BTC Breaks Through $70,000

According to the latest data from AICoin, BTC has increased by 5.77% in the past 24 hours, breaking the $70,000 mark, reaching a high of $71,607, marking a new price peak since June, and is currently valued at $71,146.

Image Source: AICoin

When analyzing the background of BTC's price increase, macroeconomic factors cannot be overlooked. Political changes and global economic concerns are considered one of the reasons for Bitcoin's recent rise. With less than ten days until the U.S. elections, the sentiment in the cryptocurrency market is being influenced, as candidates have expressed varying degrees of support for the crypto market, leading to increased investor optimism towards cryptocurrencies, which further drives up Bitcoin's price.

Additionally, the outcome of the U.S. elections could have a significant impact on the digital asset industry, as the next president and Congress may enact legislation regarding cryptocurrencies and potentially modify tax and spending policies that affect broader financial markets.

Geoff Kendrick, Global Head of Digital Asset Research at Standard Chartered Bank, predicts that if Trump wins, Bitcoin could surpass $75,000 on election day, and if the Republicans control Congress, Bitcoin could reach a high of $125,000 by the end of the year. Conversely, if the Democrats led by Harris win, Bitcoin may temporarily decline but could still set a historical high of around $75,000 by the end of the year.

Matthew Siegel, Head of Digital Asset Research at VanEck, also stated that Bitcoin's recent rise is related to political changes and global economic concerns.

At the same time, large institutions like Grayscale and BlackRock are actively participating in the Bitcoin market, making significant purchases of Bitcoin, demonstrating confidence in its future potential. The involvement of these institutions not only brings in capital inflows but also enhances market recognition of Bitcoin.

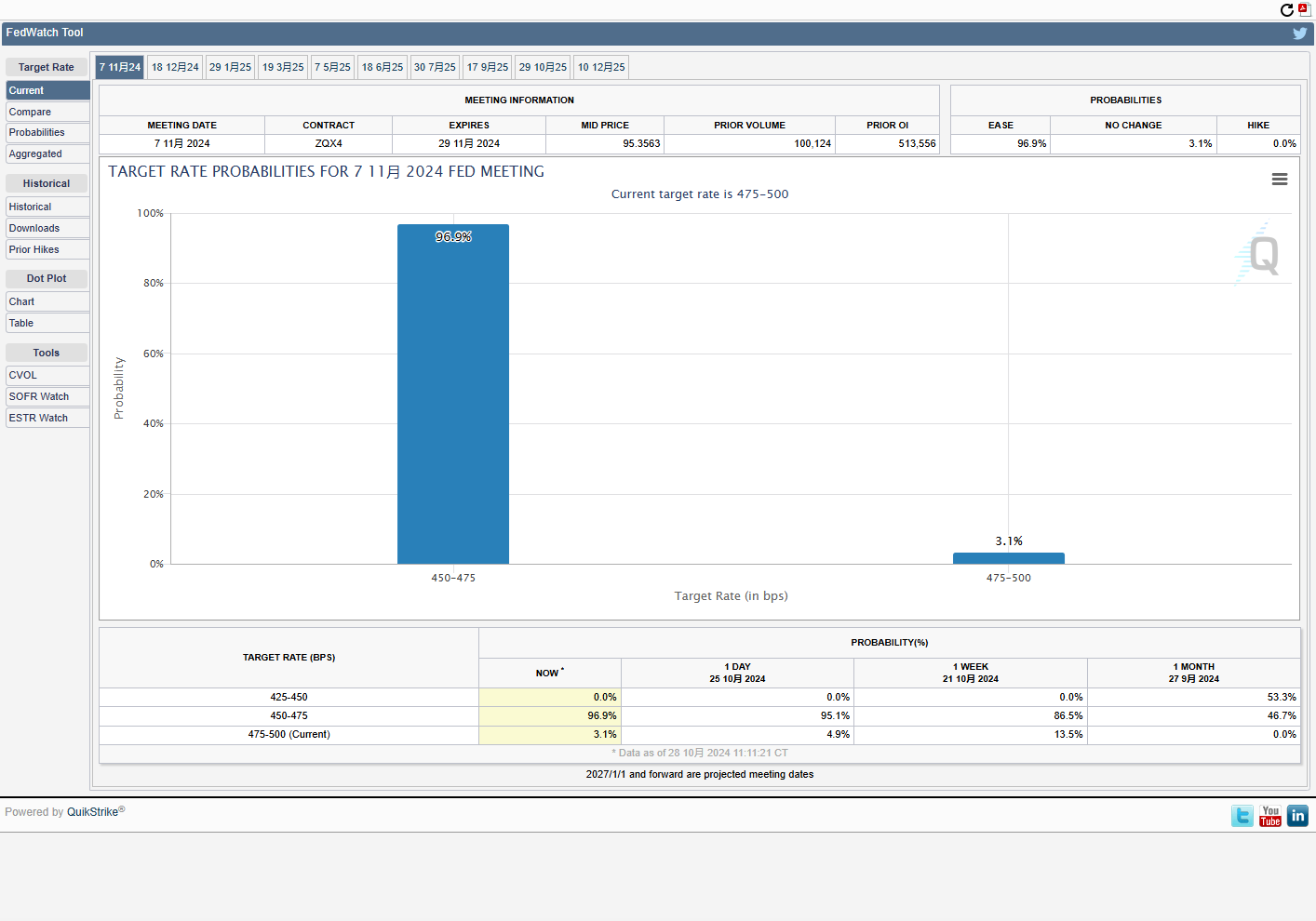

High Probability of Fed Rate Cut Again

As of today (October 29), according to CME data, the market is almost certain that the Federal Reserve will cut rates by 25 basis points at that time, with traders currently estimating a 96.9% probability of a 25 basis point cut in November, a 0% probability of a 50 basis point cut, and a 3.1% probability of no cut.

Image Source: Internet

If the Federal Reserve cuts rates as expected, it typically increases market liquidity, stimulating demand for speculative assets and driving capital inflows into the crypto market, especially traditional cryptocurrencies like BTC. For example, during the last Fed rate cut of 50 basis points in September, market expectations of an impending reduction in borrowing rates propelled Bitcoin's price, with BTC rising over 6% at one point.

Conclusion

The breakthrough of Bitcoin's price above $70,000 is not only a result of market speculation but also a product of the intertwining global economic and political forces. From the confidence of institutional investors to the Federal Reserve's monetary policy, and the upcoming U.S. elections, each factor is pushing Bitcoin's price to new heights. As these factors continue to evolve, the Bitcoin market may experience more volatility and opportunities in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。