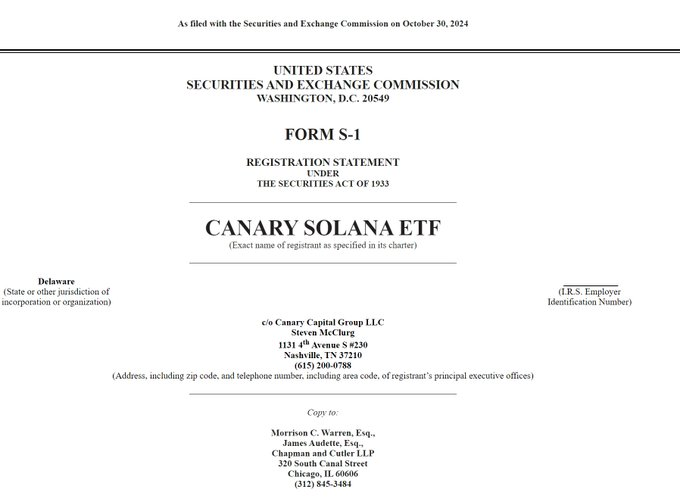

Canary Capital has submitted an application for a SOL ETF to the U.S. SEC. This is the third cryptocurrency ETF application submitted by the company this month, following applications for LTC ETF and XRP ETF. It has been previously shared that this bull market is an institutional bull market and also an ETF bull market, which will need to be monitored going forward.

Although ETH spot has halved from 4000 to 2111, it is currently one of only two spot ETFs in the Crypto market. While its trading volume is far less than Bitcoin, it is still worth watching over time.

Bitcoin

is still fluctuating around 72000. Yesterday's lowest dip was 71436, which did not break below our previously mentioned upward stop-loss position of 70888. From the perspective of weekly wave theory, after the fifth wave of the rise reached 73777, it has undergone more than half a year of corrective waves. The breakout of the ascending flag is considered a new wave, but it has not yet fully broken through the previous high. Once it breaks through, the third wave of the rise could target 80,000 to 100,000 as the first phase goal, and the market will be observed as it progresses.

In the coming days, there may be slight pullbacks and fluctuations, waiting for the current election developments. Short-term volatility is expected, and there is also a 25 basis point rate cut on the 8th.

Support: Pressure:

SOL

Canary Capital has submitted an application for a SOL ETF to the U.S. SEC. Back to the market, the weekly chart shows a rounded bottom with a triangular structure. The bottom support is between 106 and 120, and future pullbacks can be bought in batches. The MACD is at the zero axis, indicating at least a weekly level rebound, but it can only be a short-term pullback to 160 for buying.

The daily chart is still under pressure at the upper edge of the triangle, so watch for a potential breakout. Key resistance levels to watch are 183, 193, and 210.

Support: Pressure:

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

The article is time-sensitive and for reference only, with real-time updates.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Trading Prince Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。