Written by: Heechang, Four Pillars

Translated by: Glendon, Techub News

With the development of the cryptocurrency industry, stablecoins have found a clear product-market fit. Meanwhile, stablecoin issuers are reaping considerable rewards. For example, Tether, the issuer of USDT, achieved a net operating profit of $1.3 billion in the second quarter of 2024, outperforming many traditional financial companies.

This success is not limited to established players; newcomers like Ethena and PayPal (which launched the dollar stablecoin PYUSD) are also rapidly emerging in this field.

Since its launch in December 2023, Ethena's circulating supply has exceeded $3 billion, generating over $75 million in fee revenue. At the same time, the protocol is actively diversifying its stablecoin products, planning to launch the stablecoin UStb based on BlackRock's tokenized fund BUIDL. Ethena also plans to launch its own network and build applications based on USDe on that network.

It is evident that the landscape of stablecoins is rapidly evolving. To date, the distribution channels and sources of revenue for stablecoins have become increasingly important. Competition among stablecoins has expanded from initial cryptocurrency startups to financial giants like BlackRock and BitGo, as well as fintech companies like PayPal, Robinhood, and Revolut.

Today, a new "stablecoin war" is about to begin. This article will start with the "Ethena Case Study - The Fastest Growing Stablecoin," analyzing the business model and success factors of Ethena USDe. Can USDe change the competitive landscape of the stablecoin market? What lessons can newcomers learn from it?

Source: Size of the Opportunity | Ethena Labs

Ethena Case Study - The Fastest Growing Stablecoin

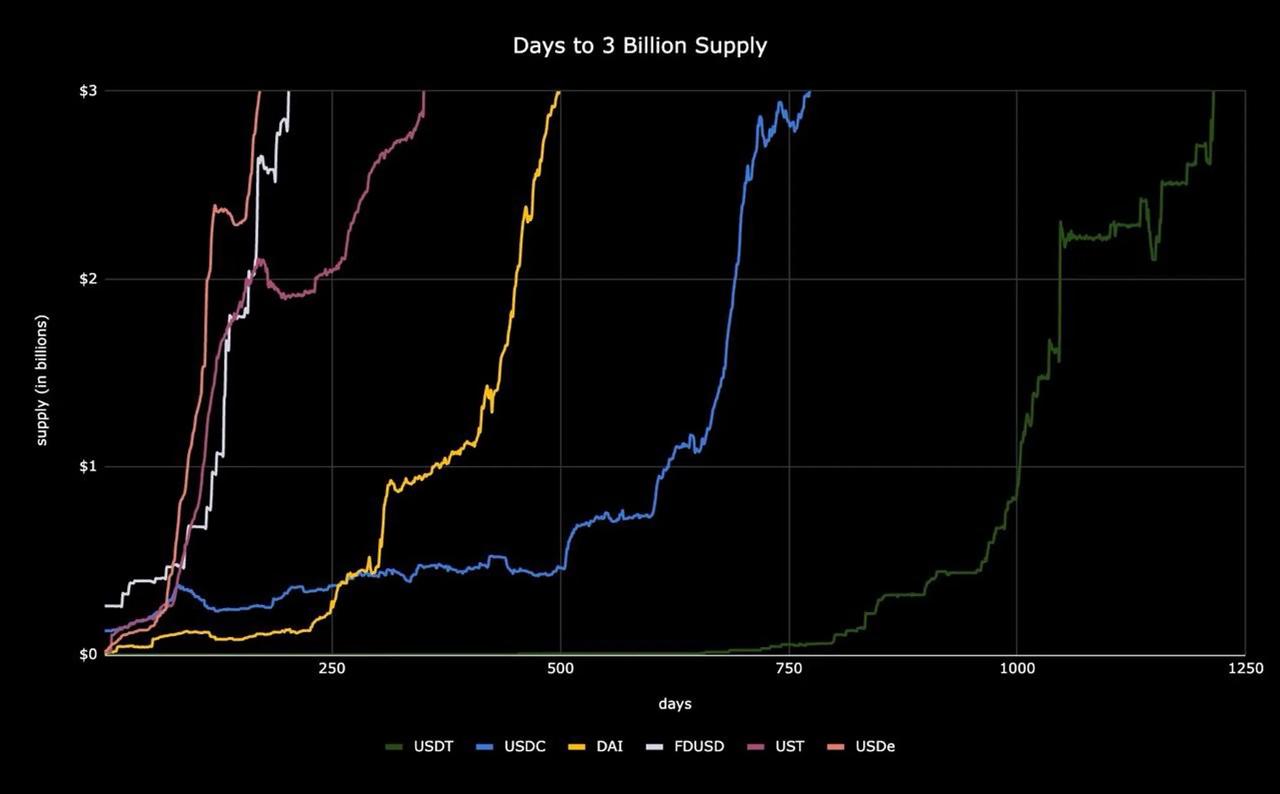

Data Source: X (@leptokurtic)

With its unique mechanism design, Ethena's synthetic stablecoin USDe has achieved remarkable growth, reaching a market cap of $3 billion in just four months. This rapid expansion has made it the fastest-growing stablecoin to date, surpassing competitors like DAI, USDT, FDUSD, and USDC. How did it achieve this?

The success factors of USDe are as follows:

A unique high-yield strategy that is not easily replicable;

Robust collateral management;

A comprehensive expansion plan;

Sources of Revenue

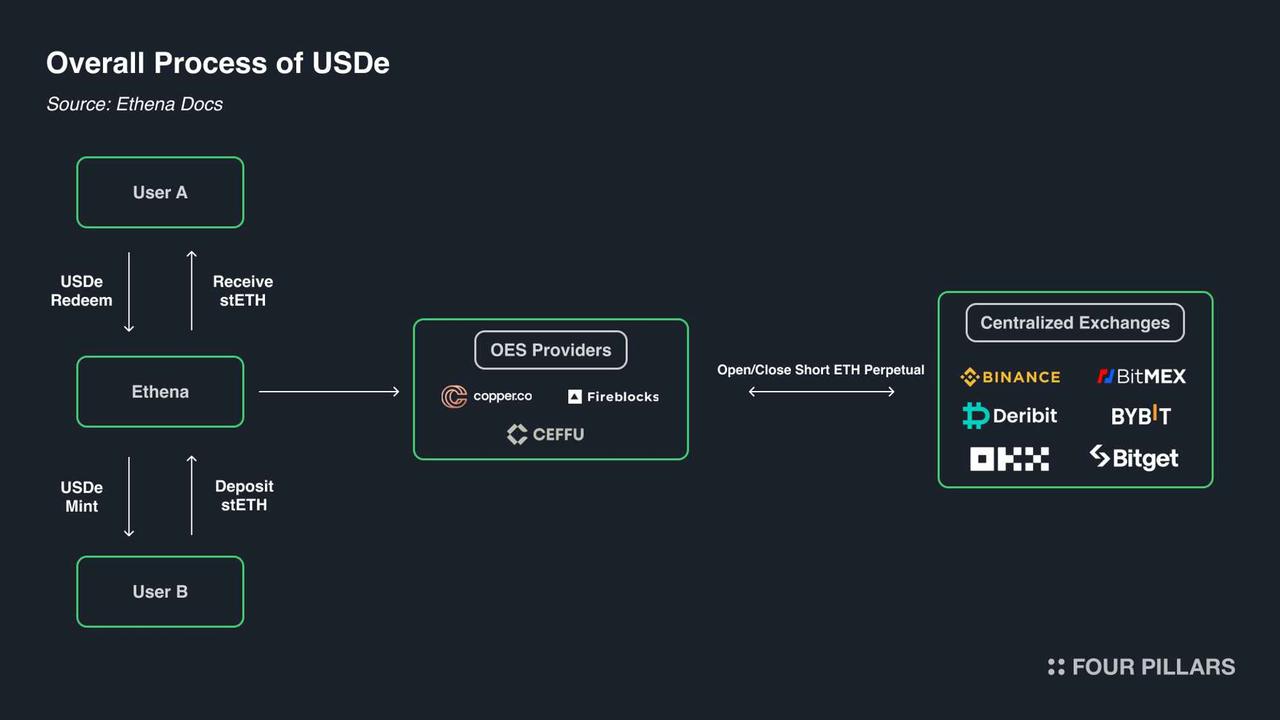

First, we need to understand how USDe maintains its stability. Ethena uses a delta-neutral hedging strategy to keep the value of USDe close to $1. In simple terms, when users collateralize ETH to mint USDe, Ethena opens an equivalent short position in perpetual futures on a derivatives exchange. This creates a delta-neutral position where the price fluctuations of the ETH collateral are offset by the inverse fluctuations of the futures short position. This strategy maintains stable value and leverages the liquidity of centralized exchanges to improve capital efficiency without excessive collateralization.

This approach combines crypto-native solutions with off-chain opportunities, using crypto assets and futures short positions to support the stablecoin. So, how is its revenue generated?

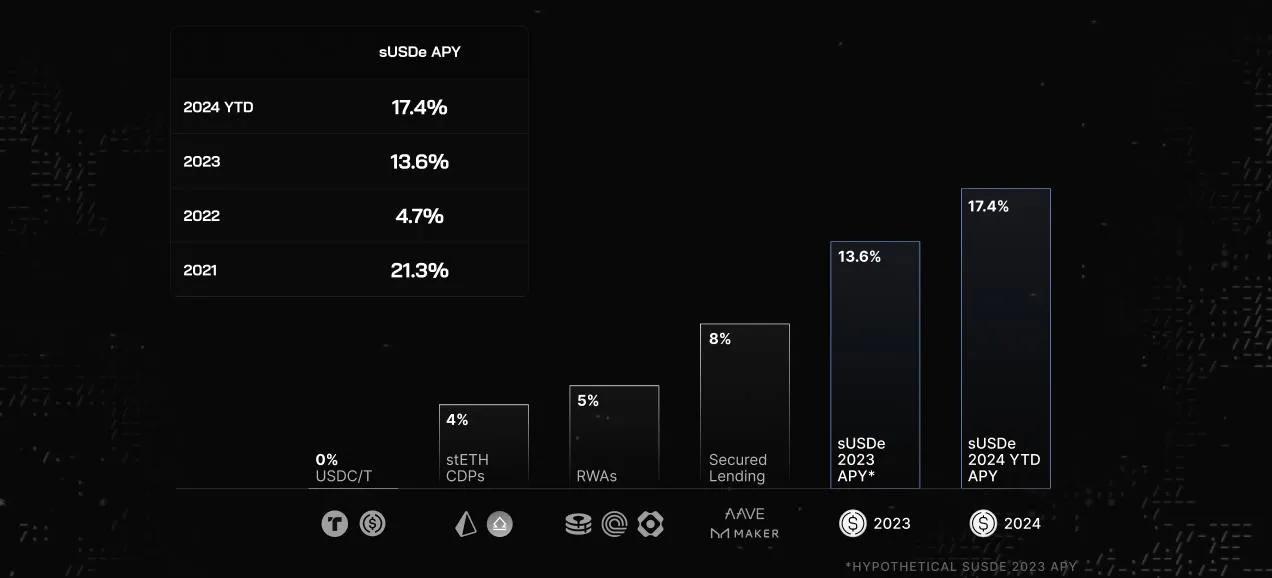

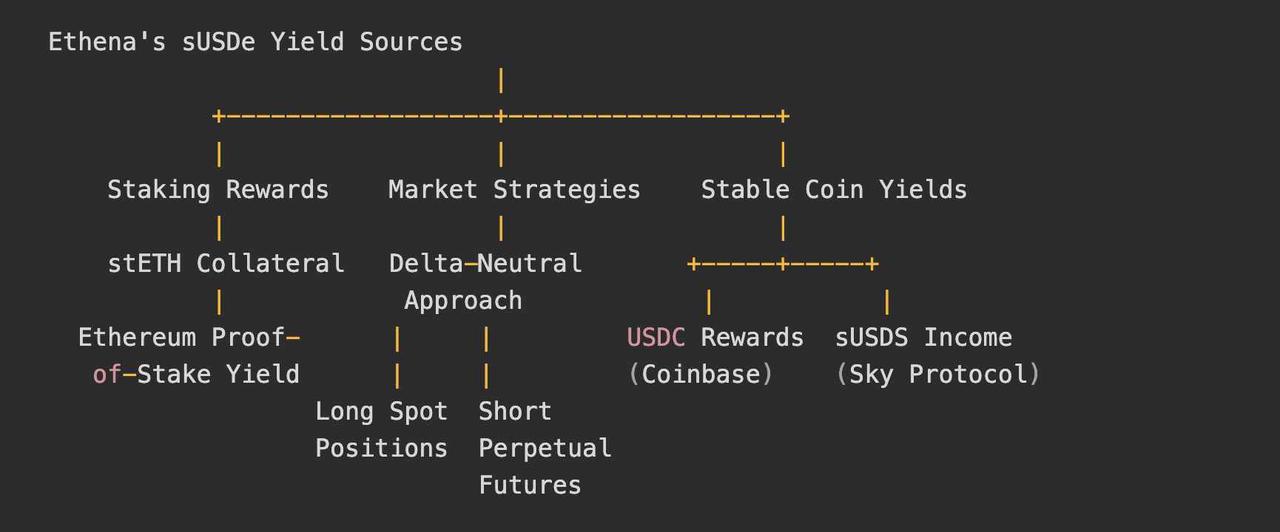

Ethena's Staked USDe (sUSDe) is a yield-bearing token that users can earn by staking their USDe tokens. sUSDe provides high yields through a combination of staking rewards and basis trading strategies.

Main sources of revenue for sUSDe:

Staking rewards: It profits from underlying collateral like stETH (staked Ethereum) and earns base returns from Ethereum's proof-of-stake system.

Market strategies (Delta-Neutral): It profits from funding and basis in the perpetual contract and futures markets. By adopting a delta-neutral approach, it holds long positions in spot assets and short positions in perpetual futures. This method allows the protocol to take advantage of positive funding rates, where long position holders pay fees to short position holders.

Stablecoin revenue: Ethena earns fixed income from two sources of stablecoins. It acquired 295 million USDC through Coinbase's loyalty program and generated 400 million sUSDS in revenue from borrowing fees via the Sky protocol (formerly known as Maker).

"Unforkable" Architecture

What sets Ethena apart is its "unforkable" architecture. Unlike most AMM DEXs, Ethena's structure cannot be easily replicated. First, traders conduct basis trading on major centralized exchanges (CEX) like Binance, Bybit, and OKX, but the collateral is held by over-the-counter settlement (OES) providers like Copper, Ceffu, and Coinbase Custody. This complex relationship and design explain why no similar protocols have widely spread across various ecosystems.

Source: The Internet Bond | Ethena Labs

Collateral Management: Ethena UStb, Liquidity Stablecoins, and Reserve Funds

Source: Positions | Ethena

As a stablecoin, USDe requires active management to balance potential risks and high yields. Ethena primarily employs three methods to ensure collateral management, including:

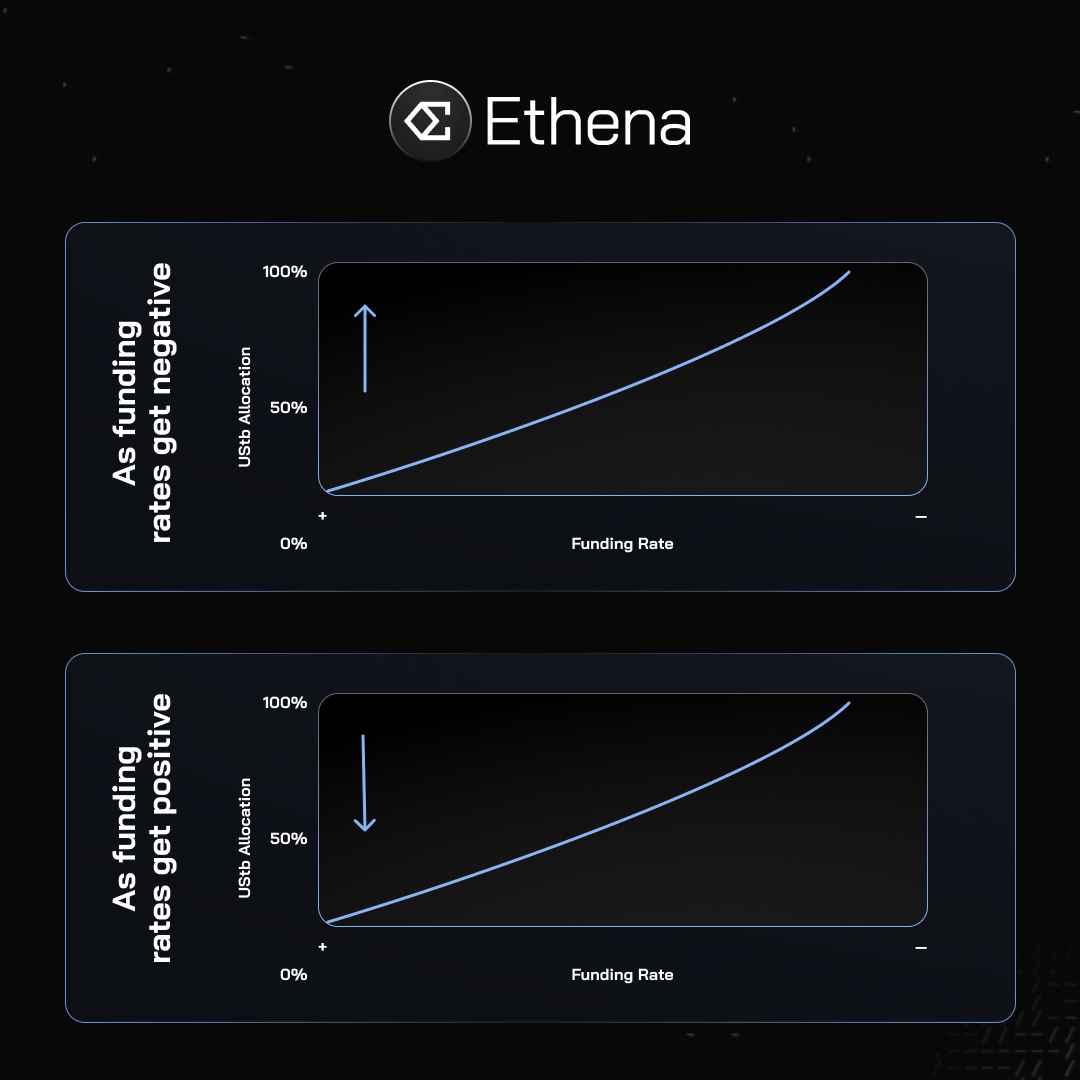

Ethena UStb (upcoming): This upcoming U.S. Treasury bond token is backed by BlackRock's BUIDL fund and is planned as a strategic safeguard. During periods of negative funding rates, Ethena can shift reserves to UStb, reducing exposure to costly perpetual futures contracts and investing in more stable assets.

Liquidity stablecoins: Ethena utilizes USDC from Circle and USDS from Sky (formerly MakerDAO) as part of its collateral strategy. These liquid stable assets provide stable yield components, helping to buffer relatively mild negative funding rates and diversify the protocol's sources of income.

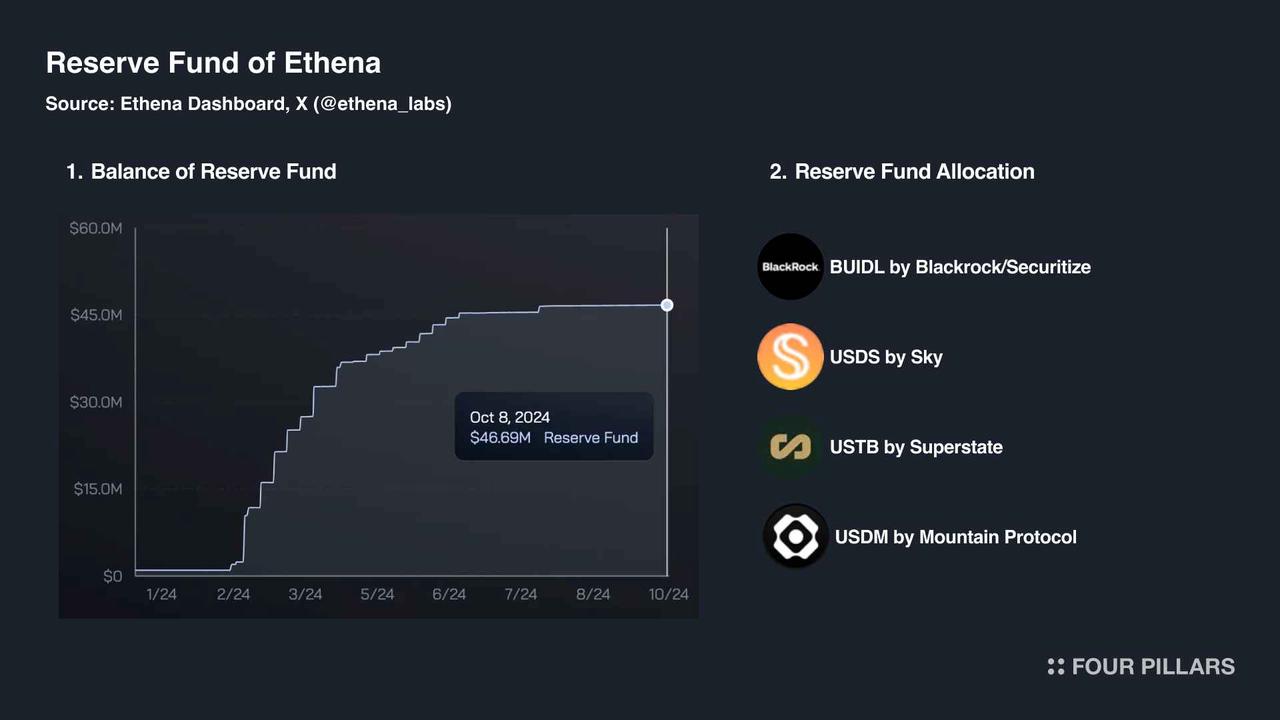

Reserve fund: Ethena maintains a safety net of $46.6 million to cover potential losses during periods of negative funding rates. This fund activates when negative rates exceed collateral yields, thus protecting sUSDe holders.

In a scenario dominated by positive funding rates, Ethena's strategy can indeed shine. USDe can generate high yields through basis trading of crypto assets, allowing Ethena to allocate a significant portion of its collateral (up to 90%) to this strategy, maximizing returns for sUSDe holders.

However, when funding rates drop significantly, Ethena will have to face the situation of declining yields, which has become a major reason for market skepticism regarding Ethena's yield stability.

Notably, the stablecoin UStb that Ethena plans to launch soon could serve as a catalyst in its development process.

At the end of September, when announcing this plan, Ethena stated that UStb could help USDe navigate challenging market conditions, explaining, "If Ethena's management deems it necessary and appropriate, during periods of negative funding rates, Ethena will be able to close the hedging positions of USDe and reallocate its collateral to UStb to further improve the associated risks."

Theoretically, once UStb is launched, if funding rates turn negative and cryptocurrency sentiment shifts bearish, Ethena can reallocate its collateral to this more stable asset. This strategic shift can serve two key roles:

UStb sets a floor for sUSDe yields: By utilizing UStb and other stable assets, Ethena can ensure a minimum yield even under bearish conditions. This helps maintain attractiveness for sUSDe holders, as the minimum yield will be close to Treasury bond yields.

UStb reduces the volatility of sUSDe yields: Shifting to more stable collateral during "bear markets" will undoubtedly lead to reduced yield volatility. This increased stability is particularly appealing to risk-averse investors seeking consistent returns even in challenging market conditions.

This flexibility helps Ethena maintain high yields under different market conditions. Additionally, the relationship between funding rates and UStb allocation is straightforward: when funding rates are negative, UStb allocation increases, even from 50% to 70%, thereby avoiding negative yields. Conversely, when funding rates are positive, UStb allocation decreases.

Source: X (@ethena_labs)

Moreover, the reserve fund not only protects the interests of sUSDe holders but is also strategically allocated to yield-generating resources such as Blackrock BUIDL, Superstate, Sky, and Mountain Protocol. This model allows Ethena to maximize the utility of the fund, potentially generating additional income to further increase the reserve fund.

Ethena Expansion Strategy

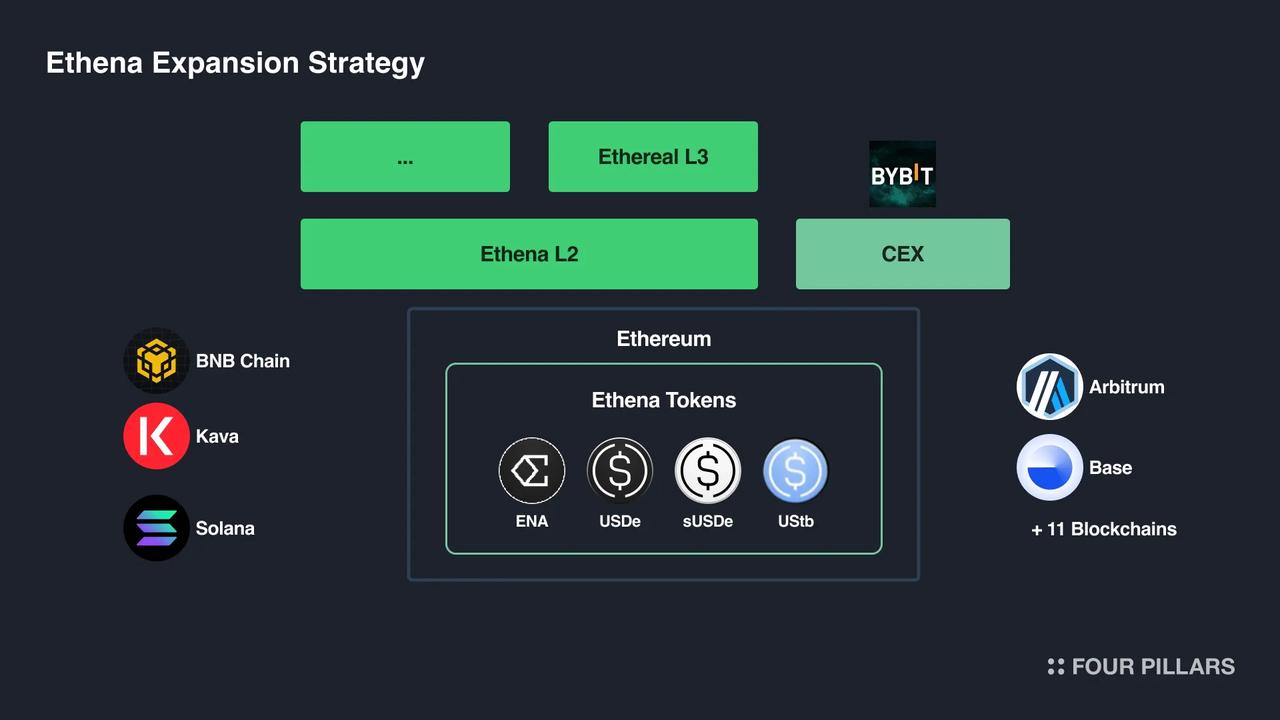

Ethena is implementing a comprehensive expansion strategy that encompasses both horizontal and vertical growth:

Horizontal Expansion: This involves product diversification and a multi-chain approach. Ethena is expanding its product range and extending to multiple blockchains. This strategy aims to cover a broader user base and reduce reliance on a single blockchain.

Vertical Expansion: Ethena is developing its own network infrastructure and collaborating with off-chain exchanges. By building infrastructure, the protocol can enhance operational control and capture more value, such as deriving value from sequencer revenue. Collaborations with exchanges also improve the liquidity and accessibility of Ethena's products.

Horizontal Expansion: Multi-Chain Strategy with LayerZero

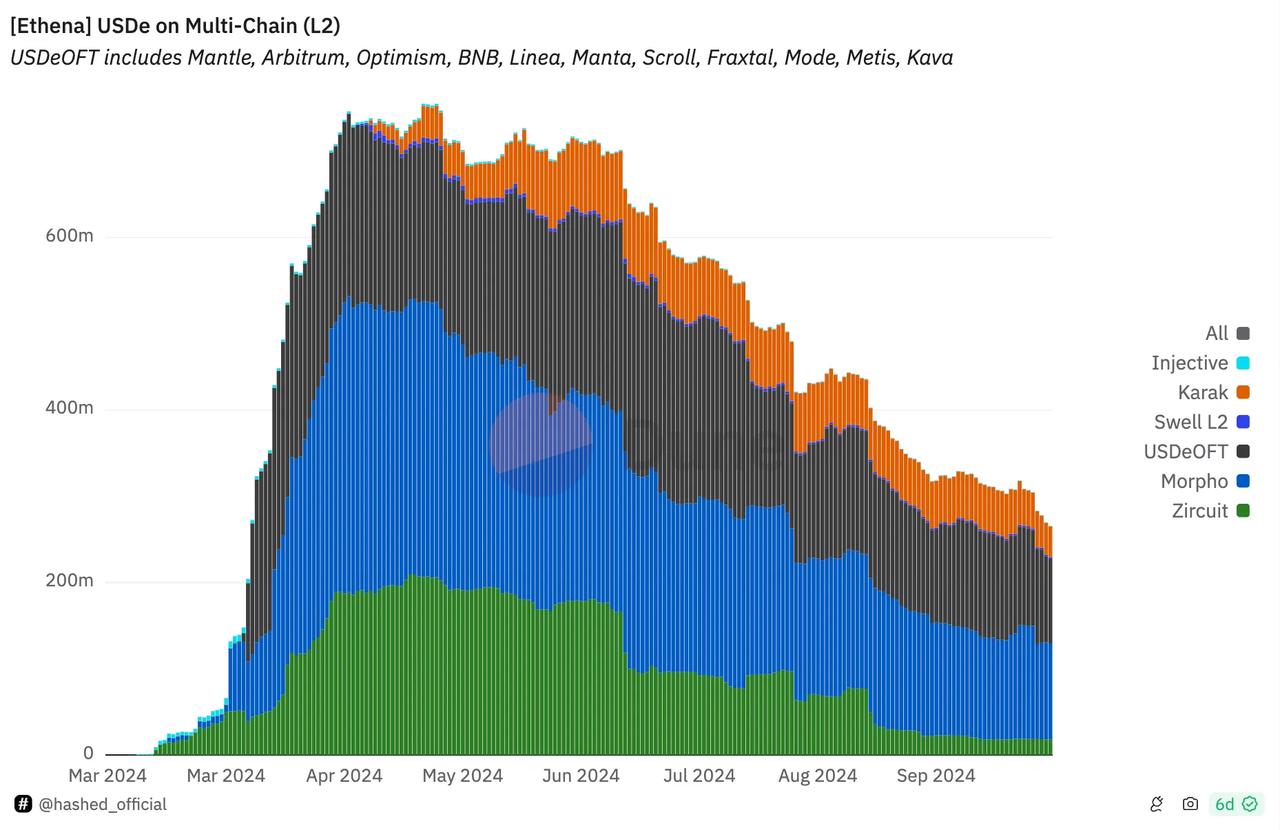

Ethena has developed a multi-chain expansion strategy in collaboration with LayerZero. This partnership leverages the Omnichain Fungible Token (OFT) standard, allowing Ethena to extend the reach of its tokens across 16 different blockchains. Currently, Ethena's native token ENA, as well as its stablecoins USDe and sUSDe, are accessible across multiple blockchains.

The OFT standard employs a "mint-burn" mechanism, enabling the token supply on all connected chains to remain consistent without the need for wrapped assets or additional liquidity pools. Ethena adopts this approach to simplify cross-chain transactions while potentially reducing associated costs and risks.

Source: Hashed's Ethena Dashboard

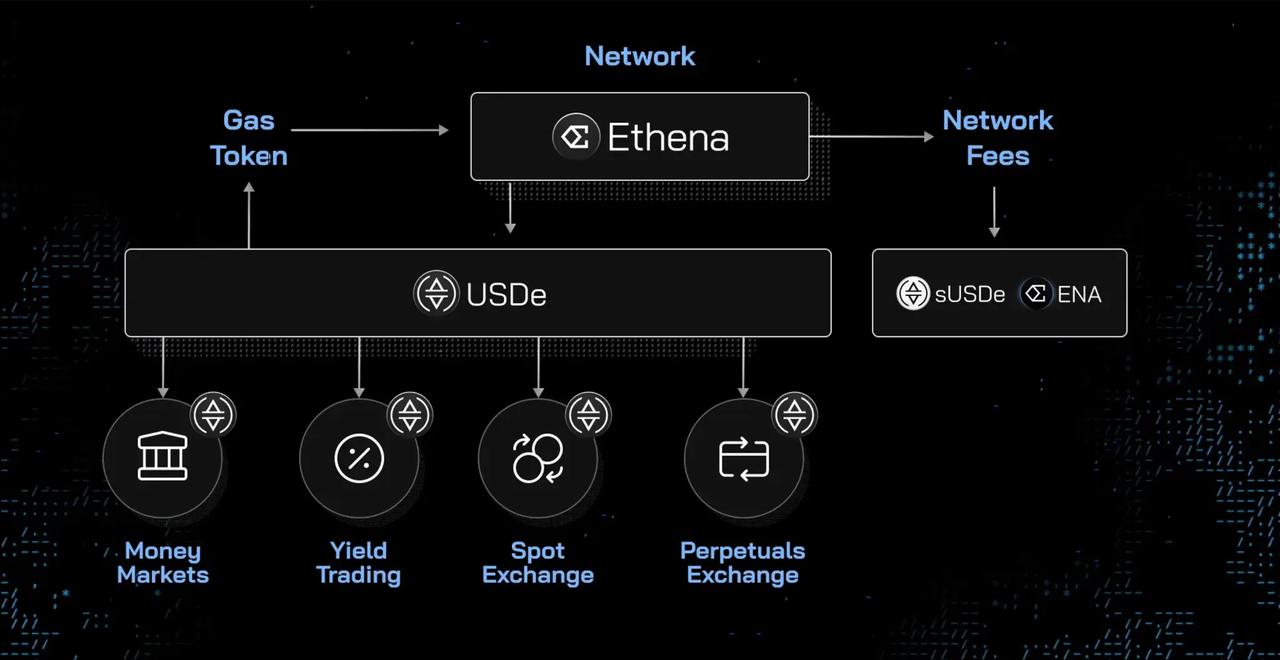

Vertical Expansion: Building the Ethena Network and Its Ecosystem

The Ethena Network is an upcoming initiative of the Ethena protocol, aimed at creating a financial application ecosystem based on USDe as the foundational asset.

This network is planned to serve as a base layer for other financial applications and incorporate a liquidity aggregation layer. This feature is also expected to support existing centralized and decentralized exchanges. Ethena aims to position itself at the intersection of currency, networks, and exchange functionalities in the crypto world.

Currently, Bybit has partnered with Ethena to integrate USDe on its platform. A key goal for Ethena is to position USDe as collateral for trading on CEXs. By allowing users to earn yields from margin assets in CEX futures, USDe can create additional advantages within the trading ecosystem.

Source: Ethena 2024 Roadmap: The Holy Grail: Internet Money

Analyzing Stablecoins: Collateral and Yields

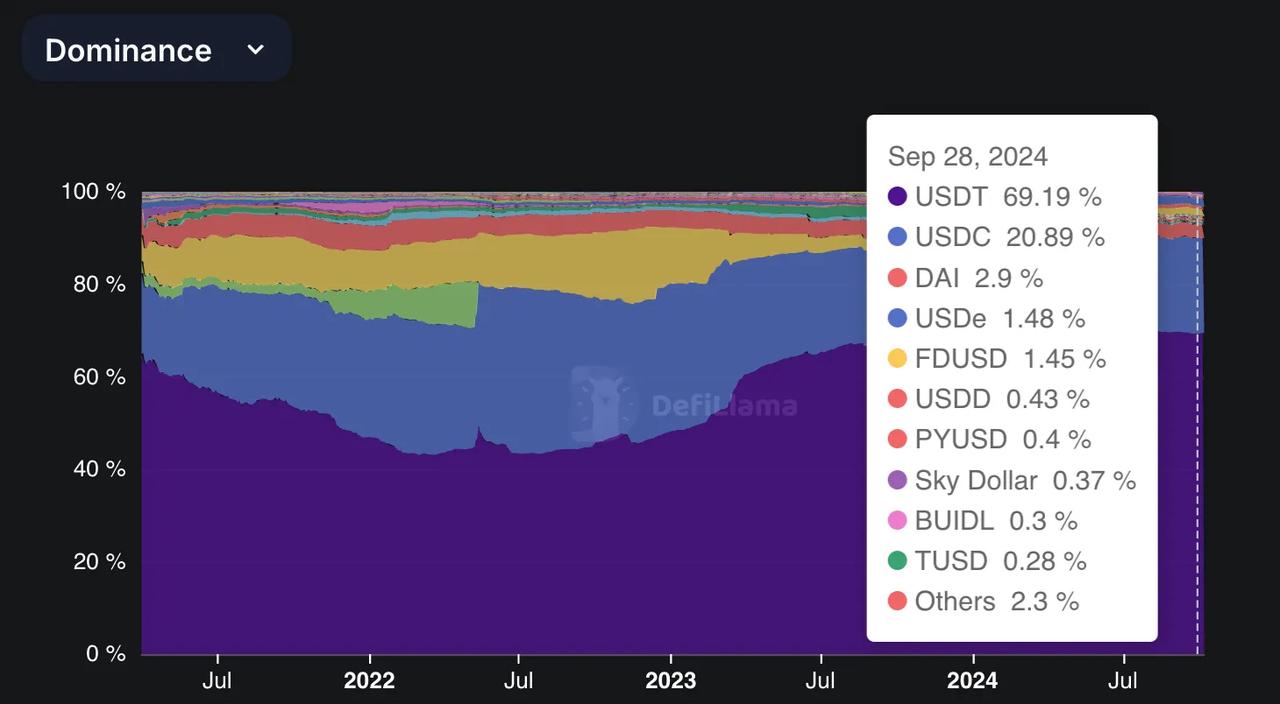

Based on the aforementioned mechanisms and strategies, Ethena has successfully penetrated a market dominated by Tether (USDT), Circle (USDC), and DAI. However, competition in the stablecoin market is not limited to issuing new stablecoins; the strategies for building stablecoins are also becoming increasingly diverse.

Source: Stablecoin Circulation - DefiLlama

How are stablecoins classified? Stablecoins use collateral and active management to maintain a value of $1. Each issuer has a system for maintaining value, minting, or redeeming currency.

The type of collateral affects how stablecoin holders earn yields. Previously, issuers like Tether and Circle generated substantial income by earning from their collateral. Currently, many projects directly offer yields to holders. This section will explore the various types of collateral supporting stablecoins and their sources of income.

Collateral: The Foundation of Stablecoins

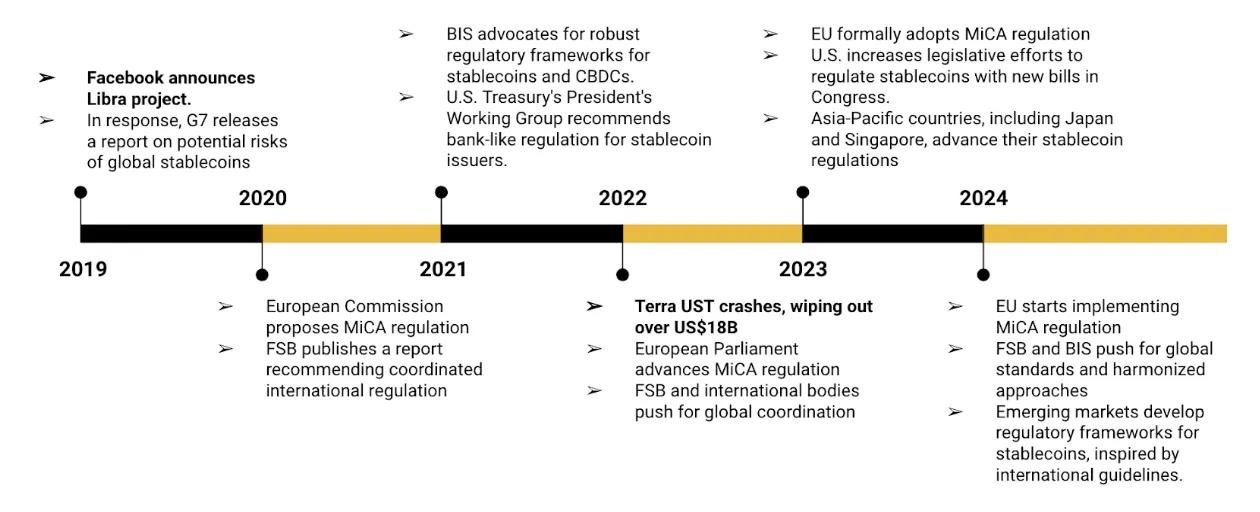

Collateral has become crucial in the stablecoin ecosystem, especially following events like the collapse of Terra UST and concerns over USDT's transparency. Today, stablecoin projects ensure that well-known entities using reliable assets provide transparent and secure backing.

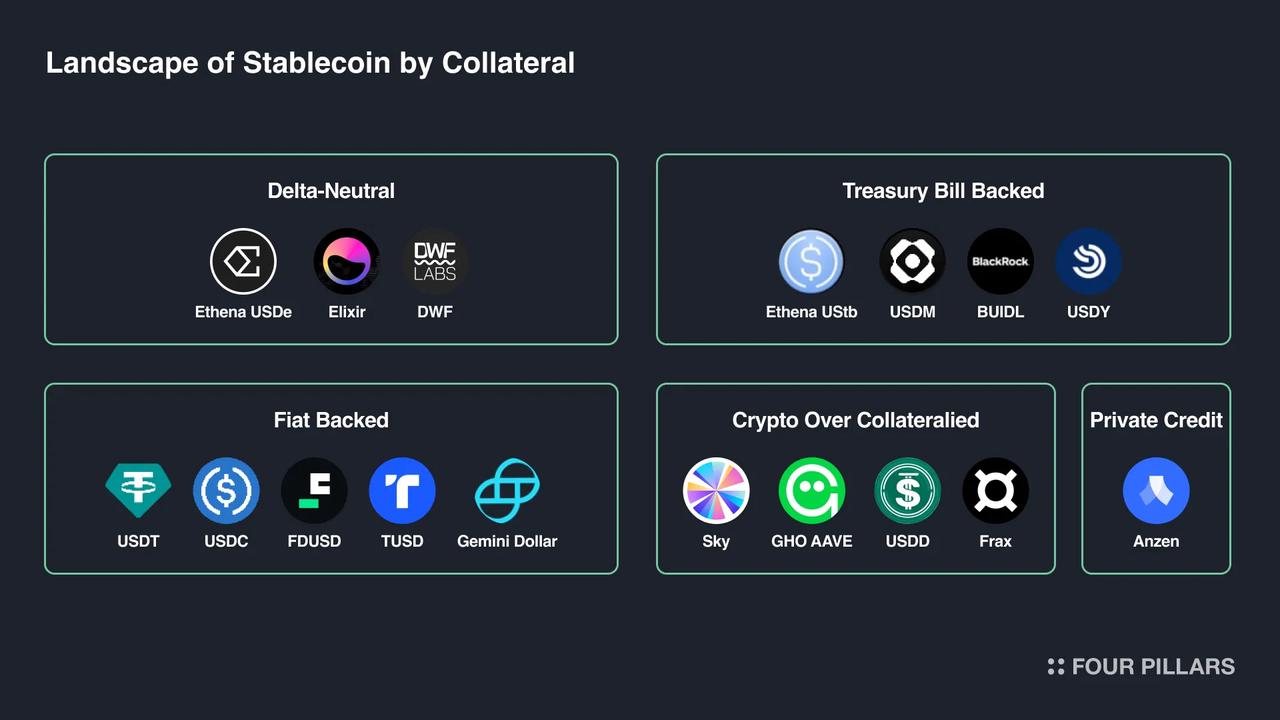

Stablecoin issuers currently use five main types of collateral, but most projects utilize several of these rather than relying on just one.

1. Crypto Assets Delta Neutral: This strategy leverages price differences between spot and futures cryptocurrency markets to maintain the peg of stablecoins, such as Ethena's USDe and Elixir's deUSD. USDe employs a delta-neutral approach, combining long spot positions in Ethereum with short perpetual futures positions to generate yields. This strategy features CEX integration and active collateral management, optimizing performance under various market conditions.

2. Over-Collateralized Cryptocurrencies: These stablecoins use more cryptocurrency as collateral to buffer against market volatility. A typical example is DAI issued by MakerDAO, which uses various cryptocurrencies with a minimum collateralization rate of 150%. USDD, Frax, and GHO also employ similar strategies, often combining over-collateralization with other stabilization mechanisms. For instance, Frax uses a fractional algorithmic mechanism.

3. Fiat-Collateralized: These stablecoins are backed by traditional currencies held by centralized entities. This category includes popular stablecoins like USDT, which is backed by cash, cash equivalents, and other assets, and Circle's USDC, which is backed by cash and short-term U.S. government bonds. Additionally, there are Binance USD (BUSD), TrueUSD (TUSD), Pax Dollar (USDP), and Gemini Dollar (GUSD), each with unique backing mechanisms.

4. U.S. Treasury Bond-Backed: These stablecoins integrate traditional finance. Examples include Ondo's USDY, Mountain Protocol's USDM, and Blackrock's BUIDL. They are typically backed by short-term U.S. government debt. As mentioned earlier, Ethena's UStb is supported by short-term U.S. Treasury bonds and Blackrock BUIDL's bank demand deposits, providing exposure to government bond yields and flexibility in cryptocurrency.

5. Private Credit-Backed: This approach uses private credit instruments as collateral. USDz launched by Anzen is a typical case, supported by corporate bonds, loans, or other forms of private debt. Compared to fiat-backed stablecoins, this method has higher yield potential while maintaining stability through risk management and portfolio diversification.

As the industry matures, the types of collateral in the stablecoin market continue to increase. There is no doubt that transparency, security, and regulatory compliance will become increasingly important in determining the success and adoption of stablecoin projects.

Sources of Income: How Stablecoins Generate Revenue

Currently, the development of stablecoins has long surpassed simple price stability. They now provide mechanisms for generating income, offering users opportunities for passive income. These revenues come from various strategies, making stablecoins more attractive, with primary sources categorized as follows:

1. Funding Revenue from Basis Trading: This strategy leverages price differences between the cryptocurrency spot and futures markets, allowing stablecoins to generate income while maintaining their peg.

2. U.S. Treasury Bonds: Some stablecoins are backed by U.S. Treasury bonds. These stablecoins earn yields through interest on short-term government debt. For example, Mountain Protocol's USDM is supported by short-term U.S. Treasury bonds, passing the earnings on to USDM holders.

3. Staking Yields: Some stablecoins allow users to stake their tokens within the protocol, earning rewards for contributing to network stability and security.

4. DeFi Mechanisms: Stablecoins can earn yields through various DeFi practices, such as providing liquidity to AMM pools or yield farming. For instance, OUSD (Origin Dollar) allocates its collateral across multiple DeFi protocols, using lending platforms like Compound and Aave, and earns transaction fees by providing liquidity. Additionally, the DAI Savings Rate (DSR) module allows DAI holders to earn yields by depositing tokens, distributing interest from Maker protocol lending activities to participants.

Volatility of Collateral and Yields

Stablecoins are referred to as "stablecoins" because they are designed to maintain a stable value relative to a specific asset or benchmark (usually the U.S. dollar), providing a reliable medium of exchange within the crypto ecosystem.

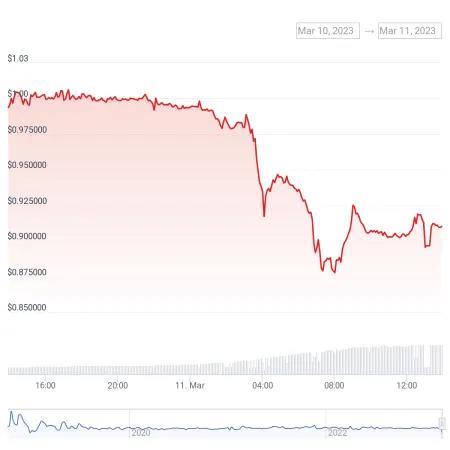

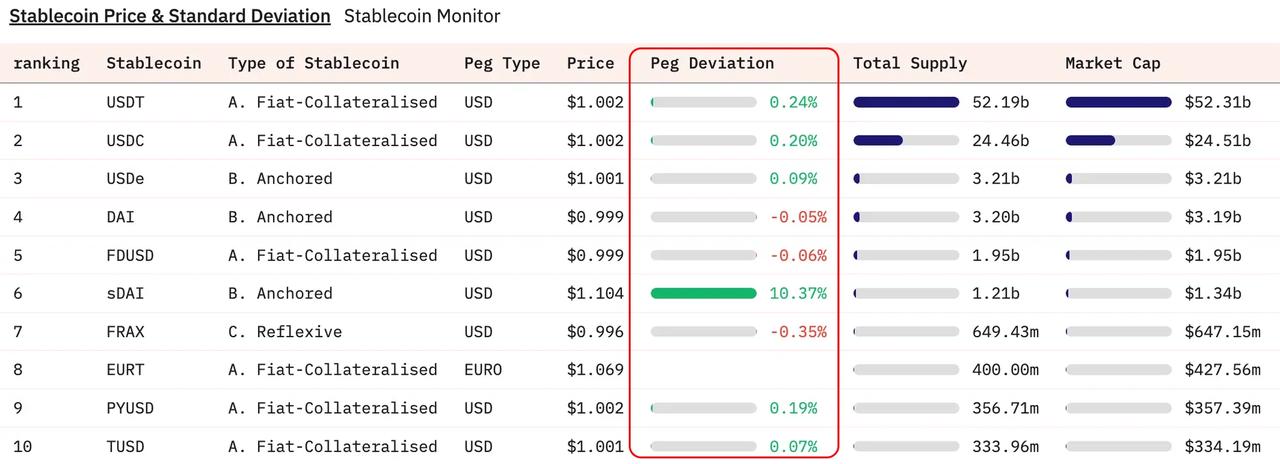

However, there have been instances in the past where some stablecoins experienced slight decoupling. For example, Tether has been criticized for a lack of transparency, leading to value instability, and during the Silvergate collapse, investors' concerns over collateral solvency caused USDC to experience a brief decoupling.

So, what potential volatility might the collateral and yields of stablecoins face?

Source: USDC Price During Silvergate Collapse 2023.03.11 | CoinGecko

Collateral Risks

For large assets, fiat-collateralized and U.S. Treasury bond-backed stablecoins are considered the safest. They carry lower risks, primarily related to the entities holding the assets. These stablecoins are regulated and insured by national financial systems.

Source: Overview of Stablecoin Regulation

The stability of delta-hedged synthetic dollars (such as Ethena's USDe token) is indeed facing some scrutiny. The main concern is that negative funding rates may occur in the derivatives market; if the cost of maintaining short positions exceeds the yield from collateral, it could lead to losses. Other risks include reliance on centralized exchanges for derivatives trading, potential liquidity issues during market stress, and the possibility of collateral assets (like stETH) losing their peg to ETH.

Source: Stablecoin Monitor

Yield Volatility

The yields of stablecoins backed by Treasury bonds are susceptible to the interplay of complex economic factors and market dynamics. The primary driver of these yields is the interest rates of the underlying Treasury bonds, which are directly influenced by the Federal Reserve's monetary policy.

When the Federal Reserve adjusts interest rates, it creates a ripple effect throughout the financial markets, including the yields offered by stablecoins. For example, during periods of monetary tightening, as the Federal Reserve raises interest rates, Treasury bond yields typically increase. This allows stablecoin issuers to potentially offer higher yields to their users. Conversely, when Treasury yields decline, users' yields will also decrease.

It is important to note that most fiat-backed stablecoins are created from a mix of cash and Treasury bonds, and their yield curves can vary based on the collateral they support and the issuer. For instance, BlackRock's BUIDL stablecoin is supported by a mix of cash, Treasury bonds, and other short-term government securities. As a regulated product from a large financial institution, BUIDL's yield is closely tied to prevailing Treasury bond rates. However, these yields are not immune to fluctuations caused by broader market conditions and changes in monetary policy. Over the past decade, the yield on 1-year U.S. Treasury bonds has fluctuated between 0.1% and 5.5%.

Source: 1-Year Treasury Rate - 54-Year Historical Chart | MacroTrends

Basis Trading

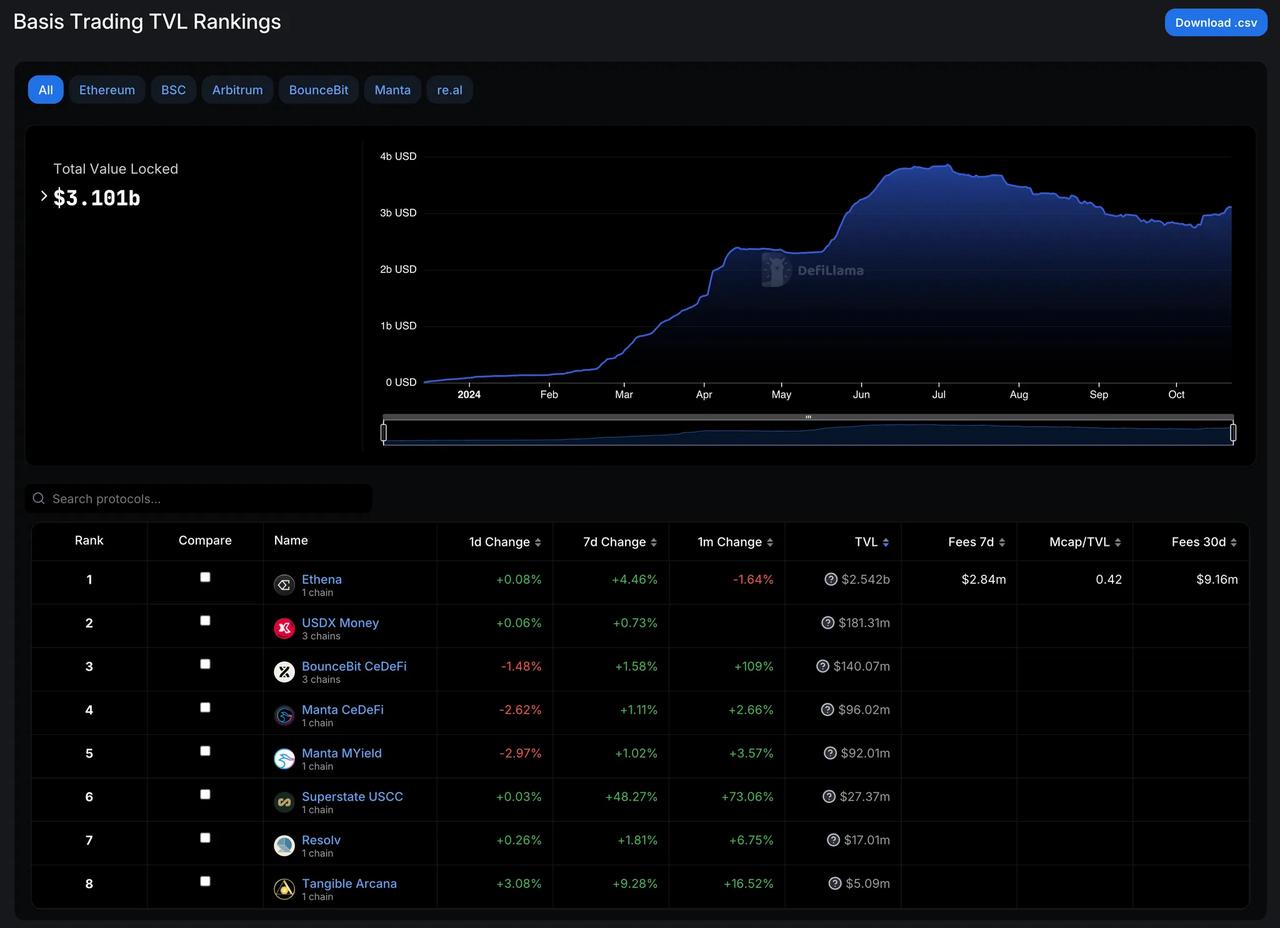

Basis trading has become a primary method for generating yields for some stablecoins. This strategy exploits price differences between the cryptocurrency spot market and futures market, typically buying in the spot market and shorting in the futures market.

The yields from basis trading can vary significantly, influenced by market sentiment, trading volume, and the overall state of the cryptocurrency market. During a "bull market" or periods of heightened optimism, increased demand for leverage in the futures market may widen the basis, potentially increasing yields. Conversely, during a "bear market" or uncertain periods, the basis may narrow or even turn negative, potentially reducing or eliminating yields.

Ethena's USDe is a typical case of using basis trading to generate yields, with sUSDe's yield previously reaching as high as 113%, but as the market cooled, this figure has stabilized around 12%.

Source: Basis Trading TVL Rankings - DefiLlama

Stablecoin Use Cases

Based on Ethena's business model and various risk factors in the stablecoin space, how can new stablecoin issuers position themselves to leverage market potential? They can generally be categorized into three use case directions: settlement tokens in trading, collateral in money markets, and payments (which have great potential but are currently limited).

Undoubtedly, the primary use case for stablecoins is to act as settlement tokens during transactions. For example, over 33% of USDT supply is held by centralized exchanges (CEX).

Ethena, through partnerships with major exchanges like Bybit and Infinex, is also positioning USDe as collateral for trading on CEXs to enhance its liquidity and accessibility.

This strategy can also enhance the utility of native tokens in some stablecoin projects. For instance, Ethena's native token ENA, similar to BNB in the Binance ecosystem, can provide reduced trading fees at partner exchanges, governance rights, staking rewards, and exclusive features. Recently, the Ethereal proposal was passed, suggesting that 15% of the future potential token supply be allocated to ENA holders, further solidifying its role in the ecosystem.

For lending protocols in the DeFi ecosystem, stablecoins are ideal collateral as they minimize the risk of liquidation due to price volatility.

Additionally, using stablecoins for payments represents a significant potential growth area. Although it currently faces challenges and is limited by various factors such as regulatory uncertainty and low merchant acceptance, it offers multiple advantages for the payments sector, including faster settlement times, lower transaction costs (especially for cross-border payments), and 24/7 availability.

Recent developments, such as fintech company Stripe announcing acceptance of stablecoin payments, indicate a growing interest among traditional payment processors in integrating stablecoins into their systems. Given that Stripe's total payment volume surpassed $1 trillion in 2023, if stablecoins can capture a portion of that transaction volume, the potential could be immense.

Conclusion

The stablecoin market appears to be undergoing a transformation, with new participants continuously entering the space and existing players expanding their product offerings. Recent data shows that the circulating supply of stablecoins has reached an all-time high, indicating increasing adoption across various sectors.

While emerging stablecoin projects face high barriers to entry in this market, the demand for liquid, yield-generating stablecoins remains unmet. Ethena may currently be the most prominent player, but it has the potential to shine even brighter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。