Recently, the upcoming TGE of Hyperliquid has drawn renewed attention to the Perp DEX sector. In the last cycle, the performance of Perp DEX was disappointing, failing to become the "on-chain liquidity star" that many had anticipated. However, since late last year and early this year, Perp DEX protocols such as Hyperliquid, Drift, Surf, and Orderly have emerged, while the established leader dYdX has also become active again. With the rapid rise of the meme sector, the power of on-chain liquidity has further opened up new opportunities for the Perp DEX market.

Memecoin Leads the New Cycle, On-Chain Liquidity Gathers

In this cycle, the performance of meme coins has been particularly eye-catching, with on-chain golden dogs appearing frequently. MOODENG, SPX, and GOAT have not only become potential meme coins in this meme craze but have also attracted more and more players to the on-chain space. Even though on-chain players joke about doing real "POW" every day, battling in various arenas for "PVP," it is undeniable that liquidity is gradually gathering on-chain, even showing signs of acceleration. Among them, MOODENG and GOAT have also caught the attention of CEX listings like Binance.

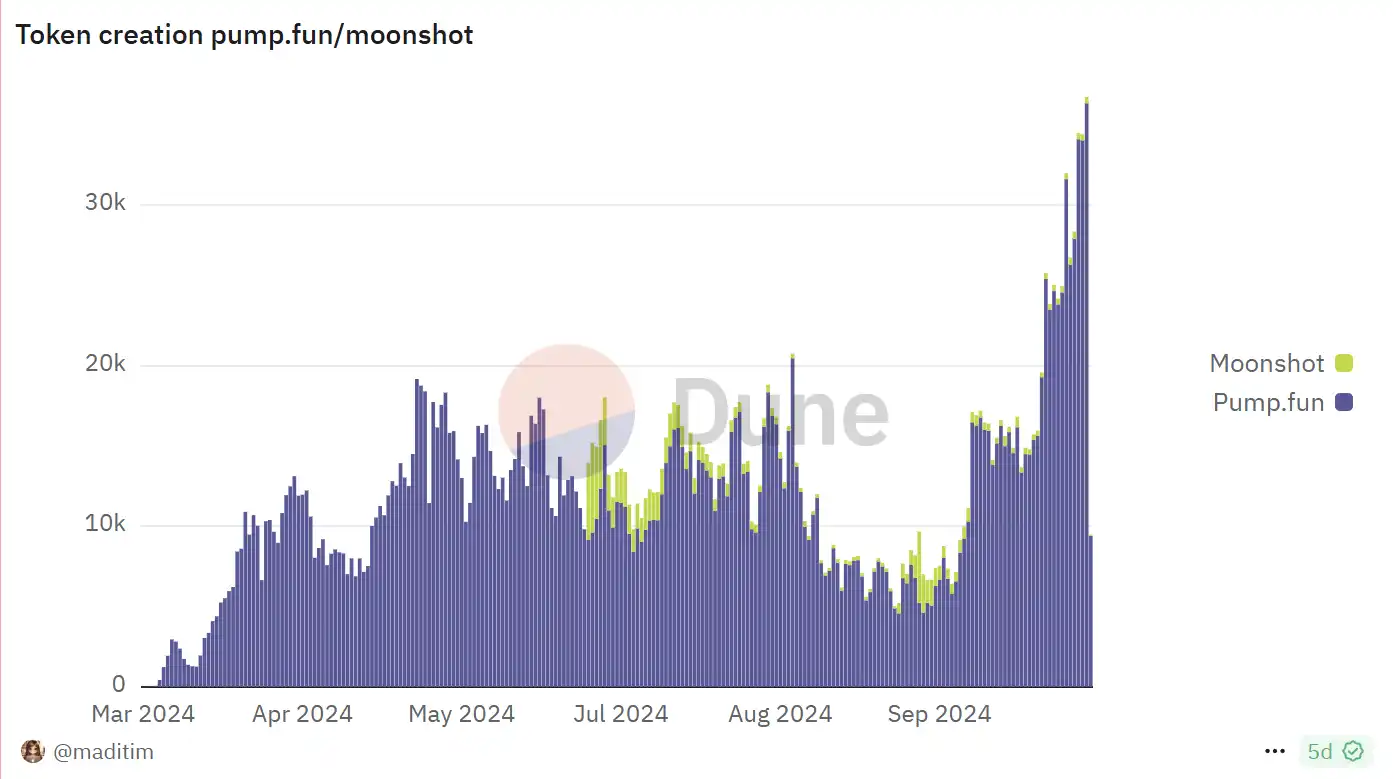

In addition to the emergence of golden dogs, the data from meme infrastructure can more directly reflect the exaggerated increase in on-chain liquidity. For example, the well-known Pump.fun began its "main rising wave" at the end of August, with the number of listed coins continuously reaching new highs. This indicates that today's crypto-native users have great enthusiasm for on-chain memes and reflects the concentration of market liquidity in on-chain memes.

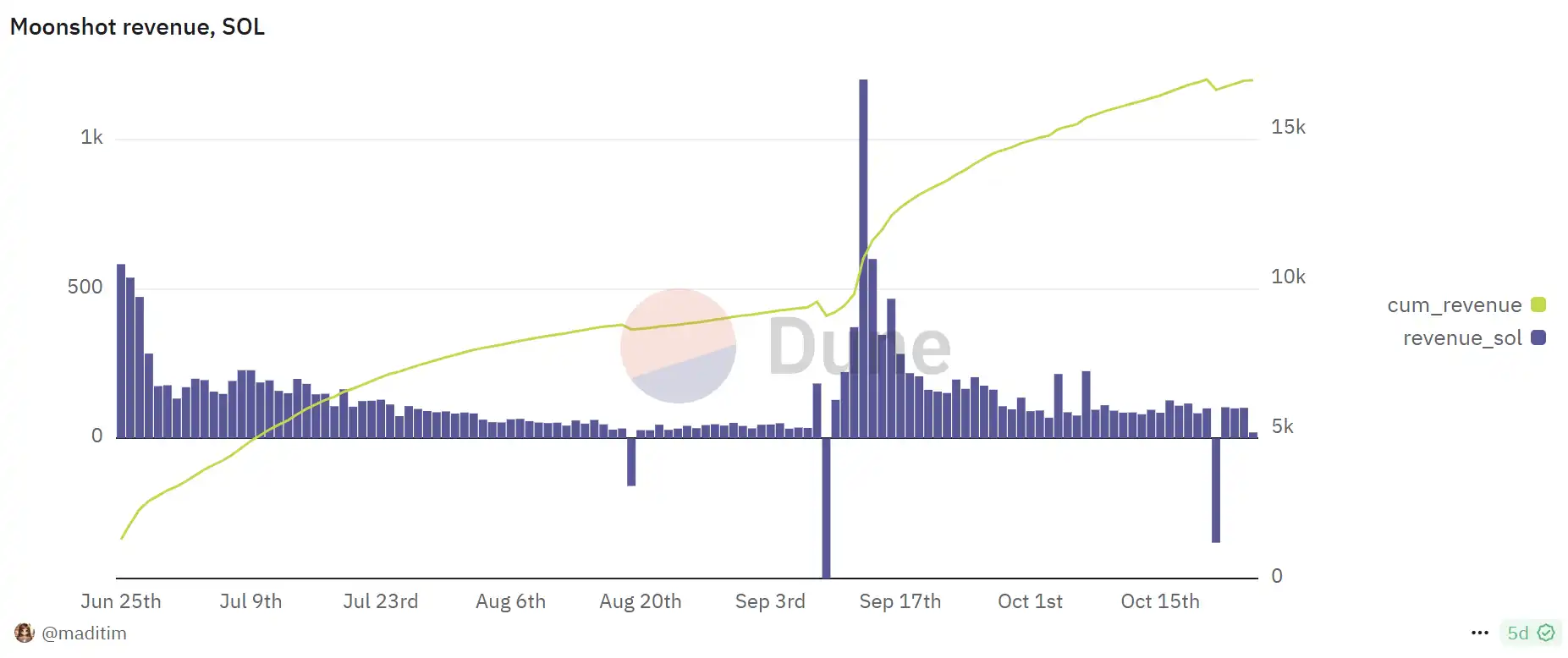

In addition to Pump.fun, there is also the equally popular Moonshot as a major liquidity gateway. Following Murad's speech on the "memecoin supercycle" at the Token2049 conference, Moonshot began to gain traction alongside MOODENG. Moonshot not only has a strong coin listing effect, becoming the "Binance" on-chain, but its fiat deposit has also opened up a new mass adoption opportunity, creating growth in Web2 traffic for crypto. By the end of September, Moonshot's daily expenses quickly rose from around $3,681 to $24,000, and daily trading users increased from 396 to 3,458. Its cumulative figures have also been steadily rising, with an accelerating trend in its slope. The success of Moonshot has further concentrated liquidity on-chain.

Perp DEX: Beneficiaries of On-Chain Liquidity

Behind the explosive popularity of on-chain meme infrastructure and memecoins, Perp DEX has naturally become a beneficiary of this gathering of on-chain liquidity. Perp DEX did not stand out in the last cycle, but during the recent recovery of the bull market, it has gradually gained popularity from the English-speaking community to the Chinese-speaking community. On one hand, the previous DeFi narrative was abundant, and Perp DEX did not have enough stage to perform; on the other hand, the current on-chain meme market is performing better than the secondary performance of CEX listings, making retail investors more willing to embrace DEX with higher odds and more diverse gameplay.

Dydx: An Excellent Cautionary Tale

In the decentralized perpetual trading space, dYdX is the earliest big player. Since its establishment in 2017, dYdX has stood out in terms of 24-hour trading volume and daily active users by adopting an order book model, providing users with comprehensive features including lending, leveraged trading, and perpetual contracts. At the beginning of this cycle, it undoubtedly became the focus of market attention. However, since this year, dYdX's development has increasingly struggled. Both its protocol revenue and token price have been in serious decline, gradually being caught up by later Perp DEXs. The specific details of dYdX's fundamental changes can be reviewed in our previous article: Is today's DeFi industry overvalued based on the price-to-earnings ratio? | Rhythm Finance Mirror.

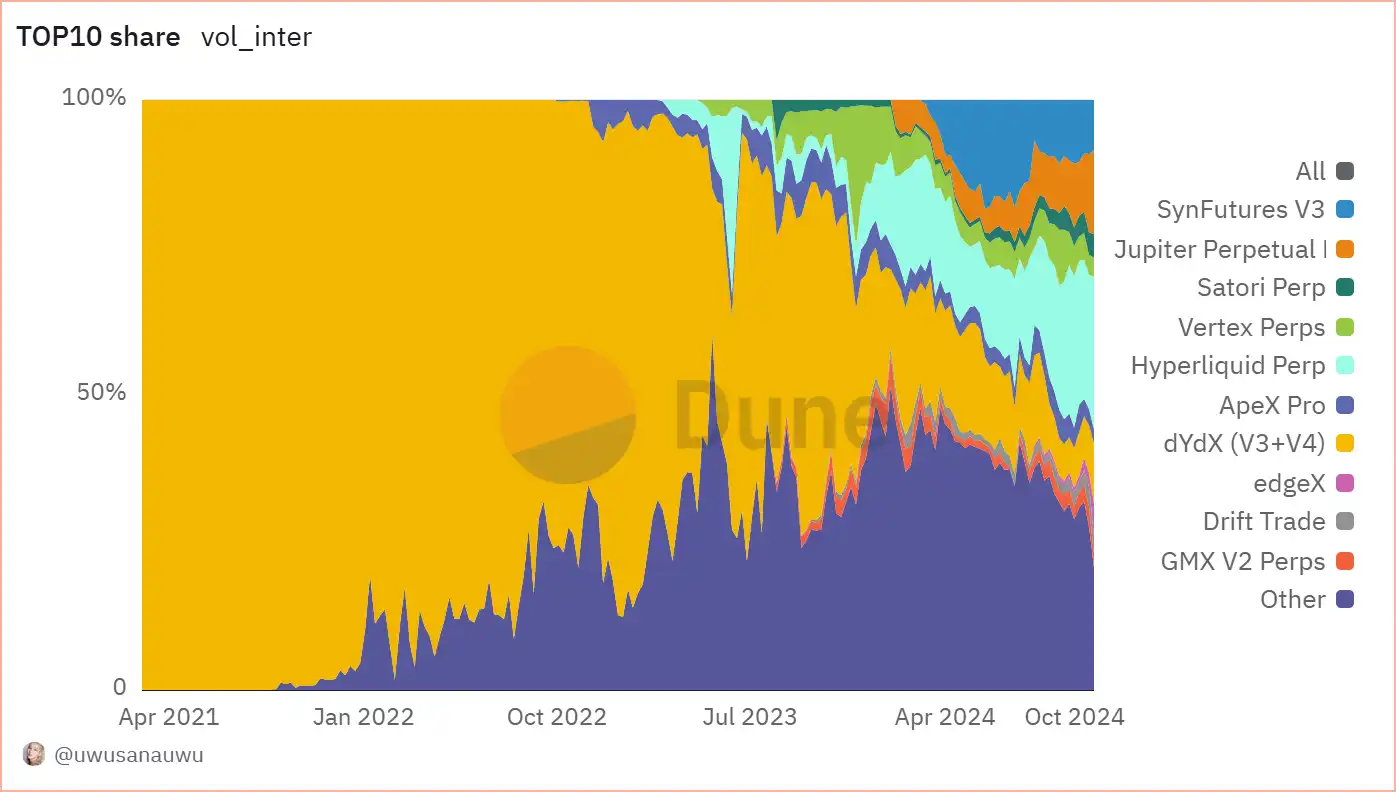

Although dYdX was the "first mover" in the Perp DEX space, it has almost become a cautionary tale for Perp DEX in recent months. dYdX's market share has gradually been eroded by several other Perp DEXs. After two years of changes, dYdX has not grown stronger but has instead regressed. From an initial market share of 80%, it has weakened to only 6%. During this wave of meme craze, dYdX has not reaped many benefits aside from announcing its involvement in Pump, and there have been recent layoffs and personnel changes, indicating the depth of its decline.

The crypto market is ever-changing, and the yet-to-launch Hyperliquid has quietly taken over dYdX's leading position.

Hyperliquid: The Low-Key Star

Hyperliquid, as the most popular Perp DEX in the English-speaking community, has always been relatively "low-key." Originally built on Tendermint, users can query orders, cancel, trade, and build order books on-chain.

In terms of technological advancement, it introduced the HyperBFT optimization algorithm in May 2024, increasing its TPS from the previous 20,000 based on Tendermint to 100,000-200,000, achieving a significant leap. The introduction of HyperBFT allows users to trade more smoothly, but there is still a gap compared to CEX (e.g., Binance's 1.4 million TPS). Meanwhile, Hyperliquid's ambitions go beyond just being an ordinary Perp DEX. Hyperliquid is actively developing an L1 public chain, aiming to create a low-latency, high-throughput public chain characterized by high-frequency trading and order books.

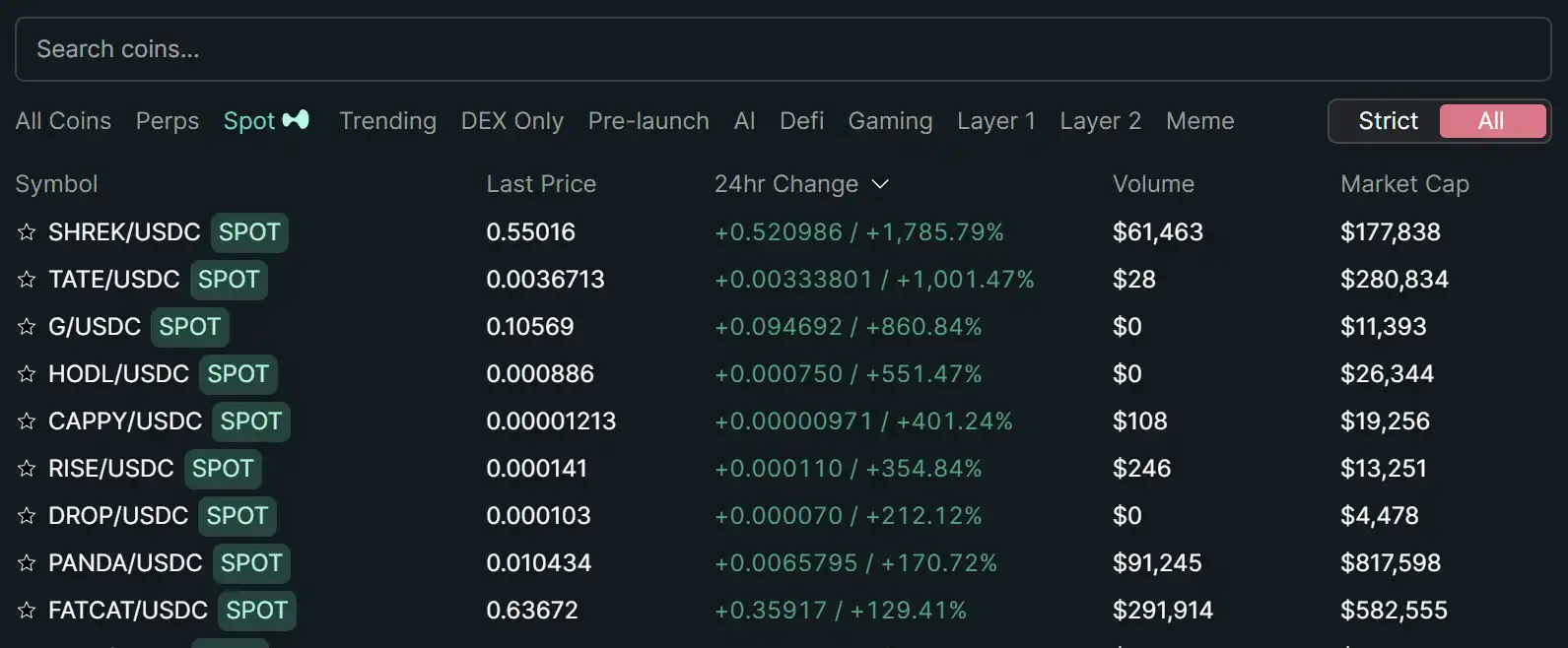

Hyperliquid is also actively embracing meme culture and has become the biggest beneficiary of this round of meme craze. Compared to CEX, Hyperliquid offers more meme spot options for users to choose from. This gives Hyperliquid a first-mover advantage in memes compared to CEX listings that arrive late when the market cap of memecoins is already in the hundreds of millions.

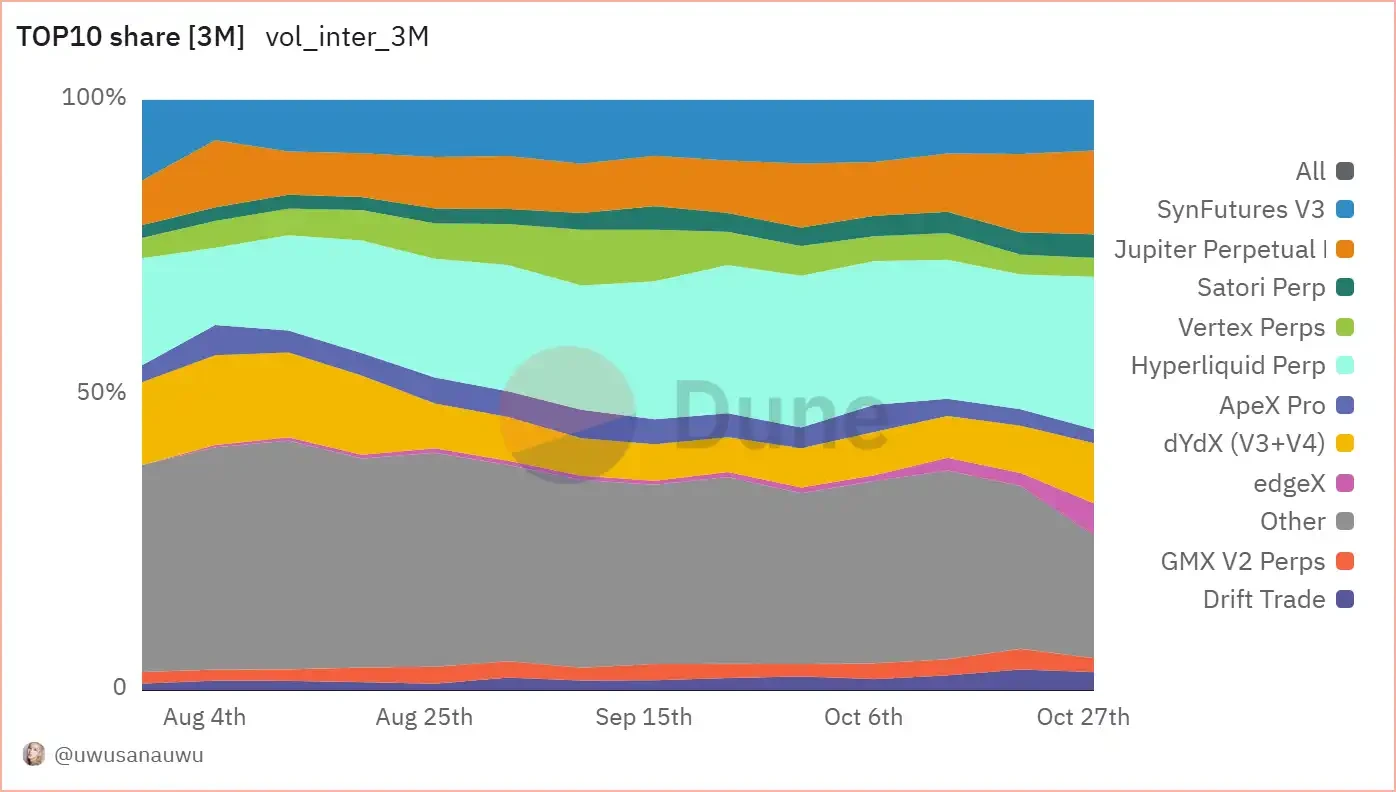

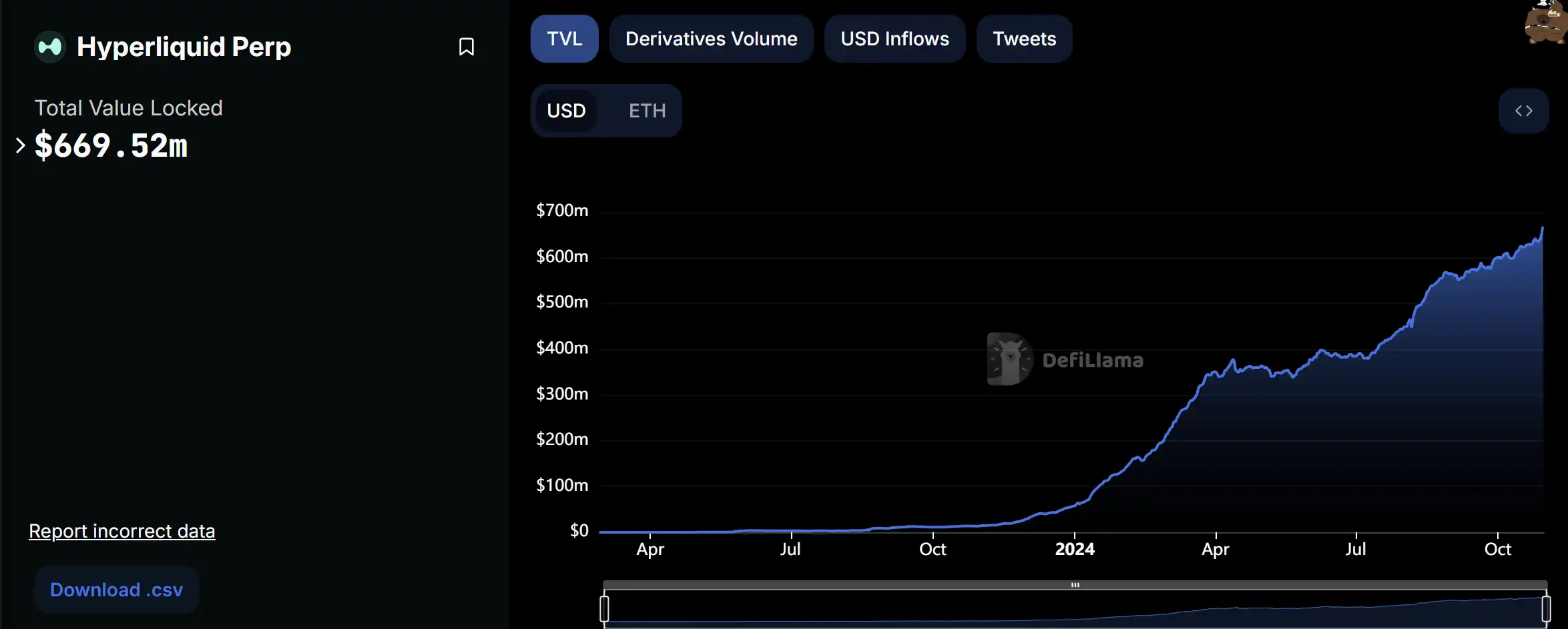

According to Dune, in the past three months, Hyperliquid has achieved a rise as a latecomer, becoming the largest Perp DEX by market share, occupying 40% of the market and becoming the undisputed leader. Its TVL has also seen explosive growth this year, now reaching nearly $670 million.

On October 14, Hyperliquid announced the establishment of the Hyper Foundation to support the development of the Hyperliquid blockchain and ecosystem.

Hyperliquid is also preparing for the TGE of its native token, and with the approach of the $HYPE TGE, millions of users will join Hyperliquid, injecting more capital into its ecosystem. This is a positive development for the spot tokens already listed on Hyperliquid.

However, the launch of Hyperliquid EVM may have some negative implications for its spot tokens. If the EVM goes live before or during the TGE, there may be a situation where investors from Solana transfer their funds to trade on other EVM chains. In this case, the current native spot tokens may experience a degree of dilution in the form of new tokens flooding in on the EVM.

What is Everyone Playing on Perp DEX?

Hyperliquid has already shown a strong wealth creation effect, but the discussion remains concentrated in the English-speaking community. According to the ranking of spot token changes on Hyperliquid, it can be seen that under the premise of catching up with CEX trading experiences, token price increases of over 100% already provide an experience that rivals CEX. Instead of playing contracts on CEX, it is better to trade spot on DEX.

In Hyperliquid, the lower market cap tokens that are discussed more include:

$SCHIZO

SCHIZO, as a representative of viral memes on Solana, originally means "schizophrenia." Its quirky image characteristics have strong virality among many memes. SCHIZO once went to zero in August this year but began to rise again in October, currently reaching a new high with a market cap of $4.72 million.

$CATBAL

In the Hyperliquid ecosystem, cat-themed memes, particularly the mysterious cat, have become a hotspot for meme dissemination. Currently, it has a relatively small following, but its price trend is strong. Since October 15, it has increased by about 30 times, with a market cap reaching $6.92 million.

$JEFF

JEFF is a character-type meme on Solana and is the most undervalued meme spot token on Hyperliquid. While JEFF has not experienced the exaggerated hundredfold increases seen with other memes, its market cap of $4.76 million still has room for growth. Currently, the price hovers around $4.80, showing potential to hit new highs.

$NOCEX

NOCEX, as a spot token launched on Hyperliquid, has a ticker that reads "NO CEX," which is quite ironic. This ironic ticker has garnered more attention from the community. Since October 2, NOCEX has achieved a hundredfold increase, with a current market cap of $687,000. After reaching a price of $2.30, it has experienced a pullback.

$PURR

When Hyperliquid launched its spot functionality, it airdropped the MEME coin – PURR – to early users of the platform, making it the first spot token listed on Hyperliquid. Currently, its price trend is strong, having nearly doubled since the beginning of October.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。