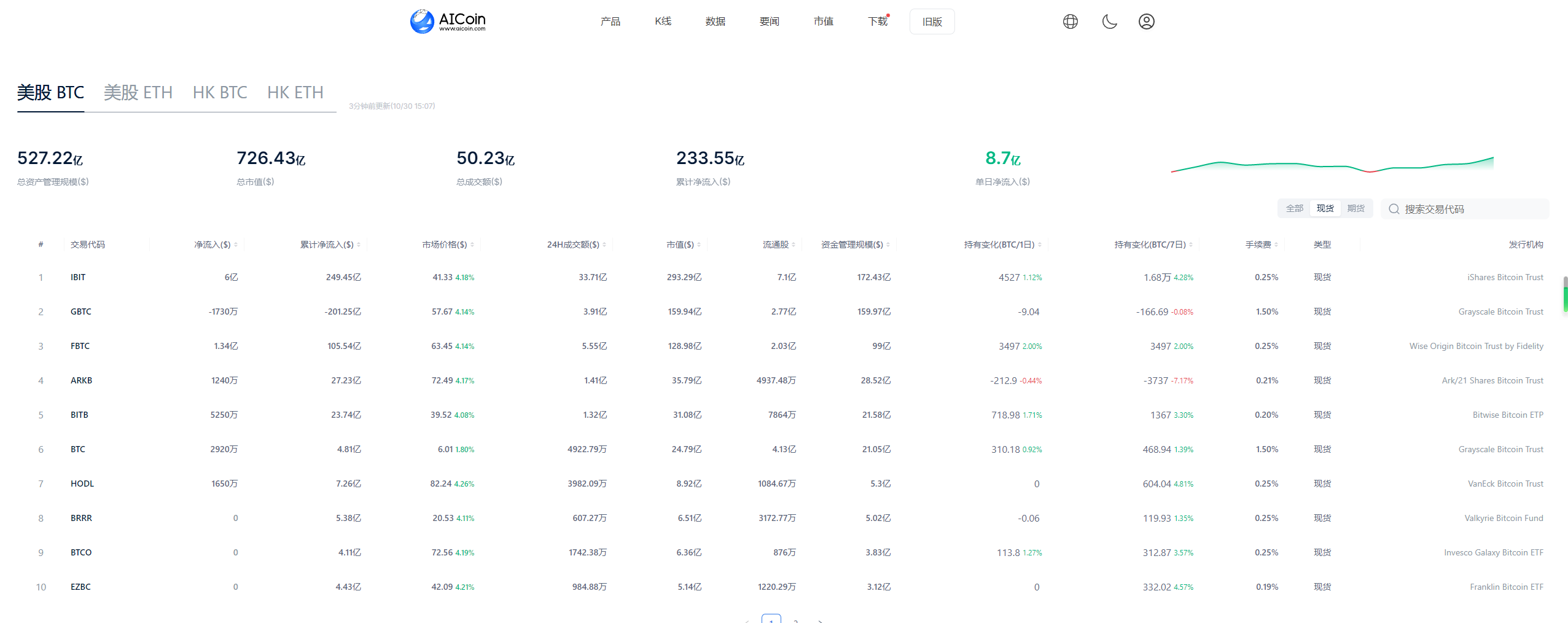

BTC Spot ETF Sees Net Inflow of $870 Million Today

According to AICoin data, the BTC spot ETF has set a new record, with a net inflow of $870 million yesterday (October 29), marking the third highest daily inflow in history. BlackRock's IBIT led the way with a single-day inflow of $600 million, bringing its cumulative net inflow close to $25 billion. Statistics show that IBIT only experienced a net outflow on the 10th of October, while achieving net inflows on all other trading days.

Image Source: AICoin

Such a large influx of funds typically indicates strong investor interest in Bitcoin. A significant inflow often also means the participation of institutional investors, who tend to have a higher risk tolerance and longer investment horizons. Their involvement can help promote market stability and growth.

BTC Reaches High After Historic Spot ETF Inflow Record

The record for the highest single-day net inflow for the BTC spot ETF occurred on March 12 of this year, with a net inflow of $1.05 billion. Subsequently, BTC reached a historic high of $73,881 on March 14, but after breaking through, it did not continue to rise, with BTC later hovering around $72,000.

Image Source: AICoin

Similarly, the second highest single-day net inflow record for the BTC spot ETF occurred on June 4 of this year, with a net inflow of $887 million. Following this, BTC reached a high of $72,144 on June 7, but again did not sustain this level, subsequently dropping, even falling to $50,000.

Image Source: AICoin

The current trend of fund inflows and historical patterns suggest a positive sentiment towards Bitcoin in the market, which may drive its price further upward. However, it is also important to discern whether this is a fleeting moment or a stable rise. Bitcoin is known for its extreme price volatility, and significant price increases may be followed by sharp declines, posing a risk that investors need to be cautious of.

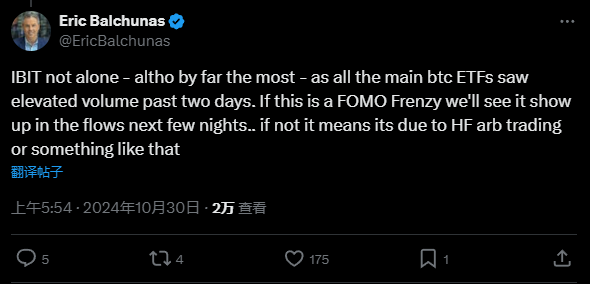

Balchunas pointed out that the significant increase in trading volume for major Bitcoin ETFs over the past two days may be due to FOMO (Fear of Missing Out), which reflects investors' psychological tendency to act out of fear of missing opportunities. FOMO can also lead to the formation of market bubbles, as seen in the cryptocurrency market frenzy of 2017, where rapid price increases attracted a large number of buyers without reflecting an increase in fundamental value, resulting in a bubble.

Image Source: x

Conclusion

Today, the BTC spot ETF inflow reached $870 million, indicating a surge in market sentiment, and BTC may potentially set new high points. However, whether this upward trend can be sustained remains to be seen. Investors should be vigilant about related risks, make rational judgments, and avoid impulsive investment decisions driven by fear of missing out. A rational analysis of market dynamics and one's own risk tolerance is essential to better navigate market volatility and uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。