Now the Movement ecosystem welcomes a group of DeFi newcomers, and our goal is to help these new users understand the basics of DeFi.

Author: Movement Official Chinese

As the Movement ecosystem continues to grow, more than 55 applications have been successfully deployed. As one of the most important infrastructures in the public chain ecosystem, DeFi has made significant contributions to the prosperous development of the ecosystem. Recently, our team member Torab @torabyou shared a guide on using DeFi projects within the Movement ecosystem on X. If you are a DeFi newcomer, this article will help you get started easily, enjoy~

I (Torab) consider myself a DeFi player. Although I missed the early frenzy of YAMS and YFI, I followed closely and started mining projects like the newly launched $FXS using http://vfat.tools.

Now the Movement ecosystem welcomes a group of DeFi newcomers, and our goal is to help these new users understand the basics of DeFi.

This article is suitable for beginners, and in the coming weeks, we will release advanced guides to help more experienced DeFi players further understand the Movement ecosystem. Today we will focus on the following projects: @ThunderheadLabs, @fraxfinance, @LayerZero_Core, @satayfinance, @SolvProtocol, @MovePosition, and @EchelonMarket.

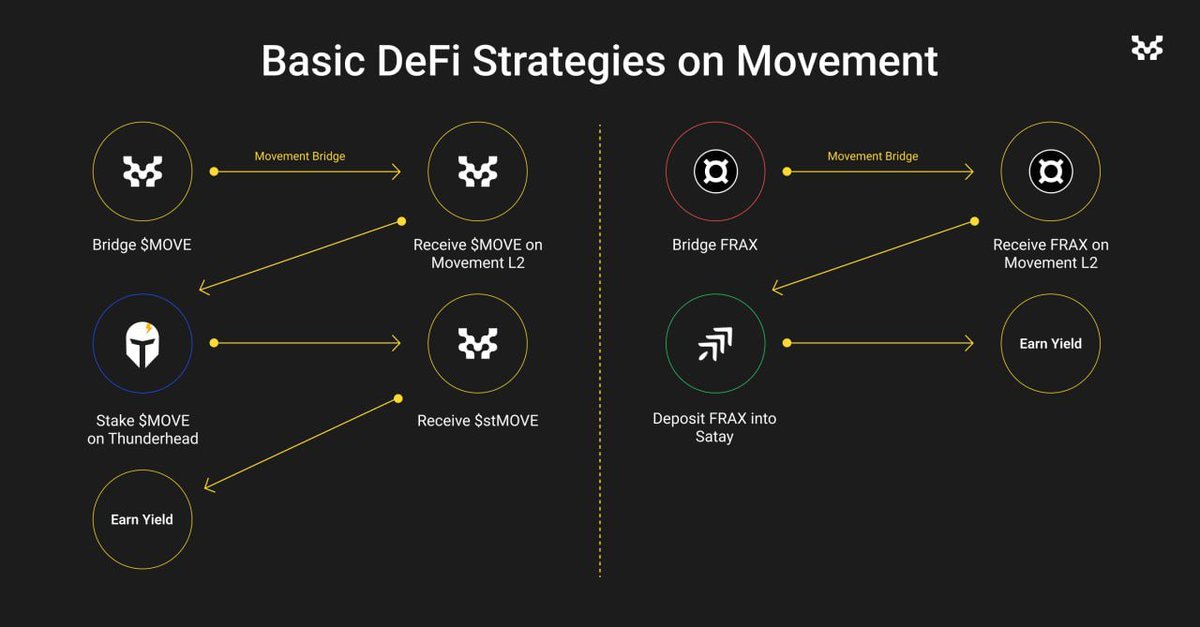

🟡 Strategy One

Bridge $MOVE to Movement using the Movement Bridge supported by LayerZero. Stake on Thunderhead to earn stMOVE and generate returns.

@ThunderheadLabs is one of our liquid staking protocols. When you stake $MOVE, you are not only helping to secure the network but also earning returns. It's a win-win. We will introduce more ways to use stMOVE in future updates!

🟡 Strategy Two

Bridge FRAX to Movement and deposit it into Satay to earn returns.

@satayfinance is a yield aggregator. What does that mean? It means you don’t have to manually search for the best yield sources; Satay will do it for you automatically. You deposit funds, and they help you achieve higher returns.

@fraxfinance is a censorship-resistant decentralized stablecoin launched by @samkazemian. If you are not familiar with FRAX, it is recommended to follow their Twitter and related documentation.

🟡 Strategy Three

Bridge solvBTC through the Movement Bridge and deposit it into Echelon to earn returns.

@EchelonMarket is a composable money market lending protocol. Simply put, you can deposit an asset, and if someone wants to borrow that asset, they will pay interest to you. There are more features, and we will present them in an easy-to-understand way.

@SolvProtocol is a Bitcoin liquid staking protocol that allows users to earn returns while using BTC on-chain.

🟡 Strategy Four

Bridge USDC to Movement. Deposit it into MovePosition to earn returns.

@MovePosition is a money market lending protocol supported by an institutional-grade risk engine. Like all lending protocols, you can deposit an asset, and if someone wants to borrow that asset, they will pay interest to you.

These projects are part of the first batch of applications and partners that will go live on the Movement mainnet. If you are a DeFi veteran, this content may be quite basic. In the next article, we will introduce advanced strategies, so stay tuned!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。