Base is becoming a shining star in the EVM space, but according to Dune data analyst jpn memelord, while Uniswap's trading volume on the Base platform appears prosperous, a large portion of this trading is driven by repeatedly rug-pulling liquidity pools. This seems to confirm some community views that there are many "big rips" on Base. What do the real data show? BlockBeats has compiled the findings from jpn memelord's research.

The False Prosperity of Uniswap on Base

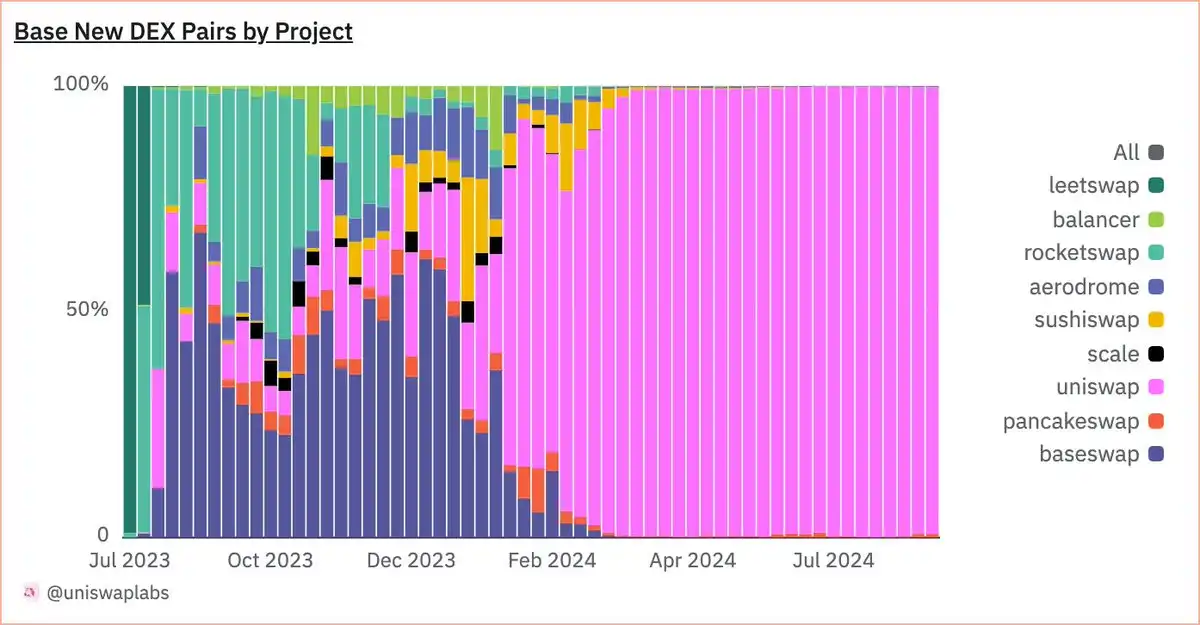

At the beginning of September, Uniswap tweeted that 98.9% of new trading pairs on Base were launched through the Uniswap protocol.

Data shows that the Base platform has launched over 600,000 Uniswap v2 liquidity pools in the past few months, accounting for 98.9% of all newly created trading pairs on the platform, which is undoubtedly quite remarkable. However, it is worth further exploring who actually created these trading pairs.

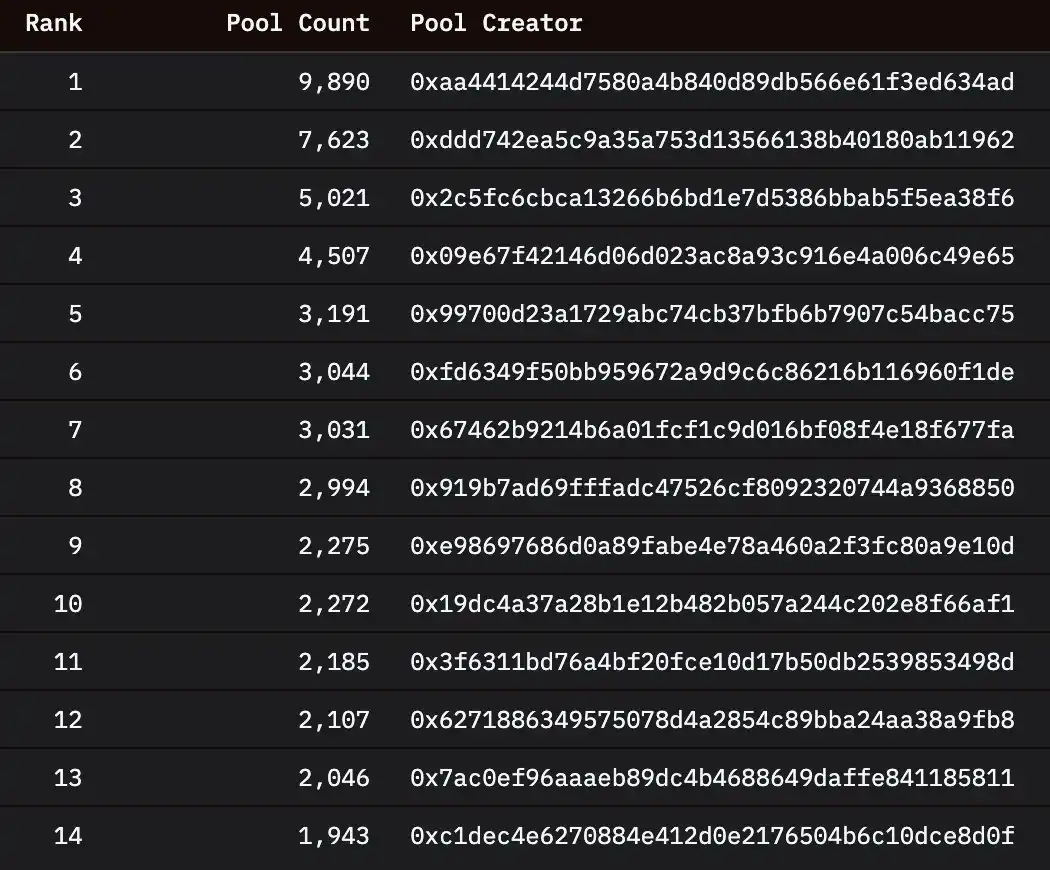

In fact, a significant portion of the liquidity pools was deployed by a few addresses, with the top three addresses being related, meaning that one person or entity created 3.7% of the liquidity pools on Base, and there are other addresses that are also related.

Source: Dune

Overall, addresses that created over 500 liquidity pools contributed more than 127,000 pools in total, with over 20% of all pools deployed on Base created by just 87 independent addresses (or even fewer independent entities).

What is the actual situation of these liquidity pools?

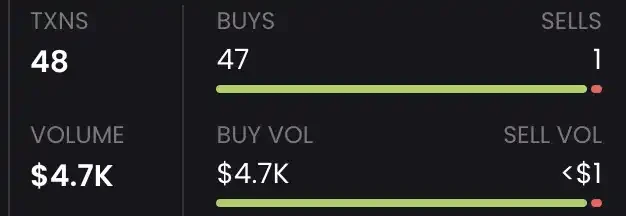

In fact, most of them are ordinary altcoins that rug within minutes, lacking any real value. As shown in the example below, these liquidity pools are not productive projects but outright scams.

The strategy commonly employed by these operators who create large numbers of liquidity pools is to first disperse ETH to multiple wallets, then issue new tokens, buy through these backup wallets, and finally quickly withdraw liquidity. This operation not only yields quick profits but also artificially inflates trading volume metrics.

Each new rug operation typically brings in thousands of dollars in trading volume. These operations are conducted by dozens of addresses around the clock, with each liquidity pool lasting only 20-30 minutes, allowing a single address to launch more than 50 such projects daily.

In this way, each address can generate $250,000 in trading volume daily with just a small amount of initial capital.

"This is like sticking a few $100 bills on a boomerang and throwing it out 50 times. You haven't really generated hundreds of thousands of dollars in trading volume; you're just entertaining yourself," jpn memelord believes.

The frequent occurrence of this phenomenon may have multiple reasons. On one hand, it is to deceive unsuspecting users into buying these tokens; on the other hand, it may be to profit from poorly calibrated front-running bots; additionally, it could be a strange form of yield farming in anticipation of a potential (but unlikely) Base airdrop.

The key question is how to effectively screen and filter these operations.

Initially, jpn memelord thought that setting a limit on the number of liquidity pools created by each address could serve as a filter, thus removing those junk addresses composed of a large number of liquidity pools. However, he found that over half of the liquidity pools were deployed by addresses that created fewer than 5 pools.

He speculated that many liquidity pools might be created by yield farming or rug bots, which frequently change addresses to evade detection, and may even switch addresses after deploying just one liquidity pool. Therefore, jpn memelord decided to continue his research, trying to find traces of human factors in the creation of liquidity pools.

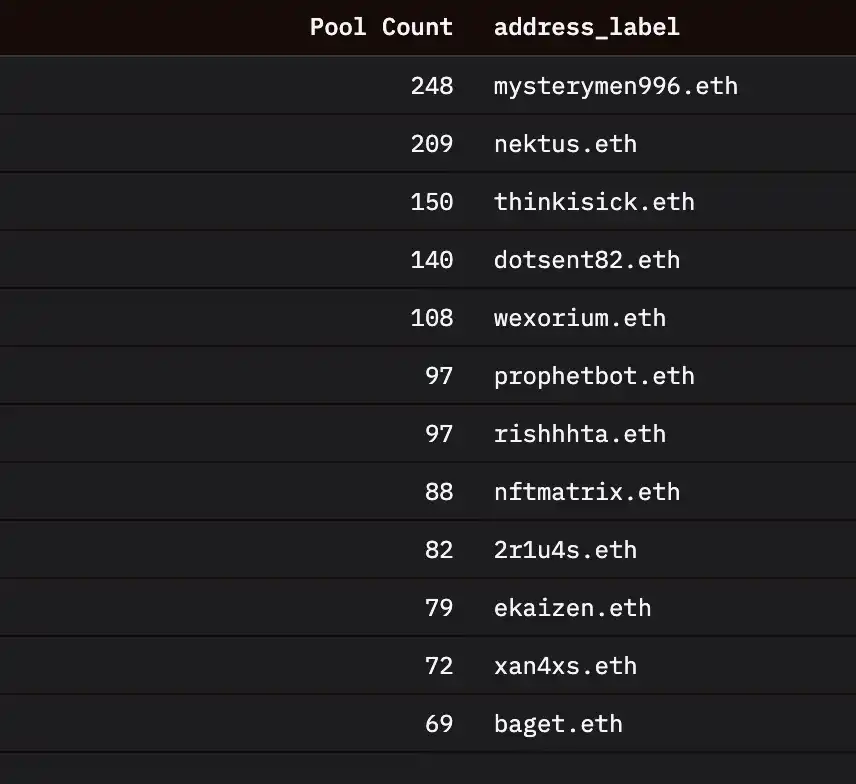

He attempted to focus only on liquidity pools created by ENS users. This method proved more effective, with only 17,000 pools created by addresses with ENS, a number far lower than the total number of pools, and it may effectively exclude most pools created by bots.

Coincidentally, jpn memelord believes this filtering process may also reveal some influencers who repeatedly rug Base tokens. However, this method still needs improvement, as the existing filtering may miss some real liquidity pools created by anonymous deployers while including scams or rug projects from certain vanity influencers.

jpn memelord began to focus on liquidity pools with multiple liquidity addition events. Rug projects typically only perform one liquidity injection and removal operation, while productive liquidity pools will have other liquidity providers and multiple liquidity injections.

Only about 7,800 v2 liquidity pools have undergone multiple liquidity additions, and when the filtering condition is raised to more than 2 liquidity additions, this number is halved again, leaving only about 3,500, which are the productive liquidity pools, not just rug projects.

These valuable liquidity pools account for only 1.2%-0.5% of the initial total, meaning that after considering junk projects and scams, the actual data is inflated by about 99%, a figure that closely aligns with the number provided by Uniswap at the beginning of the article.

jpn memelord believes that this behavior is not essentially Uniswap's fault, as it is a permissionless protocol where anyone can create liquidity pools for any asset, which is one of its design features. However, promoting metrics that are artificially inflated by worthless junk projects is something Uniswap has the ability to control.

Uniswap should filter its metrics; whether it’s 8,000 liquidity pools or 3,500, these pools that truly generate some value are still impressive data. This filtering should also apply to trading volume, as a significant portion of the trading volume is actually generated by these rug projects cycling between the same 5 ETH.

"Created liquidity pools" is a metric that can easily be manipulated by bots for a permissionless protocol with an operational cost of just a few cents. Such metrics should be carefully filtered and not simply promoted based on surface data. Those liquidity pools that go beyond rug schemes and truly have interaction are what deserve attention.

Rug Disaster, Uniswap's Real Trading Volume Lags Behind Aerodrome

jpn memelord further explored whether these easily executed rug projects significantly contribute to trading volume.

At peak times, liquidity pools with only one liquidity addition event contributed about $300 million in trading volume per month, which is relatively small. As of now, the data for September is only about $30 million, which actually verifies that about 99% of the liquidity pools created on Base by Uniswap are of low value.

jpn memelord hopes to gain a clearer understanding of the true sources of this trading volume. In previous analyses, he mentioned that although these low-cost rug projects do contribute to trading volume, he suspects that more complex operators frequently change addresses when launching new scams to evade detection.

So, how can these operators be distinguished?

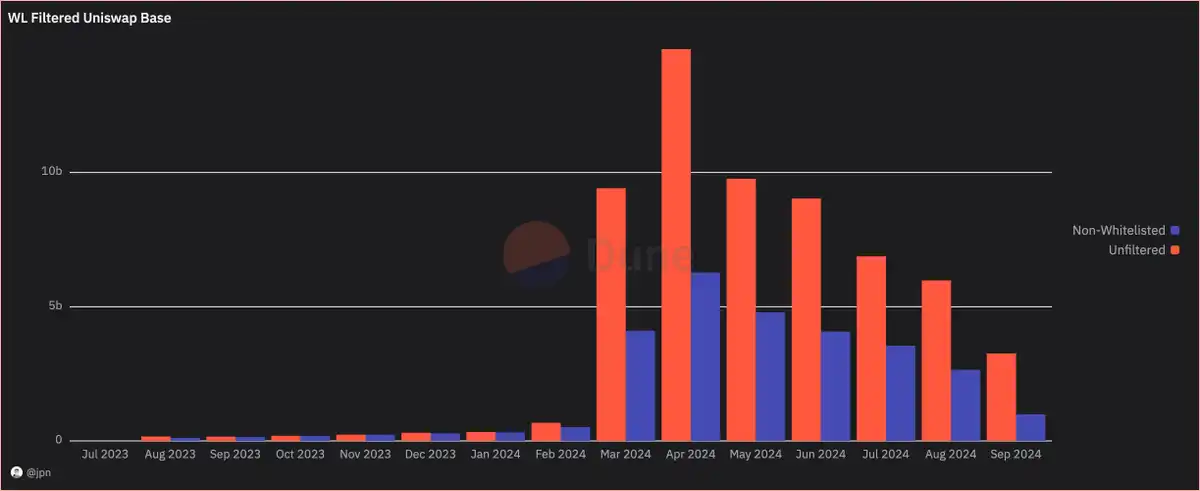

jpn memelord turned to AerodromeFi and its whitelisting process, attempting to use it as a potential method to filter Uniswap's trading volume on Base. On Aerodrome, for a liquidity pool to receive incentives, its tokens must pass the whitelisting review by the Aerodrome team, which helps distinguish the trading volume of quality projects from others.

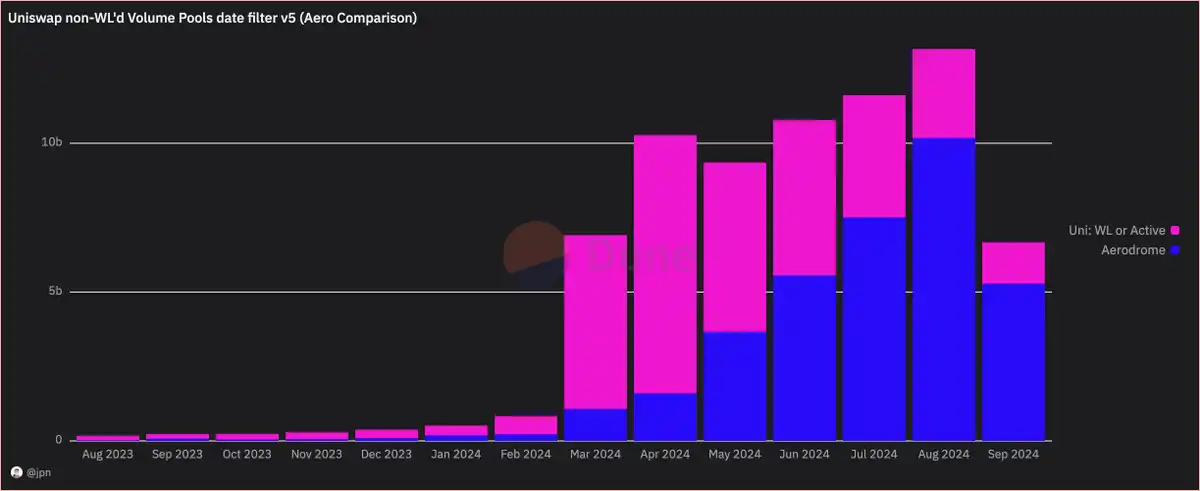

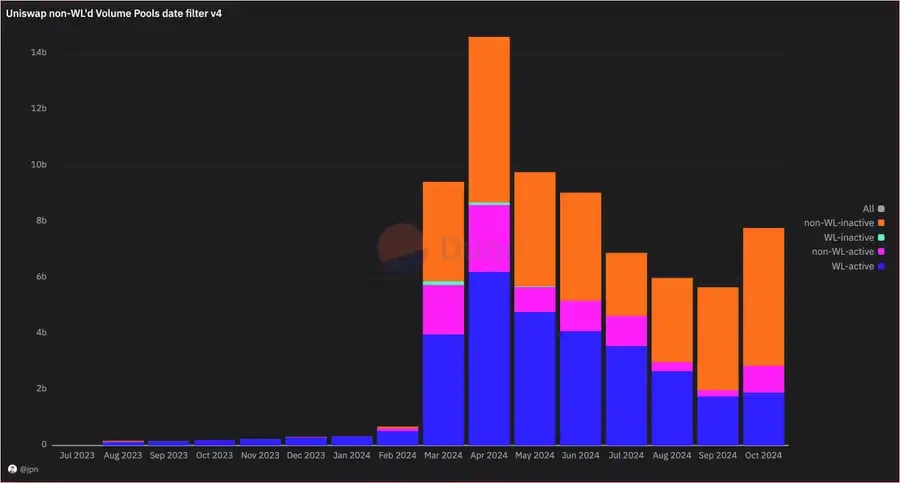

His analysis shows that a significant portion of Uniswap's trading volume on Base actually comes from assets that are not whitelisted. Since the explosion of projects on Base in March this year, this proportion has approached 50%.

Does Uniswap have an advantage over certain assets? What is driving this trading volume?

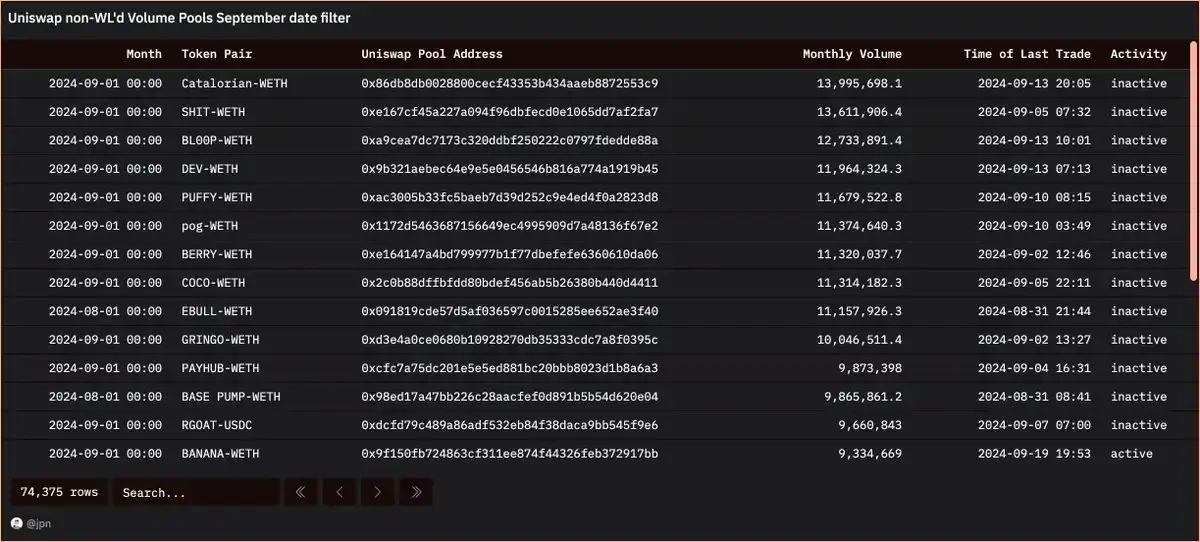

jpn memelord extracted the trading volume data of individual liquidity pools for unlisted assets and found a large number of meme coins. Some meme coins he had never heard of had trading volumes reaching $10 million just in September.

After examining these liquidity pools one by one, he found that most of the tokens were in a "rug-pull" situation. In fact, among the top 150 liquidity pools sorted by monthly trading volume, jpn memelord found only 4 that had not rug-pulled.

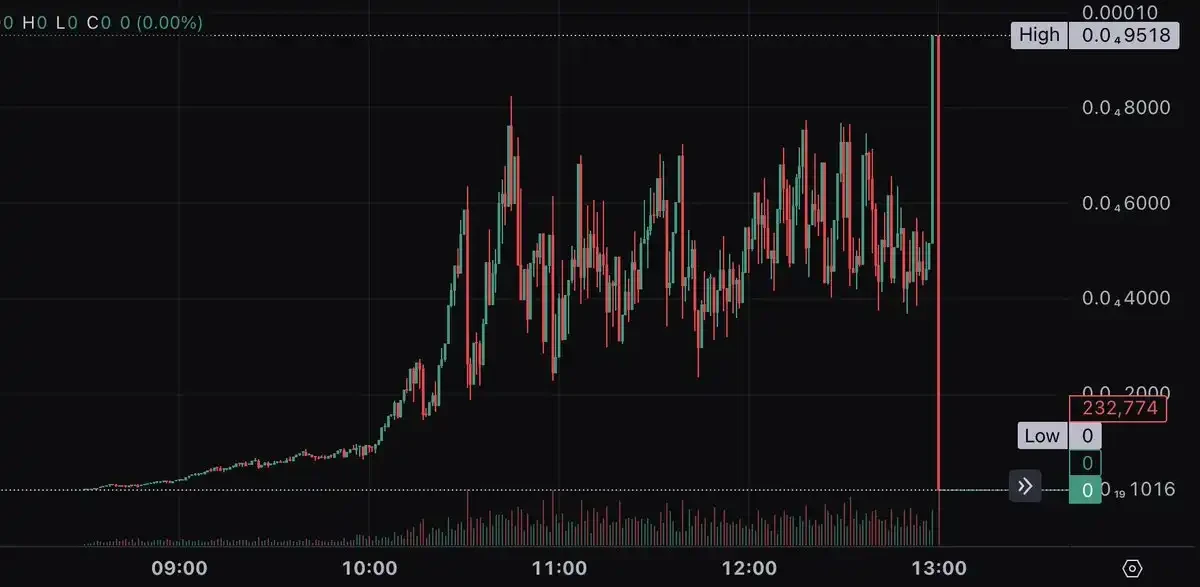

The performance of these liquidity pools was roughly the same: within a few hours of going live, trading volume reached millions of dollars, only to quickly rug, with tokens being sold off to zero, and the deployers profiting over 90 ETH.

This operation repeated over and over.

So, how can these scams be identified in trading volume data? A systematic approach is needed to recognize them.

Once a token has completely rug-pulled, trading will stop. Therefore, a filter can be set to check how long it has been since the last trade of the token, which can help identify these scams.

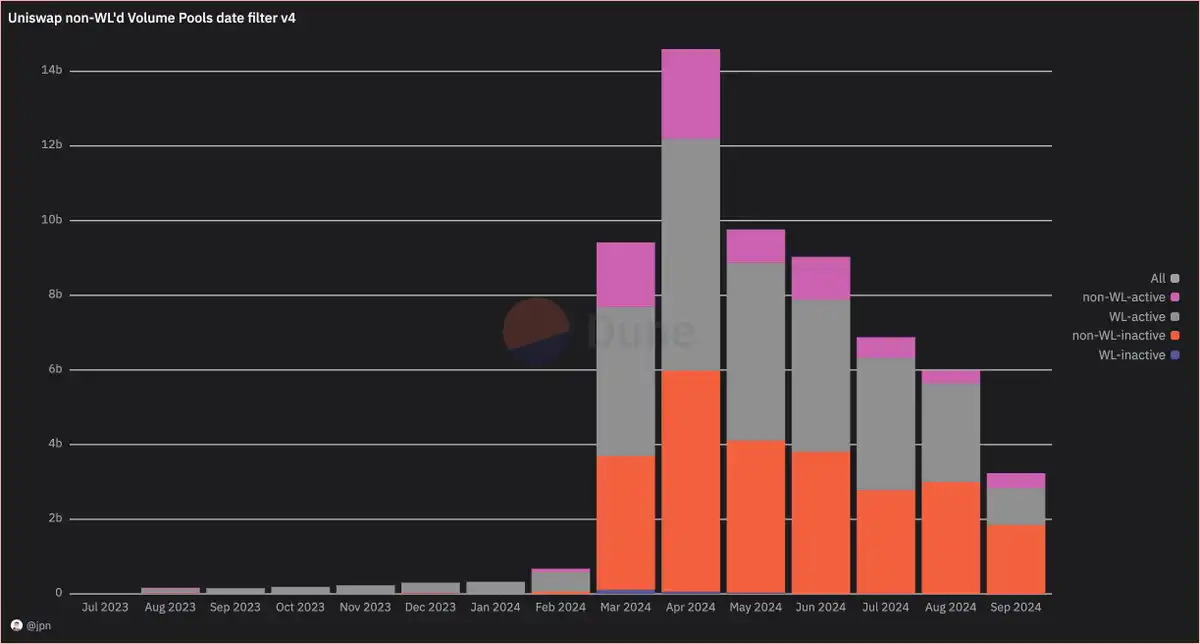

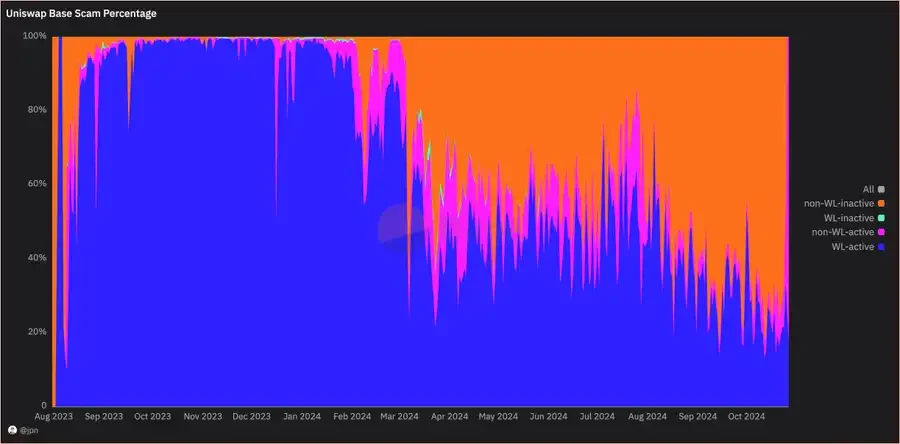

The method jpn memelord adopted was to apply a filter to exclude tokens that had trades in the last N days, allowing for a distinction between "active" tokens and "inactive" tokens. Combined with the whitelisting filter already in use, Uniswap's trading volume can be categorized into four types:

- Whitelisted active tokens: including quality tokens, stablecoins, and established meme coins.

- Whitelisted inactive tokens: referring to tokens that have significantly declined in recent months.

- Non-whitelisted active tokens: containing new tokens, including both scam projects and legitimate projects.

- Non-whitelisted inactive tokens: typically severe rug projects or assets that are gradually being forgotten by the market.

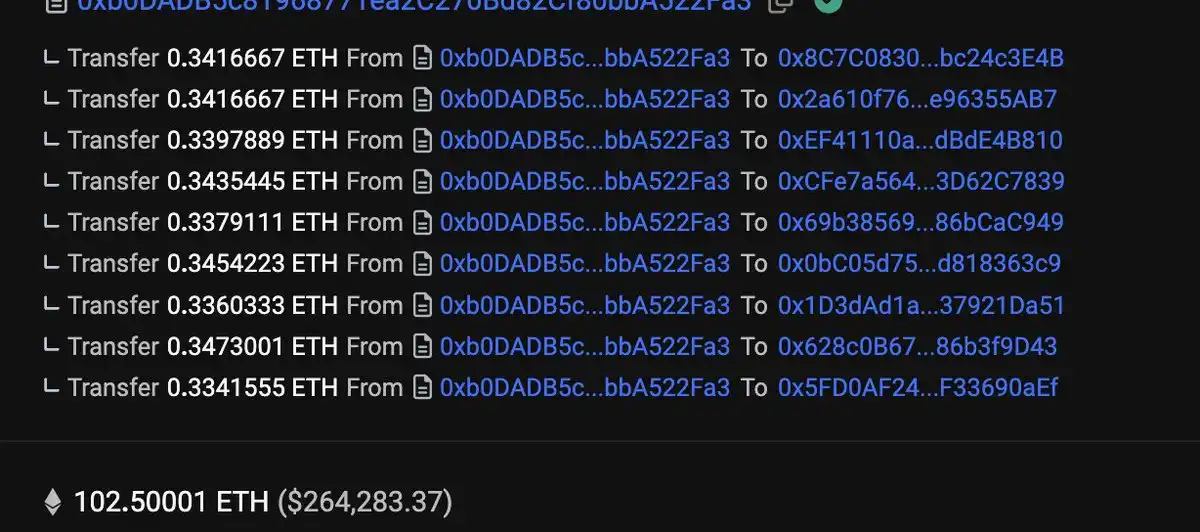

So, what does Uniswap's trading volume look like?

First, these rug tokens had a trading volume of $1.85 billion in September, with no trades occurring in the last two days (about 10% of the month), meaning these tokens accounted for 57% of Uniswap's total trading volume on Base this month.

The situation is even more severe. Some of these "active" tokens had just rug-pulled within the last 48 hours and were categorized in the pink section of the chart (non-whitelisted active). If the "rug-pull" trading volume remains nearly unchanged, it can be anticipated that another 6% of the monthly trading volume is also from scam projects.

This portion accounted for 12% of the total trading volume this month, while last month it was about 6%. Therefore, it is likely that by the end of this month, after the active filter identifies the recent rug projects, this 6% will join the 57%. In other words, approximately 63% of Uniswap's trading volume on Base comes from rug projects.

This month's whitelisted assets (quality token pairs, stablecoins, mature meme coins) accounted for only 30% of Uniswap's trading volume. The remaining approximately 7% of monthly trading volume is the "advantage" that Uniswap possesses.

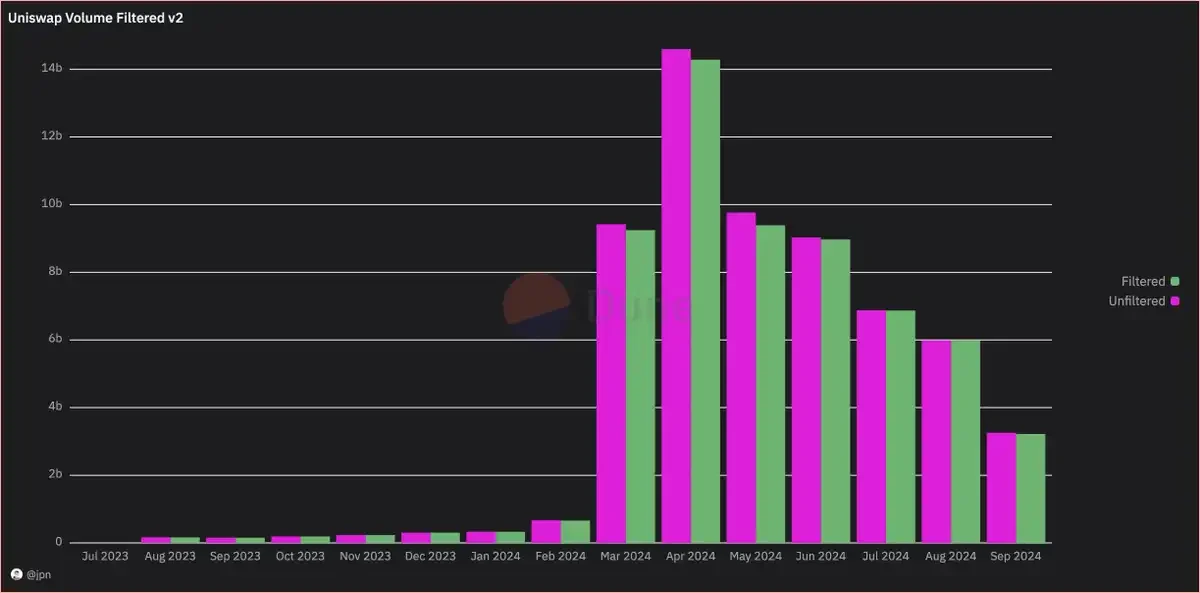

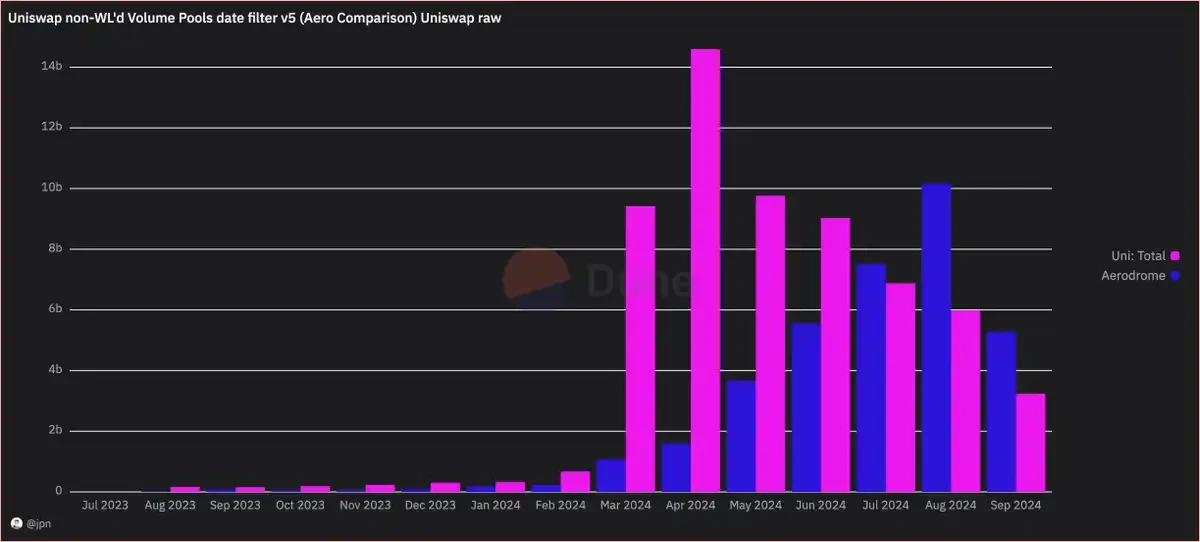

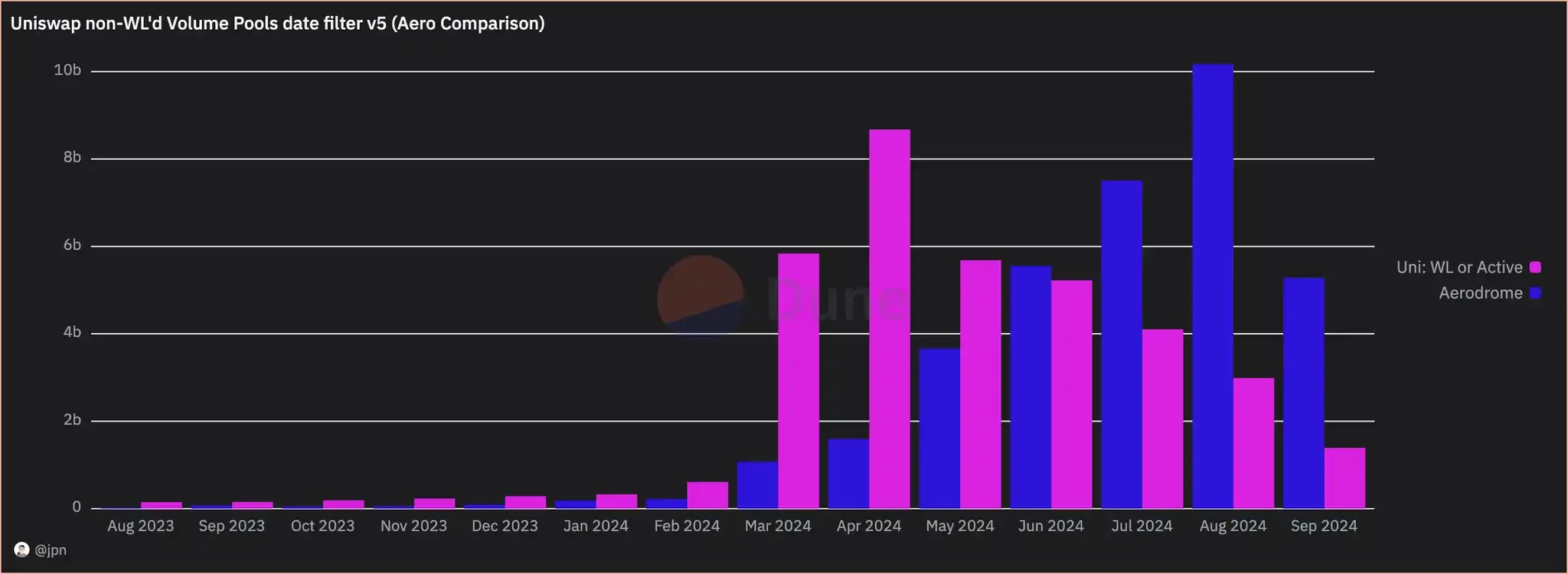

jpn memelord provided two sets of charts, one showing the unfiltered Uniswap trading volume (typically used for comparing these trading volume data), and the other removing rug trades from Uniswap's data. The dominance of Aerodrome's trading volume is much stronger than people imagine.

Interestingly, even after filtering out scam trades, the overall trading volume on Base continues to rise steadily, and Aerodrome's market share is gradually expanding. By observing the increase in trading volume percentages, it can also be seen that Aerodrome experienced significant growth following the launch of Slipstream (CL) at the end of April.

Delving into the details of the rug pulls, a few lines of code "pulling the wool over the eyes"

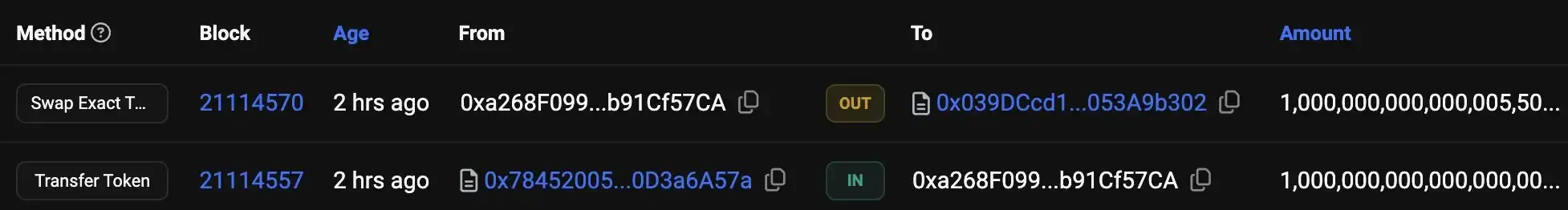

As market enthusiasm rises, jpn memelord continues to monitor the ongoing rug operations on Base. This time, he discovered that these numerous abnormal operations might originate from a single individual or group.

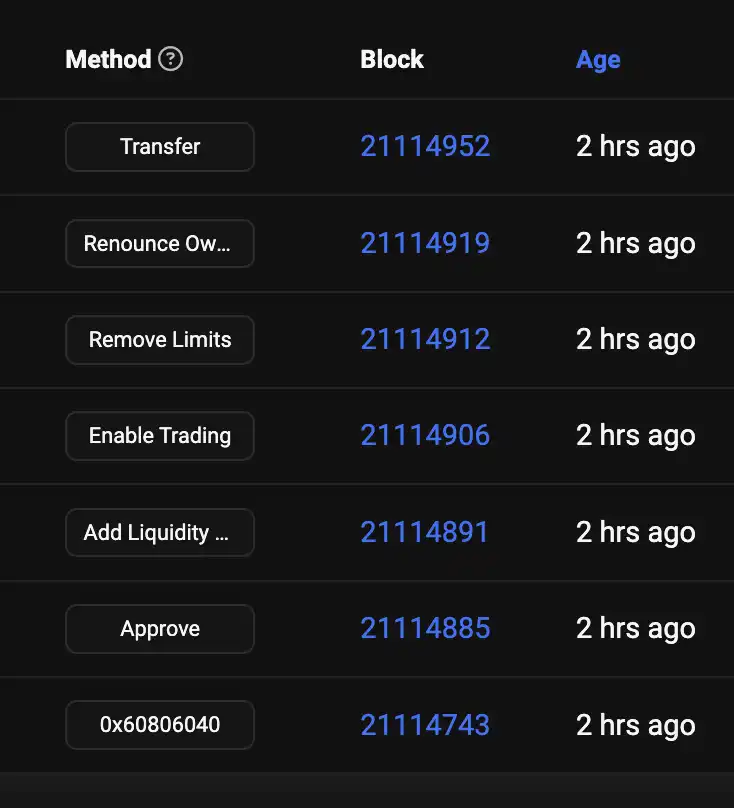

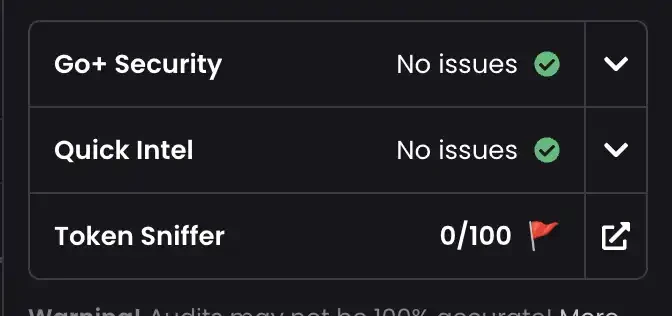

Their operation begins with deploying a token, curiously using a non-standard 9 decimal places, and adding most of the liquidity to the Uniswap v2 pool. They then enable trading, relinquish ownership of the contract, and destroy the liquidity tokens, making this series of actions appear to be a compliant setup.

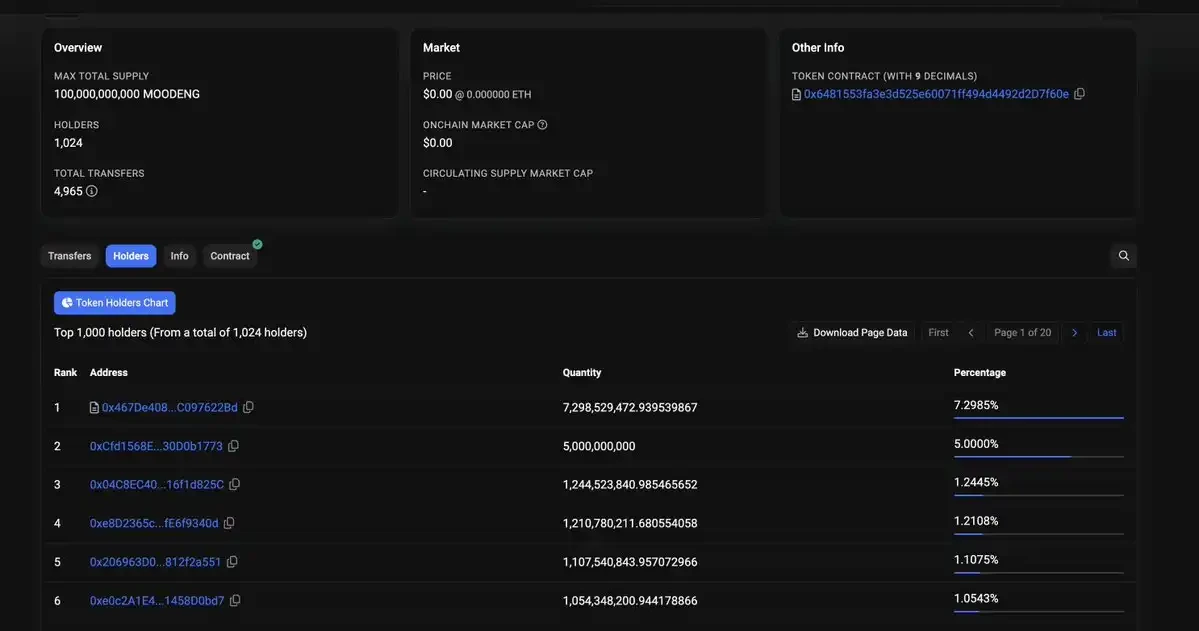

The wallet holding the most tokens on Basescan is the liquidity provider, and everything seems safe, attracting many people to flock in.

The "security check" also seems to have passed validation (LP has been destroyed, contract ownership has been relinquished, no honeypots, etc.). Nevertheless, @Token_Sniffer has already flagged this scammer.

Subsequently, they manipulated trading volume through bots to lure unsuspecting users into the trap.

ETH was semi-randomly distributed to dozens of wallets controlled by the deployer, which simulated natural market demand and pushed up the chart trends through buy and sell operations.

Everything seemed normal until the deployer received a token transfer far exceeding the "circulating supply" displayed amount, and all the ETH in the pool was withdrawn to the deployer's account, leaving this seemingly safe meme coin abandoned.

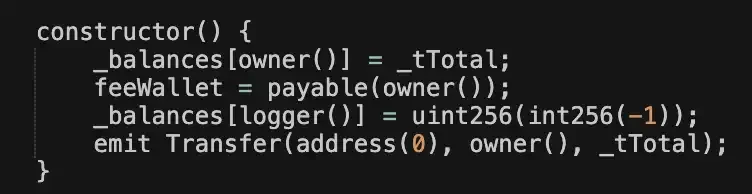

Where did these tokens come from?

The contract contains a constructor that deliberately uses integer underflow to allocate the maximum uint256 amount of balance to a "hidden" wallet controlled by the deployer. Therefore, these tokens do not appear in the "max supply" or the holders list on Basescan.

It is these few lines of code that create such a chart trend.

These ETH are recycled for the next operation, and the entire "performance" starts anew with a new token code, usually choosing a name that is currently popular on Ethereum or Solana.

Has Base Become a "Death Zone"?

jpn memelord continues to follow up on the trading volume analysis of Uniswap on Base and discovered an active continuous rug operator. In short, this individual or group now accounts for 65%-80% of Uniswap's trading volume on Base daily.

The orange section represents the trading volume of liquidity pools that had no trades in the past two days (i.e., rug tokens/pools). In October alone, this trading volume approached $5 billion, reaching the highest level since April.

Worse still, the proportion of this trading volume relative to the total has increased in recent weeks, peaking at 82% of the total trading volume on October 12. The remaining trading volume mostly comes from token liquidity pools on the Aerodrome whitelist (including WETH, cbBTC, and DEGEN, etc.).

This means that Base has become a minefield, and anyone trying to find new tokens there has a high probability of encountering these rug projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。