Crypto News

October 28 Hot Topics:

1. Three whale addresses withdrew approximately 200,000 SOL, worth about $32 million, from exchanges within 6 days for staking.

2. Cardano founder Charles Hoskinson announced plans to restart the Bitcoin education project in 2025.

3. AI Bot Fund's market cap on Daos.fun has reached $100 million and has received recognition from Marc Andreessen.

4. Castle Island Ventures founder: The meme coin craze is a reaction to the SEC's strict regulations.

5. Tether released a preview of its local AI development kit, Local AI.

Trading Insights

After this cycle, many have realized that making money in the crypto space will become increasingly difficult; without a good plan, it's hard to make significant profits. Based on personal experience, I summarize two practical methods: 1. Enter the market at the lowest range of the big cycle (end of the bear market) and invest all idle funds into quality altcoins. For example, at the end of last year, I invested all 1.7 million into Gala, Mana, and other strong altcoins, without touching BTC or ETH. After New Year's Day last year, from January to March, Gala increased fourfold, and by March, I had completely converted my holdings into BTC and ETH, resulting in 22 BTC and over 80 ETH. Meanwhile, SOL had not yet shown any signs of movement in the first half of last year; I only had 100 SOL then. The reason for buying altcoins at the lowest point of the big cycle is that their mid-term trend offers a higher profit rate than BTC, but once the yield approaches 300%, it’s necessary to convert holdings into BTC to hedge against declines. For instance, why did BTC need to be heavily invested when it retraced to around 17,000? It wasn't because the price was low enough; at that time, many were still predicting 12,000, 8,000, and 6,000. The lowest point of this big cycle is not determined by technical analysis but by macroeconomic factors, focusing on the Federal Reserve's last 50 basis point rate hike, which was essentially the lowest point for BTC and the U.S. stock market about a month prior. 2. Towards the end of a bear market, focus on buying one coin as a long position. For example, in this cycle, we already know that BTC and SOL are the best short-term contract targets, so in the next bear market, only buy these two coins, focusing on long positions in the upward trend, earning coins with coins, selling as you earn, and converting profits into USDT. During each major drop, use USDT to buy more spot and invest in financial products. As for other coins, they can almost be ignored.

LIFE IS LIKE

A JOURNEY ▲

Below are the actual trades from the Big White Community this week. Congratulations to those who followed along; if your trades are not going well, you can come and test the waters.

The data is real, and each trade has a screenshot from the time it was issued.

**Search for the public account: *Big White Talks Coins*

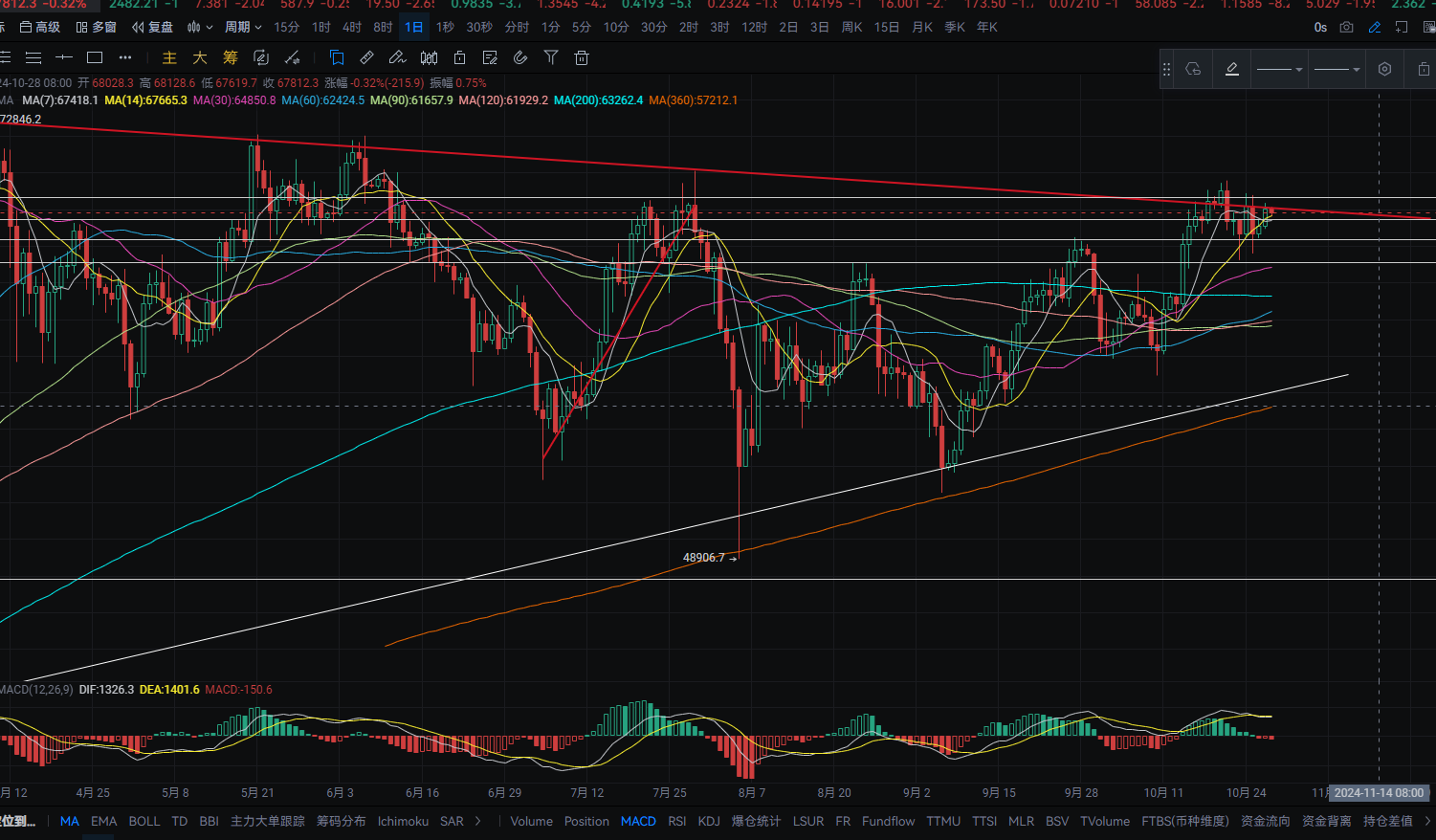

BTC

Analysis

BTC's daily chart showed a rebound yesterday, rising from a low of around 66,950 to a high of around 68,350, closing near 68,000. There have been multiple tests around 66,300 forming support; if it breaks, it could drop to around MA30. A pullback can be bought near this level. MACD shows an increase in bearish momentum. The four-hour support is near MA90; if it breaks, it could drop to around MA120. A pullback can be bought near this level. MACD shows an increase in bullish momentum, forming a golden cross. Short-term buying can be done around 66,380-65,100, with rebound targets around 67,400-68,700.

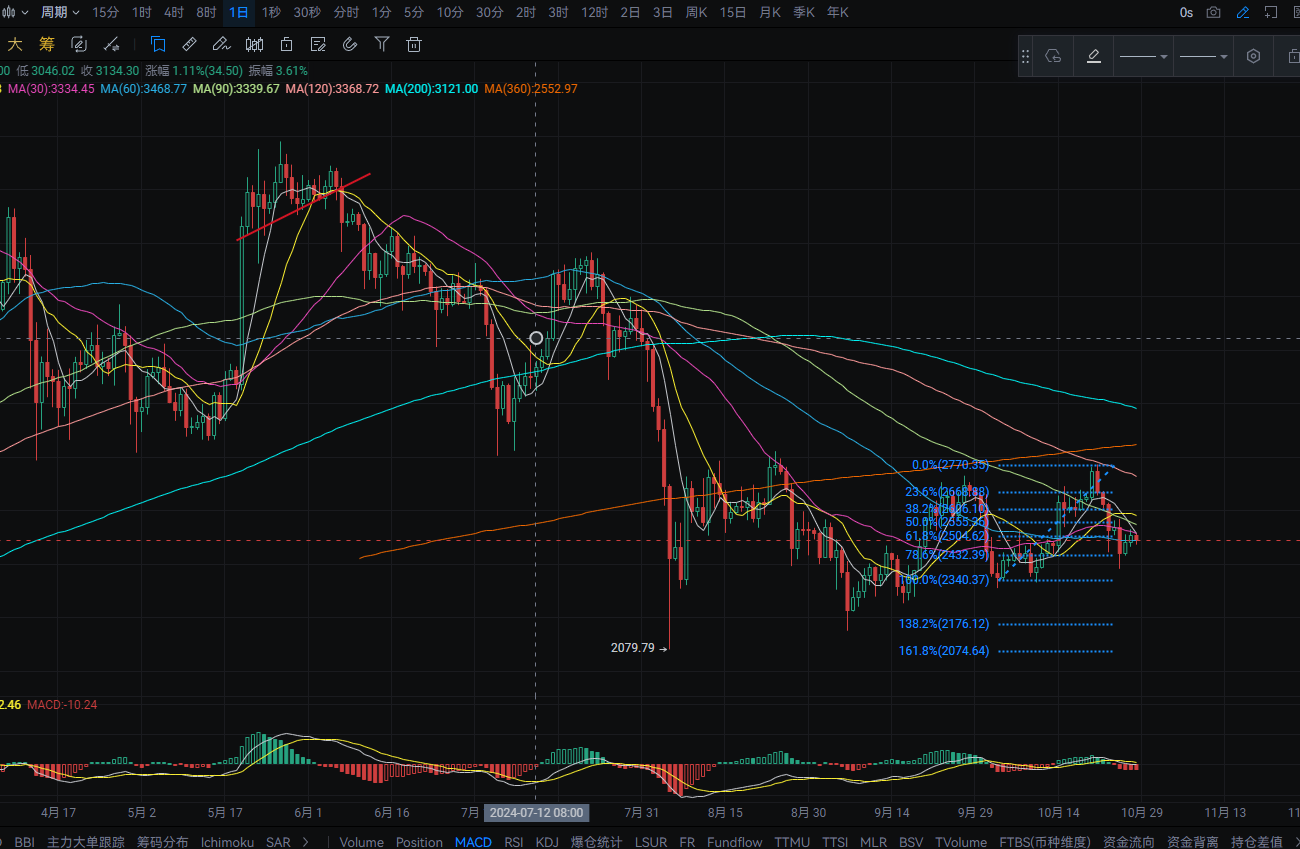

ETH

Analysis

ETH's daily chart showed a rebound yesterday, rising from a low of around 2,460 to a high of around 2,530, closing near 2,510. Support is near MA60, while resistance is near MA30; a breakout could lead to MA90. MACD shows an increase in bearish momentum. The four-hour support is at 0.786 (around 2,430); a pullback can be bought near this level. Resistance is near MA30; a rebound to this level can be used to short. MACD shows a decrease in bullish momentum. Short-term buying can be done around 2,392, with rebound targets around 2,420-2,450. A rebound to around 2,490-2,500 can be used to short, targeting around 2,450-2,400. Mid-term buying can be done around 2,300, with rebound targets around 2,450-2,540.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific trading advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。