The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens.

Those who work hard manage others, while those who labor are subject to others. Good weekend to everyone, Ethereum is once again on a downward trend, and I wonder what your current mindset is. After observing the entire Ethereum trend, I feel a bit frustrated. Currently, I still hold spot Ethereum. Yesterday's explanation was not meant to mislead anyone; things have two sides. Just because Lao Cui criticizes Ethereum in writing does not mean the end of its future trend. Please do not be too extreme in your views, including on SOL. Technology is in a state of innovation, and Lao Cui is merely viewing all coins from an analyst's perspective. I still need to clarify that compared to the entire cryptocurrency market, Ethereum's position remains that of a queen, and its long-standing second place is still relatively stable. This round of the bull market is certain to erupt, and Ethereum will continue to grow. Lao Cui still believes in Ethereum's growth trend. For example, SOL is currently the only coin that poses a threat to Ethereum, but that does not mean it will replace Ethereum's position in the future. I just hope everyone can understand what Lao Cui means.

Looking at the overall situation, the biggest resistance for Ethereum is human factors. The entire ETF market in the U.S. has maintained an inflow of nearly 200 million every day into the cryptocurrency market. However, Ethereum is facing a large amount of selling every day. I see that U.S. regulatory agencies and prosecutors are investigating the cryptocurrency company Tether for possibly violating sanctions and anti-money laundering regulations. This news seems to explain why Ethereum has been in a selling state. However, we cannot ignore Vitalik's statements; he has expressed that he has not sold and has even increased his holdings in Ethereum. It is quite ridiculous that his team's selling volume has always ranked among the top three. For Ethereum, Lao Cui does not recommend increasing holdings in the short term; it is better to remain unchanged in the face of change. At this stage, players with a steady outlook must shift their focus back to the Bitcoin market. At the beginning of the year, Lao Cui already warned that the biggest risk in the cryptocurrency market is Tether, which has always been pegged to the U.S. dollar, but its issuance lacks regulation. Therefore, if you hold Tether, it is advisable to replace it with more stable coins to hedge against risks.

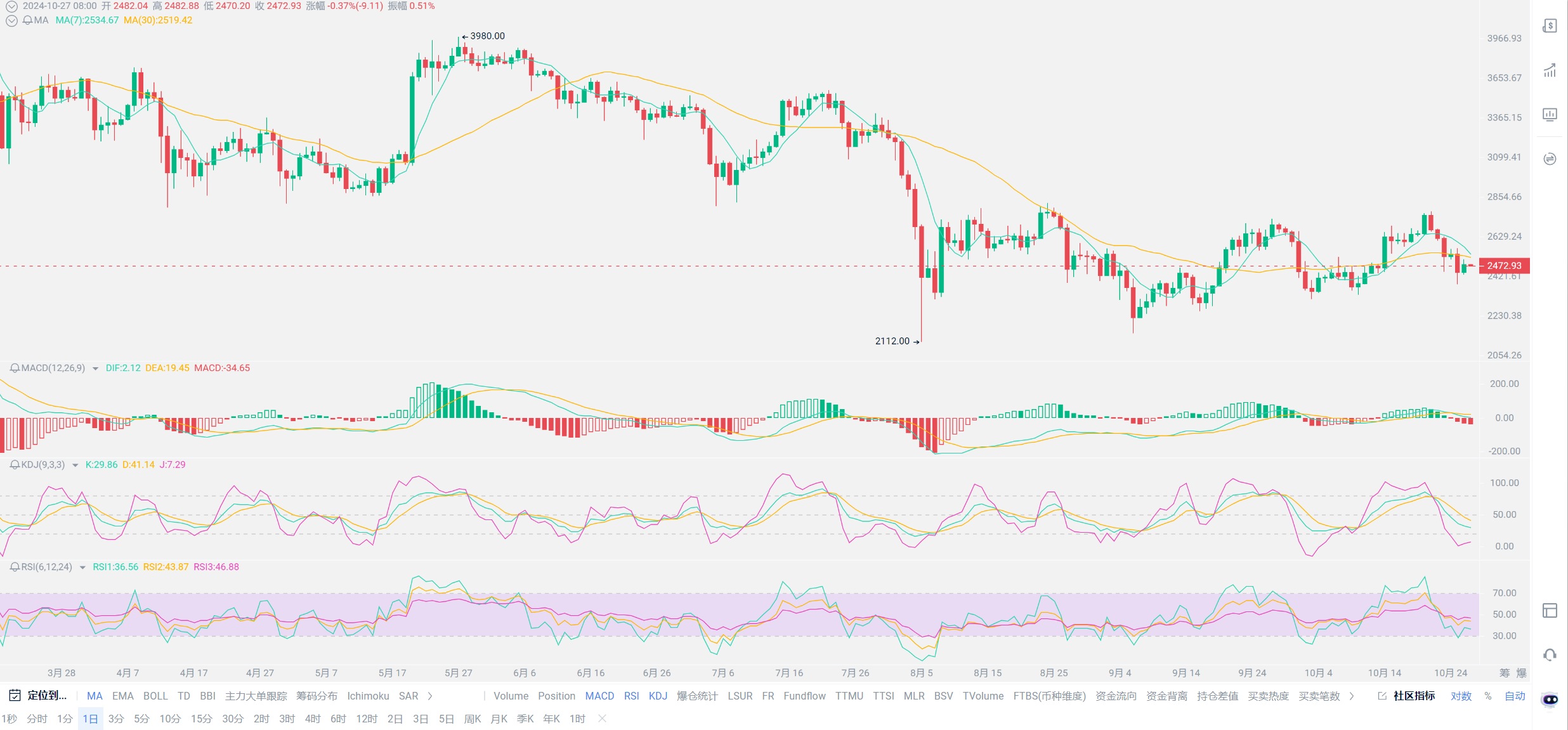

Regarding future trends, Bitcoin is still in a correction phase, and repeated attempts to break the 70,000 key level have ended in failure. Everyone needs to remember one thing: although there has been an inflow of funds for Bitcoin ETFs in the U.S., it does not mean direct purchases of Bitcoin; rather, it appears in the form of indices. Therefore, the effect of capital injection into Bitcoin in the U.S. can almost be ignored, meaning they are not directly purchasing, and the funds are not directly flowing into the cryptocurrency market. Many friends have questioned the inflow phenomenon from the U.S., asking Lao Cui why Bitcoin ETFs continue to show inflows while the market has not fluctuated. This is the fundamental reason; they are entering the market in the form of stocks, which does not affect the market trend. Additionally, the recent military situation between Israel and Iran has had almost no impact on the cryptocurrency market. Some friends have begun to question why the last situation had such a strong impact, while this time the market has basically not fluctuated, feeling that the temperament of the cryptocurrency market is difficult to grasp.

Here, Lao Cui also explains that the military situation's impact on the cryptocurrency market is not due to natural factors but rather human disasters. Military events only lead to capital fleeing from the cryptocurrency market, not directly paralyzing it. In the last round, it can be said that capital from the Middle East would flow out. The demand for capital from the Middle East in the cryptocurrency market is not large. To put it bluntly, the cryptocurrency market is more composed of giants from China and the U.S., as well as retail investors from East Asia, South Asia, and Europe. Only economically developed regions tend to invest in the cryptocurrency market. This is also what Lao Cui mentioned earlier: the cryptocurrency economy is more about future investments. Only when one has sufficient resources can they invest in the future. If one is not strong, they can only preserve their current strength; how can they talk about the future? With this in mind, you can understand why the cryptocurrency market cannot grow at this stage. Simply put, the landlord's family has no surplus grain. Currently, our country is vigorously developing the integration of the stock market and the real estate market, with most large funds flowing into these two markets. The U.S. is also developing its stock market, and the trends of U.S. stocks and the A-share market are all driven by large capital systems. The two giants' capital has basically solidified, confirming that there will be no significant capital involvement in the cryptocurrency market in the short term, and the entire cryptocurrency market can only show a trend of oscillating downward.

When will there be a stage for the cryptocurrency market? Referring to the above, it is necessary to wait for the inflow of large capital. Capital has not ignored the cryptocurrency market; BlackRock, Grayscale, and representatives like Vitalik are currently increasing their holdings, especially BlackRock, which has been aggressively increasing its Bitcoin holdings to over 400,000 during this round of decline, becoming a leader in the cryptocurrency market. This is enough to indicate that after this round of correction, a bull market will arrive, and capital is optimistic about this bull market's peak. Once it starts, this peak may far exceed everyone's expectations. Even if Bitcoin reaches 120,000, Lao Cui does not see any difference. From a long-term perspective, the trends of Ethereum and Bitcoin are definitely worth investing in, and the returns in this bull market will certainly be considerable. If you have sufficient capital, you should pay more attention to Bitcoin. With ample funds for Bitcoin, the next option is Ethereum, and for smaller capital, consider SOL and BNB. These coins will generate certain profits under the backdrop of this bull market.

Having discussed spot trading, let's return to the contract market. In fact, at this stage, Lao Cui believes that the cryptocurrency market is more suitable for entering contracts. Especially in a slowly oscillating downward trend, back-and-forth operations are possible. Lao Cui's current approach to the cryptocurrency market is very simple: just find the short-term pressure points for back-and-forth operations. The pressure point for Bitcoin is around 67,500-68,000, and for Ethereum, if it cannot stabilize around 2,500, you can short it directly, focusing on short positions. This approach can continue until the U.S. elections. Currently, waiting for the bull market to arrive requires two factors: the U.S. elections and the interest rate cut in November. If these two are achieved, Bitcoin could rise by around 5,000 to 10,000 points, and Ethereum could exceed 3,000. Among these two, everyone is most concerned about the U.S. election issue. In fact, regardless of who comes to power, it will only affect the short-term market trend. Only if Trump comes to power might it extend the bull market in the cryptocurrency market for a while. From a long-term perspective, the impact is not strong; even if Harris comes to power, it can only affect a short-term dip. As long as the U.S. continues to cut interest rates, there will be some capital inflow. Therefore, overall, this bull market is merely a matter of time; it will come sooner or later. What everyone needs to do now is to prepare for entering the spot market at low levels and hold patiently for good returns. Patience is essential!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big picture, not focusing on individual pieces or territories, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。