Trader Chen Shu: 10.28 Afternoon Bitcoin and Ethereum Market Strategy *No. 1, Narrow Range Breakthrough at 6.77, Focus on Whether It Can Stabilize for Long Positions

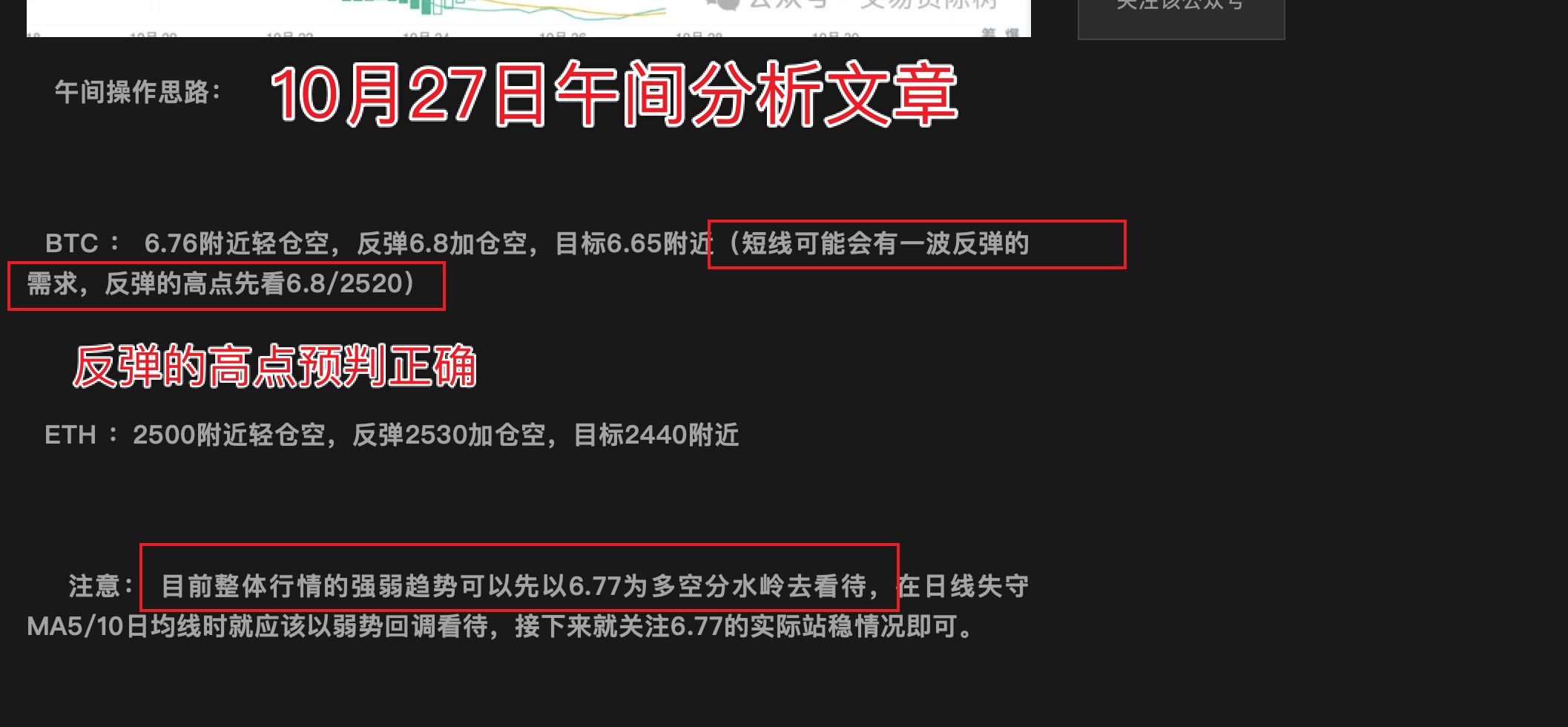

The strategy given on October 27 suggested shorting above 6.77/2500, and indicated that there was a short-term rebound demand for Bitcoin and Ethereum. The market prediction was basically accurate, as yesterday the market experienced narrow fluctuations and rebounded to the 6.8 level. Currently, the price is maintained above 6.77. Please see the following analysis for operational guidance.

From the daily chart of Bitcoin, yesterday closed with a small bullish candle breaking through the MA5/10-day moving averages, and there is currently a trend of retesting and confirming stability at 6.77. The daily support will depend on whether it can continuously hold above the MA5/10-day moving averages. If it holds, the bullish trend will continue; looking at the 1-hour chart, after a morning high of 6.83, it retraced and tested the 1-hour MA256-day moving average (6.77) which held. If it continues to stay above this line during the day, then the short-term bullish trend will continue to test 6.85. It has already broken through and temporarily stabilized at 6.77, so we can shift direction to look for short-term long positions.

From the daily chart of Ethereum, the weekend saw two trading days with two small bullish candles, and the price is short-term pressured by the MA30-day moving average (2520), showing an overall weak fluctuating market. Pay attention to the breakthrough situation at the resistance levels of 2520/2560; looking at the 4-hour chart, the rebounding price is consistently pressured by the 4-hour MA30-day moving average, while the upper 4-hour MA256/120-day moving averages are also key short-term resistance levels.

Afternoon Operational Thoughts:

BTC: Light long positions near 6.77, add short positions on a pullback to 6.73, stop loss after averaging the added positions by 500 points, target above 6.85; consider shorting above 6.88.

ETH: Short positions can be taken at the levels of 2500/2520/2550.

Note: The short-term 1-hour level has confirmed the effectiveness of the MA256-day moving average (6.77) support. Next, we can pay attention to whether the 4-hour chart can hold the MA60-day moving average. If it can hold the price range of 6.77-75, the short-term will test upwards to 6.85.

The daily analysis strategy has a very high win rate! Analysis is not easy, so I hope everyone can give a free follow, save, like, and comment. Thank you all, and feel free to leave comments below; I will reply to each one!

For real-time market strategy exchanges and inquiries about market issues, you can follow my personal account homepage, originally ranked first in (Coin World) as a personal KOL major influencer, providing free guidance and answering trading questions. Everyone is welcome to communicate and exchange!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。