Since the Federal Reserve started cutting interest rates, market sentiment has been high. Recently, with the U.S. election day approaching, the "Trump trade" has continued to heat up, and assets such as U.S. stocks, foreign exchange, and cryptocurrencies have all shown strong wealth effects. However, the volatility of financial markets is unpredictable, and many investors have repeatedly faced setbacks in the "buy high, sell low" cycle. In fact, by learning from the successful principles of top investors, retail investors can gradually build an efficient long-term investment strategy to avoid losses and achieve stable returns.

1. Clarify Investment Goals and Targets

Before starting to invest, it is crucial to clarify your target return rate and expected holding period. Choose suitable investment targets based on these goals. For young people who have just entered the workforce and have limited funds, it is advisable to prioritize low-risk, steadily appreciating asset types such as gold, bonds, and indices. If you seek high returns and can tolerate higher risks, you may focus on stocks, crypto assets, foreign exchange, and other volatile products.

2. Develop a Reasonable Fund Allocation Plan

Good fund management is the cornerstone of investment success. Once you enter the market and purchase assets, their value will begin to fluctuate with market prices. Invest only what you can afford to lose, avoiding excessive positions or high-leverage operations that can cause psychological stress. It is generally recommended to follow the "631 rule" or "541 rule," allocating funds in a ratio of 6:3:1 or 5:4:1 among daily expenses, savings, and risk investments. By ensuring stable living conditions, you can invest idle funds, effectively reducing the impact of market fluctuations on your life.

3. Diversify Investments to Reduce Risk

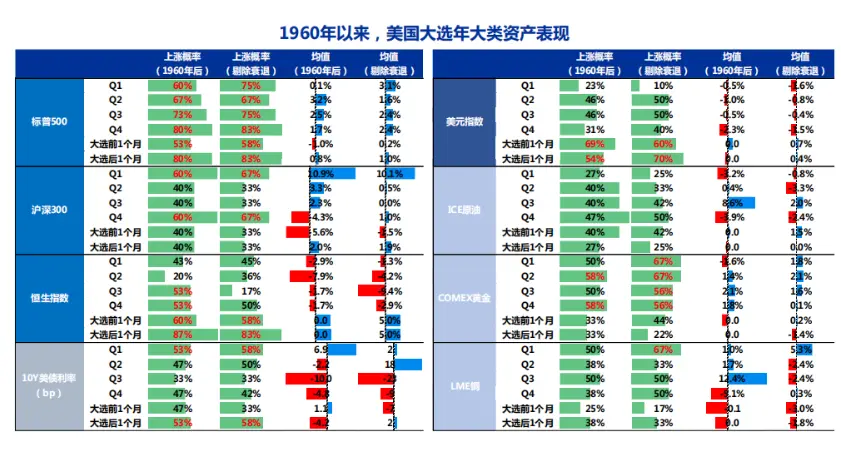

"Don't put all your eggs in one basket" is an important principle in investing. Diversifying investments can not only reduce risk but also increase the potential for returns. By allocating assets across different categories, regions, and industries such as stocks, foreign exchange, and commodities, investors can mitigate the impact of fluctuations in a single market or industry. Financial markets do not all rise or fall at the same time. For example, when the stock market is down, safe-haven assets like gold may perform strongly, and a diversified portfolio can effectively hedge against the volatility risk of a single market.

Comparison of Global Major Asset Annual Performance Over the Past Decade

4. Invest Regularly and Systematically to Smooth Costs

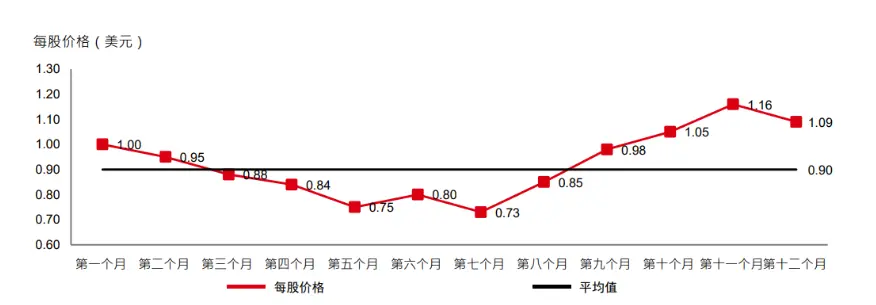

Regular and systematic investment to buy low and sell high is the ultimate goal for all investors. However, market changes are unpredictable, and predicting tops and bottoms is extremely challenging. Regular and systematic investment is an ideal strategy for steady long-term investing. Regardless of market fluctuations, investing a fixed amount at fixed intervals allows you to buy more units at lower prices and fewer units at higher prices, smoothing out overall investment costs and reducing reliance on market timing. Over time, as the market recovers, assets may exhibit exponential growth. For instance, investing $1,000 monthly is more effective in diversifying risk than a one-time investment of $12,000, while also potentially yielding more significant returns.

Comparison of Regular Investment vs. One-Time Investment

5. Manage Expectations Well

Market changes are unpredictable, and positions that yield profits or losses can lead to emotional investing, causing you to deviate from your investment plan. Market volatility is to be expected; understanding the fluctuation of assets at different risk levels and managing expectations can help you plan in advance how to respond to various situations, avoiding a gambling mentality. For example, as the world holds its breath for the U.S. election, the policy proposals of different candidates will have varying impacts on different financial assets. Being prepared in advance can prevent you from being caught off guard and making hasty decisions during market downturns.

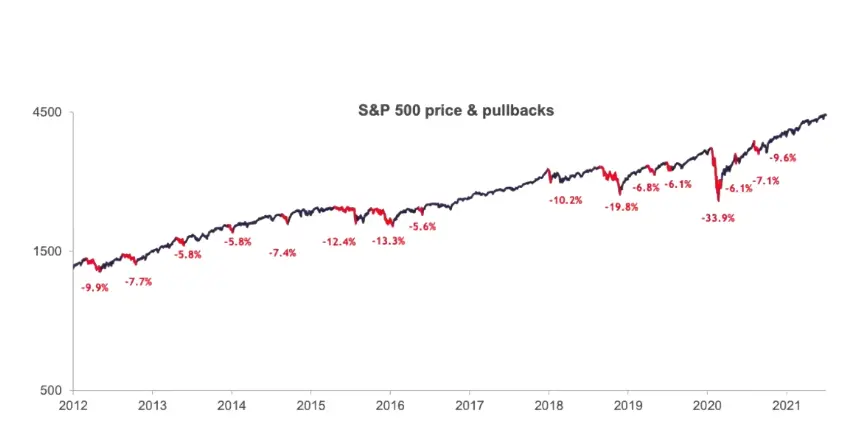

6. Avoid Being Influenced by Short-Term News

Market news is frequent and emotional, with sensational headlines and negative reports making situations more unsettling. Do not panic due to short-term negative news; focus on the fundamentals of the company/project. Historical records show that short-term fluctuations can happen at any time but do not hinder long-term market growth; the market will rebound significantly after severe setbacks.

S&P 500 Index Corrections and Trends Over the Past Decade

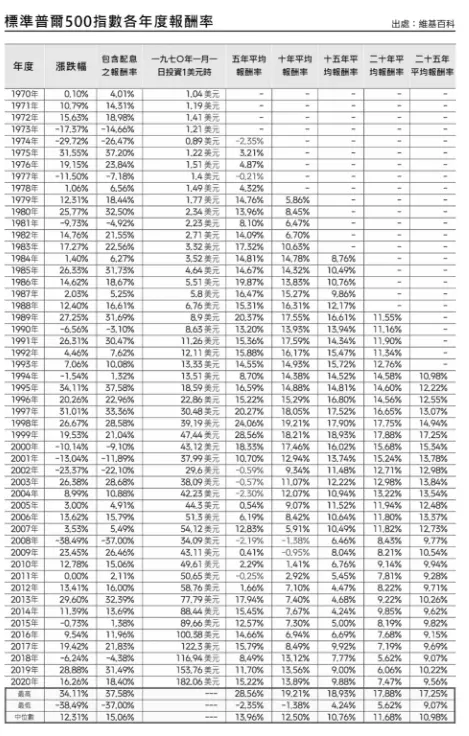

7. Long-Term Investment Can Increase Positive Return Opportunities

From a short-term perspective, risk assets such as stocks, indices, and Bitcoin carry greater risks compared to fixed-income assets like bonds. However, from a long-term perspective, as the holding period extends, they almost become "risk-free" assets. Historical records also indicate that while financial markets may experience short-term fluctuations, they generally trend upward in the long run. Although the market recovery may not follow a fixed pattern, long-term investments in good company stocks/tokens often have higher return potential. In short, the safety and potential returns of investments become increasingly evident with long-term holdings, as the saying goes, "long-term is gold."

8. Summarize Experiences and Keep Learning

Investing is not an overnight success; reviewing and learning are essential for sustained success. After each trade, investors should reflect on their gains and losses in decision-making. For example, some people always get stuck in positions due to chasing prices or miss market opportunities due to panic selling. By summarizing these lessons, investors can make more rational decisions in similar future situations. Additionally, the financial market and investment environment are constantly changing, so regularly reviewing and adjusting investment plans is necessary. Continuously tracking new market trends, combining fundamental analysis, and updating investment knowledge and skills ensure that the assets you hold still align with your financial goals.

Successful investing does not rely on short-term luck but is based on long-term planning, good fund management, and continuous learning. Moreover, market volatility is difficult to predict, and a diversified investment strategy is needed to spread risk. As a global partner of the Argentina national team, 4E offers a one-stop trading platform covering over 600 assets, including cryptocurrencies, U.S. stocks, indices, foreign exchange, and commodities, and has launched a beginner's simulation account to help everyone get started easily. If you are interested in investing, you might want to visit eeee.com to experience the convenience and security of professional trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。