Bitcoin is just a step away from its historical high.

Written by: BitpushNews

The financial markets surged on Tuesday, with bulls gaining momentum as Bitcoin, gold, and the Nasdaq all advanced, while the dollar index and U.S. Treasury yields declined.

The latest data from the U.S. Bureau of Labor Statistics shows that the number of job openings in the U.S. at the end of September was 7.44 million, down from 7.86 million in August, with the August figure also revised down from the initially reported 8.04 million job openings. The CME FedWatch tool indicates a nearly 99% chance of a 25 basis point rate cut in November, and a 74% chance of another 25 basis point cut in December.

The Nasdaq index climbed to a new all-time high, closing up 0.78%. The S&P index also rose, increasing by 0.16%, but fell short of its intraday high, while the Dow Jones index dropped 0.36%.

Spot gold continued its record high momentum, briefly reaching $2,775 per ounce before pulling back slightly.

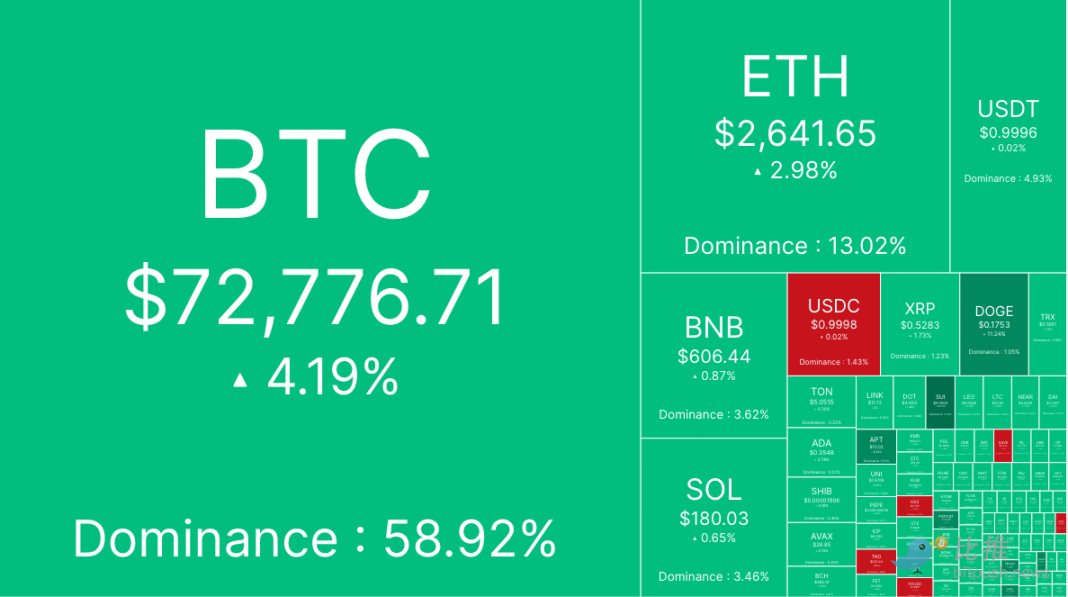

According to Bitpush data, during the U.S. stock trading hours, Bitcoin briefly rose to $73,500, just 0.4% away from its historical high of $73,750.07 set on March 14 of this year (according to CoinMarketCap data). As of the time of writing, BTC was trading at $72,776, with a 24-hour increase narrowing to 4.19%.

Almost all of the top 200 altcoins by market capitalization saw gains. Mask Network (MAS) led the way with a 19.2% increase, followed by Sui (SUI) and WOO (WOO), which rose 17.1% and 15.7%, respectively.

The overall cryptocurrency market capitalization currently stands at $2.44 trillion, with Bitcoin's market share at 58.9%.

The next phase of the bull market has begun

Data shows that open interest in futures at the CME continues to grow, with Bitcoin futures open interest reaching its largest single-day increase since June 3, now valued at nearly $42.6 billion, indicating that institutional investors' interest in Bitcoin is heating up. Additionally, since mid-September, the funding rate has been steadily rising, reflecting the market's optimistic attitude towards bullish positions.

In the cryptocurrency ETF space, Bitcoin ETFs have attracted significant inflows, totaling $479.4 million, most of which came from BlackRock. In contrast, Ethereum ETFs saw a small outflow of $1.1 million.

Veteran trader Peter Brandt analyzed several scenarios for Bitcoin's price trajectory on the X platform, each using different technical analysis methods.

In the first scenario, one variable is whether to use a semi-logarithmic or linear scale. Brandt's data shows that starting from the breakout level on the semi-log chart, BTC could "modestly trend" out of the triangle pattern and potentially rebound to $94,000.

In the second scenario, Brandt references the price fluctuations from November 2022 to March 2024 and projects them onto future price movements. Using this method, Brandt calculates a potential target price exceeding $200,000. He stated, "At the moment, I think this is a bit exaggerated. My principle is to aim for one target at a time."

The third scenario utilizes the symmetry of Bitcoin's price movements over time for cyclical analysis. Brandt's chart suggests that the next bull market peak could occur in August or September 2025, with a potential target price of $160,000. He mentioned on X, "If this trend continues, the next bull market peak should occur at the end of August/early September 2025. Of course, all these targets could be wrong. Therefore, I always keep risk management in mind when trading."

Michaël van de Poppe, founder of MN Consultancy, discussed Bitcoin's surge past $73,000, stating, "Today's market is not entirely shocking. There is a significant inflow into Bitcoin ETFs. The job openings (the first data point) are the worst since April 2021. The last data point is the market driver for yields. If the unemployment rate and labor market weaken -> yields start to decline -> DeFi rebounds -> ETH rebounds -> altcoins begin to thrive, this is the large internet bull market cycle we are all looking for."

He added, "Technically, this is what we are already seeing today, which is why the reversal is happening. It all depends on macroeconomic data, indicating that we are in the stage of becoming a mature asset class for cryptocurrencies. A huge, relatively limitless upside is coming, and most people can't even imagine how big it is."

Market analyst Keith Alan expects this rally to approach historical highs, followed by a potential pullback. He stated, "Breaking above $72,000 may put bears into 'hibernation,' but be prepared for a retest of support levels before chasing historical highs."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。