BTC Spot ETF Sees Significant Inflow of $479 Million

The spot ETF has attracted a large influx of funds due to its efficient trading method and transparent price discovery mechanism. This financial instrument allows investors to participate in the market indirectly without directly holding Bitcoin, reducing the complexity and risk of investment.

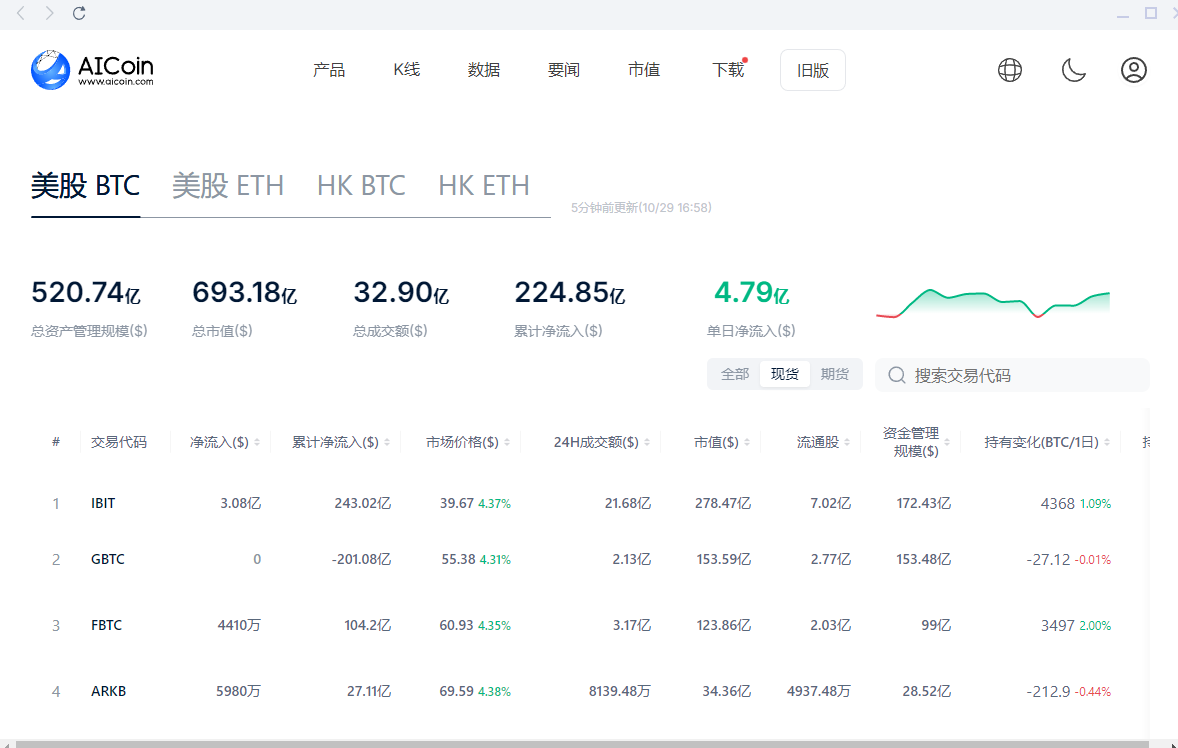

Today (October 29), the ETF continued to see a significant inflow of $479 million, maintaining the net inflow of Bitcoin spot ETF from yesterday (Eastern Time, October 28). Notably, IBIT saw an inflow of $300 million today. Statistics show that there have been 12 days of net inflow for IBIT since October, with only one day of net outflow. This indicates that the market believes the BTC trend remains very strong and will continue to be bullish on BTC.

Image Source: AICoin

According to AICoin data summary, Bitcoin spot ETF data shows that since this month, there have only been 7 days of net outflow, while the remaining 12 days have seen net inflow, and the inflow amount is quite substantial, indicating strong purchasing power.

According to the latest market data from AICoin, BTC has risen over 5% in the past 24 hours, and today (October 29) it has even surpassed the $71,000 mark, reaching a high of $71,607, setting a new price high since June, currently valued at $71,256.

Image Source: AICoin

BTC Mining Stocks Rise Due to BTC Market Influence

Recently, Bitcoin mining stocks have also seen a significant rise, with mining stocks reaching a maximum increase of 24.4% today (October 29). Bitcoin mining stocks are viewed as high-beta tools, meaning their price fluctuations are closely related to Bitcoin prices. When Bitcoin prices rise, related mining stocks typically also increase, and when related mining stocks rise, it suggests the potential for Bitcoin to continue rising.

Jefferies analyst Jonathan Peterson even gave Core Scientific (stock code CORZ) a "Buy" rating with a target price of $19. This bullish rating not only reflects the prospects of mining stocks but also indicates market confidence in the future price of Bitcoin.

As Bitcoin prices rise, miners' revenues increase, allowing them more resources to invest in advanced technologies such as artificial intelligence. At the same time, mining companies become more profitable, potentially reducing their tendency to sell their held Bitcoin to cover operating costs, which helps alleviate selling pressure in the market.

Moreover, the bullish sentiment surrounding mining stocks may also translate into increased confidence in Bitcoin's long-term prospects, attracting more institutional investors into the market.

Summary

Overall, the improvement in market sentiment, increased participation from institutional investors, and the rise in mining stocks all showcase the thriving landscape of the current Bitcoin market. Behind this prosperity, we can see not only the profit-seeking behavior of capital but also the market's recognition and expectation of digital currency as an important component of the future financial system. The continuous inflow into Bitcoin spot ETFs and the rise in mining stocks are exciting chapters in this financial transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。