Author: Chief Analyst of HashKey Group, Jeffrey Ding

Recently, the highly anticipated SmartCon conference is being held in Hong Kong, where Dr. Xiao Feng, Chairman and CEO of HashKey Group, will deliver a keynote speech on the new global payment network for compliant stablecoins on the Main Stage. As a leading figure in Web3, his focus on payments is undoubtedly exciting, indicating not only the vast potential of the Web3 payment industry but also hinting at an imminent explosion in Web3 payments.

The prospects are broad, but challenges are numerous; this is the true portrayal of PayFi at present.

Compliance and high-level risk management are necessary conditions that determine whether a project can sustain in the long run. From a long-term perspective, we need to see the positive development of current regulatory compliance, with the path to compliance gradually accelerating. For a PayFi project, aside from innovative gameplay and strengthening risk management, selecting partners with compliant licenses is of utmost importance, whether it be stablecoins or exchanges. Once a synergy is formed, it undoubtedly opens up vast opportunities.

- PayFi is a new concept, but it addresses an old problem.

1. The efficiency of capital turnover is the core of the time value of money.

PayFi (Payment Finance) is a unique concept in the Web3 field, first proposed by Lily Liu, Chair of the Solana Foundation, and defined as a new type of financial market built around the time value of money.

In the above definition, the concept of the time value of money is relatively abstract. In simple terms, the time value of money means that money has different values at different time periods. From an economic perspective, this means that, without considering inflation, the increase in money value comes from the value appreciation brought about by the transfer of the right to use money/capital. To put it more simply, if you invest, manage, or lend 1 dollar today, at some point in the future, you will earn more money, and the amount you earn directly depends on the turnover efficiency, cost, and returns of that 1 dollar.

The next question arises: Is there no unmet demand for this time value of money in Web2? The answer is clearly negative. So why is there a need for Web3 to transform payments? The conclusion can only be that the time value of money in Web2 has been significantly weakened, due to rising costs, reduced returns, and a low level of convenience in accessing services.

Having understood the above scenario, we can provide a more detailed depiction of PayFi. PayFi is an innovative financial market that leverages blockchain technology, focusing on payment and settlement scenarios, with the aim of improving capital turnover efficiency, cost, and returns. It is worth noting that while there are many scenarios that can enhance the time value of money, PayFi focuses more on payments and settlements rather than financial transactions, with its main enhancement of time value being shorter capital settlement times and faster turnover efficiency.

2. The demand for RWA may not be rigid, but PayFi is more urgent.

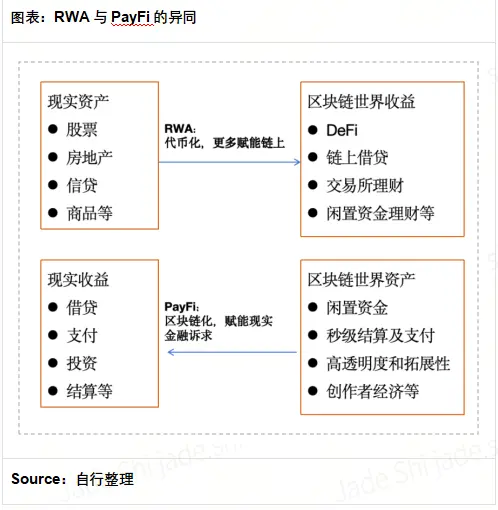

If there is a widely recognized and enduring mainstream narrative in the Web3 industry, it is undoubtedly the key proposition of mass adoption. The RWA (Real World Assets) track is a key direction born under this narrative, and PayFi, from a broader perspective, belongs to the RWA track, as both fundamentally involve the interaction between the blockchain world and the real physical world, albeit with different modes of interaction.

The core definition of RWA is the tokenization of real-world assets on-chain, allowing tangible real assets to be traded on-chain, focusing on the trading of real assets on-chain and providing higher liquidity for these assets. PayFi, on the other hand, focuses on the speed of transactions between real assets and the unmet financial needs that can be realized through blockchain.

The distinction lies in that the demand for RWA may not be rigid; it somewhat provides more sources of returns/capital for the blockchain world. PayFi's demand is a completely rigid demand, as it provides more sources of returns/capital for the real world. However, it is important to note that from the perspective of enhancing returns, both RWA and PayFi are not one-way; the following table is more about their essential functions.

Comparing and juxtaposing RWA and PayFi, the core consideration is: under the grand narrative of mass adoption, why is there a need for a new narrative for PayFi rather than a simple extension of the RWA concept, and why has it garnered such high attention?

The comparison of the two may provide part of the explanation: one is the migration from the real world to the blockchain world, while the other is the integration of the blockchain world into the real world. Both are similar in essence, but from the perspective of demand, the latter undoubtedly has a more urgent reality. However, the high attention on PayFi is not only due to the urgency of the real world but also the bottlenecks within the blockchain world itself.

Additionally, from the operational perspective of the blockchain world, whether it is second-level payment settlements or utilizing smart contracts and on-chain DeFi liquidity pools to support the real world, the greatest time value lies in improving the turnover efficiency of money.

3. The development bottleneck of blockchain calls for a new narrative with real scenarios; PayFi has a high ceiling.

From the perspective of the blockchain world, narrative exhaustion is an undeniable fact in the current blockchain landscape. The phenomenon of liquidity fragmentation is becoming increasingly severe, accompanied by a false prosperity of project data. After the TGE (Token Generation Event) of most projects, user data nearly declines linearly, along with a significant drop in token prices. This phenomenon reflects the rapid development of the blockchain world under capital support and gradual compliance, but on the downside, it reveals that many current projects lack real demand scenarios, with most being "nested doll" projects that have weak self-sustaining capabilities. Without capital support, they are almost "dead on arrival."

From the real world, in an increasingly complex geopolitical environment, the increasingly cumbersome international payment and settlement system not only faces the entrenched inefficiencies but is also under scrutiny for its neutrality and equality. Russia's exclusion from the Swift system is undoubtedly a precedent, but not the last. Moreover, the oligopolization and inequality in finance are rampant, and worse, this phenomenon is still intensifying.

It is hard to say that blockchain can perfectly solve the problems of the real world, especially since blockchain itself is facing development bottlenecks. However, it is at least one of the most likely paths currently available. Whether it is Web2 giants or top players in Web3, they undoubtedly do not want to miss the opportunity to bet on this track, such as BlackRock, JD.com, Coinbase, A16z, Sequoia, SoftBank, etc. More importantly, for the massive capital of these giants, they are less attracted by short-term limited wealth effects and more focused on long-term incremental space. This is also the core reason why both RWA and PayFi can attract large funds.

2. The PayFi ecosystem is taking shape; from stablecoins to exchanges, compliance is the foundation of cooperation.

A broader ecosystem relies on partners with compliant qualifications.

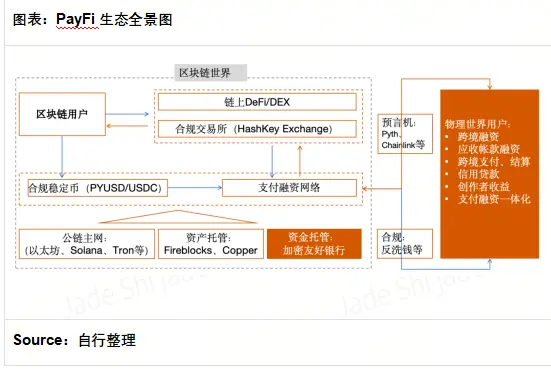

As analyzed earlier, the PayFi track is about leveraging the blockchain world to unlock vast real-world assets. In this landscape, if we simply analyze individual PayFi projects, it would be a case of missing the forest for the trees. What is needed is to see how to form a broader synergy within this blockchain ecosystem to create a new financial paradigm.

As illustrated in the above image, the interaction between assets in the blockchain world and the real world is not limited to the PayFi projects themselves; rather, PayFi serves merely as an entry and exit point. However, from the project logic of PayFi itself, it connects the capital pool of the blockchain world with the financial needs of the off-chain world, and this connection requires the integration of multiple forces.

The primary factor is that operations must be conducted in a relatively relaxed regulatory environment and in crypto-friendly cities. For example, the recently popular Huma Finance is located in San Francisco, where the early compliant exchange Kraken is also based, as well as the current Hong Kong.

Secondly, the main partners currently focus on large licensed institutions that can provide a full suite of deposit and withdrawal, liquidity provision, and decentralized infrastructure compliance service solutions. In fact, from this perspective, this is one of the high barriers and growth obstacles for PayFi at present.

Taking Hong Kong as an example, there are not many entities with certain financial strength that can provide a compliant regulatory framework for infrastructure, deposits and withdrawals, liquidity, and KYC. Only a few licensed regulatory institutions exist, such as HashKey Exchange, the largest licensed virtual asset exchange in Hong Kong.

As the largest licensed virtual asset exchange in Hong Kong, HashKey Exchange has entered the global TOP 10 exchanges, making it the best partner for PayFi projects. Currently, its trading volume has surpassed 538 billion HKD, and its asset accumulation has exceeded 5 billion HKD. According to the latest data from Coingecko, HashKey Exchange ranks 8th among global exchanges and is the highest-ranked licensed virtual asset exchange in Hong Kong. The benefits of collaborating with such compliant institutions lie in the breadth and depth of cooperation and the reduced difficulty of synergy, which is more conducive to the rapid establishment and expansion of project visibility. Otherwise, it would require finding different partners at various stages, which, in a sense, increases the operational costs of the project.

1.1 The track is taking shape, and the future is promising.

RWA is a major hotspot in this cycle, but the PayFi concept was only proposed in July of this year. Following the heat of the leading project Huma Finance, which raised 38 million USD in September, it has gradually spread widely. In less than three months, it has become a hot and highly regarded new concept and narrative in the industry, gathering top venture capital, compliant exchanges, and public chain funds such as Distributed Global, HashKey Capital, and Stellar Development Foundation.

At this year's Token2049 in Singapore, the PayFi Summit showcased 12 projects in the PayFi track along with corresponding modular Stack technology stacks, aiming to further lower the development threshold for projects.

From a compliance perspective, payment businesses face different regulatory frameworks in different regions, such as Hong Kong's TCSP and MSO; Singapore's DPT; and Dubai's VARA licenses, all of which are regulatory frameworks that projects must consider when entering the payment track.

Overall, the current scale and heat of the track cannot yet be considered mainstream; however, against the backdrop of a lack of new narratives in the industry, the high attention given by the industry indirectly proves the recognition of this direction. At least under the current influence, the track has already taken shape, and the future remains promising.

1.2 The three major challenges of PayFi: Compliance is the foundation of development, risk control is the guarantee of development, and lowering the threshold is the leverage for development.

Looking ahead, the most pressing challenge for the development of PayFi is regulatory compliance, followed by how to manage processes that connect on-chain and off-chain scenarios. The main challenges involved are as follows.

Challenge 1: Compliance management across the entire chain. From a risk perspective, if on-chain compliance risks spread to off-chain, it can deal a fatal blow to the project. Therefore, adopting compliant stablecoins is just the first step. In the long run, current stablecoins are all pegged to the US dollar, and during large-scale promotion, they may face foreign exchange control risks between countries, such as the recent plans by South Korea to introduce relevant regulations. Additionally, compliance in the deposit and withdrawal stages and liquidity provision plays a decisive role in the success or failure of the project, which is why collaboration with compliant exchanges like HashKey Exchange is necessary.

Challenge 2: Increased difficulty in managing technological, security, and credit risks. If the business model occurs purely on-chain, technological risks are relatively concentrated. However, the business model of PayFi means that its technological risks not only include on-chain hacking attacks but also risks related to off-chain performance verification. Furthermore, whether based on accounts receivable or trade, a large amount of cross-validation of online and offline data is required, and without on-site offline research, this actually raises higher demands for credit risk management capabilities.

Challenge 3: The entry threshold for users remains high. From the current PayFi projects, due to regulatory compliance considerations, the KYC and investment thresholds for users are not very suitable for widespread retail participation; they are more appropriate for institutional or high-net-worth individuals. However, from a business logic perspective, institutional business is easier to develop and relatively simple in model. Still, if large-scale promotion is to occur later, the user threshold remains one of the barriers.

Four, Suggestions and Prospects: Focus on Compliance, Multi-Party Cooperation, Innovative Gameplay, and Vast Potential

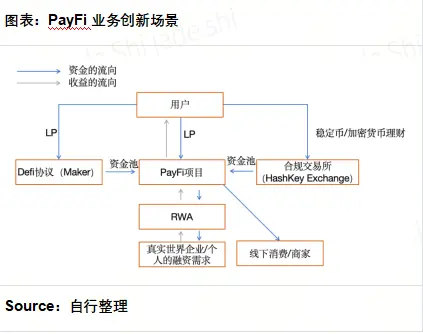

From the perspective of PayFi's development, it is currently still in the stage of solving one-way financing solutions, which means seeking blockchain financing for real physical scenarios. If further developed, it could evolve into an integrated payment financing business, or it could be described as a comprehensive form of PayFi + DeFi + RWA. On one hand, it expands funding sources while increasing the yield sources of on-chain DeFi or exchange financial products; on the other hand, it seeks breakthrough solutions for the massive financial turnover needs of offline assets.

As shown in the image above, the current PayFi capital pool does not directly come from DeFi and exchanges but rather from self-built capital pools of the projects themselves. However, for underlying assets, under compliant funding, the source of funds is irrelevant, especially considering the current state of liquidity fragmentation in the market. Collaborating with DeFi protocols and compliant exchanges can fully integrate the liquidity of the blockchain world. On one hand, it can design more products with various risk attributes and terms; on the other hand, it can achieve integrated payment financing, or utilize the high efficiency of blockchain payment settlements combined with on-chain yields to seamlessly realize integrated payment financing. Essentially, the returns obtained by users through LP can be used as collateral to instantly receive credit advances from the PayFi platform, which can be directly used for offline consumption payments.

Moreover, for centralized compliant exchanges and DeFi protocols, this also provides an effective means for retaining user funds. One possible scenario is: for example, User A deposits and withdraws funds through HashKey Exchange, and after earning returns from investing in BTC, they can use BTC or compliant stablecoins like USDC to invest in the exchange's financial products, which are backed by PayFi's financing projects to earn stable returns. These returns can also be directly used for offline payments through PayFi.

In summary, from the perspective of PayFi's own development, there are numerous gameplay options in the blockchain world. The time value of money can be fully utilized for innovation through the efficiency of blockchain, and the shortened time not only improves turnover efficiency but also facilitates the formation of integrated products for payment, financing, and settlement.

According to incomplete statistics, the entire payment field, including credit cards, trade financing, and cross-border payments, totals over $40 trillion in market size, while current PayFi is merely expanding into the long-tail market that traditional finance has overlooked.

Considering the increasingly compliant blockchain world, the scale of PayFi alone is roughly estimated to exceed a trillion. In the foreseeable future, if barriers to deposits and withdrawals are removed, online and offline integration deepens, and compliance accelerates, the highway from the Web2 world to the Web3 world may truly be opened up, and PayFi may be the key turning point for Web3 to achieve mass adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。