Colorado has become a leader in the cryptocurrency field in the United States due to its open policies and regulatory framework.

Written by: Carlton, TaxDAO

1. Introduction to Colorado

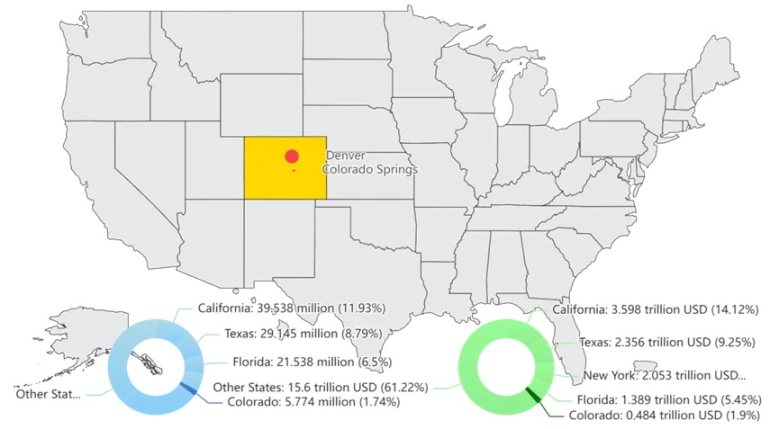

Colorado, abbreviated as CO, is located in the western United States, spanning the eastern part of the Rocky Mountains. It covers an area of approximately 268,000 square kilometers and has a population of about 5.77 million (2020). Among the 50 states in the U.S., it ranks 8th in area and 21st in population. The state capital is Denver, which is also the largest city in the state. Due to its rich natural resources and diverse economic structure, Colorado holds an important position in the U.S. landscape.

(Chart created, data source: Wikipedia Colorado)

In 2022, Colorado's economy was approximately $484 billion, accounting for 1.9% of the U.S. GDP. The economic development of Colorado is characterized by strong diversity, primarily including six pillar industries: aerospace, biotechnology, energy, financial services, and information technology software. The state's high-tech industry is highly developed, especially in cities like Denver and Boulder, which host a large number of tech innovation companies such as Oracle, Bloomberg, and Newmont Mining. Colorado is also an important agricultural state in the U.S., with major agricultural products including beef, wheat, and corn. Additionally, with famous natural attractions like the Rocky Mountains, Colorado has become a world-renowned tourist destination, attracting millions of visitors each year.

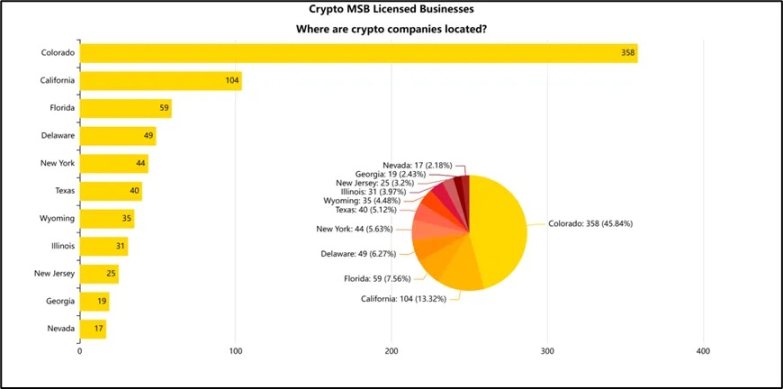

(Chart created, data source: FinCEN cryptocurrency business registration)

In terms of area, population, and economic total, Colorado is relatively small compared to other states in the U.S., but its position in cryptocurrency activities is extremely important. According to data from the Financial Crimes Enforcement Network (FinCEN), registered cryptocurrency businesses in Colorado account for about 33% of all registered cryptocurrency businesses in the U.S. This phenomenon is primarily attributed to Colorado's proactive policy support, relaxed regulatory environment, and advantages in energy and industry, with the assistance of key figures also being indispensable. Next, we will analyze Colorado's specific performance in these areas and how it has propelled the state to become an important center in the cryptocurrency industry.

2. Basic Tax System of Colorado

Colorado's tax system is characterized by simplicity and uniformity. Compared to the complex progressive tax systems of some states, Colorado adopts a single tax rate, which remains consistent for both individuals and businesses, making the state's tax system simple and transparent. Overall, Colorado's tax burden is relatively low, especially in terms of income tax and sales tax rates, which are competitive on a national level.

2.1 Types of Taxes and Rates

Currently, the official website of Colorado lists 11 major types of taxes, such as income tax, property tax, sales and use tax, etc. A summary of some taxes and rates is as follows:

2.2 Taxpayers

Under Colorado's tax system, taxpayers include individuals, businesses, and other legal entities, with tax burdens reflected in various aspects.

Individuals in Colorado are required to pay a state-level personal income tax of 4.4%, which is the uniform tax rate applicable to individuals at all income levels. Additionally, individuals must pay state-level sales tax when purchasing goods and certain services, with a base tax rate of 2.9%. Local governments can also impose additional taxes, resulting in total sales tax rates in some areas reaching 7.78%. If individuals own real estate (such as residential or commercial properties), they must pay property tax levied by local governments, with the average property tax rate in Colorado in 2023 being approximately 0.54%, which is relatively low compared to the national level.

For businesses, Colorado imposes the same uniform income tax of 4.4% as for individuals, regardless of the size or income of the business. Additionally, businesses are required to collect and remit sales tax on the sale of goods and services, which applies to most tangible goods and some digital goods (such as software, online services, etc.). Colorado also levies a motor vehicle ownership tax on vehicles owned by businesses, with tax rates adjusted based on the age and assessed value of the vehicle. Although Colorado does not have franchise taxes or similar business taxes beyond corporate income tax, businesses are still required to report their income and sales taxes to ensure compliance with legal regulations.

2.3 Tax Objects

The tax objects in Colorado encompass goods, services, capital gains, and specific industries, with a wide variety of tax types. The income of individuals and businesses, sales of goods, real estate, personal property, and specific services are all included in the tax system, forming a relatively comprehensive tax collection framework. In this system, local taxes are combined with state-level taxes to ensure a reasonable distribution of tax burdens across different economic activities and industries, resulting in a balanced tax burden for both businesses and individuals.

- Goods: Colorado imposes sales tax on most tangible goods, with a state-level tax rate of 2.9%, one of the lowest base rates in the U.S. Taxable goods include everyday consumer products, clothing, and other common items. Additionally, local governments can impose extra tax rates, resulting in total sales tax rates in some areas reaching 7.78%. Colorado's property tax applies to real estate owned by individuals and businesses, including residential, commercial properties, and vacant land, with the average property tax rate in 2023 being approximately 0.54%.

- Services: While many services are not taxed in Colorado, certain services are still considered taxable. Taxable services include repair services, digital services (such as software subscriptions, streaming services), entertainment services, and cable television services. Furthermore, with the expansion of the digital economy, Colorado has begun to tax an increasing number of virtual goods and services, such as cloud computing services and other online platform services. Businesses providing taxable services must collect and remit sales tax to ensure compliance with state regulations.

- Capital Gains: Colorado taxes the income and capital gains of individuals and businesses at a uniform rate of 4.4%. Personal wages, salaries, interest income, and dividend income, as well as business operating income, are all subject to capital gains taxation. Capital gains tax (such as profits from selling stocks, real estate, and other assets) is also taxed according to personal income tax standards.

- Personal Property and Transportation: Colorado imposes a motor vehicle ownership tax on vehicles owned by individuals and businesses.

- Specific Consumer Goods: Colorado levies special consumption taxes on certain specific consumer goods, such as fuel, tobacco, and alcohol.

2.4 Tax Incentives

According to the official website, Colorado has a wide range of tax incentive policies, totaling twenty-four categories. As a state with a relatively low tax burden, Colorado attracts investors and residents through a series of incentives and creates a favorable operating environment for businesses. These include advanced industry investment tax credits, employee stock ownership tax credits, enterprise zone contribution tax credits, and personal benefit tax credits.

2.4.1 Tax Incentives for Businesses

For businesses, Colorado offers numerous incentives covering capital investment, R&D innovation, and industry-specific tax credits. First, Colorado's Enterprise Zone Program provides significant tax incentives for businesses investing in economically disadvantaged areas. Businesses can enjoy sales tax refunds, equipment purchase exemptions, and other investment tax credits by expanding capital investment and hiring new employees in these areas.

Colorado also offers significant tax incentives for renewable energy projects and R&D activities. Businesses investing in renewable energy fields such as wind and solar can enjoy tax exemptions on equipment purchases and installations, greatly reducing initial costs. For R&D-oriented businesses, the state government provides R&D tax credits to support investments in technological innovation and high-tech fields. These tax credits encourage businesses to establish R&D centers in Colorado and promote the development of green energy and high-tech industries.

To further support technological innovation, Colorado has established the Advanced Industries Accelerator Program. This fund provides direct financial support and tax incentives for businesses in fields such as aerospace, medical devices, and energy technology. Through this fund, businesses can obtain R&D funding and enjoy tax reductions, especially in promoting cutting-edge technology and innovative product development.

Additionally, Colorado offers capital investment incentives for capital-intensive investments. Businesses making long-term capital investments in the state, such as building new factories or expanding production lines, can receive corresponding investment tax reductions.

2.4.2 Tax Incentives for Individuals

For individuals, Colorado also provides various tax incentives. First, Colorado's uniform income tax rate of 4.4% is relatively low and straightforward, applicable to residents and non-residents at all income levels, reducing individual tax burdens. Additionally, Colorado offers partial exemptions on Social Security income, allowing individuals aged 55 to 65 to exempt $20,000 of Social Security income, while individuals aged 65 and older can enjoy full exemption. This policy is particularly attractive to retirees and elderly residents, alleviating their tax pressure.

Colorado also provides property tax exemptions for specific groups, especially for the elderly and disabled. Eligible residents can apply for property tax refunds to help reduce the financial burden of property ownership.

3. Taxation and Regulatory System for Crypto Assets

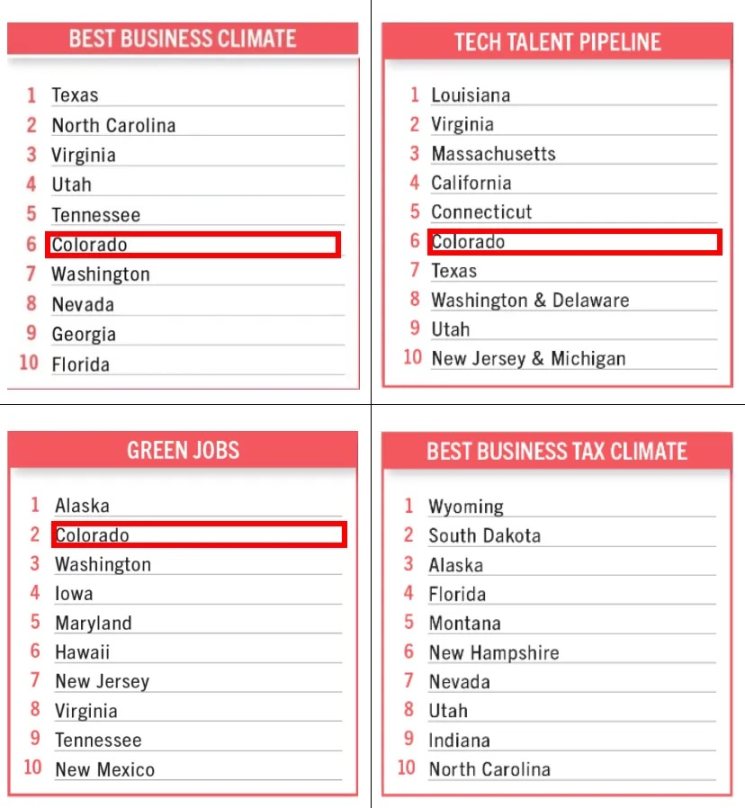

According to a report by Business Facility in 2023 on business site selection, Colorado ranks second in "green jobs," sixth in "best business environment," and "technical talent," and does not appear on the list for "best business tax environment" or "professional workforce training." From an overall tax environment perspective, Colorado does not seem to have the low tax rates of Texas; why is the state so attractive for registered money service businesses (MSBs)?

Colorado has been at the forefront of creating a crypto-friendly legal framework, which may explain the state's appeal to MSBs. The state has introduced the Digital Token Act, which provides certain exemptions from state securities laws for cryptocurrencies, potentially making it easier for blockchain and cryptocurrency-focused businesses to operate. Below, we will provide a more detailed introduction to the state's taxation and regulation of the crypto industry.

(Chart source: Business Facilities’ 19th Annual Rankings Report: State Rankings)

Before introducing Colorado's cryptocurrency tax and regulatory framework, it is essential to mention Governor Jared Polis. He was elected as the Governor of Colorado in November 2018 and officially took office in January 2019, serving to this day. He is an important example of a tech entrepreneur entering politics, having demonstrated a strong interest in cryptocurrency and blockchain technology during his tenure as a congressman, where he co-founded the Congressional Blockchain Caucus. He is committed to making Colorado a center for blockchain innovation. During his campaign, he publicly outlined five policy goals, including promoting the widespread application of blockchain in business and government, developing secure blockchain infrastructure for elections, simplifying government services, and providing legal and financial framework support for cryptocurrency businesses. Among these, his advocacy for the Digital Token Act further relaxed certain securities law regulations for tokens, providing a broader entrepreneurial environment for cryptocurrency companies.

He is also dedicated to making Colorado the first state in the U.S. to accept cryptocurrency payments for state taxes, with goals extending beyond this to allow the use of cryptocurrency for payments related to services like driver's licenses and hunting. We have reason to believe that Colorado's rapid emergence as a forefront of blockchain innovation in the U.S. is closely tied to his election and advocacy.

3.1 Cryptocurrency Taxation

3.1.1 Definition

Colorado does not have a specific tax category exclusively for cryptocurrency. In line with U.S. federal policy, Colorado treats cryptocurrency as property, subjecting it to tax rules similar to those for capital assets like stocks and real estate. Therefore, when it comes to cryptocurrency transactions or sales, individuals and businesses must report capital gains tax or capital losses, rather than under other tax categories. The capital gains tax on cryptocurrency is divided into long-term and short-term capital gains based on the holding period, with different tax rates applied; short-term rates are higher, while long-term rates are relatively lower.

3.1.2 Taxes and Rates Involved with Cryptocurrency Assets

The absence of a specific tax category for cryptocurrency means that the taxation of cryptocurrency assets in Colorado is based on the fundamental tax system.

- Capital Gains Tax: If the holding period for cryptocurrency is less than one year, the resulting gains are considered short-term capital gains and taxed at the individual's or business's ordinary income tax rate. Colorado's personal ordinary income tax rate is 4.4%, while the federal rate is tiered based on personal income, reaching up to 37%. If the holding period exceeds one year, long-term capital gains tax applies. The federal long-term capital gains tax rates are 0%, 15%, or 20%, depending on the taxpayer's income level. Long-term capital gains tax rates are generally lower than short-term rates, encouraging investors to hold cryptocurrency for the long term.

- Sales Tax: In Colorado, using cryptocurrency for transactions involving goods or services is treated the same as using legal tender. Merchants accepting cryptocurrency payments must report the transaction amount at the equivalent dollar exchange rate and pay the corresponding sales tax. The base state sales tax rate is 2.9%, but with local taxes (such as municipal and county taxes), the actual total tax rate can reach between 7% and 11%. Therefore, using cryptocurrency to purchase goods or services in everyday consumption does not exempt the obligation to pay sales tax. Similarly, buying and selling cryptocurrency as goods also requires the payment of sales tax.

- Tax Payments: Colorado is the first state in the U.S. to allow residents and businesses to use cryptocurrency to pay state taxes. Starting in 2022, individuals and businesses can pay personal income tax, corporate tax, and other taxes using cryptocurrencies like Bitcoin and Ethereum through third-party platforms. These cryptocurrencies are instantly converted to dollars by payment processing agencies, and the state government does not directly hold cryptocurrencies. This policy reduces transaction costs while providing cryptocurrency users with more payment options.

- Business Tax: Businesses conducting cryptocurrency-related operations in Colorado must adhere to state and federal business tax policies. For corporate income, Colorado's corporate income tax rate is 4.4%, consistent with the rate applicable to ordinary businesses. Regardless of whether businesses profit through cryptocurrency exchanges, mining, or other related activities, they must ultimately pay business tax based on their respective corporate income.

For individual miners or independent cryptocurrency service providers, Colorado requires income reporting and tax payment according to various tax regulations. First, income from cryptocurrency obtained through mining is considered taxable income, estimated based on the market value of the cryptocurrency at the time of mining. This income is subject to Colorado's personal income tax at a rate of 4.4%. At the federal level, this income is also subject to federal income tax based on the income scale. Additionally, if individuals sell or trade the cryptocurrency obtained from mining, their capital gains are subject to capital gains tax.

Moreover, individual miners or self-employed cryptocurrency practitioners must also pay self-employment tax, which includes Social Security tax and Medicare tax, with a total rate of 15.3%. This tax burden is particularly significant for those earning income through mining or blockchain services. If individual miners or independent practitioners operate on a larger scale and employ staff, they must also consider payroll taxes, including federal and state-level Social Security and Medicare taxes, as well as withholding personal income tax.

For cryptocurrency mining businesses or blockchain service companies, tax responsibilities are even more diverse. The profits of these businesses are subject to Colorado's corporate income tax, and profits obtained from selling cryptocurrency after generating income through mining or blockchain services are also subject to capital gains tax. Similarly, if businesses use imported equipment or equipment procured from other states for mining or providing services without paying local sales tax, they must pay consumption tax. The consumption tax rate varies by region, typically ranging from 7% to 11%. Businesses providing digital services or cryptocurrency trading platforms may need to charge sales tax on their service income, especially for consumers within Colorado.

3.1.3 Tax Incentives

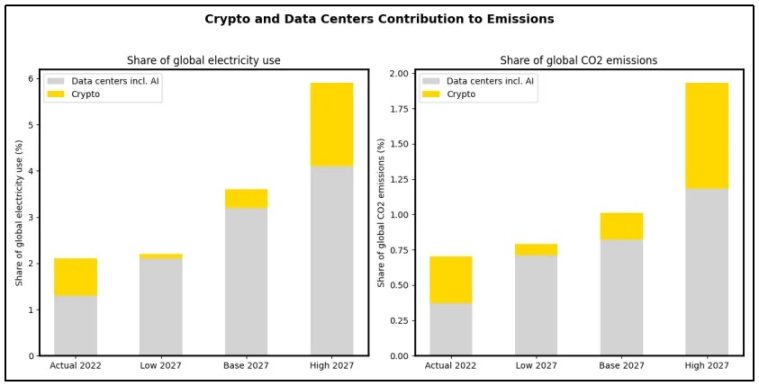

According to statistical analysis by the IMF, by 2022, cryptocurrency mining and data centers collectively accounted for 2% of global electricity demand. This proportion may rise to 3.5% within three years, equivalent to the current electricity consumption of Japan, the fifth-largest electricity user in the world.

(Chart created, original image: Chart of the Week, MACRO-FISCAL POLICY Carbon Emissions from AI and Crypto Are Surging and Tax Policy Can Help)

Cryptocurrency mining and blockchain technology heavily rely on data centers and substantial energy, similar to quantum computing and AI, both of which are industries with high demands for electricity and computing resources. As a potential tech hub in the U.S., Colorado shows strong support for high-tech industries. For instance, in the field of quantum technology, the Governor of Colorado announced a series of new tax credit incentives at the "Mountain West Quantum Summit" in Denver, such as tax credits for purchasing equipment and establishing next-generation computing laboratories, along with loan guarantee programs to help startups secure funding, aimed at attracting quantum technology companies.

Similarly, the cryptocurrency asset industry can leverage local tax incentives as it develops in Colorado—though these policies are not entirely targeted at the cryptocurrency industry. For cryptocurrency miners and businesses, the following tax incentives are noteworthy:

- Property Tax Exemption: Under Colorado's Local Government Law §30-11-132, local governments can encourage businesses to make long-term capital investments in specific areas by providing property tax exemptions or refunds. Cryptocurrency mining businesses, which rely on large-scale data centers for high-intensity computing, fall into this category of capital-intensive projects. By entering into agreements with local governments, these businesses can obtain property tax exemptions for up to 10 years. Typically, these exemption policies apply to investment projects identified as "Areas of Specific Local Concern," aimed at promoting local economic development.

- R&D Expense Deduction: Colorado's revised statute §31-20-101.7 provides significant tax incentives for businesses engaged in technological innovation. This policy allows businesses to deduct 25% of their R&D expenses from their state tax obligations. This is particularly important for the cryptocurrency industry, especially for companies dedicated to developing new blockchain applications, enhancing mining efficiency, and optimizing cryptographic algorithms. By applying for R&D tax credits, cryptocurrency businesses can offset part of their expenses related to technological R&D, alleviating their financial burden.

- Cryptocurrency Tax Payments: Colorado has become the first state in the U.S. to allow taxpayers to use cryptocurrency to pay state taxes. While this does not directly reduce tax liabilities, the ability to pay taxes using cryptocurrency provides more convenience for businesses whose primary wealth is in digital assets. This applies to various tax types, including income tax, sales tax, and use tax.

3.2 Cryptocurrency Regulation

3.2.1 Development History

Compared to Colorado's tax policies, its extensive regulatory framework and open innovative business environment are more attractive to cryptocurrency companies. The regulatory changes regarding cryptocurrency in Colorado have gone through the following periods:

(Chart created, content: Development History of Cryptocurrency Regulation in Colorado)

As early as 2014, Colorado passed the Digital Currency Exemption Act, which stipulated that businesses dealing only with digital currencies (such as Bitcoin) do not need to apply for a money transmission license. However, if a business also handles traditional currency or acts as an intermediary for buying and selling digital currencies, it must obtain a money transmission license.

In 2017, Colorado began focusing on the legal framework for cryptocurrency, with the state government first recognizing cryptocurrency as a commodity and regulating it under the Colorado Securities Act. At this time, all businesses engaged in buying or transferring cryptocurrency were required to obtain a money transmission license to ensure compliance with federal regulations such as anti-money laundering (AML) and know your customer (KYC).

In 2018, the Colorado Securities Division issued guidelines on how existing securities laws apply to cryptocurrency offerings. Companies and individuals providing cryptocurrency investments in Colorado must comply with state securities registration requirements and disclose all relevant information to potential investors.

In 2019, Colorado passed the landmark Colorado Digital Token Act, which exempted certain cryptocurrency tokens from securities registration and broker license requirements. This provided a more lenient environment for blockchain and cryptocurrency startups, promoting industry development. Its aim was to encourage innovative applications of blockchain technology and clarify the regulatory scope of digital assets.

In 2020, Colorado established a fintech sandbox program, allowing cryptocurrency companies to test new products and services in a controlled regulatory environment. This not only provided more innovative space for cryptocurrency and blockchain companies but also ensured that businesses could develop under regulation, avoiding heavy regulatory burdens.

Since 2022, businesses and individuals have been able to use cryptocurrency to pay state taxes, including income tax and sales tax. This policy marks a unique breakthrough in the state's acceptance of cryptocurrency across the United States, encouraging more businesses and individuals to use digital currency within a legal framework.

It is evident that Colorado has a proactive and progressive approach to regulating the cryptocurrency industry. We have reason to believe that in the future, Colorado's legal provisions will continue to be updated, and the regulatory environment for cryptocurrency use will keep improving.

3.2.2 Regulatory Authorities

Colorado's cryptocurrency regulatory framework is primarily based on state laws and regulations, as well as guidance from federal agencies such as the Internal Revenue Service (IRS) and the Securities and Exchange Commission (SEC).

It mainly includes:

- Money Transmission Act: Any individual or entity engaged in money transmission (including the transfer of virtual currency) must obtain a license from the Colorado Division of Banking.

- Check Sale Act: The sale or issuance of monetary instruments such as cryptocurrency must comply with sales laws, including the Uniform Electronic Transactions Act (UETA), which recognizes electronic signatures and records, including transactions involving digital assets.

- Colorado Securities Act: The sale or issuance of securities (including certain types of cryptocurrency) must comply with this act, requiring registration with or exemption from the Colorado Securities Commissioner.

- Digital Token Act and its amendments: This act exempts certain digital tokens in the state from securities laws and regulations, making it easier for companies to raise funds through Initial Coin Offerings (ICOs) or other digital token offerings. Senate Bill 20-109 added additional consumer protection measures, requiring businesses seeking exemptions under this act to disclose their token issuance status and submit annual reports to the Colorado Securities Commissioner.

- Along with guidelines from the Securities Division, IRS guidelines, SEC guidelines, and others.

Colorado has not yet established a comprehensive regulatory framework specifically for cryptocurrency. However, existing state laws and federal guidelines play a significant role in regulating the cryptocurrency industry in the state. The government agencies involved include:

- Colorado Securities Division: The Securities Division is responsible for regulating the sale and issuance of securities, including certain types of cryptocurrency.

- Colorado Department of Regulatory Agencies (DORA): DORA oversees various industries in the state and designates the Securities Division to regulate cryptocurrency activities.

- Colorado Department of Revenue: The Department of Revenue manages and enforces taxes, including income tax on cryptocurrency transactions.

- Colorado Banking Board: The state banking board regulates and supervises state-chartered banks, trust companies, and other financial institutions that handle virtual currency.

- Banking Division: As part of DORA, the Banking Division regulates state-chartered credit unions and trust companies that provide virtual currency exchange services.

- Attorney General's Office - Consumer Protection Division: The Consumer Protection Division investigates complaints related to fraud or deceptive practices involving virtual currency.

3.2.3 Regulatory Subjects

Under Colorado's gradually improving regulatory system, the subjects of regulation have also become more diverse, including:

- Cryptocurrency Exchanges and Wallet Service Providers: Platforms that help users buy, sell, and store cryptocurrency. According to federal regulations and Colorado state laws, exchanges must comply with money transmission laws and obtain money transmission licenses. These businesses are required to follow AML and KYC regulations to ensure that transactions are legal and compliant.

- Digital Token Issuers: Under the Digital Token Act, businesses issuing digital tokens can be exempt from certain securities law constraints when their tokens are used for consumption (rather than investment), but they are still subject to basic anti-fraud laws. These businesses need to ensure that their token issuance does not involve investment fraud and complies with relevant consumer protection regulations at the time of issuance.

- Cryptocurrency Miners and Mining Facilities: Mining businesses are directly regulated by securities or financial regulations when conducting transactions involving cryptocurrency assets, and due to their high energy consumption characteristics, crypto mining facilities are indirectly regulated by state energy policies and environmental regulations. Mining facilities must comply with relevant business and tax regulations to ensure legal and compliant operations.

- Fintech and Blockchain Startups: In Colorado, many fintech companies use blockchain technology for innovation. Companies participating in the fintech sandbox program test new technologies and products with less regulatory oversight, providing regulatory support and innovation space for cryptocurrency-related startups, but they must also comply with basic consumer protection and privacy regulations.

- Individual or Institutional Users: Individuals and institutions engaging in cryptocurrency transactions, especially investment-related transactions, need to report capital gains tax or other relevant taxes at the state or federal level.

4. Summary and Outlook

With its open policies and regulatory framework, Colorado has become a leader in the cryptocurrency field in the United States. The state effectively reduces the operating costs of high-tech companies, including cryptocurrency businesses, through flexible property tax exemptions, R&D tax credits, and equipment investment incentives, providing substantial support specifically for capital-intensive and energy-intensive mining activities. Additionally, laws like the Digital Token Act simplify compliance processes, provide compliance guidance, and encourage innovative development. The regulatory system covers a wide range, from exchanges to mining businesses, ensuring the standardized operation of the cryptocurrency ecosystem.

As the blockchain and cryptocurrency markets continue to expand, Colorado is expected to maintain its innovative leadership. In the future, the state may attract more globally leading cryptocurrency companies by expanding tax incentive policies and optimizing the fintech sandbox program. At the same time, with increasing energy use and environmental requirements, Colorado may implement more green energy incentives for high-energy-consuming mining businesses to balance industry growth with environmental responsibility. This will further solidify its national leadership position in the blockchain and cryptocurrency asset fields.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。