Singapore has made remarkable achievements in the Web3 field, giving birth to many well-known projects. This article organizes some representative Web3 projects in Singapore for reference.

Written by: Xu Yuewen, Iris, Mankun Law Firm

Since 2019, a series of forward-looking policy measures have been continuously introduced, effectively promoting the advancement of Web3 technology. For example, the "Digital Economy Alliance" was established in 2019 to vigorously promote the healthy growth of the digital economy ecosystem; the "Digital Payment Alliance" was formed in 2020 to actively promote the development and innovation in the digital payment sector; and the "Digital Currency Laboratory" was launched to explore the potential and applications of digital currencies in depth.

These policies have spawned a large number of Web3 projects that have taken root and flourished in Singapore. Today, Singapore has achieved remarkable results in the Web3 field, giving rise to many well-known projects. Mankun Law Firm has organized some representative Web3 projects in Singapore for reference.

* The following ranking is not in any particular order, only sorted by the year of establishment.

Merlin Chain

Infrastructure #Layer2

- Established: 2023

- Ecosystem: Bitcoin

- Funding: $800 million

- Project Introduction: MerlinChain is a Bitcoin Layer 2 supported by Bitmap, based on the native assets, protocols, and products of Bitcoin Layer 1, making Bitcoin interesting again. MerlinChain aims to empower Layer 1 assets, protocols, and user ecosystems through Layer 2, such as building a user-friendly metaverse based on Bitmap and constructing DeFi protocols based on BRC-420 to maximize the release of its duality, thereby amplifying the overall asset potential of the Bitcoin ecosystem. It is a new BTCLayer2 solution supported by OKX. Its attention stems from directly addressing the core issue of the Bitcoin network—scalability.

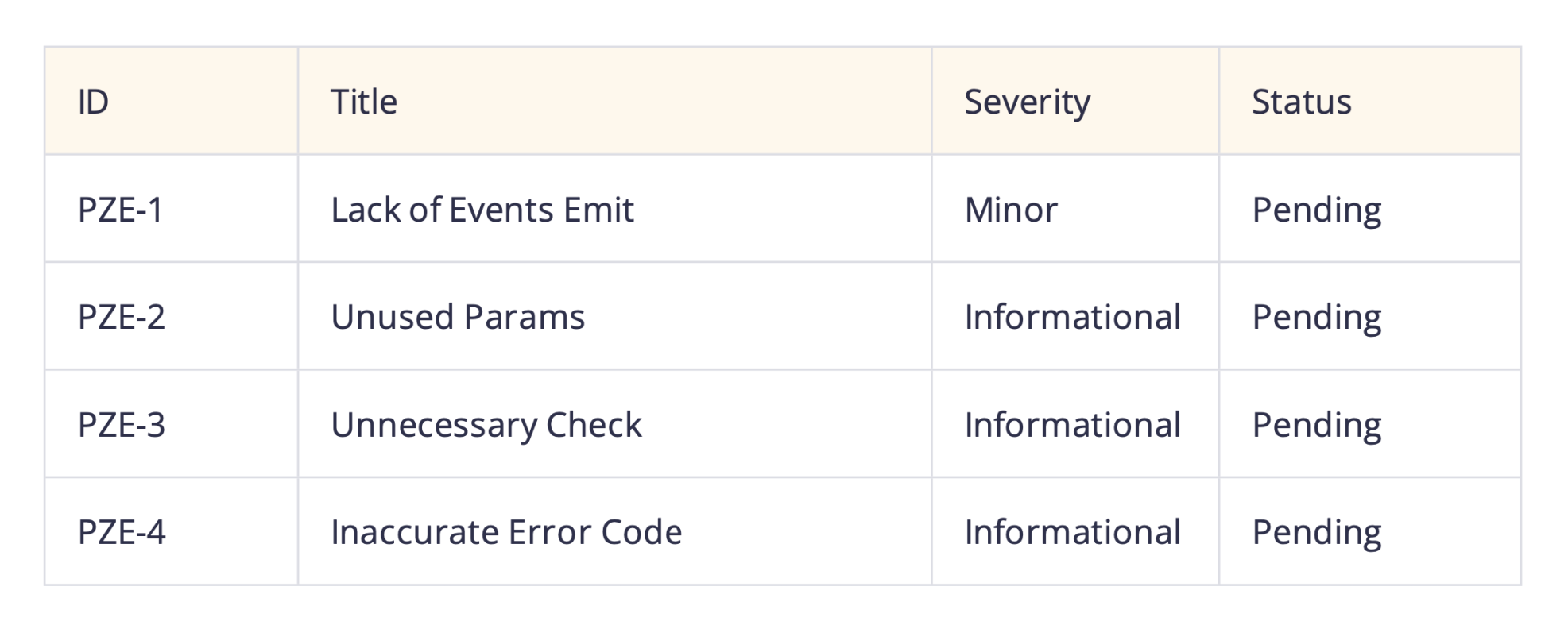

The development team of Merlin Chain, Bitmap Tech, registered a limited liability company in Texas, USA, in 2021, with its headquarters in Dallas. According to GitHub data, Merlin Chain has commissioned ScaleBit to conduct a smart contract audit report, including manual code review and static analysis, to identify potential vulnerabilities and security issues. During the audit, ScaleBit identified four issues of varying degrees: lack of event occurrence, unused parameters, unnecessary checks, and inaccurate error codes.

AltLayer

Infrastructure #Modular #Re-staking

- Established: 2022

- Ecosystem: Ethereum

- Funding: $21.6 million, completed a $7.2 million seed round in July 2022, and a $14.4 million strategic financing in February 2024.

- Project Introduction: AltLayer is an open and decentralized Rollups protocol that brings together the novel concept of Restaked rollup. It utilizes existing rollups (derived from any rollup stack, such as OP Stack, Arbitrum Orbit, ZKStack, Polygon CDK, etc.) and provides them with enhanced security, decentralization, interoperability, and rapid finality of cryptoeconomics.

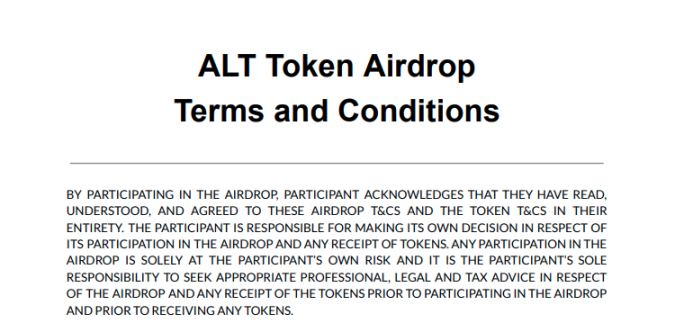

AltLayer's airdrop document specifies some specific legal terms, such as strictly requiring users to complete KYC (Know Your Customer) certification, especially in its collaboration with Binance Launchpool, where all participants must complete identity verification when staking BNB or FDUSD to receive ALT token rewards; additionally, airdrops are not available to users from sanctioned regions or countries, including Canada, Cuba, Crimea, Iran, Japan, New Zealand, the Netherlands, North Korea, Syria, the United States and its territories, and any non-government-controlled areas of Ukraine; furthermore, the document also mentions potential regulatory and tax issues that ALT may involve and clarifies that the agreement is governed by the laws of the British Virgin Islands; it also mentions compliance with data protection and privacy regulations, such as GDPR.

DWF Labs

CeFi #OTC #Market Maker

- Established: 2022

- Project Introduction: DWF Labs is a Web3 venture capital and market maker. DWF Labs provides market making, secondary market investment, early-stage investment, and over-the-counter (OTC) services for Web3 companies, as well as token listing and consulting services. DWF Labs is part of DigitalWaveFinance (DWF), one of the world's top cryptocurrency traders, trading spot and derivatives on over 40 top exchanges. DWF is headquartered in Switzerland, with its Asia regional headquarters in Singapore. It also has offices in Dubai, mainland China, and Hong Kong.

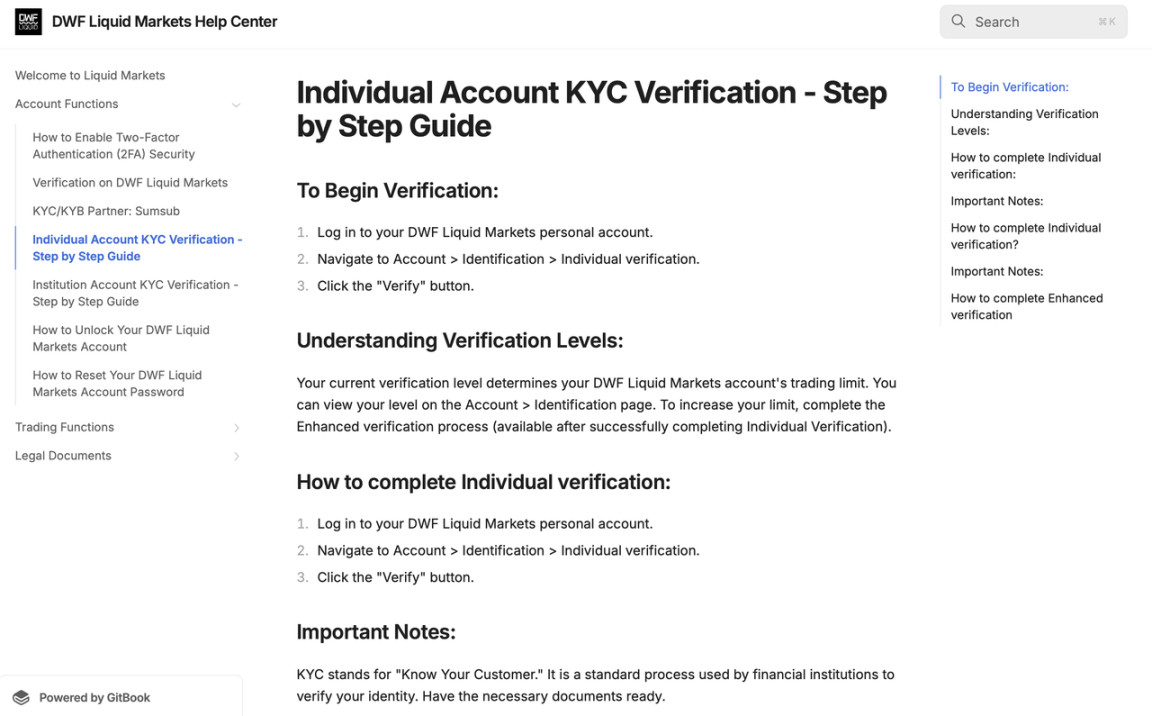

DWF Labs is headquartered in Switzerland but has an office in Singapore. According to the privacy policy document disclosed by DWF Labs, DWF Labs collects and shares data based on legal regulations and retains user data rights. Especially for users residing in the European Economic Area, DWF Labs complies with the General Data Protection Regulation (GDPR). Users have the right to access, correct, delete, and restrict the processing of personal data, and the company relies on legitimate processing bases when handling user data, including contract fulfillment, legal compliance, and user consent.

DWF Labs requires users to complete KYC (Know Your Customer) certification on the Liquid Markets platform, including collecting and verifying user identity information, address proof, and conducting biometric verification (such as facial recognition). These processes aim to prevent identity theft, money laundering, and other illegal activities. The KYC process has basic and enhanced versions, with the enhanced version applicable to users with higher transaction limits, such as accounts withdrawing over $1 million daily.

Additionally, DWF Labs collaborates with Sumsub for KYC and KYB certification, with Sumsub providing technical support for global ID verification, address verification, and database checks. It has integrated multi-layered security and compliance measures on its platform, including anti-money laundering (AML) requirements and compliance with the Travel Rule, to ensure its global operations meet local regulatory standards.

Aethir

Infrastructure #DePIN #Cloud Computing #Artificial Intelligence

- Established: 2022

- Ecosystem: Ethereum, Arbitrum

- Funding: $9 million, completed Pre-A round in July 2023

- Project Introduction: Aethir is a decentralized real-time rendering network that unlocks content accessibility in the metaverse. Aethir builds scalable, decentralized cloud infrastructure (DCI) that helps gaming and AI companies (of all sizes) deliver their products directly to consumers, regardless of their location or hardware.

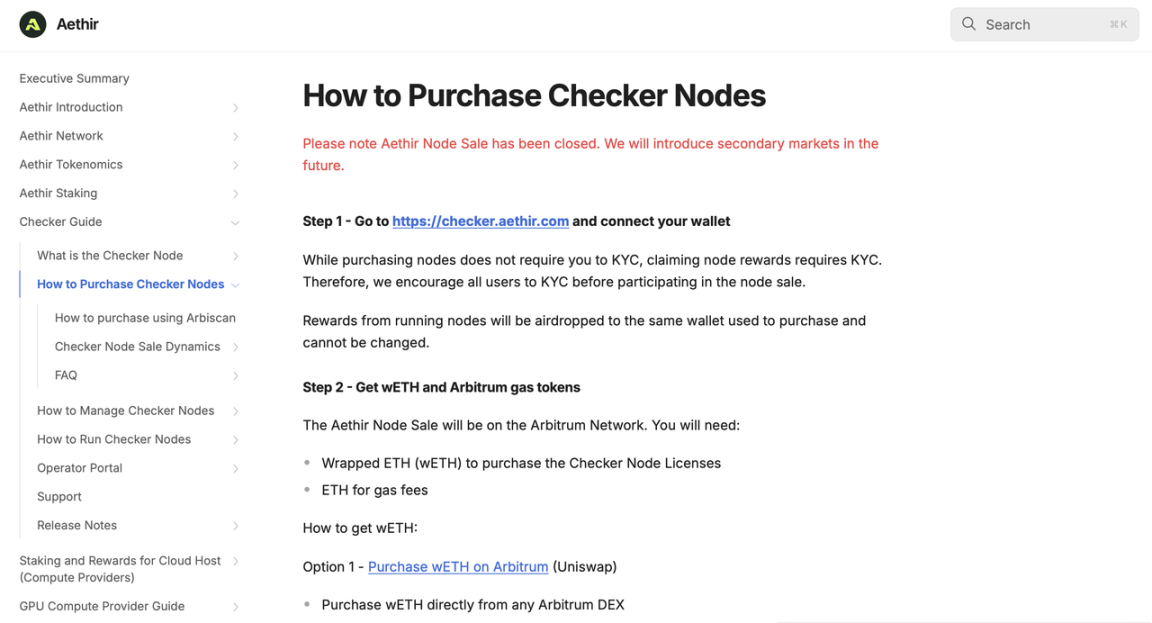

Aethir has registered the Aethir Foundation in Singapore, primarily aimed at supporting the expansion of decentralized computing and the Web3 ecosystem. To ensure project compliance, the Aethir Foundation has taken necessary measures to ensure its operations comply with international and Singaporean legal requirements. For example, Aethir requires users to complete KYC verification during its Checker Node rewards and withdrawal processes to comply with anti-money laundering (AML) requirements; similarly, node operators must also complete KYC during node sales and operations. Additionally, Aethir's terms explicitly restrict user behavior to comply with applicable laws and regulations, such as prohibiting the use of unauthorized software or engaging in illegal content publishing. These terms also cover the ownership of intellectual property and feedback, ensuring the platform's legal operation. Furthermore, in certain regions, Aethir restricts participation from certain users, such as those from the United States and sovereign sanctioned countries. These measures comply with local laws and international sanctions, ensuring compliance with legal regulations worldwide.

Cointime

Crypto Media

- Established: 2022

- Project Introduction: Cointime is a crypto news aggregation platform operated by QUANTBASE PTE. LTD. Cointime primarily provides readers with the latest crypto news, events, data, and indices. Whether it's cryptocurrency trend news, real-time price movements, in-depth industry analysis, or cutting-edge technology, readers can find it on Cointime.

zkLink

Infrastructure #Layer2

- Established: 2021

- Ecosystem: Ethereum, Polygon, BNBChain, Avalanche, Arbitrum, Optimism, Base, StarkNet, ZkSync, Linea, PolygonzkEVM, Manta, opBNB

- Funding: Completed a $8.5 million seed round in October 2021, a $10 million strategic financing in May 2023, a $4.68 million public offering round in January 2024, and a strategic financing in July 2024.

- Project Introduction: zkLink is a transaction-centric multi-chain L2 network with unified liquidity protected by ZK-Rollups. dApps built on the zkLink L2 network leverage seamless multi-chain liquidity to provide rapid deployment solutions for decentralized and non-custodial order books, AMMs, derivatives, and NFT exchanges. zkLink operates as a trustless, permissionless, and non-custodial interoperability protocol designed to connect different blockchains, eliminate discrepancies between different tokens, and address the liquidity island problem formed on isolated chains.

Currently, according to public information, during the $ZKL token sale and registration process of zkLink, the company has implemented a series of compliance measures, such as requiring participants to complete KYC (Know Your Customer) identity verification, and excluding residents from the United States, Canada, China, South Korea, and certain restricted areas to comply with relevant national regulations. At the same time, the zkLink platform restricts access for users from certain economically sanctioned regions, ensuring that the use of services complies with local and international regulations, such as the economic sanctions lists of Europe and the United States. This measure ensures zkLink's compliance in the global market and avoids legal risks.

zkLink provides a detailed privacy policy document to ensure compliance with data protection regulations such as GDPR. This policy stipulates the collection and processing of users' IP addresses, access data, and log information, primarily used to ensure service stability and improve user experience. Additionally, zkLink conducts anonymous user behavior tracking to collect non-personally identifiable data for product improvement. Furthermore, the policy document emphasizes user responsibilities, including ensuring the security of wallet keys and recovery phrases.

zkLink has commissioned ABDK Consulting to conduct a comprehensive review of its smart contracts and protocols. The review scope includes the differences between zkLinkProtocol and Era contracts, including specific .sol files and documents related to synchronization cost optimization and interfaces. The audit identified some medium-level issues, primarily focused on suboptimal design aspects of the code, such as parameter passing, encoding call efficiency, and storage address calculations, as well as some overflow and defect issues that have been fixed, with corresponding recommendations provided for these issues.

SkyArk Chronicles

GameFi

- Established: 2021

- Ecosystem: BNB Chain

- Funding: $15 million

- Project Introduction: SkyArk Chronicles is a Triple A fantasy JRPG game with interoperable NFTs. SkyArk Chronicles is a trilogy of 2 GameFi projects ("House of Heroes" and "Legends Arise") and 1 SocialFi Metaverse ("Mirrorverse").

The developer of SkyArk Chronicles, SkyArk Studio, is a blockchain gaming company based in Singapore, aiming to replicate the success of Hong Kong unicorn Animoca by establishing an ecosystem for incubating crypto projects and leveraging SkyArk Studio's proprietary resources.

The token system of SkyArk Chronicles includes two tokens, $SAR and $REO, which will be used in multiple scenarios within the game and metaverse, providing players with ways to participate in the game economy, purchase game items, and earn rewards. Currently, SkyArk has not officially launched its token sale.

SkyArk Chronicles has clarified compliance matters related to virtual currencies in its official website terms.

First, it clearly defines virtual currencies and commodities, stating that virtual currencies may serve as cryptocurrencies but do not represent securities or other investment instruments, are not registered with government entities or regulatory agencies, and holders only have limited practical rights.

Second, it strictly sets purchase restrictions, stating that not everyone can participate in purchases, and attention must be paid to the regulations of the country/region of residence, with access only open to experienced senior purchasers with knowledge of cryptocurrencies and blockchain technology, and explicitly marketing, providing, and selling only to individuals who can legally purchase and use them within specific jurisdictions, ensuring that transactions do not constitute regulated investments or financial products when conducted within permitted jurisdictions.

Finally, it stipulates regulations for prohibited jurisdictions, where certain regions explicitly prohibit or restrict cryptocurrency-related transactions, while other regions may require licenses or other regulations. SkyArk may independently decide to prohibit sales of virtual currencies in certain areas to ensure that the game operates within a compliant framework.

Nansen

Tools #Data & Analysis #On-chain Data

- Established: 2019

- Funding: $88.2 million, completed a $1.2 million seed round in October 2020, a $12 million Series A in 2021, and a $75 million Series B in 2021.

- Project Introduction: Nansen is a blockchain analytics platform that enriches on-chain data through millions of wallet tags. Crypto investors use Nansen to discover opportunities, conduct due diligence, and protect their portfolios through its real-time dashboards and alerts.

Nansen, as an analytics platform, does not directly engage end-users in cryptocurrency trading but focuses more on analysis and data mining. Additionally, in collaboration with Kaiko, it utilizes Kaiko's market data and Nansen's blockchain data to provide regulatory compliance reference prices for centralized exchanges (CEX) and decentralized exchanges (DEX) digital assets.

Nansen is not completely free to use. The platform offers limited free features, but advanced analytics and data access services typically require a subscription. Users can choose different paid plans to unlock more advanced tools and deeper on-chain data analysis. Accordingly, Nansen's on-chain data platform uses a Master Service Agreement (MSA) established by customers purchasing products and/or services in order form for compliance. The MSA clarifies the boundaries of responsibility between the two parties in the transaction, such as stipulating the timing, method, and quality standards for product delivery, ensuring that customers receive products and services that meet their expectations. Additionally, there are corresponding clauses regarding payment methods, payment deadlines, and potential refunds or exchanges. These provisions help ensure fairness and transparency in transactions, avoiding situations where disputes arise without a basis for resolution, thereby protecting the legal rights of both the platform and customers, ensuring compliance with relevant laws and regulations and industry standards in business operations.

Mask Network

SocialFi

- Established: 2018

- Ecosystem: Ethereum, Polygon, BNB Chain, Solana, Avalanche, Arbitrum, Optimism, Fantom, Gnosis Chain, Scroll, Harmony, Aurora, Conflux, Flow, Astar

- Funding: Nearly $200 million

- Project Introduction: Mask Network is a Web3 portal aimed at connecting Web2 users to Web3. By introducing a decentralized application ecosystem into traditional social networks, Mask Network provides decentralized options for features familiar to Web 2.0 users. Users can enjoy secure, decentralized social messaging, payment networks, file storage, and file sharing without leaving mainstream social media networks. The 2.0 version released by Mask Network includes a multi-chain Mask wallet, a MaskID login system that aggregates user social media accounts and Web 3.0 addresses, and a dApp marketplace called D.Market.

The Mask Network team has an office in Singapore and conducts some management and operational activities locally. Its legal entity "Mask Network Pte. Ltd." has been deregistered. Therefore, Mask Network primarily operates through its affiliates and partners: Mask Network has established funds with partners such as Bonfire Union, headquartered in Singapore, to promote the development of Web3 and decentralized social networks. In addition to commercial activities, Mask Network has also established a non-profit organization, Mask Academy, to support Web3 research and education through collaborations with universities and research institutions worldwide.

Mask Network's privacy compliance measures are based on its user privacy policy, covering aspects such as data management, user autonomy, and third-party DApp integration. The platform states in its privacy policy that it is only responsible for DApps developed by it, while DApp services provided by third parties are not under its direct control, thus users must bear certain risks when using these services.

Additionally, Mask Network clarifies its data encryption and privacy protection principles, ensuring that users' social information and data are properly protected when using Web3 decentralized applications. The platform also adopts a self-sovereign control mechanism, allowing users to have control over their wallets, private keys, and other information, and the platform will not store these sensitive data.

Regarding data usage permissions, Mask Network also requires users to cooperate with necessary identity verification to ensure the security of transactions.

Bitget

CeFi #CEX

- Established: 2018

- Funding: $30 million

- Project Introduction: Bitget was established in 2018 as a cryptocurrency exchange and Web3 company. As of early 2024, Bitget serves over 100 countries and regions worldwide, helping more than 25 million users achieve trading "intelligence" through leading solutions such as copy trading.

Bitget is registered as a Virtual Asset Service Provider (VASP), particularly in countries like Poland and Lithuania. These registrations allow Bitget to legally offer cryptocurrency trading and related services in these regions, ensuring compliance with local and international financial regulatory requirements.

Regarding KYC, Bitget implemented mandatory KYC verification starting September 1, 2023. All new users must complete KYC verification to use the platform's services, such as spot trading, futures trading, and other features. Users who have not completed KYC will only be able to perform limited operations, such as withdrawals and order cancellations, after October 1, and will not be able to create new trades. This measure aims to enhance the platform's security and ensure compliance with global and regional anti-money laundering (AML) and counter-terrorism financing (CFT) requirements.

In terms of auditing, Bitget publishes monthly Proof of Reserves (PoR) reports to demonstrate the health of its asset reserves, ensuring the safety of user funds. In 2023, these reports showed that its reserve ratio remained at approximately 200%, well above the industry standard of 100%.

Additionally, Bitget launched a $300 million auditable protection fund in 2023 to enhance compliance and transparency. The platform's protection fund mainly consists of BTC, along with a small amount of ETH and USDT. These funds are used to protect assets stored on the platform from hacking, theft, and other threats. Bitget commits to not using these funds for at least three years and maintains publicly accessible wallet addresses. The fund has recently been supported, currently totaling $300 million, and is stored in seven public wallet addresses to enhance transparency.

The cryptocurrency group BGX has made a strategic investment in OSL, a licensed virtual asset exchange in Hong Kong, subscribing to new shares worth HKD 710 million in its parent company, BC Technology Group (HKG: 0863).

Paradigm

CeFi

- Established: 2018

- Funding: Completed a $35 million Series A funding round in December 2021.

- Project Introduction: Paradigm is a liquidity network for crypto derivatives traders across CeFi and DeFi. The platform provides traders with on-demand unified access to multi-asset, multi-protocol liquidity without impacting price, scale, cost, and immediacy. The company's mission is to create a platform where traders can transact with anyone, anywhere, and settle any trade. Paradigm has the largest network of crypto institutional counterparties, with over 1,000 institutional clients trading more than $10 billion monthly, including hedge funds, over-the-counter desks, lenders, structured product issuers, market makers, and prominent family offices.

In Singapore, the entity behind Paradigm is Paradigm Pte. Ltd., focusing on liquidity provision and innovation in the digital asset market. Paradigm has also recently incubated a decentralized perpetual derivatives application chain called "Paradex," aimed at integrating its liquidity and providing a more transparent trading environment.

The relevant terms and agreements on its official website make significant efforts in compliance: explicitly restricting services to restricted persons (including individuals of certain nationalities and those under sanctions); having strict regulations on the use of systems and software, including authorized user management; emphasizing that users must comply with usage regulations and not engage in illegal operations; involving fees, duration, and termination clauses; having detailed provisions on confidentiality and intellectual property; clarifying responsibilities of all parties, including users' indemnification responsibilities and Paradigm's exemption circumstances; stipulating the applicability of Singapore law and arbitration for dispute resolution, ensuring compliant business operations.

KuCoin

CeFi #CEX

- Established: September 2017

- Funding: $180 million, completed a $20 million Series A funding round in November 2018, $150 million funding in 2022, and $10 million strategic financing in 2022.

- Project Introduction: KuCoin is a global cryptocurrency exchange established in September 2017, providing services such as spot trading, margin trading, P2P fiat trading, futures trading, staking, and lending.

Starting July 15, 2023, KuCoin implemented mandatory KYC verification. All new users must complete KYC certification to fully access the platform's services, including spot trading, futures trading, leveraged trading, and other financial products. For users who registered before this date but have not completed KYC, their account functions will be restricted, allowing only limited operations such as selling spot orders and withdrawing funds, but not allowing new deposits.

Along with the introduction of KYC, KuCoin has also strengthened the management of user data security. The platform commits to using encryption and secure storage methods to protect users' personal information, ensuring data security when users submit identity verification information. Additionally, KuCoin continues to provide withdrawal functionality, allowing users to withdraw funds from their accounts at any time, even if they have not passed KYC.

Paxos

CeFi #Custody #Stablecoin Issuer

- Established: 2013

- Funding: Approximately $535 million, completed $3.25 million in 2013, $25 million in Series A funding in 2015, $65 million in Series B funding in 2018, $142 million in Series C funding in 2020, and $300 million in Series D funding in 2021.

Paxos is a fintech company headquartered in the United States, focusing on blockchain and digital assets. It issues the Pax Dollar (USDP), a stablecoin pegged 1:1 to the US dollar, and provides secure digital asset custody services to help institutional clients manage cryptocurrency assets. Additionally, Paxos has developed blockchain infrastructure to support its financial product operations, aiming to promote the integration of traditional finance and digital assets, building enterprise blockchain solutions for institutions such as PayPal, Interactive Brokers, Mastercard, Bank of America, Credit Suisse, and Société Générale.

Paxos provides various digital asset services, including stablecoins (such as Pax Dollar, USDP, and PayPal USD, PYUSD launched in collaboration with PayPal) and gold tokens (PAXG), through a trust company license approved by the New York State Department of Financial Services (NYDFS). With the trust company license, Paxos can offer regulated financial services, including custody, trading, and clearing, with a regulatory level higher than that of typical cryptocurrency exchanges or payment institutions.

On July 1, 2024, Paxos announced that its Singapore entity, Paxos Digital Singapore Pte. Ltd., received formal approval from the Monetary Authority of Singapore (MAS) and obtained a VASP license, becoming a major payment institution, allowing it to issue stablecoins in Singapore. Companies holding a VASP license must comply with specific laws and regulations to ensure compliant operations: the company follows compliance measures such as anti-money laundering (AML) and Know Your Customer (KYC) to reduce the risk of financial crime; regular reporting and audits are required; and it is subject to supervision by financial regulatory authorities.

Additionally, as a digital asset custodian, Paxos discloses on its official website that it has achieved bankruptcy isolation. If Paxos Trust were to go bankrupt (which is unlikely), customer assets would be protected. It states that its operational model differs from banks, particularly in not holding partial reserves; Paxos holds all customer assets at a 1:1 ratio, ensuring that customer funds are always redeemable and never lent out.

Summary by Mankun Lawyers

From the above projects, although Singapore authorities have begun to advance cryptocurrency regulation and establish a cryptocurrency VA license, the practical situation remains relatively open and ambiguous in terms of regulation. However, this also facilitates the entry of the cryptocurrency industry and projects into Singapore—among global popular startup locations, Singapore remains high on the list.

However, for Web3 projects, compliance is undoubtedly the future trend. Therefore, while developing, entrepreneurs should also cooperate to complete compliance implementation, such as financial projects obtaining relevant licenses, dApp projects ensuring compliance with data and privacy regulations, and paying close attention to changes in Singapore's regulatory rules to avoid being affected by regulations during the hot development phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。