Large-cap Meme coins are gradually acquiring the attribute of "value storage," with investors showing a stronger tendency to hold them. Many investors are adopting a "buy the dip" strategy, further strengthening the head effect.

Written by: bitsCrunch

Recently, BTC has once again broken through the $70,000 mark, and the market's greed index has reached 80 again. Meme coins often serve as the clarion call for each bull market, such as $GOAT, which saw its price rise over 10,000 times in just five days. By analyzing the trading data of the current market's TOP 25 Meme coins, we have identified several noteworthy market characteristics and evolving trends.

Meme Market Characteristics

Holder Address Stratification

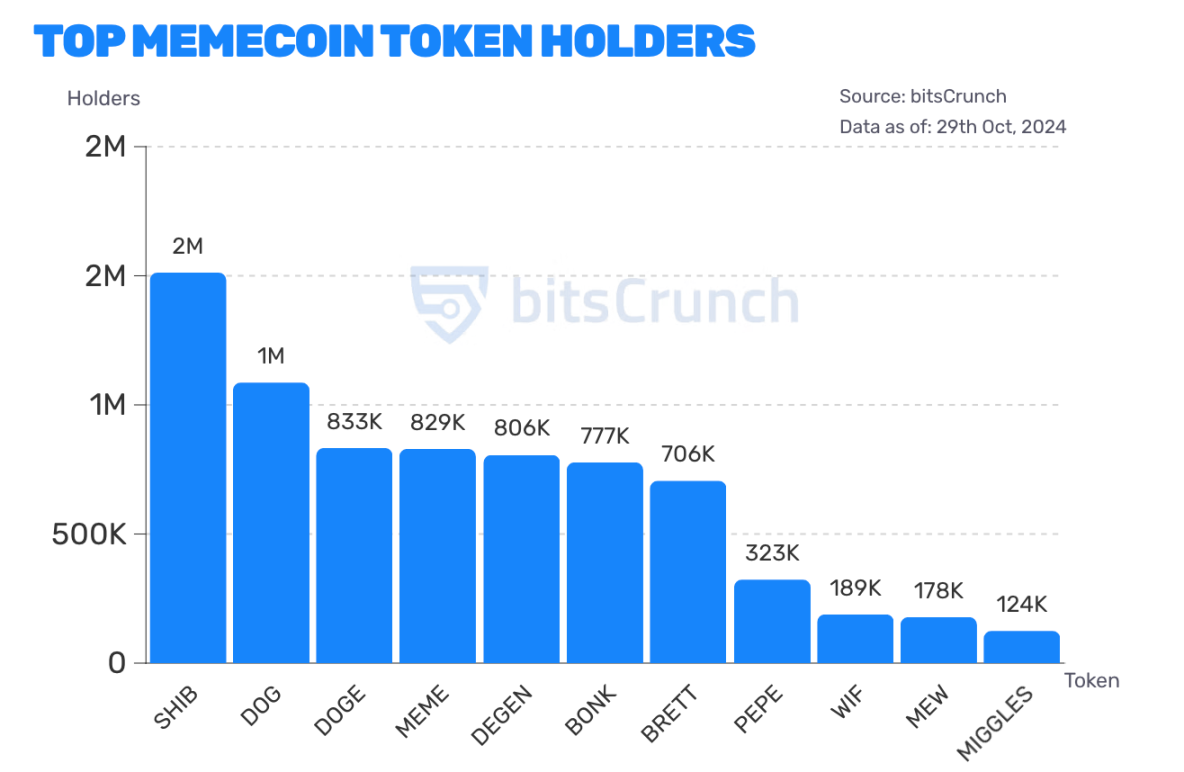

In terms of the number of holders, SHIB, DOG, DOGE, MEME, and DEGEN all have over 800,000 addresses, with SHIB leading with 1.51 million addresses, about 400,000 more than the second-place DOG. At the same time, these projects also account for a significant portion of the overall market's trading volume.

BONK and BRETT have over 700,000 holder addresses, while projects like PEPE and WIF have 320,000 and 180,000 addresses, respectively. However, it is noteworthy that the 30-day growth in holder addresses for these two projects is 3.02% and 4.86%, respectively, surpassing the growth rates of all the previously mentioned Meme coins with the most holders.

According to bitsCrunch data, MEW and MIGGLES are the only two remaining Meme coins with over 100,000 holder addresses, with MIGGLES experiencing a 30-day growth of 26.55%. Tokens like HIGHER, FLOKI, POPCAT, MOCHI, PONKE, MOODENG, and MYRO fall into the 50,000 - 100,000 holder address range, but their liquidity is relatively limited.

Liquidity Stratification

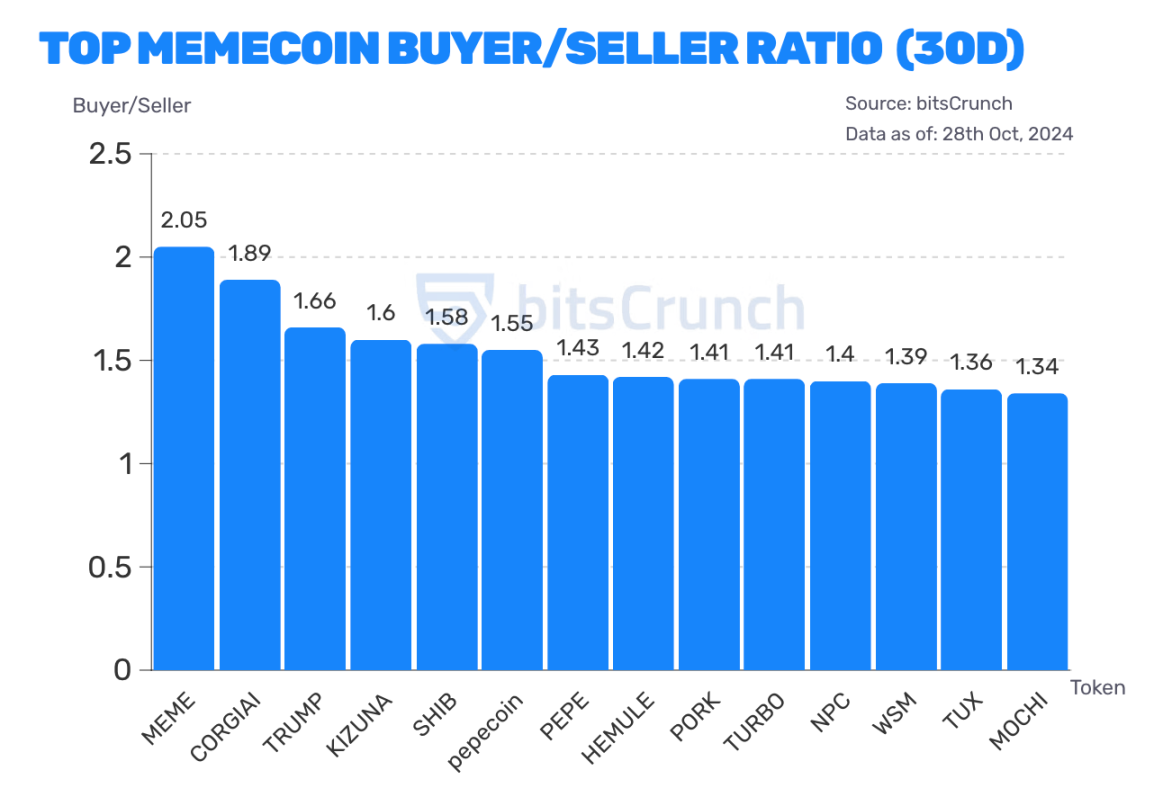

The price of Meme coins shows a strong correlation with social hot events. According to the buy-sell comparison index, TRUMP has an index of 1.66, with a price increase of 15.9%. This is highly related to the recent U.S. political election events.

SHIB and WIF had the highest trading volumes in the past 7 days, at 70.2 billion and 67.3 billion, respectively, far exceeding the third and fourth places. By comparing trading volume and price fluctuations, it is found that projects with high trading volumes (such as SHIB and DOGE) have relatively mild price fluctuations, while projects with lower trading volumes tend to have larger fluctuations.

Thus, large-cap Meme coins are gradually acquiring the attribute of "value storage," with investors showing a stronger tendency to hold them. Many investors are adopting a "buy the dip" strategy, further strengthening the head effect. In contrast, small-cap Meme coins are more likely to serve as speculative tools, with stronger short-term speculation. Liquidity stratification will become more pronounced, which may lead to increased market polarization.

The ratio of address and price change reflects the immediate changes in liquidity. According to bitsCrunch data, HIGHER and MOODENG have seen short-term liquidity increases of 2.32% and 1.98%, respectively. Such abnormal liquidity inflows often indicate potential price fluctuations.

Conversely, TURBO and PONKE have experienced liquidity outflows of -0.31% and -0.13%, respectively. This slow but steady liquidity outflow may suggest a gradual weakening of market confidence.

For investors, this means a need to more cautiously assess the liquidity risks of projects rather than merely focusing on price fluctuations. In this rapidly evolving market, the importance of risk management may outweigh the pursuit of returns.

Ecological Analysis Framework

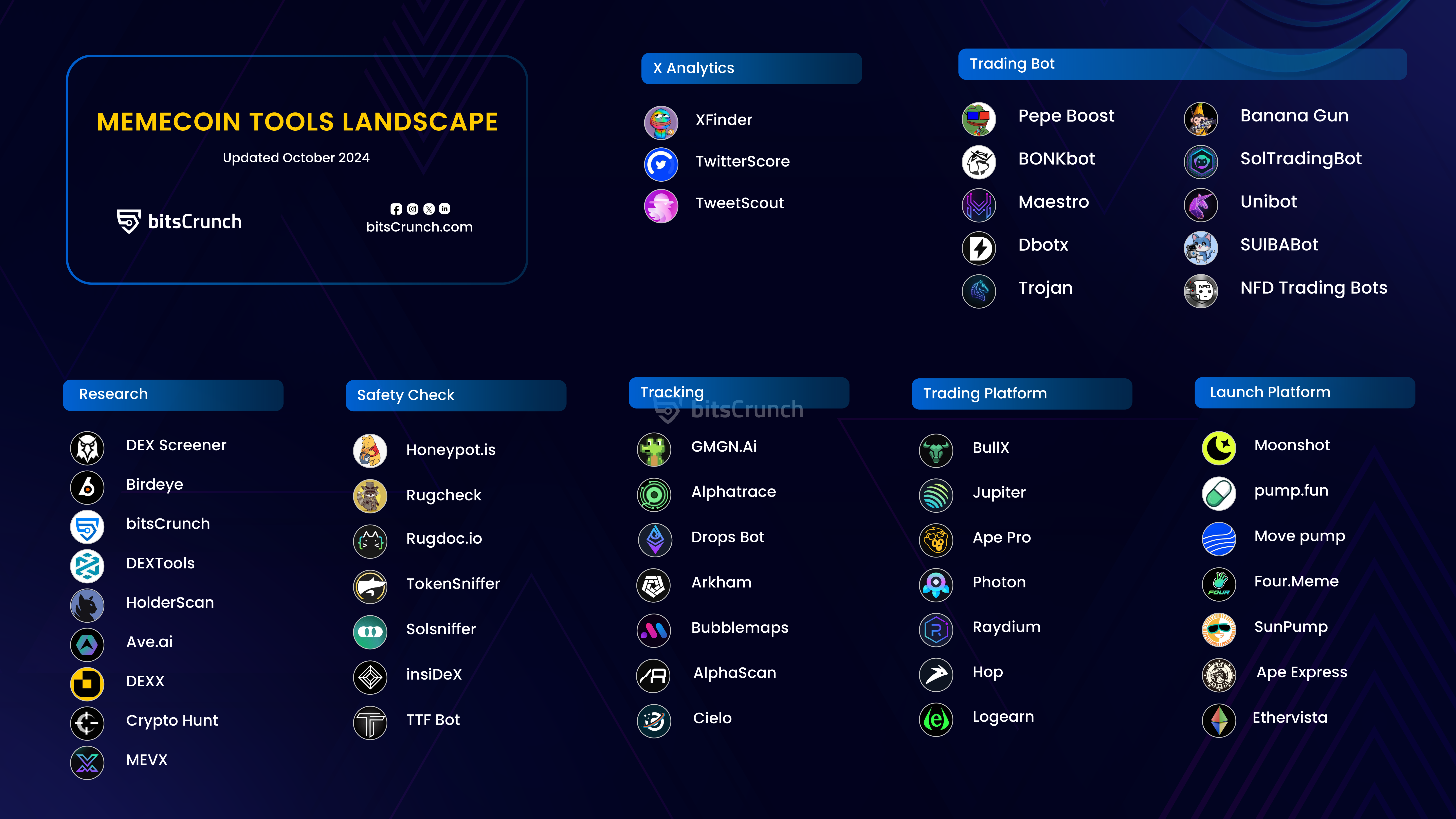

The panoramic view of the Meme tool ecosystem presents five core sectors of the entire industry: research tools, security checks, tracking systems, trading platforms, and issuance platforms.

Trading Security Data Analysis

From the current market data, authenticity verification and contract security assessment have become the primary steps in investment decision-making. The rampant manipulation in the Meme coin trading market often hides two possibilities: first, project parties attempt to create trading activity to climb the DEX Screener trend list; second, bots are engaged in market manipulation. Therefore, it is essential to identify genuine community interactions before trading.

By analyzing the contract of the holder addresses of Meme coin projects, several risk issues have been identified: one is excessive centralization of permissions, the second is the lack of liquidity locking, and the third is a significant overlap of holder addresses.

Specifically, a core address frequently interacts with multiple dispersed addresses. This pattern is particularly common in some emerging projects with abnormal 24-hour price increases, often indicating the risk of centralized control. Additionally, it is necessary to monitor whether there are complex fund flows between multiple large holding addresses, which may indicate the operation of a large speculative group behind the scenes.

Therefore, for newcomers to Meme coins, it is crucial to observe the degree of dispersed holdings, which is usually more common in mature projects like SHIB or PEPE. However, it is worth noting that even in such projects, the TOP 100 addresses still control the vast majority of the supply.

Social Influence Analysis

Generally, a successful Meme coin project requires endorsement from at least 3-5 KOLs with over 100,000 followers on average. However, this metric is changing.

Currently, high follower counts are no longer a decisive factor. For example, although HIGHER has only received support from medium-sized KOLs, its ability to rise is even stronger. This reflects a market shift towards de-KOLization. The timing of KOL endorsements has a significant impact on project trends. Projects that receive multiple KOL endorsements concentrated in a short period often perform worse than those with endorsements spread over different periods.

Key Indicator System

Based on statistical analysis of successful cases, we summarize the following key indicator system:

- Trading Volume Indicator: A robust project should achieve an organic trading volume (excluding bot trading) of $500-1,000 within the first hour of launch. This figure is below the industry-standard threshold of $1,000-2,000, but we find that a lower initial threshold is conducive to the project's sustained development.

- Market Cap Threshold: $100,000 is a critical psychological barrier. Data shows that 87% of successful projects begin to achieve substantial growth only after surpassing this market cap. However, it is noteworthy that this threshold varies across different sectors. For example, AI-themed Meme coins often require a higher starting market cap.

- Supply Distribution: The proportion of holdings by the founding team is an important indicator. Statistics show that when the founding team's holdings are below 5%, the project's survival rate significantly increases. This may be because lower team holdings reduce the risk of selling pressure and increase community confidence.

Risk Warning Mechanism

First, basic indicator monitoring. Real-time tracking of trading volume, holding distribution, price fluctuations, and other basic data, setting alarm thresholds for abnormal fluctuations.

Second, on-chain behavior analysis. Monitoring large address movements, especially interactions with known risk addresses. At the same time, track changes in liquidity pools to warn of potential sell-off behaviors. Establish a dynamic stop-loss system, setting different stop-loss ratios based on the project's different development stages.

Third, social signal monitoring, establishing a KOL database to identify potential market manipulation signals. Pay special attention to abnormal activity on social media, look for opportunities on new public chains, and diversify the investment portfolio.

Through extensive data and market observations, we hope to provide investors entering the Meme market with a comprehensive market overview and a systematic analysis framework. However, it is important to emphasize that this article does not constitute investment advice, and any framework needs to be continuously adjusted and improved based on market changes. Since Meme is a high-risk, high-reward market model, it is essential to focus on risk monitoring before trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。