Original Author: Taran (Founder of OTC trading platform STIX)

Translation by|Odaily Planet Daily (@OdailyChina)

Editor's Note: Celestia will unlock 175.59 million TIA at 22:00 Beijing time tonight, worth approximately 900 million dollars, accounting for 79.91% of the current circulating supply. This is one of the largest and most anticipated unlocking events in this cycle. Regarding the market structure of TIA after the unlock, Taran, the founder of OTC trading platform STIX, provides his professional analysis based on on-chain data, futures data, and STIX platform data. Taran believes that the actual spot selling pressure is not as high as the market imagines; and due to the need for early short hedging funds to close positions, it may further offset the spot selling pressure; in addition, most chips have already changed hands in the OTC market, further complicating the subsequent momentum of TIA.

Below is Taran's original content, translated by Odaily Planet Daily.

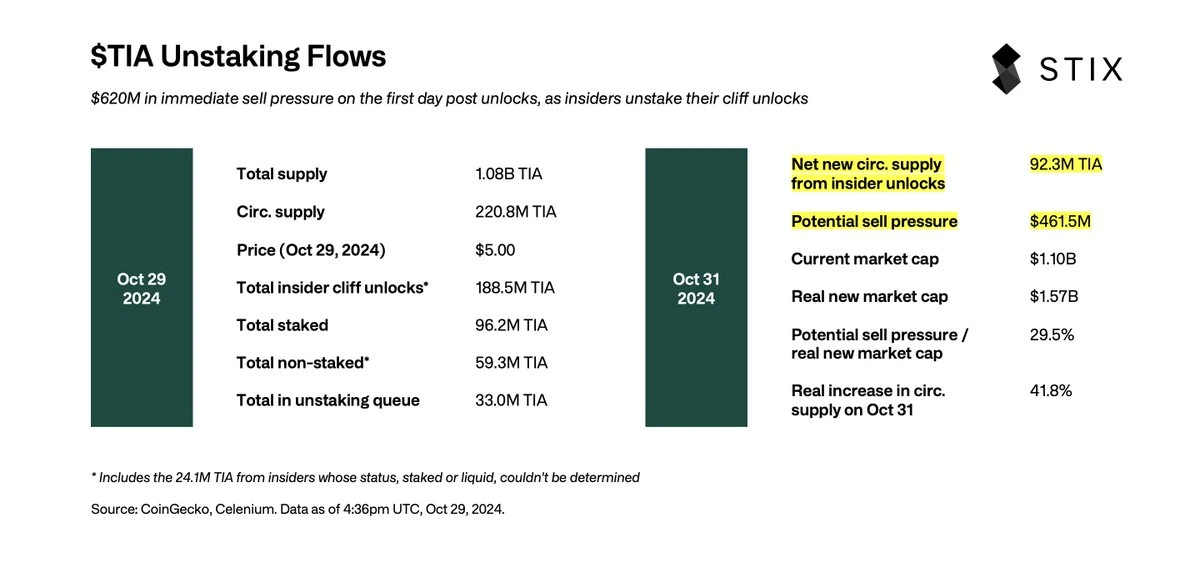

This chart outlines the new circulation of Celestia (TIA) on October 31, 2024, and I will explain this data below.

We accurately calculated the circulation changes of TIA entering November using on-chain data (data sourced from Celenium). The final conclusion is that after the unlock, approximately 92.3 million TIA is expected to enter circulation, which is the upper limit of new spot selling pressure.

Staked TIA requires 21 days to be unstaked, and those who wish to trade TIA immediately on the unlock date of October 31 have already unstaked their tokens. Currently, the total of all "unstaked tokens" (including 24.1 million tokens belonging to insiders, whose status is uncertain) and "tokens in the unstaking queue" is approximately 92.3 million TIA.

This equates to about 460 million dollars of maximum selling pressure, accounting for about 50% of the total unlock amount, which means the actual selling pressure may only be half of what people expect.

Comparing the actual new circulation with the current circulation means a dilution of 41.8%.

A large number of unlocked tokens have already changed hands through the OTC market, and buyers will choose to hedge in the futures market, which has caused the funding rate of TIA to soar in the past few months. We expect that after the unlock, the short positions in the futures market will be reduced, partially offsetting the spot selling pressure. This funding allocation model may become a bullish signal for spot buyers.

Our analysis assumes that 11 million TIA, which will be unlocked tonight (excluding the subsequent linear unlock portion), has already changed hands through the OTC market, and we categorize it as "unstaked tokens" (these tokens come from treasury addresses and are not marked in the browser). We have mapped a total of 292 unlock addresses, with some not fully mapped, and these discrepancies are also included in the "unstaked tokens" category.

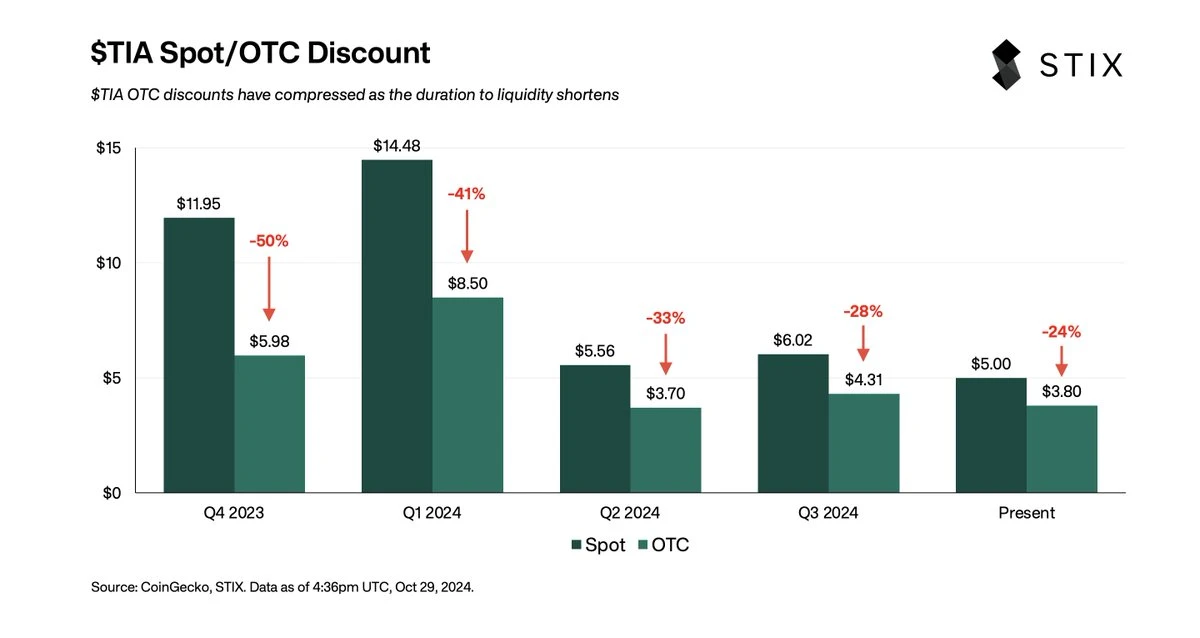

STIX has witnessed the changes in TIA's OTC trading during this cycle.

Undoubtedly, TIA is one of the most traded assets in the OTC market during this cycle. The main reason is that in the early stages of this cycle, TIA provided an early long opportunity for buyers eager to position themselves directionally; sellers also had their motivations, primarily to realize significant unrealized profits (PNL) and because they did not anticipate the upcoming bull market (Q3 2023).

By the first quarter of 2024, the bull market trend had solidified, and TIA had risen above 20 dollars. At this time, OTC activity was relatively low; on one hand, sellers were unwilling to accept larger discounts (40%+), and on the other hand, buyers did not want to bid too high (over 8.5 dollars). During this period, we saw almost no OTC trading activity, as sellers generally "felt they had already made a lot" and wanted to maintain their risk appetite, even though they had the opportunity to realize returns of 100 to 800 times on their investments.

When TIA fell below 5 dollars, the situation changed, coinciding with the Celestia Foundation starting to raise 100 million dollars in OTC round financing at a price of 3 dollars. The lock-up conditions for buyers were the same as for private investors, with 33% unlocking on October 31, 2024 (less than 2 months from this round of financing), followed by a 12-month linear unlock.

In the third and fourth quarters of 2024, TIA's OTC trading became very active, with sellers actively selling various shares, including the initial unlock shares and all subsequent shares. On STIX, the OTC trading volume of TIA since July has been approximately 60 million dollars, assuming STIX occupies 75% of the OTC market share, this may indicate that the scale of TIA trading completed through various OTC liquidity channels exceeds 80 million dollars.

TLDR

In summary, short positions in the futures market will gradually close before the unlock date, which means the funding rate may reset to 0 or a positive number. Those who missed the October 9th unstaking deadline may unstake in late October, leading to further growth in the circulating supply in November. Regardless, the scale of the new supply is enormous, making this one of the most well-known unlocking events in this cycle, and combined with the impact of OTC trading, it may make the subsequent trend of TIA even more unpredictable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。