Calculate and compare the staking rewards of various leading LRT projects.

Written by: 0xResearcher

1. Introduction to LST and LRT

What is LST: stETH obtained by users through liquidity staking protocols like Lido.

Behind LST: PoS network security, staking interest.

What is LRT: Users delegate lsdETH assets like stETH to liquidity restaking protocols, which then restake the lsdETH into EigenLayer on behalf of the users, obtaining collateral certificate tokens, i.e., LRT assets.

Restaking is a concept first proposed by Eigenlayer.

2. Overview of LRT Reward Data

EigenLayer's recent rewards were first (and even exclusively) announced and distributed by Renzo. Let's take a look at the data:

"From August 15, 2023, to October 8, 2023, ezETH generated rewards of 769.01 ETH (593,727.31 EIGEN) through restaking.

ezEIGEN generated 1,731.05 EIGEN in just one week from October 1 to October 8."

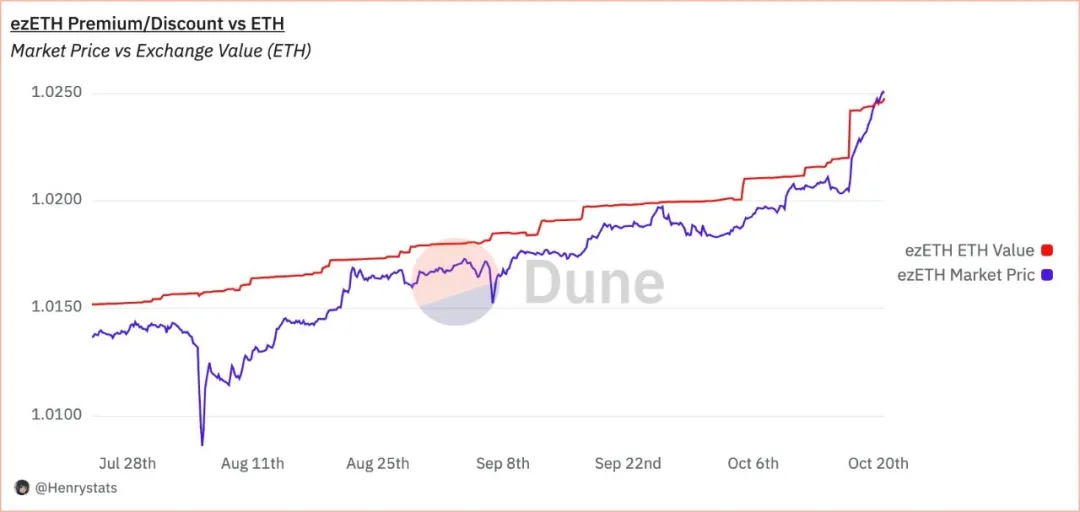

During the period from August 15, 2023, to October 8, 2023, users earned over $2 million in rewards from EigenLayer's restaking, with these rewards directly reaching users' accounts through an automatic compounding mechanism. Meanwhile, the price of ezETH surged from 1.0224 to 1.0242, currently trading at a premium of 0.043%. A total of over $2 million in restaking rewards has been distributed and continues to compound. These rewards are automatically allocated to users' accounts without the need for manual claiming, greatly enhancing the participation experience.

3. Advantages of LRT Restaking

1. High Restaking Rate

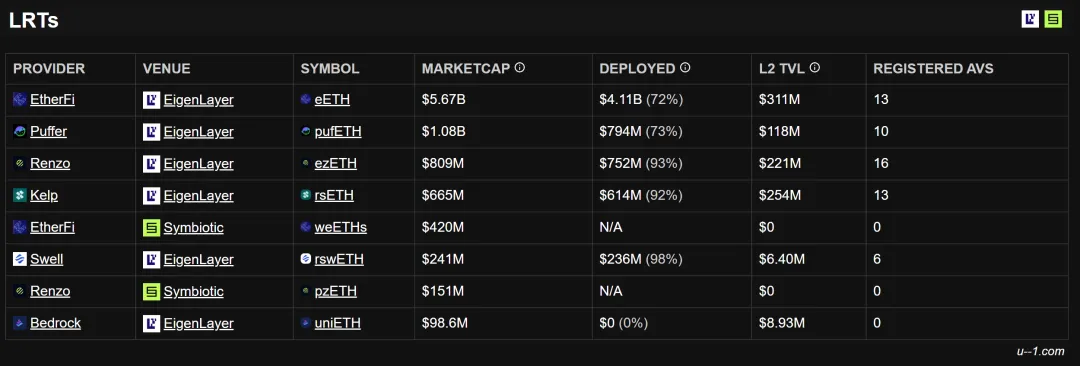

From the third-party data in the above image, we can see that among the many protocols in EigenLayer, Swell, Renzo, and Kelp lead with high restaking rates. Compared to Puffer (73%) and EtherFi (72%), the total restaking TVL ratio is significantly higher, maximizing the returns from AVS rewards.

2. Automatic Compounding Returns

The traditional restaking process is not only complex but also incurs high gas fees and cumbersome manual management. Taking EigenLayer as an example, users typically need to select operators through the EigenLayer App, manage risks, and manually claim and process rewards. Additionally, EIGEN stakers face long unlocking periods and frequent tax events. For most users, this series of operations is both time-consuming and labor-intensive.

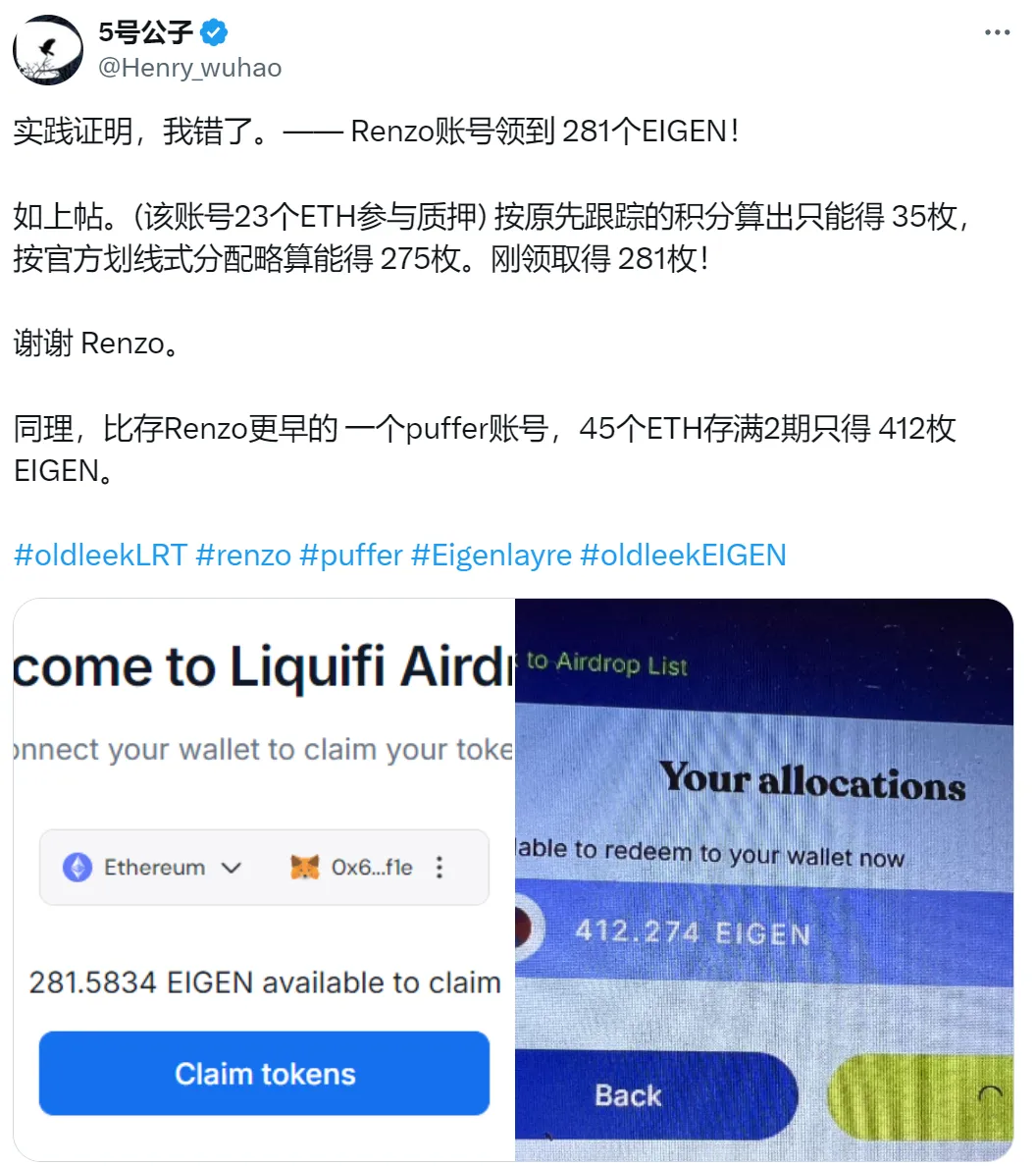

$ezEIGEN addresses these pain points by providing an automated solution. By automatically managing operator and validator services (AVS), $ezEIGEN significantly reduces the burden on users while automatically claiming rewards and compounding them weekly, thus lowering gas fees and improving overall yield. Perhaps this is why we see genuine expressions of appreciation from community users.

4. Calculation of LRT Reward Efficiency

EigenPods are tools for Ethereum validator nodes to interact with EigenLayer, ensuring that UniFi AVS services can penalize validator nodes that violate pre-confirmation commitments. As the number of EigenPods increases, the gas fees for claiming rewards rise significantly. Renzo has only 5 EigenPods, keeping weekly gas fees in the hundreds of dollars, while other protocols, like EtherFi, may have thousands of EigenPods, with weekly gas costs reaching up to 35 ETH. By using fewer EigenPods, Renzo not only reduces gas costs but also ensures efficient reward distribution.

Moreover, AVS rewards are distributed weekly, further enhancing the value of user participation and the frequency of earnings.

Overall, Renzo is not just providing basic staking or restaking services; it focuses more on providing professional operational support and technical services for AVS, such as network management and node operations. Therefore, it is reasonable that Renzo stands out in the competition for AVS rewards through high restaking ratios, automatic compounding, and lower gas costs, along with efficient use of EigenPods.

Let's compare Renzo and Ether.Fi:

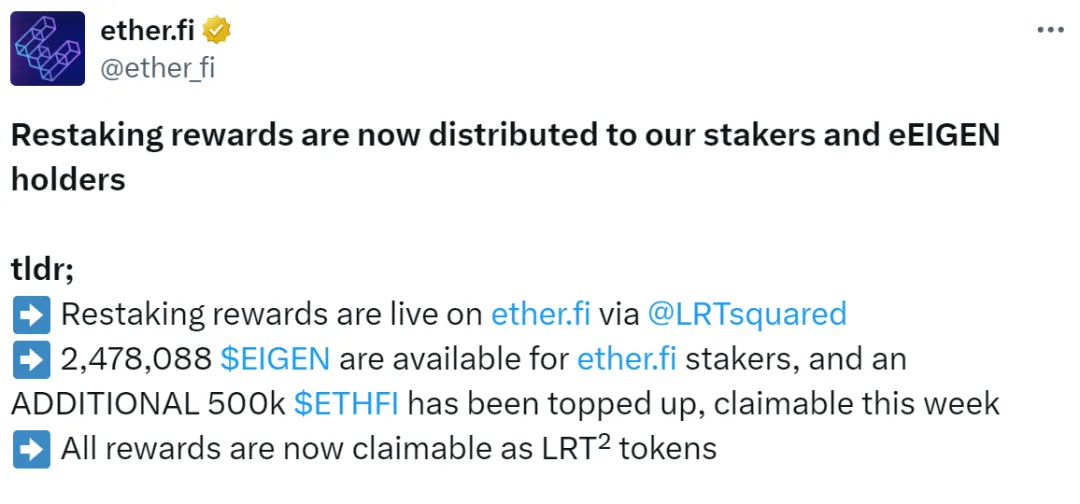

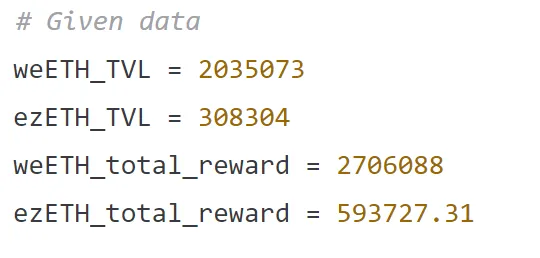

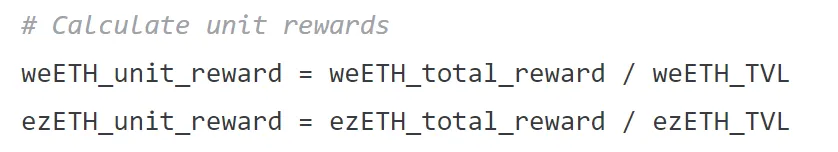

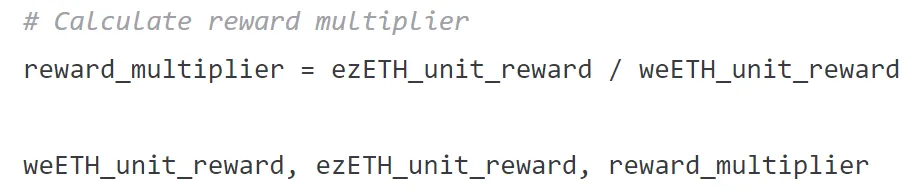

TVL and Restaking: According to the latest reward distribution tweet from EtherFi, it distributed 2,478,088 EIGEN in its first batch of restaking rewards, along with 500K ETHFI available for claiming. ezETH stakers received 593,727.31 EIGEN, while weETH stakers received 2,478,088 EIGEN. On the surface, it appears that weETH stakers received 4.17 times the rewards. However, considering TVL for unit returns, let’s do the math.

According to the calculations, the reward per unit of weETH is 1.33 EIGEN, while the reward per unit of ezETH is 1.93 EIGEN. Therefore, the unit reward for ezETH users is 1.45 times that of weETH users. Thus, while the total reward amount for EtherFi appears large, the actual returns are not as satisfactory.

Renzo's automatic compounding vs. EtherFi's manual claiming: Renzo's automatic compounding mechanism saves users significant gas fees. Users do not need to manually claim rewards; all earnings are automatically compounded into restaking. In contrast, EtherFi's rewards require manual claiming, leading to higher gas fees and reduced actual returns.

Gas fee issues: Since EtherFi users need to manually claim rewards, especially on the Ethereum network, this means users face high gas costs. Renzo's automatic compounding feature eliminates this cost, allowing users to receive and reinvest their rewards without paying gas fees.

5. Incentive Rules for Each LRT

As the restaking track based on Eigenlayer continues to develop and market shares are gradually divided, users aiming for "airdrop hunting" rather than (so much) caring about staking rewards have already gained a good understanding of their earnings. We can also look at the incentive rules to get a basic understanding of this track.

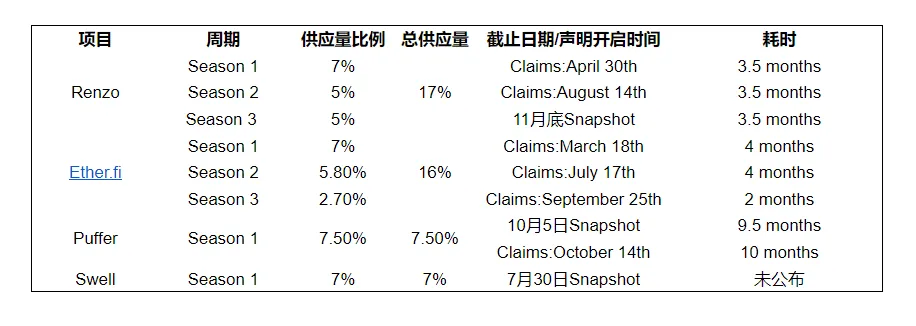

It is clear that the incentive rules of each project have their own strengths in different aspects:

Expected time consumption: Ether.fi and Renzo's incentive activities take the least time. Compared to Puffer's first season, which took nearly 10 months, users spend less time on Ether.fi and Renzo, allowing them to participate and earn rewards more quickly.

Expected token distribution: Puffer's single-period distribution ratio is 7.5%, the highest among all projects. However, considering the market and restaking rates, the author believes Puffer is merely a paper fortune, while Ether.fi and Renzo appear to be more sincere.

Expected long-term participation: Projects that can sustain participation and profitability are the optimal choice in today's market volatility, with Renzo's total season duration of 10.5 months and Ether.fi's 10 months of year-end data push being very good options.

6. Future Outlook for the Restaking Industry

Currently, protocols based on Eigenlayer are still in their initial stages. Ultimately, one or two will dominate the market, depending on which protocol can maintain growth and create a significant gap with the second and third players, thus determining the leading players. Each bull market will bring new narratives; Lido has established itself over time, so who will be the next "Lido" in the staking track?

With numerous restaking platforms emerging, who truly calculates users' earnings and platform benefits clearly and transparently? This is a track that requires time to test, and time is precisely what everyone lacks. So how can one filter out the mixed projects in the market? Everyone has their own set of criteria, and the author does not make any biased statements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。