Talent recruitment is linked to the U.S. election cycle.

Written by: Zackary Skelly (Head of Talent, Dragonfly)

Translated by: Zen, PANews

The well-known crypto VC Dragonfly Capital analyzes the recruitment market in the crypto industry every quarter, providing insights on job trends, candidate perceptions, portfolio company activities, and forecasts for its portfolio companies.

Recruitment Market Trends

In analyzing the market, Dragonfly monitors multiple signals, but "new positions in portfolio companies" best reflects the overall sentiment in the industry. In short, the talent recruitment market in the crypto industry has gradually recovered since 2023, with a surge in the first quarter of 2024, but stagnation occurred entering the second quarter.

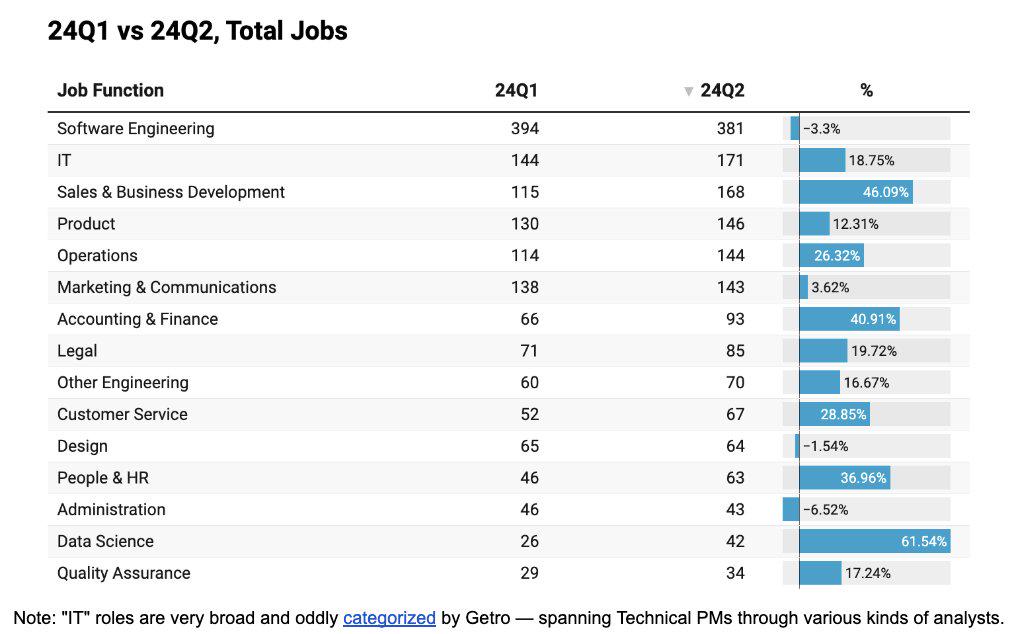

Quarterly Job Changes

In the second quarter of 2024, engineering and design positions remained relatively stable, GTM (GoToMarket) positions surged, and data science positions also saw considerable growth. Marketing positions shifted towards leadership roles.

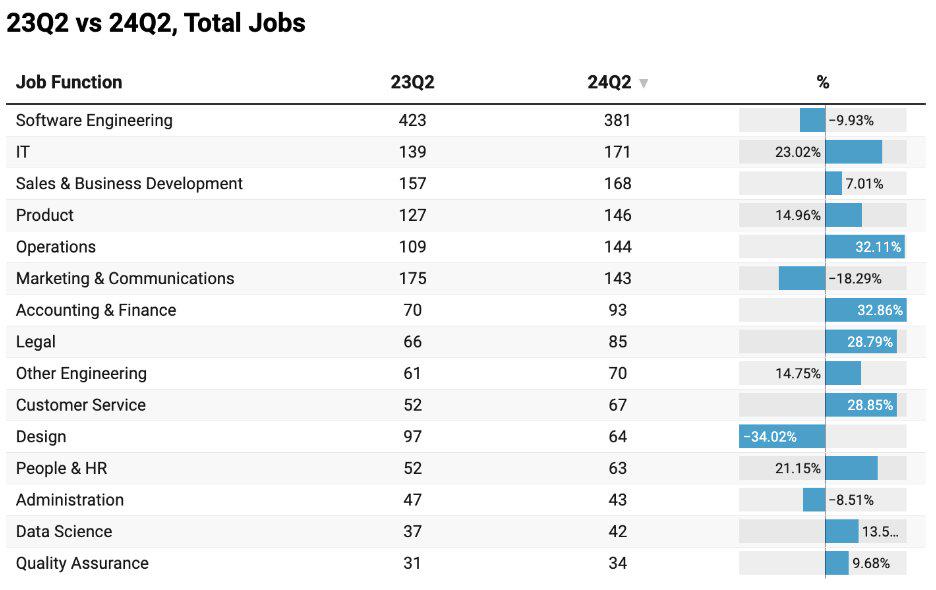

Year-on-Year Comparison

Comparing the second quarter of 2023 with the second quarter of 2024, GTM positions saw significant growth, especially in finance, operations, legal, and customer support sectors.

Engineering positions became more specialized, with high demand for Rust language skills, while DevRel (Developer Relations) and Protocol Eng (Protocol Engineers) remained in high demand. Design roles, however, experienced a significant decline.

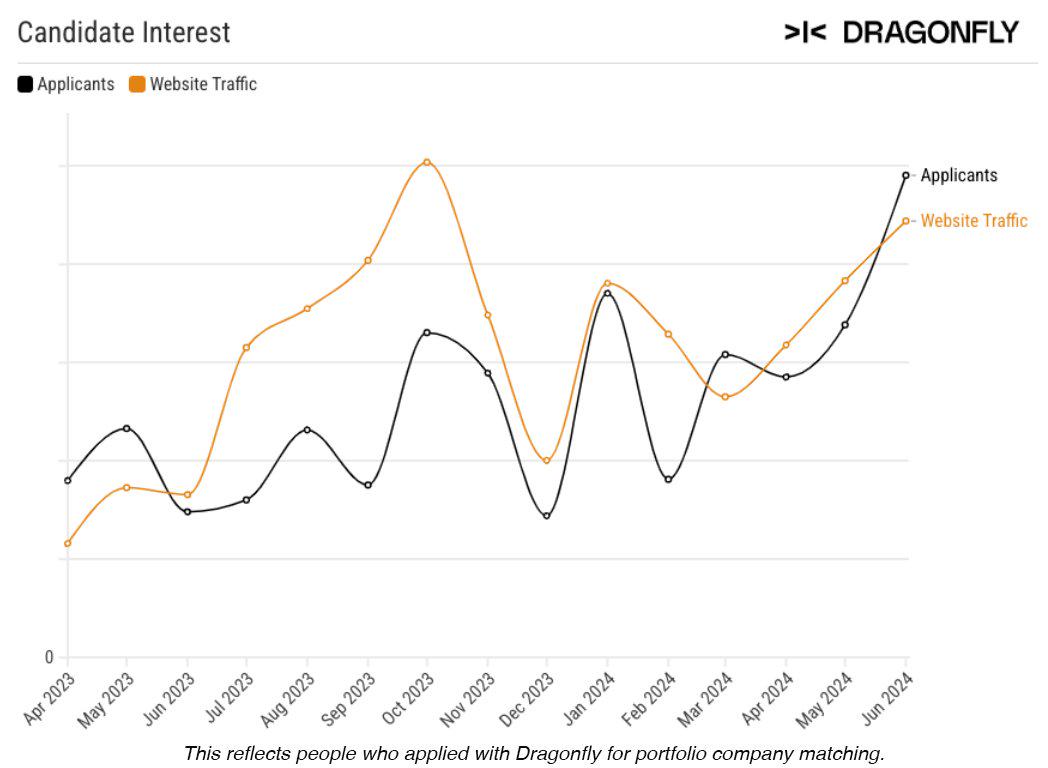

Candidate Interests

In the second quarter of 2024, there were more DeFi job seekers in the market, while those focused on infrastructure remained in place, seeking product-market fit. Many expressed a skeptical curiosity about the combination of AI and crypto—exciting, but with uncertain use cases that seem too advanced.

Additionally, zero-knowledge proofs (ZK) remained a highly sought-after technology among senior software engineers (Sr SWE).

Evolution of Priorities and Increased Scrutiny

Job seekers are looking for project teams that have a reliable roadmap post-TGE rather than just shouting "ToTheMoon," and they tend to favor companies with strong ecosystems and well-known brands. Few candidates are willing to consider jobs that do not match their personal skills or have unclear job descriptions.

Burnout Among Crypto Professionals and Openness to Web2

An increasing number of crypto-native job seekers are willing to consider Web2 job opportunities while seeking positions in the crypto industry. Conversely, exchange-traded funds (ETFs) and U.S. policies favorable to crypto are attracting more talent from traditional finance and Web2 sectors.

Office Models and Salary Expectations

Remote and hybrid work remain the preferred options, but more companies are beginning to discuss the arrangement of physical offices. In terms of salary expectations, candidates' standards remain high, and most are unwilling to compromise.

Portfolio Recruitment Trends

Several of Dragonfly's portfolio companies have increased their recruitment efforts in the second quarter, showing increased interest in niche, product-focused engineering positions (such as front-end development).

GTM recruitment has grown in the Asia-Pacific region, while engineering positions are expanding in Europe, the Middle East, and Africa (EMEA). Additionally, recruitment momentum among Layer 1 projects (Alt L1s) is strengthening.

Recruitment Market Forecast

Recruitment is linked to the U.S. election cycle. The evolving pro-crypto stance of Trump and the changing attitude of Harris have sparked discussions that may drive GTM recruitment. Dragonfly expects this trend to continue, and as use cases solidify, candidates' sentiments towards the combination of AI and crypto will also shift towards excitement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。