Original text: [Ten Thousand Words Research Report] A Comprehensive Guide to the Tokenization of Real World Assets (RWA): Technical Challenges, Legal Barriers, and Industry Case Analysis, Exploring the Application of Tokenization in Various Fields

With the maturity and widespread application of blockchain technology, the tokenization of real-world assets is rapidly evolving, a phenomenon referred to as the "Great Tokenization." This transformation in asset ownership, trading, and value creation is reshaping the market landscape worth trillions of dollars. Imagine being able to own a small piece of air above Manhattan and trade it like a stock; or investing in a famous Picasso for just $50; or easily purchasing government bonds with a simple tap on your smartphone, or even buying time to chat for 30 minutes with your favorite cryptocurrency figure (this time can be traded, and its value will fluctuate). These are not distant fantasies, but realities happening today.

The emergence of asset tokenization has made many previously inaccessible markets approachable. Now, real estate ownership is being divided, allowing investors to purchase shares in properties around the world for far less than the cost of a lavish dinner. Government securities, traditionally monopolized by large institutional investors, are gradually moving towards blockchain, enabling ordinary investors to participate. Whether it’s energy, time, airspace, intellectual property, mortgages, car rentals, or carbon credits, any asset, whether tangible or intangible, is undergoing exploration for tokenization.

The core of asset tokenization lies in converting the rights to an asset—whether physical or digital, tangible or intangible—into digital tokens on the blockchain. This seemingly simple process harbors infinite possibilities, primarily reflected in the following four major advantages:

1. Enhanced Liquidity

Through tokenization, assets can be bought and sold at any time, increasing market liquidity.

2. Fractional Ownership

Investors can purchase partial rights to assets, significantly lowering the investment threshold for high-value assets.

3. Increased Transparency

The openness and immutability of blockchain technology make the asset trading process more transparent, reducing the risk of fraud and disputes.

4. Lower Transaction Costs

Technologies such as smart contracts significantly reduce intermediary fees in traditional transactions.

The impact of this transformation is profound. In the field of scientific research, the tokenization of intellectual property is changing the way biomedical research is financed, attracting more small investors. The tokenization process in the high-end spirits market is also allowing more people to access assets previously considered luxury items. Even precious metals like gold are being redefined in the wave of digitization, enabling investors to own and trade partial rights to gold without touching the physical asset.

From real estate to rare whiskey, from carbon credits to future earnings, the potential of tokenization seems boundless. It not only changes the way we invest but also reshapes our understanding of ownership and value. In the following report, we will delve into the world of tokenization and its far-reaching impacts, analyze various unique projects, study the technologies driving this transformation, and look ahead to the trends in asset ownership and trading. Let us witness how the "Great Tokenization" is reshaping the global financial ecosystem on a new level.

I. "The Great Tokenization": The Rise of Trillion-Dollar Opportunities

Globally, trillions of dollars in assets are waiting for the possibility of tokenization. According to RWA.xyz, the currently tokenized assets amount to approximately $185 billion (including stablecoins), a figure that has garnered widespread attention. This leads one to ponder: what does this wave of great tokenization truly mean? How can individuals seize this opportunity to realize profits?

1. Blockchain: The Cornerstone of Tokenization

When discussing asset tokenization, the role of blockchain is particularly important. Although cryptocurrencies are sometimes seen as "solutions in search of problems," the advantages of blockchain become very clear in the context of asset tokenization. The traditional asset management field has long faced many issues that have troubled investors, issuers, and regulators. The lack of transparency in private markets has led to pricing distortions and increased risks; the poor liquidity of high-value assets (such as real estate and art) has locked up large amounts of capital for extended periods; high entry barriers have made it difficult for small investors to diversify their assets; and inefficient processes involving multiple intermediaries have made transactions slow, costly, and prone to errors. Additionally, limited trading hours restrict investors' ability to respond quickly to global events, while market opacity provides opportunities for fraud and manipulation.

Blockchain technology offers solutions to these long-standing problems. It records all transactions through an immutable public ledger, accessible to any participant. This unprecedented level of transparency and security not only enhances trust among investors but also significantly reduces the risk of fraud, improving the transparency issues in many asset markets.

2. Revolutionary Changes in Trading Methods

Another major breakthrough of blockchain technology is its enhanced tradability. This technology enables 24/7 trading, breaking down time zone barriers and reducing reliance on intermediaries. This continuous market activity injects new vitality into traditionally illiquid assets. Imagine being able to buy and sell a portion of real estate as easily as trading stocks; this is the allure of tokenization.

These benefits are not limited to transparency and tradability. The programmability of blockchain, especially through the application of smart contracts, opens up new possibilities for asset management and governance. Dividend distribution, voting rights, and other complex processes can be automated, increasing efficiency and providing new opportunities for investor participation. This mechanism effectively addresses the cumbersome nature of corporate behavior management in traditional systems.

3. Breaking Barriers and Expanding Investment Opportunities

These features combine to democratize investment opportunities in unprecedented ways. High-value assets that were once only accessible to wealthy investors can now be divided into smaller, more affordable units. This model of fractional ownership not only expands access to various assets such as artworks and commercial real estate but also enables more investors to build diversified portfolios, breaking down the high barriers that have long excluded small investors.

II. Advantages of Tokenization

The core of tokenization lies in creating a digital representation of assets through blockchain technology. This process encompasses a wide range, from real estate and artworks to intangible assets such as intellectual property. Each token symbolizes partial ownership of the underlying asset, making the ownership structure of assets more refined and flexible.

Four Pillars of Tokenization

- Fractional Ownership: One significant advantage of tokenization is the ability to divide assets into smaller, more affordable units, making previously inaccessible investment opportunities more widespread. For example, investors no longer need millions of dollars to invest in high-end real estate but can purchase tokens representing a small portion of that property.

- Enhanced Transparency: Blockchain technology provides an immutable record of transactions, and this transparency not only reduces the risk of fraud but also enhances market trust while simplifying the auditing process.

- Lower Transaction Costs: By eliminating intermediaries and streamlining transaction processes, tokenization can significantly reduce costs associated with asset transfer and management.

- Increased Liquidity: Tokenization transforms traditionally illiquid assets into easily tradable digital tokens, potentially creating new, more liquid markets for various assets.

Tokenization of Tangible and Intangible Assets

One of the most striking aspects of tokenization is the tokenization of intangible assets. These assets have often been difficult to convert into liquid, tradable commodities in the past. However, through tokenization, intangible assets such as personal time rights or intellectual property can now be transformed into easily tradable liquid assets.

- Tangible Assets: Physical assets with real, measurable value, such as real estate or artworks.

- Intangible Assets: Assets that, while lacking a physical form, still hold value, such as intellectual property, future earnings, and carbon credits.

While the tokenization of tangible assets like real estate and artworks is groundbreaking in itself, the potential of bringing intangible assets onto the blockchain is even more exciting. These assets have often lacked suitable mechanisms for value exchange, but now, through tokenization, intellectual property, future earnings, and even personal time are creating entirely new markets, redefining the concept of value.

Imagine trading the future earnings of an emerging artist, investing in a patent for a groundbreaking medical discovery, or purchasing a portion of a rainforest's carbon offset potential. These intangible assets, previously difficult to quantify and trade, are now accessible and liquid through tokenization.

III. Current Status of Tokenization

The writing of this report stems from in-depth research into the field of tokenization of real-world assets (RWA), where the author found that activities in this area are much more vibrant than most people imagine. This phenomenon is exciting, and it is hoped that it will attract more attention to the tokenization movement and its various projects.

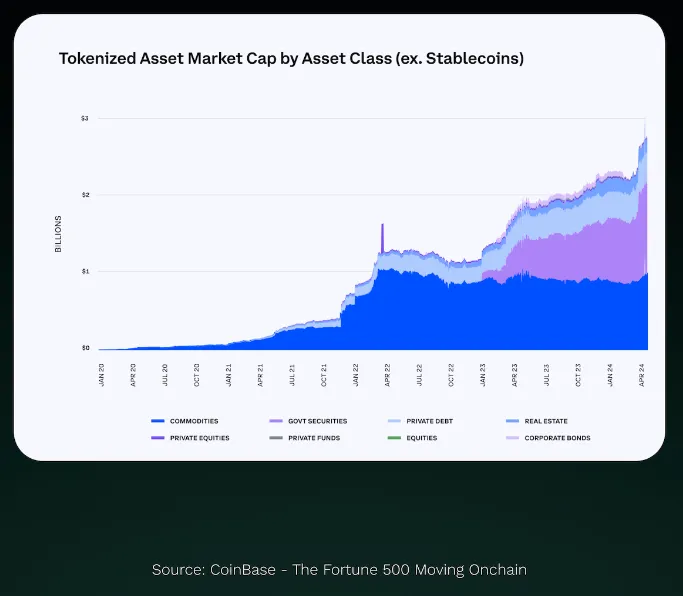

Recent market forecasts indicate that the tokenization market is poised for explosive growth. By 2030, the market size of tokenized assets could reach between $2 trillion and $10.9 trillion, depending on the trusted source of the forecast. Real estate, debt instruments, and investment funds are seen as the main drivers of this growth, expected to become the three major categories of tokenized assets.

1. Impact of Tokenization

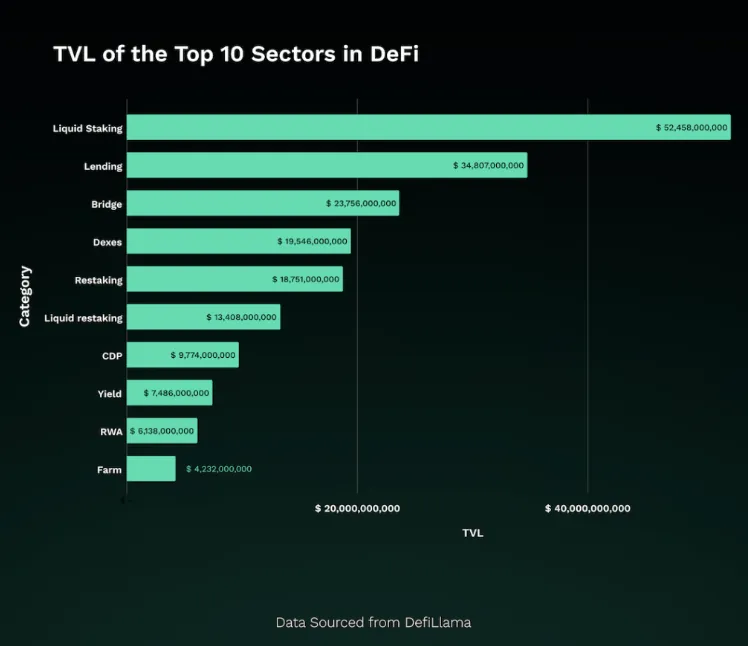

In the decentralized finance (DeFi) space, the impact of tokenization has already begun to manifest. By 2024, real-world assets will occupy a significant position in DeFi, becoming the ninth largest sub-market, with a total locked value of $6.13 billion. This data indicates that investor confidence in tokenized assets is strengthening, while also showcasing their important role in bridging traditional finance and DeFi.

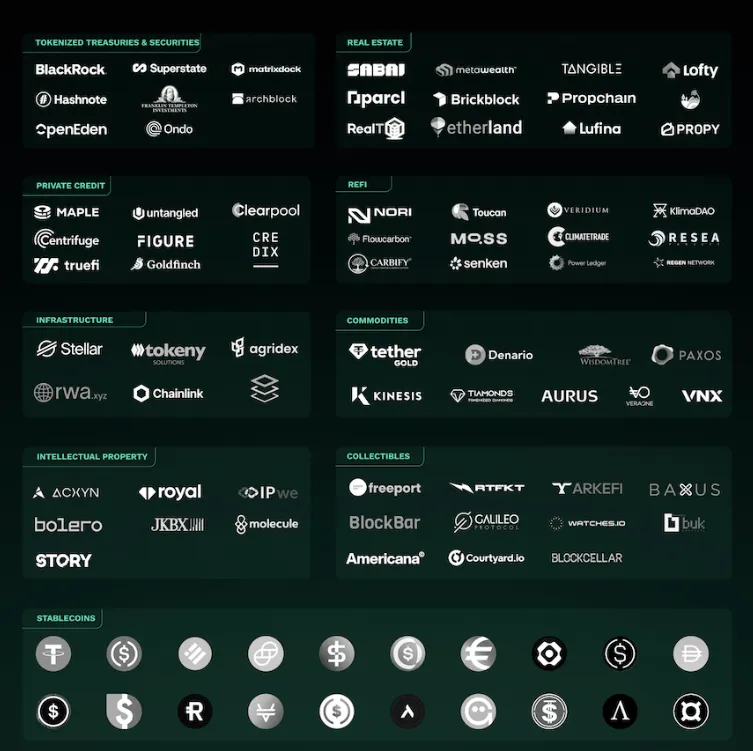

2. Ecosystem Overview

The RWA ecosystem is rapidly evolving, with various projects bringing traditional assets onto the blockchain. This field encompasses everything from tokenized government bonds and securities to more innovative developments like tokenized intellectual property. These projects aim to tokenize assets such as private credit, real estate, commodities, and high-value collectibles, showcasing the diversity of blockchain technology in reshaping asset ownership and trading methods.

What makes this ecosystem remarkable is its potential to transform traditional markets. By enhancing accessibility, liquidity, and efficiency, these projects are changing the way financial markets operate. Whether it’s achieving fractional ownership of high-end real estate, providing more opportunities for art investment, or creating new ways to trade commodities, tokenization is continually pushing the boundaries of finance and asset management. As the market matures, the integration of traditional finance and blockchain technology is deepening, with stablecoins based on real-world assets serving as a bridge connecting these two realms. This dynamic and rapidly evolving ecosystem reflects the tremendous potential of blockchain to fundamentally change our understanding of assets, value, and trading methods in the global economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。