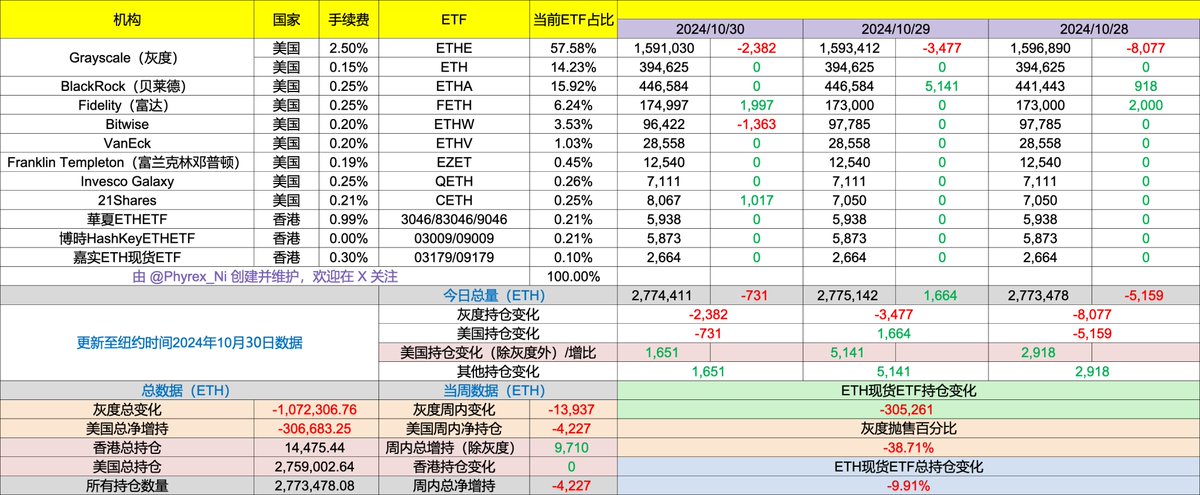

In Wednesday's ETF data, BTC continues to soar, while ETH's data is still unsatisfactory. BlackRock's investors did not continue to increase their holdings; in the past 24 hours, only Fidelity and 21Shares added a total of 3,015 ETH, while on the selling side, Grayscale's $ETHE and Bitwise together reduced their holdings by 3,745 ETH, with others being zero. It is clear that there was another net outflow in the past trading day.

Today, I was still discussing this with Brother Brain. More funds will still choose #BTC, while #ETH, despite passing the ETF, may struggle to attract funds due to lower liquidity and less buzz.

Especially, the selling by Grayscale investors has not yet ended. Although Bitwise has sold, the amount is not significant. Most investors still hold a long-term optimistic view on ETH, but there is currently no buying motivation in the short term.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。