Ethereum stablecoin synthetic dollar project Ethena still has a "criminal record"?

Written by: Nomad

Translated by: Felix, PANews

The Ethereum stablecoin synthetic dollar project Ethena has not shaken off the doubts of being the "next LUNA" and has recently faced another "crisis of integrity." A community user posted on the X platform questioning the use of 180 million ENA tokens to earn Sats in Q3, diluting the rewards of other participants. Below are the details.

The Ethena team is using 180 million ENA tokens (25% of the SENA supply, used to earn Sats) for liquidity mining of Sats in Q3, which effectively dilutes the rewards of other participants. This has raised significant concerns about the team's ethics.

Evidence Timeline:

August 22: Coinbase announced that its Prime service would become the primary custodian of ENA tokens for Ethena Labs and Foundation.

August 23: The Coinbase Prime custody address received over 3 billion ENA tokens, exceeding the total circulating supply of ENA at that time according to Ethena's allocation plan. There is reason to believe this is the Coinbase Prime custody address for ENA tokens locked by the core team of Ethena Labs and the Ethena Foundation.

October 3: When SENA staking was launched through the S2 airdrop, the Coinbase Prime Custody address distributed 180 million ENA tokens to six wallets:

Day 1: 2 transfers (30 million and 35 million ENA)

Following days: 4 transfers (35 million, 30 million, 25 million, 25 million ENA)

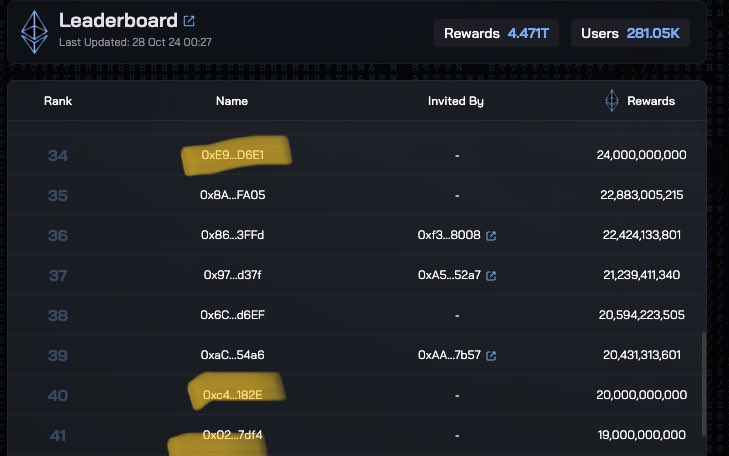

Ethena Sats Leaderboard shows:

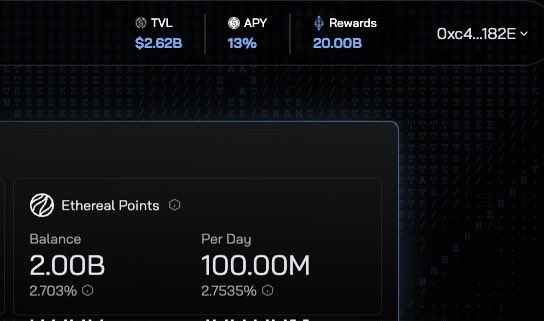

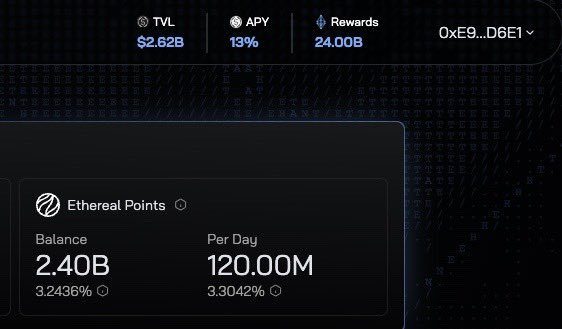

These SENA not only earn Sats but also earn Ethereal points (the DEX in collaboration with Ethena is set to launch by the end of 2024). The following image shows that the Ethena team has currently accumulated 20% of the total Ethereal points.

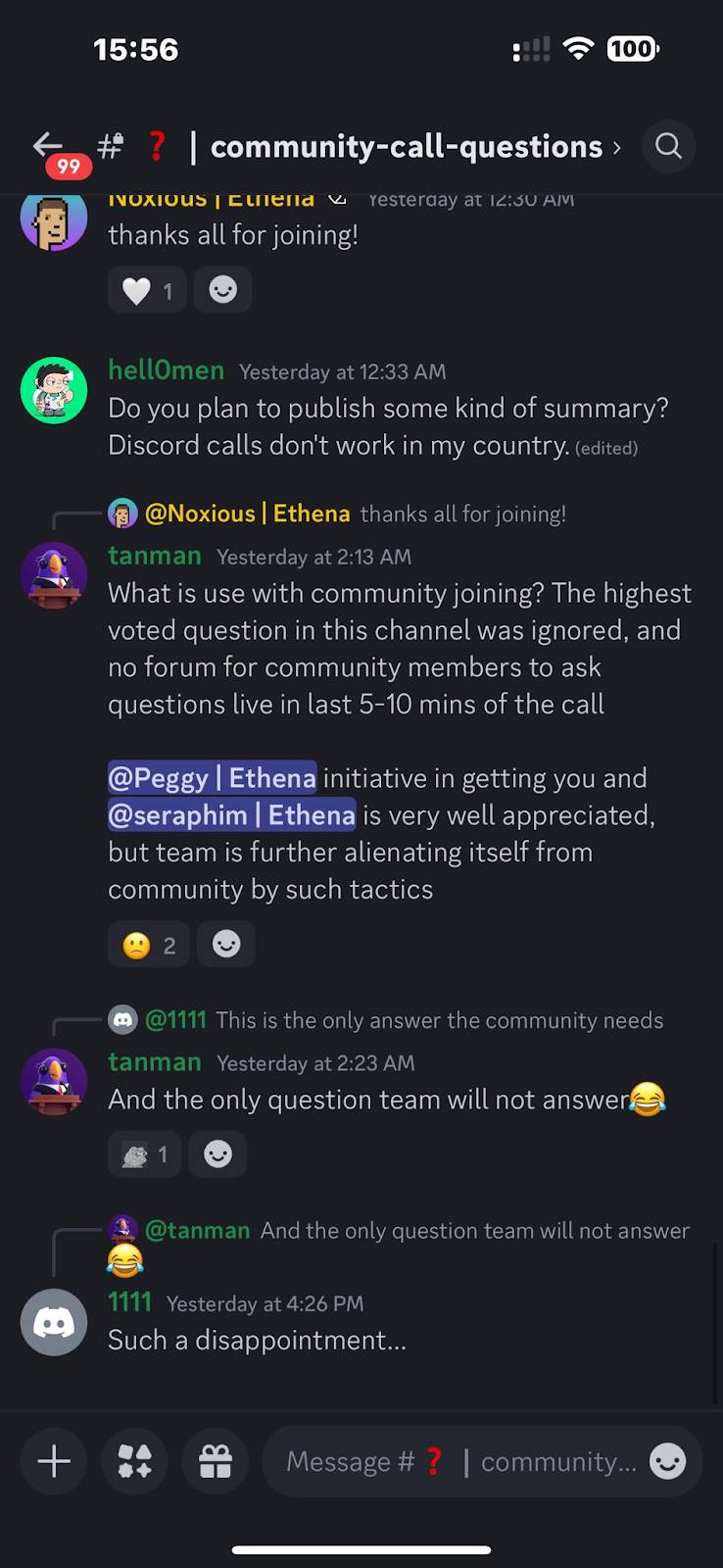

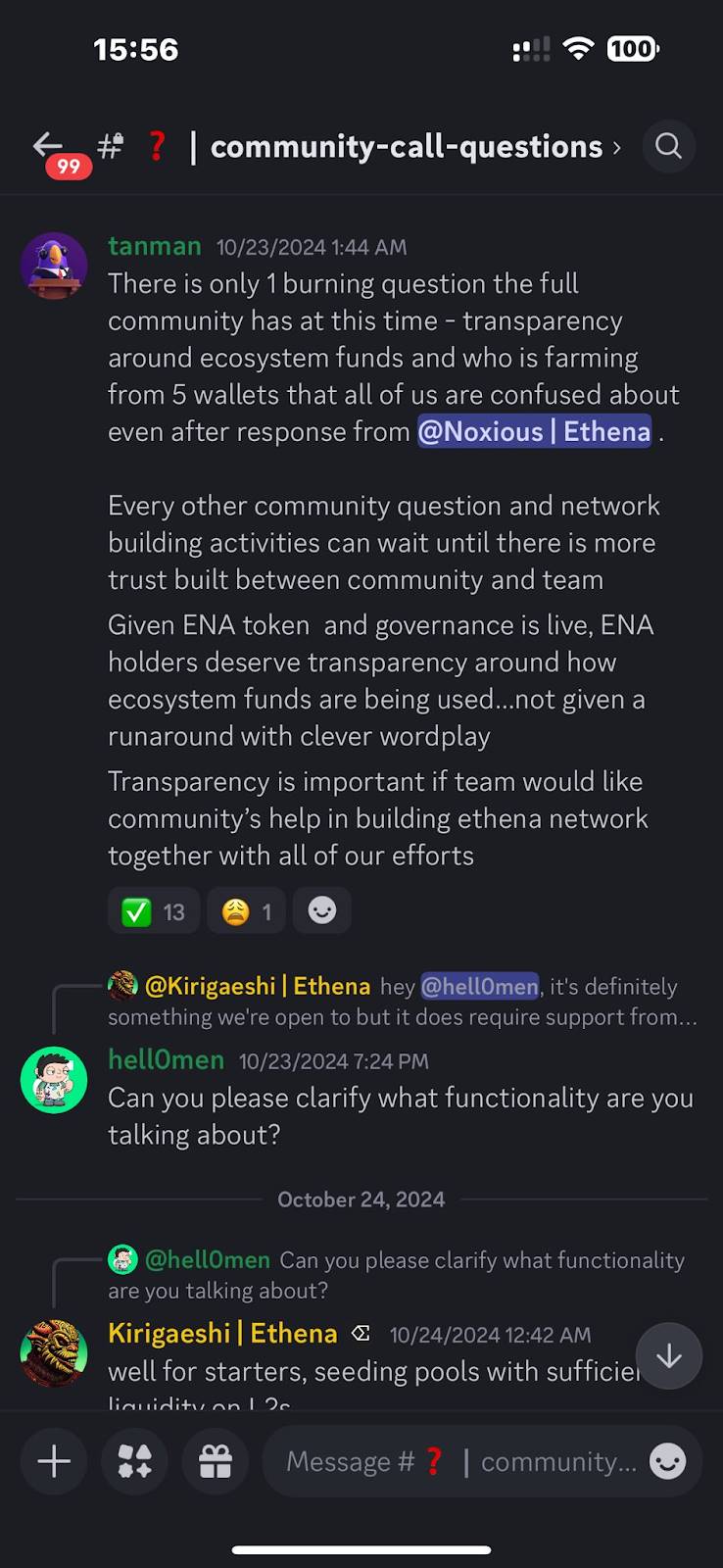

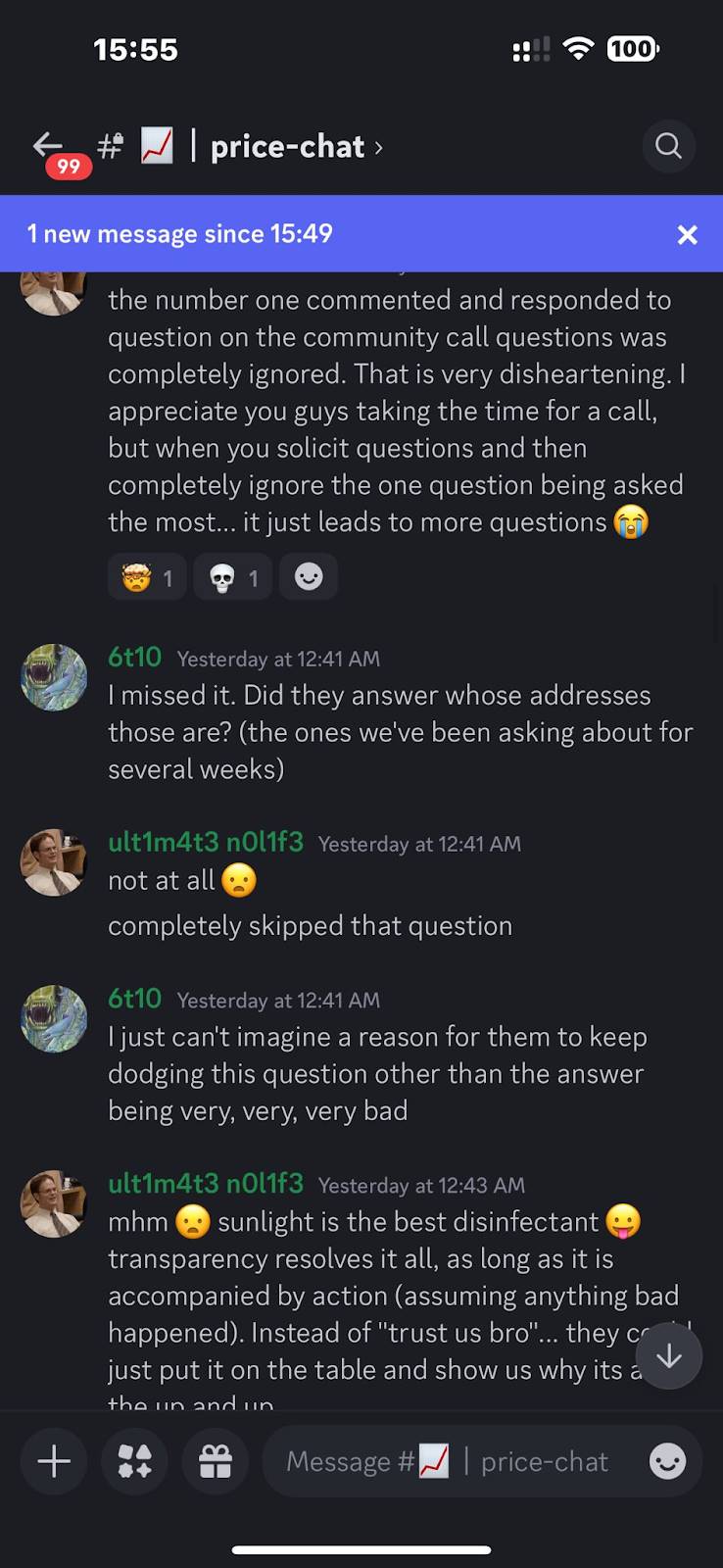

These suspicious addresses have raised questions before. In Ethena's first community call, this was the most voted question, but the Ethena team chose to completely ignore it, which fully illustrates the team's ethical standards and attitude.

The ethical conduct of the Ethena team has always been questionable, having previously changed allocation rules arbitrarily. Users participating in S1 mining may remember that the Ethena team forced them to stake 50% of their allocated tokens halfway through the allocation plan. Users participating in S2 mining suffered losses due to the last-minute implementation of a 30-day average USDe holding rule. S2 YT holders were nearly facing significant losses when subjected to the same average holding rule.

As a CeDeFi project, it is largely a black box. Users have no choice but to trust the numbers published by the Ethena team. No one really knows how much profit and staking income Ethena has generated from the $2.6 billion user fund, or whether all income is flowing to SUSDe holders. While establishing strong trust with users is crucial for protocols like Ethena, the team's past performance has been contrary to this principle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。