourth round of retroactive public goods funding in April this year, 10 million OP tokens were specifically allocated for on-chain builders deploying contracts and generating block space demand on Superchain. In August, Optimism announced that it would reward creators and builders of Superchain with 50 million OP tokens.

Currently, many Superchain members have received funding. For instance, the Optimism Foundation has provided 118 million OP tokens to Base over the next six years; the DeFi L2 Mode based on OP Stack will receive 2 million OP tokens from the Optimism Foundation (valued at approximately $5.3 million at the time); the L2 network Ink launched by the U.S. crypto exchange Kraken received 25 million OP tokens in a deal reached earlier this year, now valued at approximately $42.5 million, with the tokens being unlocked in monthly batches; the Bitcoin L2 project BOB, as the first Bitcoin-native project integrated into the Superchain ecosystem, received OP tokens worth $870,000 from the Optimism Foundation; Mint Blockchain received a strategic investment of 750,000 OP tokens (valued at $1.35 million) from the Optimism Foundation…

Regarding the unlocking rules for these funded tokens, Mint Blockchain co-founder Shier Han revealed to PANews, "For projects with smaller token rewards, OP officials often provide direct subsidy support, but there are also some incentive requirements related to promoting ecosystem development. When blockchain projects conduct community rewards, they also set corresponding rules, such as ordinary users can directly earn rewards by using ecosystem applications, while application developer teams need to lock up tokens accordingly, with a normal lock-up period of one year. According to personnel from the Optimism Foundation, of the 25 million OP tokens allocated to Ink, 5 million are directly used for project development, while the remaining 20 million are released based on the scale of on-chain transaction volume. Therefore, for projects like Ink that receive substantial support, OP officials will sign more complex cooperation models such as betting agreements and will examine contributions to key data like Gas fees."

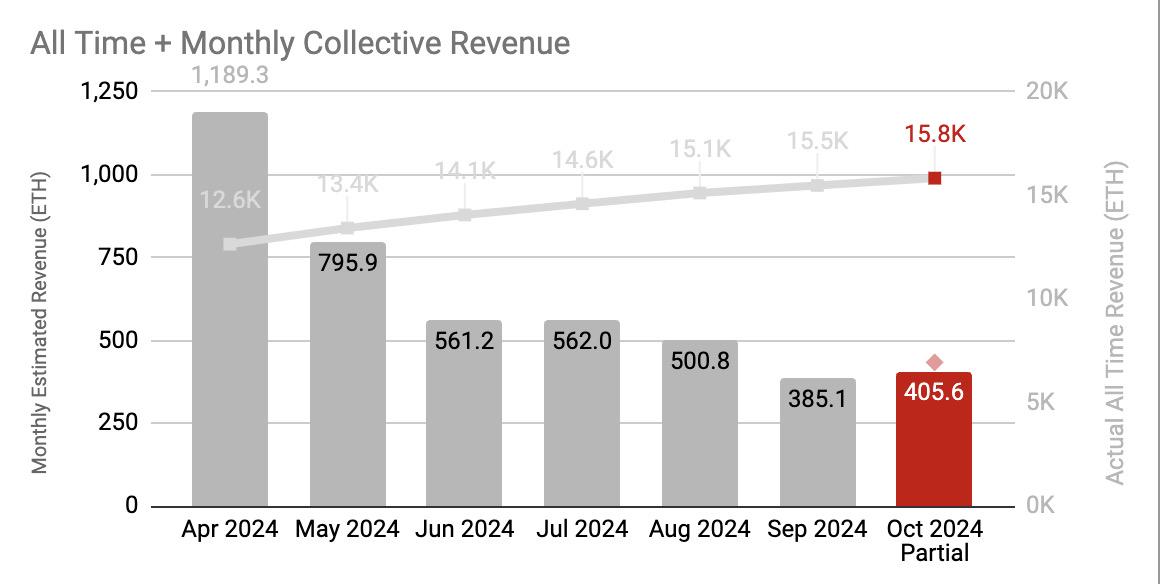

Since each OP Chain operates under a standardized revenue-sharing model, these Superchains are required to contribute 2.5% of the total revenue from on-chain sequencers or 15% of pure profits (whichever is higher) to the Optimism Collective. However, the current economic benefits appear limited.

Superchain Eco statistics show that these Superchains have cumulatively contributed approximately 15,800 ETH in revenue (currently valued at over $42 million), with OP Mainnet contributing the most at over 12,800 ETH (accounting for 80.2%); followed by Base, which contributed about 2,878.7 ETH (accounting for 18.6%); other chains contributed less than 0.5% of the total revenue. Moreover, Optimism Collective's monthly revenue has shown a downward trend, declining nearly 65.9% from April of this year. However, with the addition of more projects with built-in traffic, such as Unichain and Ink, the revenue potential for OP Mainnet is expected to increase further.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。